With the rising popularity of stock option strategies and covered call writing in particular, we have seen the creation of more option products like weekly stock options. Weeklys expire each Friday of the month whereas the more traditional monthlys generally expire only on the 3rd Friday of each month. Weeklys fall into one of two categries: standard weeklys or expanded weeklys. In the last quarter of 2012, the options exchanges received regulatory approval for extended Weekly expirations. The options exchanges can now list up to five consecutive Weekly expirations for selected securities. Although any product with Weekly expirations can be part of the extended Weekly program, the exchanges will typically select the most actively traded options.

If the regular monthly expiration is three weeks away, then investors would most likely see Weekly, Weekly, Monthly, Weekly and Weekly expirations listed over a five-week period. There are no new Weeklys added that would expire during the expiration week for traditional monthlys, which is typically the third Friday of each month, nor are they even listed if they would expire on the same date as a Quarterly option on the same underlying security. Quarterlys are options that expire at the ends of quarters.

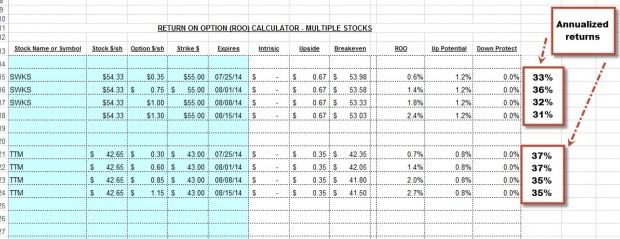

With so many more choices than we previously had available I thought it would be interesting to evaluate the returns for 1,2,3 and 4-week options on the same underlying securities and then annualize those returns to give us a sense as to which time frame may be in our best interest. Although this is far from a long-term scientific study, I did find the results interesting as a preliminary view into the world of weekly stock options. Here’s how I set things up:

Evaluation setup

I selected 2 stocks from our Premium Stock Report dated 7-18-14

- These stocks had to have expanded weeklys associated with them

- Neither stock could have an upcoming earnings report prior to expiration

- Data was taken immediately after expiration of the July contracts

- 1,2,3, and 4-week options were calculated

- The 2 stocks selected were SWKS and TTM

Calculating results

Here are the results as shown in the “multiple tab” of the Ellman Calculator:

Summary of results

- The options in weeks 1 and 2 showed slightly higher returns than those in weeks 3 and 4 for both stocks

- Is this small difference enough for us to favor weeklys over the more traditional monthlys?

In my humble opinion

From this initial, admittedly cursory, view of weekly calculations there appears to be no clear reason for favoring weeklys or monthlys based on annualized returns although the weeklys in weeks 1 and 2 did slightly outperform. Therefore, I would make a decision based on an overview of the pros and cons of weeklys as compared to traditional monthlys.

Pros and cons of weeklys as I see them

Positives:

- Annualized returns can be higher

- Can avoid exposure over weekends

- Can generate greater premium as earnings report dates are approached and trade up to the week before earnings

Negatives:

- The pool of stocks with weeklys is much smaller than those with monthlys

- Management is much more time-consuming as “rolling” possibilities come up every week

- Less time for exit strategy execution

- Quadruple the number and amount of trading commissions

- Lower option liquidity

- Wider bid-ask spreads

Conclusion

There are many ways to make money in the stock market and using weeklys is certainly one of them. There is no one strategy appropriate for every single investor so when deciding between weeklys and monthlys we must make sure we understand all the nuances (pro and con) associated with each choice to come to the conclusion that is in our personal best interest.

BCI WEBSITE NOW IN 80 LANGUAGES:

Because we have members from over 90 countries my fabulous team just added a new feature located under the google search tool at the top of our web pages where the site can be viewed in over 80 languages. However, expect responses from me to only be in English!

