Exit strategies for covered call writing are critical to the ultimate success we achieve when selling covered call options or cash-secured puts. One of the prime strategies associated with covered call writing when share price declines is the 20%/10% guideline. This strategy guides us when to close our short options position if share price declines based on a percentage of the original premium received and time within the contract. As an example, if we sold an option for $2.00, the guideline tells us to close it at $0.40 in the first half of the contract and at $0.20 in the latter part of the contract. So far, this is pretty straightforward. However, what if we have rolled out and up, perhaps incurring an option debit along with a buy-up in share value? How do we then establish our base premium to then use the 20%/10% guidelines? This article is a product of one of the best questions I have ever received from our members:

Question from Paul S

Alan,

I would appreciate some clarification relative to determining the sale price of a covered call position, which is needed to apply the 20%/10% guideline on an ongoing basis. In some in-the-money, roll-out-and-up situations (later date and higher strike price) where a net option debit results, some buy-up value is sometimes involved as well. Shouldn’t this buy-up value be algebraically included in determining the net sale price of the call thereby offsetting part or all of the debit value? Am I looking at this correctly?

Paul sure is, let’s explore.

Let’s set up a hypothetical trade to review the question and establish a clear baseline

Initial trade

Buy BCI at $28.00

- Sell $30.00 call at $1.00

- Initial return = 3.6%

- Upside potential = 7.1%

- Price as expiration nears = $33.00

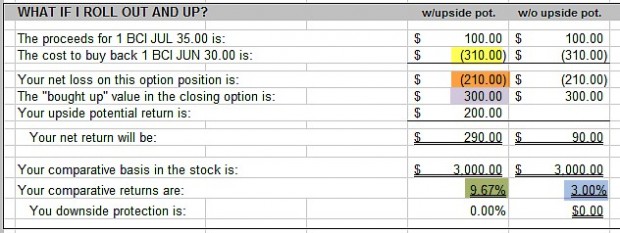

Rolling out-and-up to the $35.00 strike: “What Now” tab of Ellman Calculator

Rolling Out-And-Up Example

- Cost to close = $3.10 (Yellow)

- Premium from the sale of the next month $35.00 strike = $1.00

- Option debit from rolling-out-and-up = $2.10 (Brown)

- Buy-up value of stock from $30.00 (original strike) to $33.00(current market value) = $3.00 (Purple)

- Net credit from rolling out-and-up = $0.90

- Initial return = 3% (Blue)

- Upside potential to the $35.00 strike = 6.67% (9.67 total potential return- Green)

Click here for a free copy of the Basic Ellman Calculator

Setting cost basis and option premium for the second trade after rolling-out-and-up

- Stock value = $33.00

- Option premium for this out-of-the-money strike = $0.90

- 20% guideline = $0.18

- 10% guideline = $0.09

- The are guidelines, so veering slightly from these numbers is okay

***Thanks to Paul S for this outstanding question which allowed me to provide color to our members on an exit strategy that is an integral part of our position management arsenal.

Upcoming live events

September 10th, 2016

Silicon Valley (San Francisco) California

8:30 AM – 12 PM

I am the 2nd of 2 speakers

Registration link to follow

October 24th, 2016

Austin, Texas

Registration link to follow

November 5, 2016

Plainview, New York

Saturday morning 3-hour workshop at the Plainview Holiday Inn. I am the only speaker and plan an information-packed presentation covering 5 actionable ways to make money or buy a stock at a discount using both call and put options. I’ll provide registration information once I receive it from the host investment club.

Thanks to you!

Not only have you, our members, put BCI on the financial map but you expanded those borders to Europe and beyond. Have a look at an article I wrote for a prestigious German financial publication:

Traders Magazine: Germany

Your support has never been more appreciated.

___________________________________________________________________

On behalf of retail investors

Isn’t it time for companies like Amazon and Google to split their shares like Apple did in June, 2014 to make them more affordable for retail investors? After all, Blue Collar Investors do play a major role in the success of these corporations.

