Options calculations will give us an accurate assessment of our covered call writing profits. It’s more meaningful to use percentages rather than dollar amounts when executing these calculations. For example, a $1000.00 profit on a $10,000 investment (10%) is much more significant than a $1000 return on a $100,000 investment (1%). That’s why percentages forms the foundation for both versions of the Ellman Calculator (Basic and Elite).

A few months ago, one of our members, Jonathan, shared me with one of his successful covered call writing trades and inquired about percentage returns month-to-month. In this article, I will breakdown that trade and use the Ellman Calculator to demonstrate the second leg of the trade where Jon rolled out and up:

The trade in 100 share format

- 2/10/14: Buy 100 x AGN @ $120.36

- 2/10/14: Sell 1 x Feb. $120 call @ $2.52

- 2/21/14: Share value = $125.59

- 2/21/14: Buy back Feb $120 call @ $6.20

- 2/21/14: Roll out and up to the March $125 call @ $4.10

- 3/21/14: Option expires in-the-money and shares are sold for $125

The calculations

You will note that the trade was established mid-February contract. Here is the final returns from the first 12 days of the trade as shown in the “multiple tab” of the Ellman calculator:

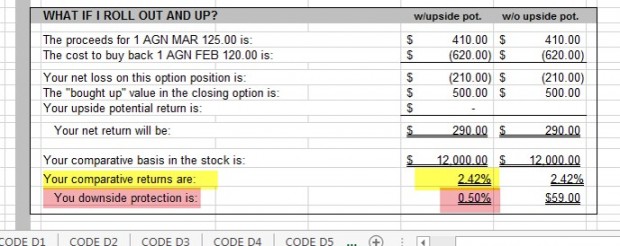

Jon achieved a very nice short-term return (1.8% in 12 days) and then decided to roll out (next month) and up (higher strike price). For this computation we use the “what now tab” of the Ellman Calculator and first fill in the blue cells on the left:

The option was bought back @ $6.20 and the next month’s higher strike was sold for $4.10. The key point here is that our cost basis is now $120, not $120.36 or $125.59. The reason is that we are deciding whether to roll the option or allow assignment we must compare “apples-to-apples” If we permit assignment we will receive $120/share as per our initial option obligation. If we roll the option, our cost basis must be the same so we can decide which approach is in our best interest. Once the blue cells on the left side of this tab our filled in as shown above, the white cells on the right side become populated with results:

Once the shares were sold as a result of option exercise on 3/21/14, a 2.42%, 1-month return was realized and Jon had $12,500/contract in cash to use the following week for the April contracts.

2-month final returns

In reality this is a 6-week return because the trade was initiated mid-contract in February:

1.8% + 2.42% = 4.22% = 36.6% annualized

Summary

Although calculations can be challenging for many of us, using percentages and the Ellman Calculator will make our covered call writing decisions more meaningful and help elevate our returns to the highest possible levels. For a detailed discussion of covered call writing calculations see pages 99 – 152 in the Complete Encyclopedia for Covered Call Writing. Also, for a free version of the Basic Ellman Calculator see the “free resources” link on the black bar at the top of this page…just enter your email address and download this tool to your computer.

Next live seminar:

Saturday July 19th

Arlington, Virginia

Washington DC Chapter of the American Association of Individual Investors

9 AM – 10AM Dr. Eric Wish will speak (outstanding presenter)

10 AM – 12PM I will present a covered call writing seminar

http://www.aaii.com/localchapters/pdfs/Washington%20DC%20Metro%20140719.pdf

Market tone:

This was an extremely light week for economic reports but The Federal Reserve officials did make some significant comments. For the first time they set an end date of October to end the bond-buying program as long as the US economy continues its expansion. The program has been reduced from $85 billion to $35 billion at a pace of $10 billion per month and plans to decrease by the final $15 billion in October. The Fed funds rate should remain near zero for the foreseeable future even past the termination of the bond-buying program. The latter depends on inflation remaining below the 2% target rate. This week’s reports:

- Consumer credit [a report of the dollar value of consumer debt, including categories such as credit card use and store charge accounts (known as revolving debt) as well as longer-term loans for autos, education, recreation vehicles, etc. (known as non-revolving debt). The level of consumer credit is considered a barometer of consumers’ financial health and an indicator of potential spending patterns] rose by $19.6 billion in May mainly due to strong auto sales

- April stats for consumer borrowing was adjusted higher to a gain of $26.1 billion, the largest increase since December, 2010

- Initial jobless claims for the week ending July 5th came in @ 304,000, near expectations

For the week, the S&P 500 declined by 0.8% for a year-to-date return of 7% including dividends.

Summary:

IBD: Uptrend under pressure

BCI: Moderately bullish, expecting another favorable earnings season and favoring out-of-the-money strikes 3-to-1

Wishing you the best in investing,

Alan ([email protected])

www.thebluecollarinvestor.com

Premium Members,

This week’s Weekly Stock Screen And Watch List has been uploaded to The Blue Collar Investor premium member site and is available for download in the “Reports” section. Look for the report dated 07-11-14.

