Never sell a covered call option or cash-secured put if there is an earnings report due out prior to contract expiration. This is one of the golden rules of the BCI methodology. We know that a report that disappoints generally did not meet market consensus regarding sales, earnings or both. However, the report still may have reflected great corporate performance aside from not meeting analyst expectations. This article will highlight such a scenario with Facebook, Inc (FB) which dropped $10.00 in value after the November 2nd, 2016 earnings release.

Technical chart

FB Chart before and After a Disappointing Earnings report

The brown field highlights a drop in share price from $129.00 to $119.00 resulting from the report that did not meet market expectations. The blue arrow points to the bearish moving average crossover which occurred shortly after the price decline. What we have here is a company that is generating huge revenues and profits but a bearish technical chart. Following our earnings report rule, BCI members moved out of FB prior to the report but can now re-enter at a lower price point if the assessment is that of an opportunity despite the technical breakdown. Many BCI members did exactly that.

Options chain as of 12/21/2016

FB Options Chain for the 1/20/2017 Expiration

A bullish outlook on FB will guide us to out-of-the-money strikes, highlighted in the yellow field. The more bullish we are on the overall market and the stock, the deeper out-of-the-money strikes should be favored. Let’s feed these stats into the multiple tab of the Ellman Calculator.

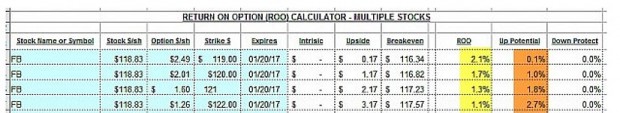

The Ellman Calculator: FB

The ROO (return on options) ranges from 1.1% to 2.1% for the one month. The upside potential ranges from 0.1% to 2.7%. The $122.00 strike offers the greatest 1-month potential return of 3.8% (1.1% + 2.7%).

Price action post report

FB Chart After Disappointing Earnings Report

After a brief period of consolidation (blue arrow), FB has been in a strong bullish price pattern (red arrow).

Discussion

A disappointing earnings release can create a bearish technical chart for an otherwise elite-performing security. Frequently, the report was impressive but fell short of market expectations. Buying the stock after the share decline and favoring out-of-the-money strikes when we anticipate price recovery is a choice available to us. An excellent free resource for stock news including earnings reports information is finviz.com.

$10 Discount coupon/ The Complete Encyclopedia- Volume 2 now available in hardcover

The Complete Encyclopedia for Covered Call Writing-Volume2 is now available in hardcover format. The classic version has been available in hardcover for the past 2 years and many of our members have been inquiring about Volume 2. In recognition of this product expansion, we are offering a $10 discount coupon on all orders for all products in the BCI store with a minimum purchase of $50. This offer is valid from June 17th through June23rd. Use promo code “HARDCOVER” to receive a $10 discount at checkout.

Complete Encyclopedia-Volume2: Hardcover

Next live event

American Association of Individual Investors

Washington DC Chapter

Saturday July 15, 2017

9 AM – 12:00 PM

“Using Stock Options to Buy Stocks at a Discount and to Bring Portfolio Returns to Higher Levels”

Co-presenter: Dr. Eric Wish, Finance Professor, University of Maryland

Market tone

Global stocks remain unchanged on the week. The price of West Texas Intermediate crude oil declined to $44.70 from $45.50 last Friday. Volatility, as measured by the Chicago Board Options Exchange Volatility Index (VIX), moved up to 10.38 from 10.0 a week ago. This week’s economic and international news of importance:

- Despite falling inflation data in recent months, the US Federal Reserve hiked rates on Wednesday, and indicated it will likely hike rates once more this year

- The central bank laid out the framework it will use when it begins to shrink its massive balance sheet later this year

- Fed chair Janet Yellen chalked up the recent decline in inflation to factors such as falling prices for cell phone service and prescription drugs

- Despite three consecutive monthly declines in consumer prices, the Federal Open Market Committee said that it expects inflation to stabilize around the committee’s 2% target in the medium term

- Despite three rates hikes, yields on US 10-year notes are nearly a half-percent lower today than they were when the FOMC resumed its tightening cycle in December 2016

