Our stock options strategies, whether writing covered calls or selling cash-secured puts (the topic on my just published book) requires us to make an overall market assessment before entering any trades. In last week’s article we evaluated bull market scenarios. In this week’s blog we will examine bear market environments. When selling covered calls we would favor in-the-money strikes to gain additional downside protection should share price decline. When selling cash-secured puts, we would favor selling out-of-the money puts (lower than the current market value of the stock). In today’s article I will use the options chain for FaceBook, Inc. to demonstrate the calculations for potential covered call writng and put-selling trades. First the options chain from May, 2014 where I have highlighted a row in pink:

Calls and puts in bear market environments

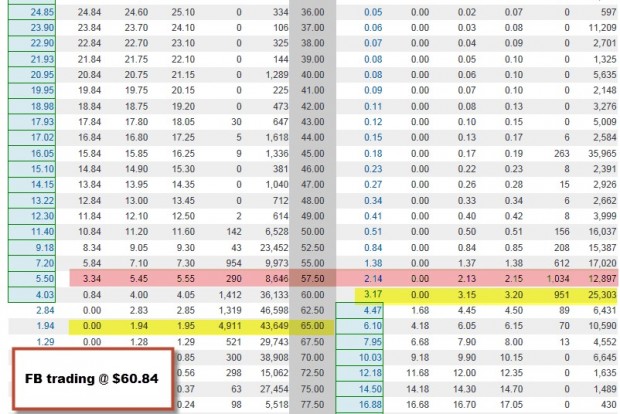

Facebook options chain

Bear market trade and calculations for covered call writing

We favor in-the-money strikes (ITM) which will generate time value returns that meet our goals along with downside protection of the option profit (different from breakeven). The deeper in-the-money we go, the greater our protection. With FB trading @ $60.84, we will view the $57.50 ITM strike:

- Call premium = $5.45

- Intrinsic value of the premium = $3.34

- Time value of the premium = $2.11

- Initial profit = $211/$5750 per contract = 3.7% (the intrinsic value “buys down” our cost basis to the strike price)

- Annualized return = 31%

- Downside protection of the 3.7% = $3.34/$60.84 = 5.5%

- This means that we are guaranteed a 6-week return of 3.7% as long as share value does not decline by more than 5.5% by expiration Friday

- Breakeven = $60.84 – $5.45 = $55.39

Bear market trade and calculations for selling cash-secured puts

We favor out-of-the-money strikes which will generate more protection against share decline and less likelihood for share assignment (shares “put” or sold to us). The deeper out-of-the-money we go, the greater our protection. With FB trading @ $60.84, we will view the $57.50 ITM strike. Note that we are using the same strike as for writing calls where the $57.50 strike is considered in-the-money. For selling puts, that same strike is considered out-of-the-money:

• Put premium = $2.13

• Initial profit = $213/$5537 per contract = 3.8% (put premium decreases our cost basis)

• Annualized return = 33%

• Downside protection of the 3.8% = $3.34/$60.84 = 5.5%

• This means that we are guaranteed a 6-week return of 3.8% as long as share value does not decline by more than 5.5% by expiration Friday

• Breakeven = $57.50 – $2.13 = $55.37

Summary

In bear market environments we favor in-the-money call options for covered call writing and out-of-the-money put options when selling cash-secured puts. The returns will be similar when going a like amount in- and out-of-the-money.

**********************************************************************************************************

NEW PUT BOOK NOW AVAILABLE WITH LIMITED TIME DISCOUNT:

https://www.thebluecollarinvestor.com/alan-ellmans-selling-cash-secured-puts

Use promo code PUT5 for a $5 discount @ checkout.

I am humbled to say that orders, thus far, have been off the charts…thank you so much. I have asked the publisher to double the production and send BCI more books as soon as possible. Shipping will begin mid-week based on when orders are received.

Visit our store for all our educational products:

https://www.thebluecollarinvestor.com/store/

**********************************************************************************************************

Next live seminars

Phoenix, Arizona area

January 9, 2015: Tempe, AZ: 7:00 – 9:00 PM

January 10, 2015: Scottsdale, AZ: 9 AM – 12PM and 1:15 PM to 2:30 PM

Details and registration links to follow.

Market tone

Actions taken by the central banks in Europe, Japan and China have allayed many of the global-economic fears of our markets. Few would argue that our economy continues to expand at a moderate pace. This week’s reports support that position:

- The Labor Department reported that 321,000 jobs were created in November, far surpassing the expectation of 228,000

- September and October jobs stats were revised upward by 44,000

- The unemployment rate remained unchanged at 5.8%

- The labor force participation rate also remained steady at 62.8%

- Hourly earnings for workers expanded by 0.4%/month, the best pace since June, 2013, causing the Fed to keep a close eye on inflation

- The US trade deficit decreased by 0.4% in October, but still wider than anticipated

- US worker productivity rose by 2.3% in the 3rd quarter, better than first reported by the Labor Department

- In October, construction spending increased by 1.1%, better than the 0,5% expected

- Construction spending increased by 3.3% year-over-year

- The Fed’s Beige Book confirmed that we have an improving jobs environment

- The ISM Non-Manufacturing Index rose to 59.3 in November, well above the 57.5 stat anticipated

- The ISM Manufacturing Index came in at 58.7, slightly better than the 58.3 projected by analysts (above 50 reflects expansion)

For the week, the S&P 500 rose by 0.4%, for a year-to-date return of 14%, including dividends.

