Option trading basics teaches us that the concept of put-call parity means that for every call option price, the corresponding put option (same stock, strike and expiration) will have an implied value. For example, if Company BCI is trading at $50.00 per share, if the $50 call option generated $1.50, the put option would also be expected to generate $1.50. The reason for this is that if there was a movement away from this parity there would be an arbitrage opportunity where one option could be bought and the other sold for a risk-free profit. Now this concept applies to European style options. Since, in reality, we are dealing with American style options, dividends and interest rates need to be factored in. As an example, if the $50.00 stock had an ex-dividend date prior to expiration and the dividend amount was $1.00, the call option would be worth less and the put option more because share price will drop by the dividend amount on the ex-date. This will impact calls negatively and puts positively.

The “moneyness” of options

Another factor that impacts the value of the option premiums is the “moneyness” of the option or the relationship between the strike price and the market value of the stock. In the example below, Taser Intl Inc. (TASR) was trading at $30.90 on 7/24/2015. That would make the $31.00 strike very close to at-the-money. But what about the $30.00 strike? Well that strike is in-the-money for calls and out-of-the-money for puts. From this perspective we would expect the call option to be more expensive because of the intrinsic value component. Let’s view an options chain to make this concept come alive:

Let’s first look at the $31.00 strike price (brown row) which is very close to at-the-money. The blue arrows highlight the fact that the option-pricing is the same thereby confirming the following put-call parity rule:

Buy stock + buy put = Buy call

If there was a disparity between the put and call premiums at this strike it would set up an arbitrage opportunity for market makers to take advantage of and generate a risk-free profit…not fair to us.

Next, let’s have a look at the $30.00 strike price in the yellow-highlighted row. This strike is considered in-the-money for calls but out-of-the-money for puts so we would anticipate a higher premium for the call option because of the intrinsic value component of the option premium. This is confirmed with a bid price of $2.40 for the call and $1.45 for the put as shown with the green arrows. Next, let’s calculate the time value for the call option:

Time value = Total premium – intrinsic value

Time value = $2.40 – $0.90 = $1.50

Now the two time values are in sync, the call at $1.50 and the put at $1.45.

Discussion

Put-call parity is an important concept in option pricing as it prevents unfair arbitrage opportunities. If these opportunities did present themselves, it would benefit market-makers, not us. There are factors that would create a discrepancy between the same strike prices for the same stock and expiration. These include interest rate factors, dividends and the moneyness of options. Understanding these concepts will elevate us the elite status as covered call writers and put-sellers.

Blue Collar Scholar Competition: Great prizes and a worthy charity

HURRY: CONTEST DEADLINE IS NOVEMBER 30th

Click on this link for our contest video and entry form.

Contest leaders as of Friday’s market close (S&P 500 reading at the end of the year)

Vincent L

Joe S

Michael P

Sample Commentary from Chris:

“With the economy getting back on its feet, I think the markets will see more consumer confidence. With the potential rate hike everyone seems to be talking about though, it might suffer a minor setback. I think it will rise but a conservative rise”.

Thanks for the great response we’ve had to this event. Keep those entry forms coming. We allow two per email address and the deadline is MONDAY November 30th.

Next live appearance

Saturday January 23rd, 2016: Kansas City, Missouri

9 AM – 12:30 PM

Matt Ross Community Center

PREMIUM MEMBERS

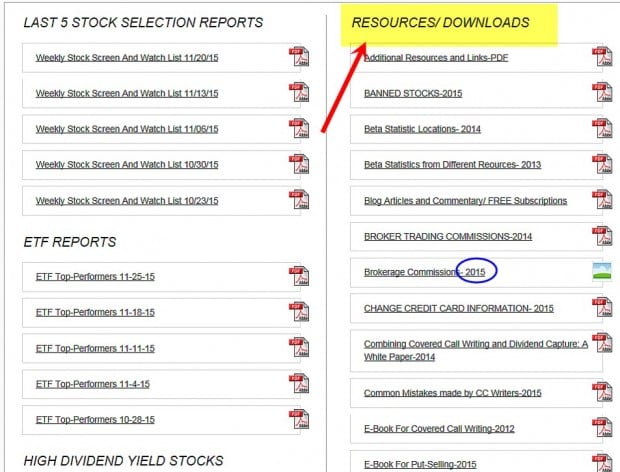

All files in the “Resources/Downloads” section of the Premium site have been updated and dated as shown in the screenshot below:

Premium Site Files and Downloads

Market tone

Markets were tranquil during this holiday-shortened week, as US economic data were predominantly positive and investors seemed more accepting of a rate hike in December. However, Chinese stocks fell on Friday, as investors grew nervous over officials’ efforts to regulate brokers. The Chicago Board Options Exchange Volatility Index (VIX) traded near a calm 15, down from 20 in recent weeks. This week’s reports:

- US GDP grew at an upwardly revised 2.1% annual pace in the third quarter, according to the US Department of Commerce but still down from a 3.9% growth rate in the second quarter. The latest reading was revised higher largely because inventories grew more than first estimated

- Consumer spending, a bright spot, increasing at a 3% rate.