- French president Emmanuel Macron’s Republic on the Move party is set to secure a significant majority in the National Assembly

- Credit rating agency Moody’s Investors Service warned this week that the minority government resulting from the recent snap election in the United Kingdom further complicates Brexit negotiations with the European Union

- The International Monetary Fund raised its gross domestic product forecast for China to 6.7% in 2017, up from its prior 6.6% projection

- Greece’s creditors reached another deal to release a further round of funding to keep the country afloat

- The Trump administration announced a revised Cuba policy on Friday that will tighten rules on Americans traveling to Cuba and restrict US companies from doing business with entities controlled by the Cuban military. Exceptions will be made for US air carriers and cruise lines

THE WEEK AHEAD

Sunday June 18th

- France: Final round – parliamentary elections

Monday June 19th

- United Kingdom Brexit negotiations commence

Wednesday June 21st

- US Existing home sales

Thursday June 22nd

- US Leading economic indicators

Friday June 23rd

- Global Flash purchasing managers indices

- Canada Consumer price index

For the week, the S&P 500 moved up by 0.06% for a year-to-date return of 8.68%.

Summary

IBD: Uptrend under pressure

GMI: 4/6- Buy signal since market close of April 21, 2017 (as of Friday morning)

BCI: I am fully invested in the stock portion of my portfolio currently holding an equal number of in-the-money and out-of-the-money strikes.

WHAT THE BROAD MARKET INDICATORS (S&P 500 AND VIX) ARE TELLING US

The 6-month charts point to a cautiously bullish outlook. In the past six months, the S&P 500 was up 7.5% while the VIX (10.38) moved down by 15%.

Happy Father’s Day to our BCI Dads.

Much success to all,

Alan and the BCI team

Alan,

Hope all is going well for you.

Can you give me an example of what laddering calls may look like?

Thanks,

George

George,

We use the concept of “laddering strikes” when we are getting mixed market signals and we own 200 or more shares of the underlying. Let’s say we owned 400 shares of Dave & Busters (PLAY). With the stock currently trading at $68.35 we can sell a combination (2 and 2 or 3 and 1) of the $65 in-the-money contracts and $70 out-of-the-money contracts rather than 4 contracts of one or the other.

As shown in the screenshot of the Ellman Calculator below, the $65 strike generates a 1.3%, 1-month time value return (yellow) with a robust 4.9% protection of that profit (purple).

The $70 strike, generates a 1.9% 1-month time value (yellow) return with upside potential of 2.4% (brown) for a possible 4.3% 1-month return.

In essence, we are diversifying strike prices.

CLICK ON IMAGE TO ENLARGE & USE THE BACK ARROW TO RETURN TO BLOG

Alan

Thanks Alan,

Why would stock selections, etc. on the weekly watch list report not be good candidates for “buying calls” rather than selling covered calls.

George,

The stocks on our lists would be appropriate for all strategies that benefit from securities with bullish tendencies. This includes share ownership and call-buying . My personal preference is to be on the sell-side of options. This is where I have enjoyed the greatest success.

Long call buying is most appropriate for sophisticated investors with high risk tolerance. This eliminates most retail investors.

Alan

Allen,

How many trades can a newbie manage. How many calls do you have going at any one time?

Thanks you,

Dan

Dan,

Typically, I have between 15 – 25 positions and sell between 50 – 100 contracts per month (plus a few in my mother’s account).

However, when I first started with covered call writing my account consisted of 5 positions. I then increased that amount as my portfolio cash value increased and my management skills improved.

I would advise beginners to start small and then increase the number of positions gradually until a maximum comfort level is reached. As a guideline, we can start with 5 different stocks in 5 different industries or 2-3 exchange-traded funds (ETFs). Most importantly, start by paper-trading (practicing) a hypothetical account so skills can be honed without losing money.

Alan

Allen,

What if any adavantage or disadvantage of writing calls on stock that has gapped-up or down. Let’s say GOOG shoots up or down $30?

Dan

Dan,

When a stock price has gapped-up or down, there was an event that led to that price correction. We must check the news for that event (finviz.com is an excellent free site) before we make a decision whether to incorporate that security into our portfolio.