Market tone

Global stocks were little changed amid conflicting central bank outlooks from the US Federal Reserve and the Bank of Japan. Oil prices continued their downward slide. The Chicago Board Options Exchange Volatility Index (VIX) dipped slightly this week to 11.87. This week’s reports and international news of importance:

- The U.S. economy expanded at a disappointing 1.2% annual rate, as reported by the US Bureau of Economic Analysis. However, the US consumer activity was strong, but weak corporate investment was a drag on headline growth

- In the eurozone, Q2 growth came in at 1.6%, in line with the consensus forecast

- The US Federal Reserve upgraded its outlook for the US economy, saying near-term risks have diminished while pointing to improved employment figures

- Michel Barnier, a former French finance minister, has been appointed the European Union’s chief Brexit negotiator. The appointment is seen as somewhat provocative by members of the UK financial community, given Barnier’s past tussles with London while he was finance minister and during his time as the EU’s single market commissioner. He will begin work in October.

- A crackdown on perceived enemies of Turkish president Recep Tayyip Erdogan continues in the wake of a failed coup two weeks ago. Jean-Claude Juncker, head of the European Commission, this week said there is no possibility for Turkey to join the EU

- The Bank of Japan surprised markets on Friday by leaving interest rates and its bond-buying program unchanged after its policy-setting meeting on Friday

- According to FactSet Research, since 1900 the Dow Jones Industrial Average has increased in value 69% of the time during the summer Olympic Games. The average gain for the Dow was 1.8% during the games

THE WEEK AHEAD

- Global manufacturing purchasing managers’ indices are released on Monday, August 1st

- Global service sector PMIs are released on Wednesday, August 3rd

- The Bank of England Monetary Policy Committee meets to set rates on Thursday, August 4th

- The US employment report is released on Friday, August 5th

For the week, the S&P 500 slipped slightly by 0.07% for a year-to-date return of +6.34%.

Summary

IBD: Market in confirmed uptrend

GMI: 6/6- Buy signal since market close of July 1, 2016

BCI: Moderately bullish. I’m favoring out-of-the-money strikes 2-to-1 as earnings season has supported the resilient stock market

WHAT THE BROAD MARKET INDICATORS (S&P 500 AND VIX) ARE TELLING US

Alan ([email protected])

Blue Hour Webinar:

Thanks for all the positive feedback the BCI team has received from our premium members. We’re glad you liked it and we’re just getting started!

My team is in the process of researching why some of you could not login. We’re so sorry this happened but there is good news. This (and all) webinar was recorded and will be available for free to all premium members on the premium site in a few days (I’ll send an email to premium members). It will also be available to general members in the Blue Collar store.

The next Blue Hour webinar will be in about 2 months with specific information to follow. We have several topics in mind and would also love to hear from you regarding topics you would like us to cover at these events.

Alan

Premium Members,

This week’s Weekly Stock Screen And Watch List has been uploaded to The Blue Collar Investor Premium Member site and is available for download in the “Reports” section. Look for the report dated 07/29/16

.

Also, be sure to check out the latest BCI Training Videos and “Ask Alan” segments. You can view them at The Blue Collar YouTube Channel. For your convenience, the link to the BCI YouTube Channel is:

http://www.youtube.com/user/BlueCollarInvestor

Since we are in Earnings Season, be sure to read Alan’s article, “Constructing Your Covered Call Portfolio During Earnings Season”. You can access it at:

https://www.thebluecollarinvestor.com/constructing-your-covered-call-portfolio-during-earnings-season/

Best,

Barry and The BCI Team

Alan, thanks for your reply to my MCU question, and that’s alright I just thought there was a different answer for if the price starts declining quickly.

This is a great article as I had only been using the next month’s option value I sell for using in my 20/10% buyback plan. I had earlier thought we maybe should be including these other option buyback / buy-up price values too, but dismissed this seeing as it wasn’t shown in the book calculations or included in the resources section.

– So if this now means using the 20/10% rule on all the values for rolling-out and up, then do we do the same for just rolling-out as well?

– Can you also tell me where you go to see how the earnings season is going, as I have looked on some websites but it is only for finding out for the individual stock. Thanks

Adrian,

When rolling out, the cost basis is the original (and current) strike price. If we originally bought a stock for $48 and sold the $50 call, then rolled out because share value was $52 at expiration, our cost basis is $50.