- Personal income rose 0.4%

- The personal savings rate rose to 5.6%, its highest level in nearly three years

- The Conference Board’s consumer confidence index fell in November to the lowest level in more than a year, dropping to 90.4 from 99.1 in October

- The future expectations index dropped to 78.6 from 88.7, a two-year low, as the job market was viewed less positively

- Orders for US durable goods rose 3% in October after a decrease of 0.8% in September

- The sale of new US single-family homes increased in October by 10.7% to a seasonally adjusted annual rate of 495,000

- However, existing-home sales fell by 3.4% to an annual rate of 5.36 million units

- The S&P/Case Shiller composite index of home prices in 20 US cities increased 5.5% from a year earlier in September, up from a 5.1% year-over-year rise in August. The report represents an increase in residential real estate and supports a US Federal Reserve rate hike in December

- Initial jobless claims fell 12,000 to 260,000 for the week ending November 21st. Initial claims have now been below the 300,000 threshold for 38 straight weeks and are close to 40-year lows

- Continuing claims increased 34,000 to 2.21 million for the week ending November 14th

For the week, the S&P 500 rose by 0.05% for a year to date return of 1.52%.

Summary

IBD: Confirmed uptrend

GMI: 6/6- Buy signal since market close of October 19, 2015

BCI: Same stance as last week: Cautiously bullish using an equal number of in-the-money and out-of-the-money strikes. I remain fully invested using 50% in-the-money strikes until the Fed makes its position on interest rates known and evaluating the ensuing market reaction. I believe that most institutional investors have factored in a 25 basis point rate hike with moderating guidance from the December Fed meeting.

Happy holidays,

Alan ([email protected])

Premium Members,

The Weekly Report for 11/27/15 has been uploaded to the Premium Member website and is available for download.

Also, be sure to check out the latest BCI Training Videos and “Ask Alan” segments. You can view them at The Blue Collar YouTube Channel. For your convenience, the BCI YouTube Channel link is:

http://www.youtube.com/user/BlueCollarInvestor

Best,

Barry and The Blue Collar Investor Team

Alan,

I heard that the New York Stock Exchange is no longer allowing stop orders and good until cancelled orders. I can’t understand why they’re doing this and how much it will effect us? I’d appreciate your take on this.

Carol

Carol,

This new rule will begin on February 26th, 2016 and it appears will have no significant impact on retail investors.

The purpose of the rule is to protect us against temporary periods of volatility (like the flash crash of a few years ago) where stop orders may result in a trade execution against our best interests.

The reason I believe that it will be a non-factor for most of us is that stop and GTC orders are usually managed on “clearinghouse levels” before they reach the major exchanges. Once “activated” by these lower-levels of exchange venues, they are then passed on to the major exchanges as market orders.

The NYSE would argue that retail investors should consider price alerts rather than limit or GTC orders.

Bottom line: At this point it appears that the new ruling will have little to no impact on us.

Alan

Alan,

Until I read the Complete Encyclopedia for Covered Calls I never realized that a stock price goes down when there is a dividend. Can we assume the price will always go down by the dividend amount on the ex date and if your answer is yes, what is the big deal about dividends?

Thanks

Gary

Gary,

The price movement of the stock on the ex-date will be influenced by the amount of the future dividend distribution but also by all the other factors that impact share price on a daily basis. A stock may still go up on the ex-date.

Investors like dividend-bearing stocks because they represent reliable income streams. Generally, these are corporations with adequate cash reserves available to share with stock holders and not needed for daily operations. Newer, growth companies may need this cash for research and development and these growth companies may appeal to other investors. Then there are companies like Apple Computer which are cash-rich to the extent where they can do both.

Alan

Alan,

I own 800 + shares JCI. I accumulated share with DSP Plan starting 1997 with $50 – $100 each month until recently.

I JCI a good candidate for Selling Covered Calls?

Ron

Ron,

JCI has adequate option liquidity (open interest) for near-the-money strikes) as shown in the yellow field below. I’ve circled the per-share 3-week returns for 2 out-of-the-money strikes.

You must ask yourself if you are willing to sell the shares at the strike prices and that will dictate the strike selection and position management techniques necessary for successful outcomes.

CLICK ON IMAGE TO ENLARGE & USE THE BACK ARROW TO RETURN TO BLIOG.

Alan

Hi Alan,

I found your website while researching covered calls and am very interested. I hope you have the time to answer a couple preliminary questions I have from watching your beginners course video.

I am looking to trade the weekly deep in the money covered calls with a portfolio of $100K, looking for a weekly return of 1-2% selecting options with at least 8% downsilde protection. From paper trading, I estimate that about 70% of these trades will be profitable and 30% will lose money. So if I have have 5 positions each week with a size of $20K, my profit will be (20 * 1.5% * .7) less (20 * .1.5% * .3) = 120 * 5 trades = $600/week * 52 = $31,200 annual.