Market tone:

Those members who have followed our site over the years know how much emphasis I put on our real estate market as it relates to our overall economy. This is, to a great extent, related to the fact that I am an active investor in real estate, my 2nd favorite investment venue. In the past 2 months, the real estate data has been troubling, muting my aggressiveness in my covered call positions (along with geo-political events). This week, the real estate data was quite encouraging:

- New home construction rose by an impressive 15.7% in July, after 2 consecutive months of declines. This exceeded analyst’s projections and June statistics were also revised upward. Both multi- and single-family homes participated in the rise

- Building permits were also up by 8.1% and completions were up by 3.7%

- Housing starts are up 21.7% year-over-year

- Economists are watching how the housing market responds when the Fed begins raising short-term interest rates

- Sales of existing homes went up by 2.4% in July to an annualized 5.15 million, much better than analyst expectations (5.02 million)

- Existing home sales have been up 4 months in a row and on its best pace this year

- The median price of existing homes is up 4.9% year-over-year

- Minutes from the July FOMC meeting shows that despite an improving employment picture and slightly rising inflation, members are uncertain when short-term interest rates will increase. This rate has been between 0 and 0.25% since December, 2008 (sorry I had to mention that year)

- According to the Labor Department, the Consumer Price Index (CPI), a measure of inflation, was up very slightly by 0.1% in July, a smaller increase than the previous 2 months

- The Conference Board’s index of leading economic indicators increased by 0.9% in July, well above the 0.4% expected. This was the 3rd consecutive rise and 11th in the past 12 months

For the week, the S&P 500 rose by 1.7%, for a year-to-date return of 9%, including dividends.

Summary:

IBD: Confirmed uptrend

GMI: 6/6- Buy signal since market close 8/15/14

BCI: Moderately bullish, favoring out-of-the-money strikes 3-to-1

Thanks for all your amazing support,

Alan ([email protected])

www.thebluecollarinvestor.com

Covered call writing and dividend capture: Premium Members:

Many of our members have recently inquired about adding another component to our covered call writing strategy…dividend capture. In some contacts a 3rd aspect, tax-avoidance, was suggested. I believe the reason for this recent flurry of interest in expanding our cc writing strategy has to do with a recent series of articles presented in the journal published by The American Association of Individual Investors.

As I initiated my response to these inquiries, I realized that the response would be much too long and require far too many responses for an email response or a blog article so I undertook a project to write a “white paper” on this subject and posted it on our Premium Member site in the “resources/downloads” section. Scroll down to “Covered Call Writing and Dividend Capture: A White Paper”

I hope you enjoy and benefit from it.

Alan

Premium Members:

This week’s Weekly Stock Screen And Watch List has been uploaded to The Blue Collar Investor premium member site and is available for download in the “Reports” section. Look for the report dated 8/22/14

Also, be sure to check out the latest BCI Training Videos and “Ask Alan” segments. You can view them at The Blue Collar YouTube Channel. For your convenience, the BCI YouTube Channel link is:

http://www.youtube.com/user/BlueCollarInvestor

NOTE: The Premium Report (dated 08/29/14) for next week will not be available until Monday evening (Labor day, 09/01/14).

Best,

Barry and the BCI Team

Alan,

Is the open interest column in our stock reports based on weekly or monthly options for stocks that have weeklys? What about the etf report? Keep up the good work.

Joel

Joel,

The open interest column in our stock reports is based on near-the-money strikes for MONTHLY options. For members using weeklys, please double check the option liquidity even if our reports show adequate liquidity for the monthlys because weeklys tend to have lower open interest and wider bid-ask spreads.

All securities in our ETF Reports have adequate open interest for near-the-money strikes for monthly options.

Alan

Alan, you told me a few days ago how to calculate the end of month return of any stock I have, and I want to just confirm I am getting the right % return- based on where price could end up.

Another example is a stock I used this contract.

The stock ‘ATHM’ I have a buy @ $48.20, and I STO the $50C for $2.20.

Now if at expiry the price closes at say $45, then the way I understand it is I have a $2.20 profit – $3.20 share loss = – $1 loss. And return is -$1/$46 = – 2.17%.(loss)

If instead the price ended down at $47, then I calculate $2.20 – $1.20 loss = $1 profit. With return at $1/$46 = 2.17%.(profit)

Is this the right way to calculate the returns?, if these % returns aren’t correct can you then show me the right method? (and I guess if the stock was sold that any “BTC transactions” are deducted off the profit/ loss first, but not off the cost basis ($46) amount from just the premium?). Thank you.

Adrian,

Yes you have a good understanding as to how to calculate a completed trade where the stock price ends up below the purchase price. We will have a net gain or loss depending on if the option premium generated was more or less than the share loss. A general formula for a trade completion (not initial returns) where the option expires worthless and shares are sold at a lower price than purchase price is:

Premium profit + share loss/cost of shares – premium profit = % gain or loss.