Earnings reports are the most common cause of these events but certainly there are others. Once the price has settled and we have determined the nature of the event, we can decide if that security has earned its way into our portfolio.

We cannot make a general rule that a gap-up or down should or should not lead us to use that security.

Alan

Premium Members:

This week’s Weekly Stock Screen and Watch List has been uploaded to The Blue Collar Investor Premium Member site and is available for download in the “Reports” section. Look for the report dated 06/16/17.

Also, be sure to check out the latest BCI Training Videos and “Ask Alan” segments. You can view them at The Blue Collar YouTube Channel. For your convenience, the link to the BCI YouTube Channel is:

http://www.youtube.com/user/BlueCollarInvestor

Best,

Barry and the BCI Team

[email protected]

Hi Barry,

Did you see WCN ??? Somthing must be happening !!!

Roni, members:

WCN: 3-for2 stock split:

https://finance.yahoo.com/news/waste-connections-shareholders-approve-3-200500170.html

Deep breadth…

Alan

Hi Roni,

WCN had a 3 for 2 stock split on June 19th.

Best,

Barry

Thanks Barry,

I was trying to enter a covered call trade on WCN yesterday morning and could not understand what was happening.

I gave up and entered another trade instead.

Now i am fully invested for the July 21 options cycle.

Roni

To Jay,

I hope you read my response on your Kennedy Sr & his shoeshine last week.

How was your expiration weekend ?

Roni

Hey Roni,

Thank you for the kind follow up. I loved your response to the shoe shine boy story last blog 🙂 I am glad it resonated with both you and Barry!

If you believe in seasonality this week will be terrible. When you add in the politics of the moment in the US it could be worse.

I plan to cover the stuff I own on any strength and wait for more weakness before I buy anything new. – Jay

Good morning Roni,

Well, I got my wish for an up day and sold some OTM calls. July has a sneaky habit of being a good month with a summer rally. I only covered half of my positions. I do not buy on up days so I will not add anything today. We will have some down days this week.

Everyone has a method that works for them, I buy positions on down days and cover them on up days. The market never moves in a straight line :)! – Jay

Yes !

Your method is certainly very good, but it requires guts.

I am starting to follow it gradually with some special tickers.

Take care – Roni

Thanks Roni,

This comment is for our new friends and not you :

Please do not do anything based on what I say or on what anyone else here says. When you are facing a live trading platform with a mouse in your hand and your money at risk there is only one accountable person: you.

Please make certain whatever you do it is because you have thought it through first and have conviction in it. – Jay

That’s OK Jay,

do not worry, I am still the same old coward as before.

But I really believe your method of buying the stocks on down days, and waiting to sell the calls on up days is very good.

Especially with rock solid tickers in bullish environments.

Best – Roni

Thanks Roni,

It works for me but there is no perfect system and I did not want to come across as preaching so I added heavy caveat. – Jay

Allen at the end of the week do we want a covered call to be assigned or expired?

Dan

Dan,

As long as we apply our position management skills, it doesn’t matter.

If a strike expires out-of-the-money at expiration, we still own the shares and make a decision about the next contract month based on system criteria.

If a strike is about to expire in-the-money, we make decision to either roll the option or allow assignment. We are in the driver’s seat and decide whether or not our shares will be sold.

Both scenarios will present themselves every month so it is critical to master the position management skill before entering any trades.

Alan

Hello Alan,

I am sending this expiry weekend report because I feel very happy with my monthly results, and wish to share it with you.

I followed your lead, and was fully invested this month, holding equal number of ITM and OTM strikes.

Total of 9 different tickers, all selected from the BCI watch list.

4 were assigned.

2 expired worthless, 1 is breaking even, and 1 is losing 6.6% (AEIS) after deducting the call premium.

3 rolled out and up on Friday 06/16 to the July 21 expiry.

My total account value rose 1.7%. Big smile.

Thank you for guiding us in the best possible strategy and tactics.

Roni

Roni,

You made my day.

Keep up and good work and continued success.

Alan

Gradually increasing how much I’m committing each month – here’s what I bought on Monday for those looking for CC ideas. Other stocks with interesting call options were CRUS, QRVO,SMTC,GATX, and SBGI.

