RHT on our Premium Running List

For purposes of establishing a foundation for this exit strategy trade we will assume an initial purchase of 100 shares @ $48 and the sale of the November $48 (at-the-money) call for $2.20. As of market close on Thursday November 10th, the share price was $49.07 and the “ask” price for that option was $1.95. Here is the options chain:

RHT- November Options Chain

Now that we know what it will cost to close our short options position, let’s look at the options chain for December, the upcoming contract month:

RHT- December Options Chain

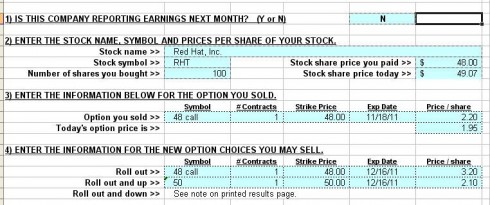

Here we see that if we roll out to the December same-strike $48 call we can generate $3.20 per share and if we roll out and up to the December $50 call, we will generate $2.10 per share. Our next step is to feed this information into the blue cells of the “what now” tab of the Ellman Calculator:

Ellman Calculator- Blue Cells

All the information fed into this spreadsheet was gleaned from the options chain. The results appear in the white cells on the right side of the page:

Ellman Calculator- Results

Evaluation of calculation results:

Rolling out (yellow highlighted areas)

-

Closing and opening the short option positions results in a credit of $125 or a 2.6%, 1-month initial return

-

The downside protection of that 2.6% return is $107 or 2.2% ($107/$4907)

-

This means that our 2.6%, 1-month profit is guaranteed as long as share value does not depreciate by more than 2.2% in the contract month

-

We consider a rolling out strategy when we still like the underlying security, the returns meet our 2% – 4%, 1-month goals and market conditions are such that additional protection is indicated

Rolling out and up (green highlighted areas)

-

Closing and opening our short option positions result in a credit of $15

-

The share value is “bought up” from the previous strike ($48) to the current market value of $49.07 or $107 per contract (purple highlighted area)

-

This results in an initial credit of $122 or a 2.54%, 1-month initial return

-

Additional profit (upside potential) of $93 can be generated if share value appreciates to or beyond the $50 strike

-

This would result in a total credit of $215 or a 4.48%, 1-month return

-

We consider a rolling out and up exit strategy when we still like the underlying, the returns meet our 2% – 4%, 1-month goals and market conditions are favorable for continued share appreciation

Conclusion:

When considering rolling strategies on or near expiration Friday we follow these steps:

- Determine if the underlying security meets our system criteria. Stocks on our “premium running list” are eligible

- Check the option chains for the current and next month stats

- Enter those stats into the “what now” tab of the Ellman Calculator

- Make sure the initial returns meet our 1-month goals of 2% – 4%

- Evaluate market conditions and chart technicals to determine if downside protection is indicated

Now start cashing in on covered calls!

For more information on rolling strategies see pages 277-292 of my latest book Alan Ellman’s Encyclopedia for Covered Call Writing and pages 95-109 of Exit Strategies for Covered Call Writing.

*********************************************************************************************************

Kindle format:

My new book, Alan Ellman’s Complete Encyclopedia for Covered Call Writing is now available in kindle format on Amazon.com:

*********************************************************************************************************

New video:

This video explains the expanded and enhanced version of our Weekly Stock Screen and Watch List:

http://www.youtube.com/watch?v=f_pYyeaV9fs&list=PLF95C00AC7E801D5E&index=1&feature=plpp_video

Market tone:

The major player in the current market remains the European debt crisis. Signs of tentative progress on Friday in Greece and Italy seemed to allay investor fears for the time being. Here is a review of last week’s economic reports:

- Consumer credit rose to $7.4 billion in September, more than expected but not enough to counter Augusts’ decline of $9.5 billion. Consumers are still concerned about unemployment and a sluggish economy.

- The US trade deficit declined by 4% to $43.1 billion in September

- This decline in the trade deficit may result in an upward revision in the initial GDP growth estimate for this quarter

For the week, the S&P 500 rose by 1% for a year-to-date return of 2.3%, including dividends.