Alan

Hi Alan,

I had the opportunity to utilize your premium report for the first time last Monday (8/18). I purchased 100 shares of CAVM and sold one option on that stock. On Friday, I bought back the option and sold the stock. It looks like it was a good decision but because I am so new at this I was hoping for a little feedback from you. I have read your book and read the “exit strategy” chapter several times. Any response would be very much appreciated.

I have included a screen shot of the Unwind Now page of the Ellman Calculator. My numbers have the commissions built into them. (Members…click on John’s image to enlarge and use the back arrow to return to this blog-Alan).

Thanks!

John

John,

No one can criticize a 189% annualized return but the question is should the position have been closed and at what cost? The initial trade appears to be:

– Buy @ $52.35Sell the $55 call @ $0.94

-Initial profit = 1.8%

-Upside potential = 5.1% which was achieved at the time you closed the position

-Total profit at time of closing = 6.9%

-If share price remains above $55 by expiration that would be your 1-month return

Now the cost to close is:

$269 loss on the option side

$70 gain on the stock side from the strike to current market value

Net loss to close = $199/$5500 = 3.62%

So the question we ask ourselves is: can we generate > than 3.62% by the end of the current contract by using the cash generated from the sale of the stock? I will usually wait for the time value of the option premium ($1.99 in this case) to approach zero before unwinding mid-contract. See pages 264 – 271 of the Complete Encyclopedia… for more details on this strategy.

Keep up the good work.

Alan

You are quite correct in stating there are many strategies to suit anyone’s comfort level or expectations when trading options. Personally, I am much more comfortable trading weekly options and I do not mind the additional transaction costs.

The shortened exposure squares well with my time horizons at my advanced age. Furthermore, the challenges keep me mentally alert and on my toes, this is an additional benefit everyone can eventually appreciate.

Alan, thanks for all your guidance! I am still able and willing to learn.

Austin,

Thanks for your valuable feedback. That’s what this site is all about…we learn from each other to become better investors. You bring out a fantastic point about trading with stocks and options being a form of “mental exercise”

Stay in touch.

Alan

Alan, If I don’t find enough stocks that have a positive chart and returns(or both) from the premium report after expiry, then which ETF report is it best for me to then turn to?,- the one just before expiry or the next one after expiry? Thanks

Adrian,

Always use the most recent ETF Report as it is based on the most recent information and security performance.

Alan

Hi Alan,

John opened his trade on Monday and closed it on Friday so he made a 3.1% return on his capital in 4 days.

If the trade is held to expiration a 6.9% return on capital would be realized if the share price was above $55. This would take 32 days from opening the trade.

His annualized return is approximately 3.5 times greater with the short time frame.

As long as he redeploys his capital isn’t he better off closing and banking a sure profit rather than waiting until expiration?

Love your site and all of your information.

Kind regards,

Iain

Iain,

The final determination is based on whether we can generate a sigificantly higher return with the cash generated from closing the long stock position than the cost to close. Generally speaking, that is difficult to accomplish when the cost to close is 3.62% using low-risk securities. There are always exceptions to this guideline but 95% + of the time, we will want the time value of the premium to approach zero.

Thank you for your generous comments.

Alan

Alan,

I’m sorry to bother you with a question. After closing out an option on Friday for 11.70 and then rolling out and up or 6.40 you would think I wouldn’t have my stock assigned. Did I perform this buy to close too late?

(I canceled the first entry as a mistake.) I did the BTC and STO on Friday.

Thanks for you help.

Dave

***CLICK ON DAVE’S IMAGE TO ENLARGE & USE THE BACK ARROW TO RETURN TO BLOG

Dave,

Without viewing all the activity in your account I can’t be 100% sure but one possibility is that you inadvertantly sold more than 1 contract while owning 100 shares.If that’s the case and you closed one short near-term position the other was still open for exercise.

If that’s the case, make sure that you are not in a naked options position with the latest contract you sold. I know you are paper-trading but I would treat it as if you were risking your hard-earned money…best way to learn.

Alan

Alan,

I am very much thankful for the amazing videos. They are extremely helpful.

I was wondering if you answer direct questions because so far I have two:

I am starting out both older and wealthier than your model—I am in my 30s with around $40k savings to invest. Do you recommend skipping the mutual funds aspect of your model and moving directly into stocks/covered calls?