Alan,

I just love the book you sent me, I highlighted it, now going over it again. Just awesomeness, I will be buying copies for the people I love, thank you.

My question…

Reading your book, I understand the importance of reinvesting the premium immediately. But, in what? Lets say I have five positions, and in total I get $500 to $700 in premiums that month. I can’t write calls with that small amount of money, what vehicle can I use?

Trade long and prosper,

Luis

Luis,

When I first started with covered call writing (back in the 1990s!) my portfolio cash value was $25k and it consisted of 5 stocks in 5 different industries (plus cash for exit strategies).

When option-selling generated $500 – $700 per month, there wasn’t much I could do in terms of buying new shares and compounding initial profits.

Within a year, I was able to add additional positions and the rest is history.

When compounding is added to our portfolio strategy, it will have a major positive impact on our goal of financial independence.

Alan

Hi Alan,

In video 135, if i let that stock get called away, i WON’T have to buy back the option at 12.75? thank you Randal

Randal,

Yes. When a strike expires in-the-money by $0.01 or more, the option will be exercised and the shares are sold at the strike price. There is no need to also buy back the option. The broker will charge a commission to sell the stock but not to close the option. Some brokerages will charge a higher fee for exercise than for selling the stock. I would ask them to reconsider this policy for your portfolio or find another broker.

Alan

Here is my status and my experiences after Expiration Friday 6/16 and the Monday and Tuesday thereafter:

I have 5 accounts split between Fidelity and Optionshouse.

Been with Alan now since April 2016 – 14 months, Studied his methodology for 4 months before that and many other Library books on options. I was a bunch of nerves for those first trades since it does not matter how much you read and practice, there are just so many variation of events that can occur and documentation to do and your memory has to go into high gear and make decisions per Alsn’s Guidelines at the same time. Too makes things harder, it happened to be that my first Expiration Friday was Earnings Reports month, which meant i could not roll some positions, let them get assigned, and adds more work to do to find some option candidates the next few days.

.

This Exp Fri 6/16 was the most pleasant one of them all. Had 20 positions, 10 securities, 5 accounts, 2 brokerages.

Was 92% invested and averaged 2.8% (36.4%) in 4 accounts, and 1.6% (20.9%) in the fifth account. Overall Year to Date, after 6 months, I am averaging 8.1% 19.5% in 4 accounts and 1.5%, 20.9% in the 5th account.

I have been playing mostly ITM positions for my peace of mind, but this last month i split with some more OTM positions. I did 5 mid-contract unwinds (MGM, PAYC, ATHM) when the Time Value was small with a loss around 0.1% to 0.2% (out of 2-4% gains) per trades. Then I went right back and reinvested the free cash from the unwinds.

On Expiration Friday 6/16, I rolled out 3 securities (EWY, HLT, GLW), 7 positions in 5 accounts. The rest, 12 option positions and 1 stock were worthless but not necessarily bad since some were OTM positions that were just under the strike and making money.

I find that I need at least 1/2 hours to roll each security plus an extra 1/2 to 1 hour as margin before the market closes. You need the time to analyze the trade (Pinning, latest last price, gain from roll with ITM and OTM strikes, placing order, playing the spread). If I have one security in multiple accounts, I set them all up at the same time with Roll Limit orders so I can Send the order at the same time my action items straight. I play the spread and found if it does not execute within a minute, I have to adjust the limit so i can get it to fill. No time to play around.

Monday, was a good day for many of us, I believe. With Expiration Friday, securities were down and worthless and on Monday, the jump in the market regained profits. I unwound EDU, which gapped up lots in the AM and stayed there, added options to ATVI ITM. On Tuesday, I opened new Covered calls on MGM ITM to become fully invested again. I still have 2 stock positions. One is UCTT, which I am waiting to match my BEP (breakeven point) or a spike up for a profit and unwind. The other is dead money which I am holding on, violating all of Alan’s rules but I feel it will come back, since it is an ETF.

Mario G.

.

MarioG,

Interesting! As a matter of interest though, why five accounts

and two brokerages? And how long does it take you to find twenty good positions? (I assume you must be managing a large sum of money.)

