Whether we sell covered calls or cash-secured puts strong consideration should be given to trading in sheltered accounts whenever possible. Most, if not all, of our trades will be short-term in nature (less than one year) and therefore will be taxed at the ordinary income tax rate (up to 35%) which is much higher than the short-term capital gains tax rate (15%) if we trade in non-sheltered accounts.

What is a Capital Gain?

This is an increase in the value of as capital asset, such as a stock or an option, which gives it a higher worth than the purchase price. It must be claimed on income taxes in non-sheltered accounts.

Rules for Covered Call Writers:

Premiums received for writing a covered call are not included as income at the time of receipt, but are held in suspense until the writer’s obligation to deliver the underlying stock expires or until the writer either sells the stock as a result of the call assignment or by closing the option position (buy-to-close). With that in mind, here are three possible scenarios that may occur after the sale of the option:

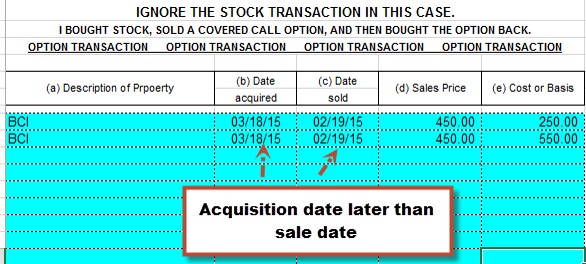

1- An expired option (we sold the call, we didn’t close the position by buying back the option and the holder did not exercise the option) results in a short-term capital gain. For example, we sell a BCI April 90 call for $4.50 in March. The proceeds are $450. Since the cost is $0, the short-term capital gain is $450. The acquisition date will be LATER than the sales date and the word “Expired” should be written in column e, the cost basis column.

2- If we buy back the same option in the above example to close the position (usually to execute an exit strategy), the difference between the sale profit and the buyback cost will represent a capital gain or a capital loss. As in example 1, above, the acquisition date will be LATER than the sales date.

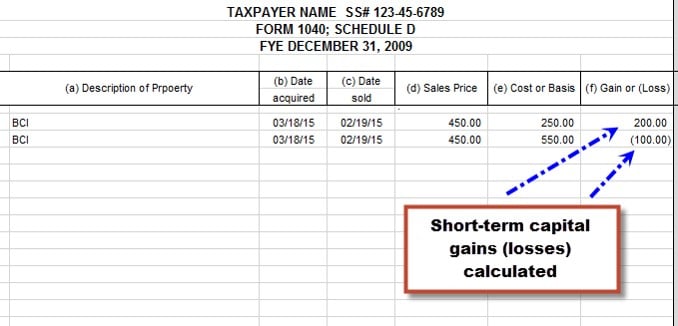

Capital gain example: We close our position by buying back the option for $250. The capital gain is $200 ($450 – $250).

Capital loss example: We close our position by buying back the option for $550. The capital loss is $100 ($550 – $450).

3- If the option is exercised, the option transaction becomes part of the stock transaction. The option premium is added to the strike price received, less commissions. If the stock has been held for less than one year, the entire transaction will be treated as short-term. If the stock had been held for one year or more, the entire transaction will be treated as long-term as the option holding period is ignored.

***The Schedule D of the Elite Calculator is designed to assist your tax advisor with these long and short-term capital gains (losses) issues:

- Acquisition date later than sale date

- Capital gain (Loss) calculations

The specific information referenced above can be found in IRS Publication 550 entitled Investment Income and Expenses, pages 57 – 58.

I avoid these tax issues by trading covered call stock options predominantly in tax-sheltered accounts.

In an upcoming article, I will discuss capital gains and losses related to selling cash-secured puts.

***Contact your tax advisor before making any investment tax-related investment decisions.

Premium members: All Beginners Corner Videos on Premium Site for your convenience:

- Complete Beginners Corner video series now on Premium Site

Scroll down on the left side of the premium site below the stock and ETF reports.