Just about every FinBiz stock that matches your criteria is trading at or near its 52-week (or even all-time) high? If the market turns bearish like it did in 2008 then I assume some losses are to be expected and that we simply move into mitigation mode. Obviously when the dust from the next bearish cycle settles conditions will be ripe for entering, but it currently looks like an inflated time to enter the market. I’m not saying that out of timidity or fear of taking that first step—in fact I’ve already executed several covered calls with great success—but I would love to know your thoughts/feedback on this.

Thank you again!

Gordon

Gordon,

From the standpoint of portfolio size and diversification $40k is in the area where you can consider both stocks and/or ETFs (mutual funds have no options).

You can also consider ETFs if your risk-tolerance is low and you are willing to accept lower returns. It’s not just cash available that dictates the type of underlying securitites we use. I use individual stocks in my cc accounts and ETFs in my mother’s.

Now as far as 2008 is concerned (I had just about forgotten about it until you brought it up…just kidding), I do not believe we should make the foundation of our trading strategy based on an aberration although we should have a plan in place for the next recession. My personal opinion is that we are not even in the same galaxy for a repeat of 2008 but others may disagree. With that in mind:

1- Our obligations are only 1 month. We can maneuver our strategy style based on the most current information.

2-Those who are bearish can “stay in the game” by using low-beta stocks or ETFs and sell in-the-money strikes for protection and, of course, we always have our exit strategy opportunities in place and ready to go.

3- I view stocks nearing 52-week highs as a positive and favor out-of-the-money strikes if market conditions are favorable. However, for those who are concerned about an impending price reversal, using the more protective in-the-money strikes may be appropriate.

Alan

Alan, In one of your books I have noted down a comment you say which was, “Get out of positions when new concerning information becomes available”.

I’m a bit uncertain whether I need to check each stocks company news everyday, or possibly to set up an alert (if this is even possible) for when any new news comes out?

(I already am by your past instructions checking the economic reports, and breadth/sentiment charts at end of each week, but it’s any important stock news I don’t want to miss too long.)

Thanks

Adrian,

You can easily set up alerts for any news on your current stock holdings. Most brokers offer that capability as part of their trading platform. You can also have alerts sent to you if you are a user of the Google Chrome browser. Google will send you email alerts when ever there is news on the stocks you have requested updates on.

Best,

Barry

Thanks Barry for making the point of using Google for getting alerts. I don’t have that browser but is something I may likely try after seeing what the brokers have to offer me first. Thanks

Adrian,

You might want to try the Chrome browser…it is offered by Google at no cost and you can set as many alerts as you need to. Takes seconds to set up.

Best,

Barry

Alan,

I’m working my way through McMillan on Options where McMillan says “…corporate news may be released after the 4 P.M. Friday close. Since options may be exercised up until 5 P.M. on expiration Friday, it is possible for news to come out after the market closes that would make holders of the options want to exercise.” (P. 21)

So, it sounds like if we like a stock we wrote a covered call on and wish to keep it in our portfolio then it’s imperative to buy back the option just prior to close on expiration Friday. Is that accurate?

Buyback almost seems like a must because if our option is firmly out of the money, say two minutes before expiration Friday closes, the price to buy it back would likely be nominal. If we don’t buy it back and it gets exercised on some positive news released after closing but prior to expiration, we have forgone any upside which might result from that positive news. If the news causes a spike in the underlying price then we’ve forgone a possibly substantial gain all for what could have been a nominal buyback fee.

Thoughts?

Gordon,

It is true that an option which is out-of-the-money at 4PM ET on expiration Friday can be exercised after hours when good news is reported. It is also quite rare. I have also recommended in my books and articles to “roll an option” on a stock you want to include in your next month’s portfolio if the price is very close to the strike as 4PM ET approaches because the price will tend to close at the strike (called “pinning the strike”).

Your question seems to imply a situation where the price is well below the strike (if it’s close, definitely buy back the option if you want to keep the stock and then sell the next month’s option as long as the option credit meets your goals). You are 100% correct that the time value will be minimal in the case where the price is below the strike as 4PM nears. So the question becomes do you want to incur this minimal time value expense + commission on every position in your portfolio that is below the strike in the unlikely event that good news will come out in the next hour and result in exercise?