Justin

Premium members:

This week’s 8-page report of top-performing ETFs and analysis of ALL Select Sector Components has been uploaded to your premium site. The report also lists Top-performing ETFs with Weekly options as well as the implied volatility of all eligible candidates. For your convenience, here is the link to login to the premium site:

https://www.thebluecollarinvestor.com/member/login.php

NOT A PREMIUM MEMBER? Check out this link:

https://www.thebluecollarinvestor.com/membership.shtml

Alan and the BCI team

Received this new policy notice from Schwab:

“Pay no commissions to close short options at $.05 or less.”

Terry,

Options House has been doing that starting at the 10 cent level for a while. It’s a nice gesture and encourages folks to take profits on sold options when all that is left in them is risk. They could reverse and go back the other way. It may be of more use on things like credit spreads. If you sell one for $1 and it goes your way once it erodes down to a dime or a nickle why try to get those last pennies? Buy it back for no commission.

With covered calls if you are buying back at the 20% or 10% points it may not help since you will likely be above 5 cents doing your buybacks. But we don’t trade to save commission once at a competitively priced on line discount broker. We trade with a larger game plan in mind :)! – Jay

Yes Jay, trade with a larger game in mind. This will help though by reducing commissions costs when appropriate to use.

Roni,

Good result there last month with 1.7% (saw the FB post by Alan.) It would be good to see more people sharing their results (I don’t think too many would call it bragging.) Was there any opportunity to close out of AEIS when it jumped up around 85? That was a pretty bad fall just before expiration!

Justin

Thank you Justin,

I will try to keep it up.

I mean, I will post it every month after expiry weekend, no matter if the results are good or bad.

I closed AEIS at a big loss, but what really matters is the overral positive result.

We will always have a loser among our chosen tickers, and the most difficult lesson is to cut them off early, forget about it, and move on.

If you hang on to a loser, you risk losing more every day.

Someone said “The best loss is the first loss”.

Easy said, but very hard to learn.

Roni

Thanks Roni,

Yes I agree, the overall result is what matters. I’d disagree that we “will always have a loser” though – you only had one last month because of that weird late-contract plunge by AEIS, in which case

your total would probably have been above 2% 🙂

Justin

That is correct Justin,

It is possible to have a 100% batting average once in a while.

What I mean is, you must expect some losers as part of the game.

See you on next week’s thread.

Roni 🙂

Hello Allan,

I have a question regarding buying an ITM strike for a covered call. I was taught to buy a strike above the ATM strike because you make money from the option premium and the stock (if the buy exercises the option).

I am noticing people buy in the money strikes, and I am wondering about the strategy. Please let me know if I interpret the ITM covered calls correctly –

– The reason someone would buy an ITM call is for insurance if they are worried the stock could fall.

– I assume the calculate what they get from the premium. If the premium is high enough, it could buffer the loss if the stock falls. and the Seller could still come out ahead.

Am I correct?

I currently saw a play like this with a covered call for PTLA. It is currently around low 39. The person in my group sold a 35 call at a 9.10 premium. I’m thinking their rational is as long as that stock doesn’t fall below 35, they still could profit roughly 400-500 dollars from the premium. Am I correct?

Thank you.

Harold

Harold,

There’s a lot here but let me highlight the key points:

1- Yes, you are correct in your assessment. The intrinsic value of the premium protects the time value component. I use ITM strikes in bearish markets and when chart technicals are mixed.

2- With the strike $4 in-the-money, the time value profit would be $510.00 per contract if share price remains above $35.00.

3- Have a look at the calculations taken from the multiple tab of the Ellman Calculator in the screenshot below. This is a very risky trade. The 1-month time value return is 14.6% with a downside protection (of that time value…not breakeven) of 10.3%. If you checked the implied volatility of this trade, it would be through the roof meaning we would be undertaking a huge amount of risk. This may be appropriate for some but not for most retail investors where capital preservation is a priority.

CLICK ON IMAGE TO ENLARGE & USE THE BACK ARROW TO RETURN TO BLOG

Alan

PTLA – a pharma with an imminent FDA decision. Danger Will Robinson! =:-O