Summary

IBD: Confirmed uptrend

GMI:6/6- Buy signal since market close of October 27, 2014

BCI: Moderately bullish favoring out-of-the-money strikes 2-to-1

Wishing you the best in investing,

Alan ([email protected])

Premium Members,

This week’s Weekly Stock Screen And Watch List has been uploaded to The Blue Collar Investor premium member site and is available for download in the “Reports” section. Look for the report dated 12/05/14.

Also, be sure to check out the latest BCI Training Videos and “Ask Alan” segments. You can view them at The Blue Collar YouTube Channel. For your convenience, the link to the BCI YouTube Channel is:

http://www.youtube.com/user/BlueCollarInvestor

Best,

Barry and The BCI Team

Hi Alan,

Great article on put selling vs covered call writes.

My question this week is, are you saying that for any underlying position we should now consider both selling calls and puts simultaneously to enhance returns?

Rgd

Gary

Gary,

Glad you like the article, thank you.

The two strategies are similar but have differences which are detailed in the book. Many of our members have been asking for this book for years and here, at BCI, we do our best to respond to member’s interest and needs. I have provided as much information to the best of my ability for our members for both strategies. Members can decide which strategy they prefer. Both are conservative option strategies that can generate monthly cash flow.

That said, I personally still prefer cc writing but do employ put-selling in bear market environments. In the book, I also detail a strategy where both strategies can be utilized as one multi-tiered investment strategy. This is the one I use in bear markets. I hope the information in this book benefits all members whether they use just one of the strategies or both simultaneously.

Alan

Greetings Mr. Ellman,

I was reading your article on “Margin Accounts and Covered Call Writing”, I would like to ask you a question if I may…

If I owned 100 shares that were currently trading at $10 per share and I had a margin account, I could buy another 100 shares on 50% margin, so I would control 200 shares or two call contracts. If I wanted to sell 2 calls at an a $8 strike price for a $2 premium per share, if at the end of the month the share price rises to $15 and I am assigned by the call buyer, I know I will receive $2 premium x 100 shares x 2 contracts = $400 in premium

The question I have regarding margin is how much I receive when the call buyer buys the shares from me at the strike price of $8. Since I control 2 contracts, 1 contract I own and 1 contract on margin, how much would I receive back into my account when assigned? I am guessing $8 strike x 1 contract x 100 shares = $800 + $400 premium = $1,200 cash would be in my account with no shares left

I have excluded interest and commissions from the $1,200 balance for simplicity.

Is this correct? I was just puzzled on how the strike price is paid on assignment to the covered call seller when using 50% margin.

Thank you for taking the time to read this, much appreciated. Look forward to hearing from you.

Warm Regards,

Vladmir

Vladmir,

This is an important question that requires us to examine the trade from 2 aspects:

1- From a calculation perspective is this a trade that we should get involved in? The answer is no. We buy the shares @ $10 and undertake an obligation to sell @ $8 for $2. There is no time value component to the premium…no profit.

2- If assigned, what do we end up with? A small loss based on commissions and interest payments. We bought 200 shares, half we paid for with our own money and the other 100 shares we bought with cash borrowed from our broker for which we pay a certain interest rate. Once the options are exercised and the shares sold we no longer own any shares. We have the $400 in premium and a $400 loss from the sale of the 200 shares, a wash. Then we have debits based on commissions and interest paid on the $1000 borrowed to purchase the second 100 shares.

Good question…thanks for asking.

Alan

Greetings Mr Ellman,

Yes, thank you for you response, the information you have provided from your posts are invaluable, much appreciated.

I read from your previous post that about 8% of options are exercised by option buyers. This is primarily due to extra commissions paid, opportunity cost, lose any extrinsic value left, lack of cash to purchase shares at the strike, increased risk of owing shares outright…etc.

The question I have is, if we do sell-to-open a call that is “in the money” and the stock continues to increase where it has some extrinsic value left before expiration, if the buyer decides to sell-to-close his option, do we no longer have an obligation to deliver shares since the contract was closed-to-sell by the buyer, therefore we are no longer a party to that contract? In essence, do we still get to keep our shares?

Lastly, from your experience and observations as a call seller, how many times or percentage of times were you assigned for options that were “in-the-money” close to expiration vs. the amount of times the buyer sold-to-close out their position?

Thank you, look forward to hearing from you.

Regards,

Vladmir

Vladmir,

For purposes of our trading, we (correctly) assume that if the strike is $0.01 or more in-the-money on expiration our shares will be sold 100% of the time. Our shares are not sold to a specific person but rather go into a pool where the OCC matches up buyers and sellers.

Now, if we don’t want our shares sold, we simply buy back the option prior to 4 PM ET on expiration Friday…we are in full control.

Alan

Hi Alan,

I am just curious , in the book that I have of yours complete encyclopedia for covered call writing on page 6 your graph indicates to get out of stocks in a bear market. Is this a new strategy that you have developed?

Joel,

No. That chart shows 5 market conditions: normal, slightly bullish, slightly bearish, incredibly bullish and extremely bearish. “Get out of stocks” applies to scenarios like the collapse of 2008. I remain active in the market 99% of the time.

Alan

good to know! Thanks Alan

Alan, just to say in case you may not know yet, I had posted some 4 more questions but forgot to realise it was with last weeks comments instead, – will be away for few days, so if you can reply whenever you like will be great. Thanks