Obviously very key piece to this strategy is finding a way to limit my average losses to 1.5%

1. Is there a way on most trading platforms to place a net credit stop loss on an entire covered call position?

2. Do you think this strategy / profitability is feasible (likely) or is this fantasy land?

Thanks,

Dan

Dan,

My responses:

1- Yes, many brokerages have “buy-write combination forms” which will allow us to set “net credit limit orders” to close complete covered call positions. Check with your broker to see if their platform offers this service.

2- A 31% annualized return is ambitious but possible under certain circumstances and depends on:

1- Overall market performance that year

2- Skill of the investor

3- Risk tolerance of the investor (trading style….yours is extremely conservative)

4- Re-investing profits

To achieve a 1-month return of 1.5% with 8% downside protection, you would be dealing with highly volatile stocks so management skills would be critical.

I would respectfully ask you to review the advantages of out-of-the-money strikes in bull market environments and allow some strategy flexibility.

I am skeptical.

Alan

Thanks to Ricardo for sending the below upgrade to buy.

CLICK ON IMAGE TO ENLARGE & USE THE BACK ARROW TO RETURN TO BLOG

Alan and Co,

first of all I would like to thank you for the useful information I am getting as being part of the premium membership. I am now in my second month ´testing´all the knowledge I acquired by reading all your books. My question is the following (which actually is happening right now as we speak):

Last week i sold a I-T-M contract (#1) of IPGP which, at that time, was an eligible stock. However, in this week´s report, it is banned. The question is what i should do in situations like this one: if unwind and use another financial soldier or still remain with this position open. What is your view on this?

Thanks

Marcos

Marcos,

Thank you for your kind words.

Once a position is entered, it is managed as described in my books and DVDs, NOT based on its disappearance (not “banned”) from our watch list (running list) the following weeks. If IPGP remains off the running list at contract expiration, you may choose to move the cash into a better-performer. Of course, position management is critical for all stocks in our portfolio.

Alan

Alan,

I bought ntes in October when it first appeared on your stock list. I didn’t sell any options for the November options because of the earnings report but I kept the stock and its up about $40 since then. My question is are there some stocks that we are better off not selling options and just letting the price rise?

Thanks for the stock and your help.

Bill

Bill,

If we have a stock that we feel may take off like this one did, there are a few things we could do:

1- Move the stock into our longer-term buy-and-hold portfolio, perhaps setting up an 8- 10% trailing stop loss order.

2- If hundreds of shares are owned, sell options on half and hold the other half as a longer-term holding.

3- Sell deeper out-of-the-money calls, generating lower initial returns but allowing for greater share appreciation (this would be my go-to strategy).

We are viewing this trade now with hindsight…when the stock was $140 we didn’t know it would increase in value this much and this fast.

So happy for you.

Alan

Bill.

There is an old saying: “If your only tool is a hammer all your problems will look like nails.”

Covered calls are not our only hammer, as Alan confirmed in his excellent reply,

You asked one of the great questions we all grapple with: when and to what degree do we use covered calls?

Everyone’s answer will vary to fit their investing temperament. I write calls on all dividend stocks but never more than 50% of growth stocks like NTES. It makes my blood boil to miss great run ups because I am covered! But others will see it differently.

And, as Alan suggested, we trade in the now. The future is a blank canvas. So for me taking the elevated premium that comes with growth stocks at the same time I leave half or more shares uncovered to run works well. – Jay

Alan and Jay,

Thanks for your detailed answers. I’m still learning and value the insight from more experienced investors.

Bill

Bill,

If you believe that a stock will run up (based on your analysis) and you will miss the upside with a covered call trade, another idea you might want to consider is to buy upside calls on those stocks. This way, you will be able to focus on the covered call…your primary strategy…while participating in upside movement. You will need to watch the trade so you can sell the call if the stock drops or you get close to expiration.

A word of caution, you will need to be careful because if you are wrong, the upside call premium will lower your covered call return.

Best,

Barry

Premium members:

This week’s 8-page report of top-performing ETFs and analysis of ALL Select Sector Components has been uploaded to your premium site. The report also lists Top-performing ETFs with Weekly options.

For your convenience, here is the link to login to the premium site:

https://www.thebluecollarinvestor.com/member/login.php

NOT A PREMIUM MEMBER? Check out this link:

https://www.thebluecollarinvestor.com/membership.shtml

Alan and the BCI team

Premium Members,

The new StockScouter report was just published. Based on the new rankings, two stocks went from passing to failing the Risk/Reward rankings. Those stocks are:

NHTC – Went from n/a to 4

QIHU – Went from 5 to 4

The new report for 12/4/14 will reflect the new Risk/Reward rankings.

Best,

Barry and the BCI Team

OOPS!

Make that 12/4/15…

Barry