Next live seminars: Central Florida this week:

Market tone

With a strengthening dollar and lower oil prices, there are renewed concerns of the Fed raising interest rates. This was a light week for economic reports:

-

Business inventories were flat in January, below analyst expectations

-

Ratio of business inventories to sales increased to 1.35 from 1.33 in December, highlighting the number of month’s it would take to empty shelves based on current sales. This is a critical indicator for the short-term direction of production activity

-

Retail sales fell 0.6% in February, below expectations. The auto industry was the main culprit as well as severe weather conditions

-

Retail sales were actually up 1.7% from a year ago

-

Experts consider the still lower gas prices a positive for the outlook for retail sales

-

The Producer Price Index (PPI- a leading indicator for inflation) dropped by 0.5% in February, the 4th consecutive monthly decline

-

The PPI is down 0.6% year-over-year

Summary

IBD: Uptrend under pressure

GMI: 3/6- Buy signal since market close of January 23, 2015

BCI: Cautiously bullish using an equal number of in-the-money and out-of-the-money strikes. A strong dollar and low gas prices are making investors nervous that the Fed may raise interest rates sooner rather than later.

Wishing you the best in investing,

Alan ([email protected])

Premium Members:

This week’s Weekly Stock Screen And Watch List has been uploaded to The Blue Collar Investor premium member site and is available for download in the “Reports” section. Look for the report dated 03-13-15.

Also, be sure to check out the latest BCI Training Videos and “Ask Alan” segments. You can view them at The Blue Collar YouTube Channel. For your convenience, the link to the BCI YouTube Channel is:

http://www.youtube.com/user/BlueCollarInvestor

Best,

Barry and the BCI Team

My name is Eric a new options trader, I figured that I got lucky a few times and I took a much bigger risk

I purchesed 4000 shares of cos.tsx Canadian Oil Sands average price of $11.05

I got a covered call for a 0.55 for March 20, 2015 $11 strike price so they give me $2200 – commissions.

The stock dropped to the lowest price of $9.15.

I panicked and bought my options back at 0.20 and payed -856.95 with commission and was frustrated that I am losing all my gains in this trade.

so I sold 2000 shares at $9.42 and then I bought 2000 shares at $9.30 and finally sold it again $9.42 for a little gain.

the 2000 shares $11.05 – $9.42 total loss = $1.63 which was $3260

I still have 2000 shares left and waiting for a better price to maybe write a covered call.

I messed up, I have watched your videos and just did not follow your instructions.

What could I have done better, I tried to write another covered option but no money at this point for March 20, 2015 I looked the $9, and $10 strike price.

Erik,

We all need to have a specific plan and then to adhere to it unemotionally. The plan includes stock selection, option selection and position management. You had your reasons for choosing cos.tsx (fundamental, technical and common sense if you follow the BCI methodology). You selected a near-the-money strike…a bullish position which generated a nice 4.5% return. Let’s assume these were both appropriate selections.

Next, you closed your short calls, giving up 40% of your initial profits and sold half your long stock position.

General considerations for improving trades like this:

1- Consider deeper ITM strikes during volatile market environments for additional downside protection

2- Sell OTM puts instead of ITM covered calls

3- Use the 20/10% guidelines before closing short calls if you plan to keep the stock

4- Once short calls are closed, late in a contract, consider selling the shares or rolling down. Doing half of each is okay but doing nothing with half the shares is an opportunity lost.

I would view this as a learning experience which ultimately will make you a better investor and more profits down the road.

Alan

Eric, if you stomach itand your account can take it, learning with real money might be okay. However, the way to learn is with paper money. With a paper money account place a couple of trades every day, and I really mean every day. Practice practice practice making Alan’s adjustments.

Besides the fact you aren’t risking your hard earned dollars, the number of trades you can make and learn from is orders of magnitude more than you can learn from using real money.

Good luck.

Steve

Hi Alan…

I have trouble understanding the concept of selling deep in the money covered calls.

If I buy a stock @ $50 & sell a ITM call for 2.00 @ a strike of $46 .. I lose $2…

I the strike is $48 I Just break even…

What’s wrong with my thinking????

Thanks for your reply..

Tony….