A look at a 6-month chart of the S&P 500 shows that after breaking out of a recent trading range, the benchmark has tested support 3 times (green arrows) and survived each time:

S&P 500 as of 11-11-11

Summary:

IBD: Uptrend under pressure

BCI: There is no change in our position of being cautiously bullish, fully invested and favoring in-the-money strikes. This has been working well as the VIX is at the “30” level, barely within our comfort level.

My best to all,

Alan ([email protected])

Alan,

Thanks for another informative article. Any reason why you didn’t consider the 49 strike price? This would have generated the largest return.

Thanks.

Paul

Would you wait until Friday to roll forward. I’m on a business trip Fri and may not be able to get to the computer and rolling by phone is not easy? Does the extra time of the forward option generally compensate for the fact that I;m not rolling on Friday?

Paul (#1),

You are right. There are other strikes to consider. I decided on the two that I thought would be most useful in explaining the strategy. As a rule, when we role out, we do so to an in-the-money strike as in the above article ($48 is in-the-money compared to the current market value of $49.07).

When we role out and up, we can do so to an in-the-money strike, an at-the-money strike or an out-of-the-money strike. This will depend on the relationship of the new strike price to the current market value.

In this case the $49 strike is a near (at)-the-money strike. These always will generate the greatest intitial time values or ROOs.

For “newbies” it is always a good exercise to calculate as many different strikes as possible. It will not take long and will go a long way to teaching the association between different strikes and when to select them.

Alan

Frank (#2),

Yes, the extra time value spent on closing the original short position will be negated by the additinal time value generated from the new short position. This is a non-issue if you roll the option a day or two prior to expiration Friday. That’s why I use the phrase “Exit Strategies on or NEAR expiration Friday”. Have productive business trip.

Alan

Alan,

What is the date next to RHT in your first chart and why are some of those dates in red?

Pat

3 weeks ago I sold the november 50 strike price for dsw. Today it is above 51. Since there is an earnings coming out on the 22nd, is there any action I need to take if the strike is still in the money by Friday?

So far its a 3.4% return in 3 weeks.

Thanks.

Ted

Ted (#6)

This is one those of judgment calls only you can make. The ask price at Friday’s close was $2.05, almost a full dollar over the closing price of the stock at $51.07. It does look like there is some belief that the earnings will be good because it jumped $2.65 on Friday alone.

Since the 19th is the Friday before the earnings come out, you should remember that there is sometimes a runup in anticipation of a good earnings report. Perhaps the stock will hold above $50 through next Friday.

However, you should also remember that sometimes the market realizes the runup may have been overdone, and it starts it come down just before the earnings report.

There is no easy answer. If you have a decent gain, it might be wise to protect it and get out a little early. If you really think the stock will stay up there (it spent the entire month of July above $50) then you should consider holding it until Friday, but keep your finger on the sell trigger.

That’s my two cents worth. Owen.

Pat (#5),

The dates adjacent to the watch list stock tickers represent the projected upcoming earnings report dates. Those dates that are bolded in red are the ones that have been confirmed on the earningswhispers.com site.

Alan

Owen thanks for the explanation.

Ted

Premium Members,

The Weekly Report for 11-11-11 has been uploaded to the Premium Member’s website.

Best,

Barry and The BCI Team

All of the stocks I have that expire on Fri are no longer on the Passed all screens list. They are all in the money. Do I let them all go and buy new ones next Fri? Or roll them?

ADS DSW NKE NUAN and TIF

Suggestions anyone – this is the hardest part.

That should be next Monday not Fri

Frank,

Evaluating your current situation is a great exercise for all those who are honing their covered call skills. First, let me say that with ALL your strikes in-the-money, you must be doing something right!

Here are a few points to consider:

1- If an earnings report is coming out in the December contract, allow exercise so your stock will be sold.

2- If a stock has mixed technicals but passed all other screens, it is still eligible. In these instances if you still like the stock and the returns (“what now” tab of the calculator as shown in the article above) you may want to give consideration to rolling out and preserving the downside protection.

