Last month I published an article titled Complex and Leveraged Exchange-Traded Funds. I discussed the goals and risks associated with many of these products. One of the topics examined was Inverse Exchange-Traded Funds. Here is a brief review:

Inverse ETFs use derivatives to bet against the direction of financial markets. These are known as short or bear ETFs and will make money if markets decline in value. They will lose money, however, if markets move against the bet. Covered call writers who have a bearish market outlook may find these funds useful.

I highlighted the next to last sentence because we find ourselves in a market that has been appreciating and showing strength due to positive economic news. While I remain cautiously bullish on the overall market many sophisticated covered call writers can benefit from the use of inverse ETFs in bearish market environments so a discussion is useful. Over the long haul, shorting the market is NOT a sound strategy.

Advantages of Inverse ETFs over short selling:

- Retail investors can use these products to short the market without being required to achieve shorting privileges which usually will not be granted to retail investors

- There are no margin requirements as there are with traditional shorting

- The loss potential for shorting is unlimited (the underlying can appreciate exponentially) but limited to the initial investment for Inverse ETFs

- Costs associated with short-selling are avoided

- Some funds include professional management which will assist less experienced investors

Disadvantages of Inverse ETFs over short selling:

- ETF share prices may not be exactly correlated to the underlying benchmark which may result is lower-than-anticipated returns

- As a general disadvantage we must re-tool our thinking to make decisions when to enter and exit our positions as we have been trained to look for positive market movers

Inverse ETFs (non-leveraged) that follow closely watched indexes:

- Inverse ETFs- Market Indexes

Recent short and long-term performance of Inverse ETFs:

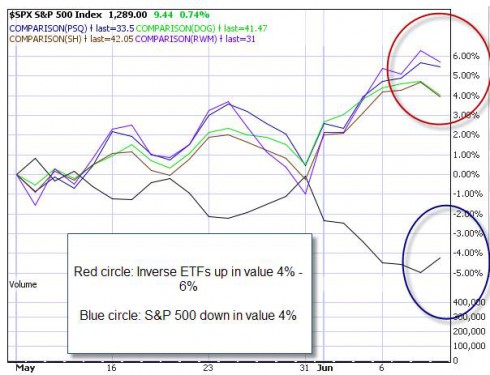

Since the market historically appreciates in value in the long run, this is a short-term strategy that must be monitored carefully. Let’s first view a 1-month comparison chart of the four selected Inverse Funds compared to the S&P 500 as of 6-2011:

- 1-month chart of Inverse ETFs vs. S&P 500

Now let’s compare to a recent chart as of 1-24-13:

Inverse ETFs as of 1-24-13

- 1-year chart of Inverse ETFs vs. S&P 500

These two charts demonstrate how both beneficial and risky Inverse ETFs can be.

Options chain for Inverse ETF RWM in a volatile market:

- RWM options chain

The 5-week return for the at-the-money $31 call is $70/$3100 = 2.3%

Conclusion:

The use of Inverse ETFs by experienced covered call writers in the short-term can be a way of enhancing returns in bearish market conditions.

Market tone:

After a strong year in 2012 and a solid start to 2013 investors have recouped the $8 trillion they lost during the recession. Our economic recovery continues at a slow pace but continues nonetheless as good news outweighs bearish economic news:

- The unemployment rate increased from 7.8% to 7.9% in December BUT the number of non-farm payroll jobs increased and the revised job growth in 2012 was more impressive than originally estimated (from 155,000 to 196,000

- Private sector payrolls rose by 166,000 as government jobs fell by 9,000

- Personal income increased in November and December at the best pace since February according to the Commerce Department

- Personal savings rate climbed to 6.5%, the best in 4 years

- According to the Institute of Supply Management durable goods orders rose by 4.6% in December well above the 0.7% rise posted in November

- In the 4th quarter, GDP declined by an annualized rate of 0.1% but, also had a silver lining as consumer spending was strong, as was business investment in equipment and software. The contraction in GDP, many felt, was caused by the military spending cuts prior to the fiscal cliff outcome

- In 2012, the economy grew by 2.2%, better than the 1.8% rate in 2011

- Consumer confidence came in @ 58.6 well below the 64.0 expected. The return of the full payroll tax this year may have been a factor

- The ISM index for manufacturing activity was at 53.1, well above the 50.5 anticipated

For the week, the S&P 500 was up 0.7% to 1513.

Summary:

IBD: Confirmed uptrend

BCI: Moderately bullish favoring out-of-the-money strikes 3-to-2

We will continue to work hard to justify the support and confidence you have gifted to our team.

My best to all,

Alan ([email protected])

Premium Members,

This week’s Weekly Stock Screen And Watch List has been uploaded to The Blue Collar Investor premium member site and is available for download in the “Reports” section. Look for the report dated 02-01-13.