Tony,

The numbers in your hypothetical will not occur. The formula for option premium for an ITM strike is:

Premium = intrinsic value + time value

If we sell a $46 strike after paying $50 for a stock, the intrinsic value is $4 ($50 – $4). There will almost always be some time value as well unless the strike is deep, deep ITM in which case it may trade at parity (only intrinsic value). So the premium will never be $2 and will be some value at or above $4. The amount above $4 is our initial profit and we use the intrinsic value component of the premium to “buy down” our cost basis.

Let’s show a real-life example of a stock that has been extremely kind to BCIers over the past 9 months, SWKS. From the options chain below we can see that the stock is trading @ $92.92 and the April $90 ITM strike generates a bid price of $5.30. Of that $5.30, $2.92 is intrinsic value (not profit) and the rest is time value initial profit of 2.6%. That profit is protected by 3.1% ($2.92/$92.92). If we selected that strike, we would be guaranteed a 5-week return of 2.6% as long as share value does not decline by more than 3.1% by expiration.

CLICK ON IMAGE TO ENLARGE & USE BACK ARROW TO RETURN TO BLOG.

Alan

Hi Alan,

I ordered your book last week (still waiting on it to be delivered) and I’m super excited to get some serious information on selling covered calls! As a new investor who has never set up or traded in a tax sheltered account, what resources or information would you recommend? Would a tax sheltered account just be something like my Roth IRA account? Or are there other ways I can set up a tax sheltered fund?

Thanks for everything you do,

Acme

Acme,

Covered call writing is the most universally-accepted options strategy for use in self-directed IRA accounts, both traditional and Roth. A good place to start gathering information is to use the “online discount broker file” found at the “Free resources including Ellman Calculator” link at the top black bar of our web pages. Contact information is included. Please check with your tax advisor for your specific circumstances.

Alan

Hi Alan! Will you give me some examples of tax-sheltered accounts? Do you use traditional and Roth IRAs?

Richard,

I use both traditional and Roth IRA accounts. Check with your tax advisor as to which is most appropriate for your circumstances.

Alan

Hi Alan,

Just left my tax preparer and after a year of covered call and now put selling I need to figure out the tax sheltered account trading. My tax preparer was hesitant to recommend a tax sheltered account strategy. I trade thru TDAmeritrade so perhaps they would be my next step, asking them? I thought I’d check here before I made the plunge into the TD help line and was ‘sold’ something I might not really need.

If you have any other guidelines available in your books or posts I’d appreciate it greatly if you could point me in that direction.

Many thanks!

Dennis,

Most of our members (including me) who trade in sheltered accounts use either traditional or ROTH IRA accounts. It will usually involve your broker rolling over from your current account to one of these or similar accounts. A knowledgeable tax advisor should be both instructive and helpful in finalizing your investment decisions.

Alan

Many thanks Alan. I’ve got some work to do now.

Dennis, I do all of my trading in IRA accounts. The advantage is there is nothing to do at tax time. The disadvantage is you cannot use margin. If you don’t use margin anyway, I think trading in an IRA is the best way to go. Steve

Hi Steve,

I do use margin but believe the benefits to going the IRA route might outway it. Thanks for the insight!

Hi from Australia

I note that many of the stocks in the weekly report have options with a $5 increment.

I have found that if a stock price goes down during the month and closes below my break even it can be difficult to generate a reasonable income from that stock in the next contract month. (Assuming I decide not to make a loss on the position by selling)

I have reviewed the Ask Alan topics and cant find any discussion on this.

Do you have any thoughts on this you can share?

Regards, Arianne

Arianne,

The BCI community welcomes and appreciates all our international members.

The returns will be based on the implied volatility of the underlying security and proximity to the strike. In a 4-week contract, we can wait 2-3 days into the contract for a more favorable position and in a 5-week contract we can wait until the beginning of week #2. If the returns do not meet our goals, we move on to another stock. Of course, also check for the earnings report date.

Alan

Attention grandparents:

Click on the image below to see the danger of bringing a book of stickers to your grandchildren (use the back arrow to return to blog).