3- If a stock is in the pink cells, but NOT taken off the list (final section of the weekly report) you can check the first 3 pages of the report to see where it failed initially. If it failed in the second from final screen (confirming indicators: MACD and Stochastic oscillator) these stocks can whipsaw back into the white cells next week. You can follow this during the week.

4- If a stock has failed an earlier screen (risk/reward, chart pattern) you should be less inclined to stick with it.

5- When in doubt, allow assignment and go with a stronger financial soldier.

You are currently in a great position with all strikes in-the-money.

Once again, I encourage members who are in the process of mastering this great strategy to assess Frank’s stocks or your own as we approach expiration Friday.

Alan

GNC:

This company went public in April of this year. It has been on our premium watch list for 4 weeks and you will note under “commentary” chart < 1 year and beta is listed as "na". Some members prefer a longer public history before investing in a company. GNC boasted a stellar 3rd quarter earnings report with a 27% positive surprise and revenues up 16%. This has resulted in a bullish 16% growth projection. GNC trades at a reasonable PEG of 1.12 and recently reached an all-time price high. Our premium running list shows an industry segment rank of "A". Alan

Alan,

Will you always buy back an option if it trades at parity?

Thank you.

John

John,

Almost always. For those new to options, when an option trades @ “parity” it trades at all intrinsic value and no time value. For example, if a stock is trading @ $55 and the $50 strike is trading @ $5, it is said to be trading @ parity. It will then cost only commissions to close the short position, sell the stock and use the cash to generate a second income stream in the same month. If it’s too close to expiration Friday to generate a meaningful second income stream closing the entire position will ensure maximum profit.

Alan

Alan,

The stock in this article RHT is at 53 today. If you rolled to the 48 strike could this also be a good candidate for the mid contract unwind exit strategy?

Fred

Fred,

You are now officially a true Blue Collar Investor! I love it. You are absolutely right that when a stock moves up significantly and quickly our first thoughts are to generate a second income stream in the SAME month with the SAME cash. Although RHT isn’t there yet, we are ready to act. When the time value approaches zero as the strike goes deeper in-the-money we look to invoke the “mid-contract unwind” exit strategy…one of my favorites. Even if it turns out that we don’t use it in this case, by being prepared it will open doors for other opportunities in the future. For those members who have copies of my latest book check pages 264-271 to review this strategy.

Great observation!

Alan

Why aren’t options available for all stocks?

I’ve heard that year end pension funding bodes well for the stock market in December. Any thoughts?

Barbara

Patricia (#19),

Stocks must meet certain exchange requiremnets to have options listed.

Here are a few:

1- Listed on national markets

2- Minimum # of shares outstanding

3- Minimum daily trading volume

4- Must be trading > $7.50

Alan

Barbara (#20),

Many “experts” feel that Thanksgiving marks the start of an early “January effect”, a month generally considered favorable for the stock market. Year-end pension funding is considered one of the reasons for an early boost to the market. However, this year’s conclusion seems to be hostage to the global issues that have caused all this recent volatility.

Great question!

Alan

Alan,

How do I calculate the cash I would need if I traded my covered calls in my margin accounts?

Thank you.

Fran

Fran,

As a general rule for out-of-the-money strikes you are required to have 50% of the stock price minus the option premium received. Here is a link to the CBOE margin calculator (for strategy put in “covered call”):

http://www.cboe.com/tradtool/mCalc/default.aspx

Alan

Premium members:

This week’s 6-page report of top-performing ETFs and analysis of ALL Select Sector Components has been uploaded to your premium site.

For your convenience, here is the link to login to the premium site:

https://www.thebluecollarinvestor.com/member/login.php

Not a premium member? Check out this link:

https://www.thebluecollarinvestor.com/membership.shtml

Alan and the BCI team

I just rolled my 70 option on TSCO. I closed the November 70 @ $2 and opened the December 70 @ $4.20. That’s 3.1% initial profit with 2.8% protection. Good deal if market holds.

Happy investing.

Steve