If it does and the shares are sold, you will have maxed your trade for the near month (option premium + share appreciation to the strike) and can use the cash from the sold securities to enter a new cc position the following week…an ideal result.

It is also possible that bad news will come out and cause the share price to decline. Then the extra cash spent to buy back the option will be like salt in the wound.

The scenario you describe is definitely possible but not common enough (in my view) to justify buying back every OTM option in your portfolio every month of the year.

Alan

Premium members:

This week’s 8-page report of top-performing ETFs and analysis of ALL Select Sector Components has been uploaded to your premium site. The report also lists Top-performing ETFs with Weekly options as well as the implied volatility of all eligible candidates.

For your convenience, here is the link to login to the premium site:

https://www.thebluecollarinvestor.com/member/login.php

NOT A PREMIUM MEMBER? Check out this link:

https://www.thebluecollarinvestor.com/membership.shtml

***Our next stock report will be published on Monday evening well before market opening on Tuesday as members of the BCI team will be celebrating the Labor Day holiday.

Alan and the BCI team

Hi Alan.

Thank you for responding so quickly about the banned stocks. I appreciate the information you provide on youtube. My question is about when assignment takes place. Example: If I write an ITM covered call, can I expect to be assigned before the expiration date?, because the stock is already in the money. Or does it only matter where the stock is trading on the expiration date. (ie. at or above the strike). So If I write the call and it’s trading in the money and goes higher but by the time it comes to expiration it’s falls out of the money. What happens? I really appreciate the help. I would really like to put your strategy to work.

Thanks,

Mike

Mike,

99% of the time, share assignment will not take place until the day after expiration Friday when the strike is one penny or more in-the-money. The reason has to do with the fact that the option holder will generate more premium by selling the option than exercising it. Therefore, even if the strike is ITM mid-contract, share assignment is extremely rare.

A possible exception to this rule is when here is a dividend distribution (more accurately an ex-dividend date) taking place prior to contract expiration. Under certain conditions (not all), an option holder may elect to exercise early to capture the dividend.

Finally, if a stock is trading above the strike for most of the contract and then dips below the strike at expiration, exercise of that option will not take place.

Alan

Hello Alan,

I have read you Encyclopedia and found it really great!

After having read your book and all the blogposts on covered call exit strategies your system seems perfectly clear to me. Thanks for this valuable wealth creation tool.

I have one question though:

Consider that expiration Friday comes and my short call is OTM, so I will still own the underlying after the contract cycle. What factors do you consider in this case to decide whether to sell the shares and look for another position or keep the shares and write a new call?

What do you do if the share price is below your purchase price (position shows a loss), the share is no longer white on the running list and/or has an upcoming ER in the next contract cycle?

What would make you book the loss after expiry and move on instead of selling another call for these shares?

Thanks for your help in advance.

David from Hungary

David,

If the price of the stock is below the strike at expiration and there is an upcoming earnings report, I will almost always sell the stock and use the cash the following week to enter a new position. Although it is not tecnically part of the BCI methodology, I will from time to time hold the stock through an ER and then sell the option after the report passes. Years ago, I did this with great success with CSCO and AAPL.

Now if there is no ER, I evaluate the stock as I would any other. Is this a good candidate to be part of my portfolio in the next contract cycle? Where is the cash currently devoted to this stock best placed to generate a profit…in this stock or in another? If the stock is in the white cells of our report, it probably is still a good candidate. If not, there are stronger candidates and most of the time best to move on. An alternative if you want to keep this stock another month is to sell an in-the-money strike for additional downside protection.

Alan

Running list stocks in the news: GBX:

The Greenbrier Companies, Inc. posted an outstanding 3rd quarter earnings report on July 2nd beating market consensus by 39%, GBX builds railcars and marine barges and its industry, Transportation-Equipment & Leasing is extremly “hot” right now. The company followed this ER with positive guidance causing analysts to continue the trend of raising estimates as shown in the chart below. Earnings are expected to increase by 53% in 2014 and by 30% in 2015.

Our Premium Running List shows a projected ER date of 10-1-14, an “A” ranking for the Transportation industry, a beta of 1.91, a % dividend yield of 0.80, adequate open interest for near-the-money strikes and the recent ex-dividend date of 7-11-14.

CLICK ON IMAGE TO ENLARGE & USE THE BACK ARROW TO RETURN TO BLOG.

Alan