Alan

Premium members:

This week’s 6-page report of top-performing ETFs and analysis of ALL Select Sector Components has been uploaded to your premium site. The report also lists Top-performing ETFs with Weekly options.

For your convenience, here is the link to login to the premium site:

https://www.thebluecollarinvestor.com/member/login.php

NOT A PREMIUM MEMBER? Check out this link:

https://www.thebluecollarinvestor.com/membership.shtml

Alan and the BCI team

Hi Alan…

A question on selling Cash Secured Puts…… after determining which stock to trade.. how do you determine which strike price to use??

I have tried using ROI to pick a strike with enough premium but that seems to put the expiration out too far.

Tony,

The strike selection for selling C-S puts is based on our goal and market assessment. Most put-sellers are looking to generate cash flow without taking possession of the stock and therefore out-of-the-money puts is most appropriate. The more bearish our market assessment the deeper OTM we go.

If our goal is to take possession of a stock “at a discount” using near-the-money and in-the-money strikes is most appropriate. Either can be used if using a combination multi-tiered strategy with both cc writing and put-selling.

We also keep in mind our monrhtly goals for returns.

Alan

Hi Alan,

Woke up this fine Expiration Friday to an email from my broker stating that my 4 contracts of XLV were assigned @ $72.50. Didn’t see that coming. The plan was to BTC today. Last night close was $74.57. Ex-Date is today 3-20. Is this an Ex-Date lesson? Regards, Joe

Joe,

We can assume that if a security will be exercised early because of a dividend it will be the day prior to the ex-date. Take a look at the screenshot below (click on image) taken from dividendinvestor.com and we can predict March 19th as the date if early exercise were to occur.

Alan

Alan,

I purchased 100 shares of Integrated Device Technologies (IDTI) at $20.57. I then proceeded to write the March 20th call on a $21.00 strike. I wrote a call and received a .61/share premium.

My question is this: It doesn’t look like I am going to be called out on Friday. Therefore, I will likely write another $21.00 and receive ~ .60 premium for April. For ROO calculations, do I use my cost basis or the current month’s

share price?

By the way, I wrote calls against 7 stocks this month and 6 are winners. I wrote mostly ITM, but also a few OTM on these positions:

AFSI (OTM Winner)

MSCC (ITM Winner)-I should have written an OTM on this one. Lesson learned.

PDLI (OTM LOSER) Had earnings in current period and not on IBD 50. Nor did it pass SmartSelect or Scout ratings. I was gambling on it, and lost less than $100. Lesson Learned.

IDTI (OTM Winner) Winner, but doesn’t appear that I am going to be called out

TSM (ITM Winner)

DHI-(ITM Winner)

SCSS (ITM Winner)

Thanks in advance!

Dwight

Hi Dwight,

I just returned from a series of 3 seminars in Florida and see your strike is now ITM…great! Your decision now is whether to roll the option.

If the price was under $21, your cost basis would be current value because you are comparing it to selling a call on IDTI or another stock. For tax purposes, it would be another story.

Congrats on your recent success,

Alan

Dwight-

Glad to see you discuss winners & losers. This brings up a question that maybe Alan can answer. How does one determine how well or poorly they did in a contract month? I made $ but am not particularly thrilled with my results. I had 11 positions in March Option cycle. On the stock side, I had 5 wins and 6 loses. However, net $ gain. On the option side I had 9 wins and 2 losses. Again net $ gain. Finally, my calculated option premium at month start was $4413. My actual option gain was only $1614. That is 36% of projected. Understand I am rather new at this. 7 positions were from portfolio overwrites and 4 from the running list. Alan, do you have a way to gauge your success month to month?

Best Regards, Joe

One more thing. Without options I was 5 winners and 6 losers. However, with options I was 9 winners and 2 losers. Overall it was good. However, I am still a bit disappointed on my percentage of potential premium. I feel 36% is a bit low. Joe

Joe,

After expiration, I calculate my portfolio value:

Value of securities held + cash on hand

If cash is added or subtracted for personal use or additional investments, this will re-set your cost basis for the following month.

Alan