Also, be sure to check out the latest BCI Training Videos and “Ask Alan” segments. You can view them at The Blue Collar YouTube Channel. For your convenience, the link to the BCI YouTube Channel is:

http://www.youtube.com/user/BlueCollarInvestor

Since Earnings Season is in full swing right now, be sure to read Alan’s article, “Constructing Your Covered Call Portfolio During Earnings Season”. You can access it at:

https://www.thebluecollarinvestor.com/constructing-your-covered-call-portfolio-during-earnings-season/

Best,

Barry and The BCI Team

Hey everyone…

Has anyone here ever looked at Interactive Brokers?

They are really cheap!

I mean, if you buy 100 shares, its like $1.00…

At TradeKing, as good as it is, its like $4.95 a trade…

So, besides this, does anyone have anything negative to say about IB?

Cheers everyone!

Dave

David,

I have two friends who are experienced traders who swear by Interactive. I’m thinking of switching over since I started making a lot more trades with covered call writing.

Good luck.

Hal

Thanks Hal… Thats good news… Yeah, I looked at how much I have spent on brokerage in the last 12 months, and I figure if I was with IB, instead of TK, iI seriously would have made an en extra 2%-3%PA or roundabouts for the year… It all adds up…

Good luck and all the best!

Dave

BTW, I will be trialling IB out for the next few months so I can give feedback to other investors on how there platforn ect is…

Expiration dates:

EBAY has been on our premium watch list for 8 consecutive weeks. There have been some inquiries why there are multiple listings for the same strike prices in the same month. This has to do with the fact that some of our securities also have weekly options. BE SURE TO CHECK THE EXPIRATION DATES BEFORE ENTERING A TRADE. In the screenshot below, note that the expiration dates are included in the option tickers and that will help you determine whether you are looking at a weekly or monthly (same strike) and explain the multiple same strikes. Obviously, also, the one with more time remaining will generate a higher premium. Click on image to enlarge and use the back arrow to return to this blog.

Alan

I have noticed some of the strikes on SPY have three different expirations. You really have to be careful.

Larry,

Great point. I’ve had a few off-site inquiries about this recently. Certain heavily-traded securities have weekly as well as LEAPS (long-term options) associated with them as does SPY. As you point out, in the same month there can be multiple expirations and for the same strikes as well. Check out the option chain below for EBAY and note the two expiration dates within the ticker symbols for the same stock in the same month and same strike. Click on image to enlarge and use the back arrow to return to this blog.

Alan

New seminar just added:

Houston: January 14, 2014

Details to follow

Premium Members,

Due to the incoming snow storm in the North East, there is the possibility that the Weekly Report may be published later than normal. There is the potential of power outages that could cause the delay. Hopefully we’ll be fine, but we just wanted to alert you the the possible impact of the storm.

Best,

Barry and The Blue Collar Investor Team

This morning I was looking at a daily chart of the S&P500… I notice a few interest things…

1) Yes, overall trend seems bullish with the 50 day moving above above the 200 day moving average… In addition the trading bars are well above the 200 day moving average which is a very positive sign for the bulls…

2) There are quite a number bearish warning signs that have appeared. They are as follows…

* The RSI (14) has in recent weeks hit overbought (above 70) levels.. A daily chart of the S&P500 shows that in the last 12 months the s&p500 has hit overbought levels (RSI above 70) about 5 times… Out of thoese 3 other times… Each of those times the market has reacted by turning south .

*The last few weeks the RSI has shown bearish divergence… The s&p500 is going up but the RSI is not, its actually trending down a little…

*There have been a few bearish candlestick patterns. (bearish engulfing pattern and the hanging man…)

*The price action is overextended…The last 12 months the s&p500 has been fairly volatile (up down up down ect) but since last Christmas the s&p500 has just been going up up up!! Going by the pattern of the last 12 months its bound to come down, atleast for a breather…

So, assuming it does come down, how far will it come down?

Based on the last 12 months of the S&P500, here are some of the possible scenarios…

* If its a mild correction, it will come down to the 50 day moving average…

*If its a bit more powerful it will come down to the 200 day moving average…

Of course, after saying all this, I could be wrong… The market could just keep going up like a helium baloon…

Personally, i have a conservative approach right now… Im listening to these warning signs…

I like to trade conservatively when the greed is dominating the market (overbought) and trade more agressively when the market is acting fearful…

Of course, in line with Alans system, I do search for excellent performing stocks with excellent fundementals… But, I do like to take positions close to or at support, and usually thats when fear is dominating the market…

All the best with your trading everyone!

Dave

Hello David,

I like your analysis. Have you thought about looking at Fibonacci retracements? They can give you a better sense of where the next price level could be. You might consider them as “focused” support and resistance lines. The 38.2, 50.0, and 61.8 levels are particularly interesting…they tend to be price levels that the “pros” watch. If your charting program has the ability to draw Fibonacci levels, draw them on a chart of the $SPX. I think that you will be surprised how accurate they are.

Fibs aren’t for everyone, but “chart junkies” (like myself) love them.

Best,

Barry

Thanks Barry…

I will be sure to check them out…

All the best Barry…

Dave

Hi Barry…

Thanks for the feedback…

Yes, I have heard about Fibonacci retracements but I have never really checked them out…

Now that you have brought it to my attention I will check them out…

Thanks Barry

All the best for a great 2013 in your trading!

Dave