Also, be sure to check out the latest BCI Training Videos and “Ask Alan” segments. You can view them at The Blue Collar YouTube Channel. For your convenience, the link to the BCI YouTube Channel is:

http://www.youtube.com/user/BlueCollarInvestor

Since we are in Earnings Season, be sure to read Alan’s article, “Constructing Your Covered Call Portfolio During Earnings Season”. You can access it at:

https://www.thebluecollarinvestor.com/constructing-your-covered-call-portfolio-during-earnings-season/

Best,

Barry and The BCI Team

Alan,

Do you consider closing the entire position when the price rises and time value is near zero even if it doesn’t pay to enter a new one (too close to expiration)?

Thanks a lot.

Dave

Dave,

If you plan to use the stock the next month, rolling the option near expiration Friday is the best choice. If there is an upcoming earnings report or if the “rolling” stats do not work for you and you plan to let the stock go, allowing assignment is the best choice as there will be 1 less commission involved. (Some brokerages charge extra for assignment…over and above just selling the stock…try to avoid these unless that fee is extremely low).

Alan

TO ALL MEMBERS:

Due to the EXTREMELY high volume this site has been experiencing lately, we are in the process of enhancing the servers which support the site. This may result in some temporary slowdowns and inconveniences but will ultimately result in an outstanding site experience which is precisely what the BCI team wants for all our members.

Thanks for all your support.

Alan

I was wondering if you have a service that identifies and recommends quality stocks, with Calls that have a very short life, i.e., about a month or less? I/m look for a way to identify reasonably robust companies, lots of daily volume, and lots of Call Options

For example, AAPL $95 7/25/14 Call (as of Friday 7/11) have a return of about 2.5% in a 2 week period. OR the FB $65.50 7/25 Call had a return of approximately 4% in a 2 week period.

These are both good trading stocks, with lots of volume, and in the short term at least (which is all I care about), seem to be good companies to own! ANd, I get a very good return, with all my money back in 2 to 4 weeks

My problem is that it isn’t always easy to identify these types of companies!

Do you have a service that would identify these types of stocks?

Thanks

Charles

Charles,

Our premium stock list will get you 3/4 of the way there for your particular goals. It will identify stocks with options that have passed a series of rigorous fundamental, technical and common sense screens (adequate trading volume etc). It will not give you the implied volatility of the options which is something you need to check with an options chain as those stats are in a constant state of change.

Your approach appears to be most appropriate for those with a high risk-tolerance because you are highlighting two stocks that generate significant short-term returns due to upcoming earnings reports. After earnings, you will see the short-term returns of AAPL and FB drop dramatically. I avoid ERs like the plague but I am a conservative investor and understand that others may have different goals and greater risk-tolerance.

My sweet spot is 2-4%/month for my initial returns, balancing a still great initial return with the caution of not dealing with highly volatile scenarios and securities.

I would highly advise against this but you could use our premium Stock Report and look for those stocks that are reporting earnings which are located in gold cells in our “running list” (we highlight in gold so our members know to avoid these).

My concern is that you may generate a 4%/2-week return and then lose 15% from a disappointing earnings report. Once you evaluate both the pros and cons you can make an informed decision that is in your best interest.

Alan

Running list stocks in the news: TRN

Trinity Industries,(transportation industry) the # 5 ranked stock on the IBD 50, and on our Premium Stocks List for the past 3 1/2 months distributed a $10/contract dividend last Friday. For most of us that will result in the purchase of additional (fractional) shares depending on how many shares we own.

As reported on our premium report, TRN has an industry rank of “A”, a beta of 1.48 (somewhat volatile), a % dividend yield of 0.90 and adequate open interest for near-the-money strikes.

Alan

Hi,

I sold the July call for KOG. It looks like the company just got bought. I’m not sure what to do in this case. It’s in the money so ordinarily I would just let it get called away. Any advise would be appreciated.

Thank you

Son,

When a situation like this arises I like to check the news to see general consensus. An excellent free resource is:

http://www.finviz.com

Here is a typical reaction to this deal:

http://finance.yahoo.com/news/whiting-snaps-kodiak-touts-biggest-175004967.html

When the deal is approved, KOG will cease to exist as a sole entity and will be part of the parent company and KOG shareholders will receive shares of the parent company based on the formula shown in the article.

The first 2 days of market reaction has been positive so your choice is to close now and spend the time value remaining on the premium or allow assignment this Friday.

I can’t tell you what to do but thus far market reaction has been positive.

Alan

Alan,

I know you usually state when we close on expiration Friday, if we are not rolling to do our buying on Mondays. Someone suggested buying on Friday will give us 3 additional day of time value. Do you agree with this strategy and its it worth the risk?

Thanks

Leo

Leo,

I must respectfully disagree. We are exposing ourselves to an additional weekend of risk for very little in return. Time value erosion (theta) is logarithmic in nature, not linear. This means that we lose very little time value the first few days of the contract up to the first week of the contract. The second week, time value starts eroding much quicker and then falls off a cliff towards the end of the contract.

We will generate a bit more premium on Friday than on Monday or Tuesday, but not much in terms of time value. The question is if that small amount is worth a weekend of risk exposure. I vote “no” but others as you stated feel otherwise.

Alan