Some of the information I publish regarding earnings season I get by listening to CNBC and Bloomberg during the day…I usually have my TV on in the background in my office during my “work” day (don’t really consider this work as I enjoy it so much).

Alan

Alan,

Is it possible to write covered call using buy-option instead of stocks to reduce risks?

JB,

Yes, it is definitely possible. The way it is usually accomplished is to buy a long-term deep-in-the-money option (LEAPS) which will serve as a stock surrogate. Then short-term out-of-the-money call options are sold against these positions. The strategy has its pros and cons. Here is a link to an article I published on this subject:

https://www.thebluecollarinvestor.com/leaps-as-stock-surrogates-and-covered-call-writing/

Alan

Premium members,

As promised, last week’s first Blue Hour webinar was recorded and is now available on the premium member site. Login to the member site and scroll down on the left side and click on Blue Hour: July 28 webinar. See instructions below if needed. My hope is that you will both enjoy and benefit from these presentations which is now an additional free benefit to your premium membership.

CLICK ON IMAGE TO ENLARGE & USE THE BACK ARROW TO RETURN TO BLOG

Alan and the BCI team

Alan:

Is there any advantages to splitting the $$$ investment between a CC and a naked Put. E.G. $20K….10K to buy the CC postion and 10K to have as margin for essentially the naked Put. Can you collect more premium on the Put rather than having all $20k committed to the CC?

Thank you,

Bill

Bill,

The best way to combine the 2 strategies, in my view, is to use the PCP strategy described in my book, “Selling Cash-Secured Puts” This is where we sell out-of-the-money puts and when exercised, then sell covered calls, hence the strategy name Put-Call-Put (PCP).

Theoretically, there is no advantage to selling calls or puts from a premium perspective because of Put/Call parity where options are priced to eliminate arbitrage opportunities where risk-free profits can be generated. This goes back to my frequent comment that there are no free lunches.

To sum up: I use either covered call writing or the PCP strategies in most market conditions and may favor put-selling in a bearish market environment where I am less likely to sell out-of-the-money calls.

Alan

Alan, I was actually really wanting to know if we should implement this same 20%/10% buyback plan for rolling-out as well?(from what Paul said at top of article.)

Like base the option premiums from both the BTC / STO trades, instead of just the STO rollout premium?

*I will just have to ask you a few things on papertrading, – I’ve run out of time to email the others out.

2. Now the “Trademonster” papertrading platform had sometimes given me option values that seemed too low or high for my papertrades. For instance I had once calculated an option premium of only 0.50% for what I thought would have been around 2%! Wondering what you think I should do about this, – maybe try another platform instead and hope it doesn’t repeat? (I did put on these orders after-hours though, as I am in another country when US market had closed?)

3. When papertrading on a software platform should I be doing this only during the market hours, or can I put in practice orders a/hours?

4. Just curious to know also if any papertrades that would be put on during market hours when using some software like Trademonster, always gets executed immediately from what the actual share/option values are?(or would I have to wait for however long until the order gets completed?)

I thought I would tell you that my papertrades for me are going quite good and had been positive to around breakeven the last few months. Last months trades my return was around 5.21% and has been the best so far! I’m quite pleased with this and hoping on more good returns to come, but I do still have more to learn first before I will ever trade live. Thanks

Adrian,

My responses:

1- The 20%/10% guidelines are based on the option credit after rolling out. For example, if BTC cost $0.50 and STO generated $2.00, 20% would be $0.30.

2- Check the paper trade prices against a known reliable resources like cboe.com or finance.yahoo.com etc. Then you can make a decision regarding the reliability of the paper-trade platform.

3- Market hours are better if possible but paper-trade either way until your confidence level let’s you know that it’s “go-time”

4- Trade execution should be quick but the exact times will vary from platform to platform.

Alan

Premium members: New spreadsheet available on member site:

The Daily Covered Call Checkup (DCCC-see image below)) is an amazing tool developed by one of our Premium members, David L. I worked with David after the initial format was created to make sure that the spreadsheet is 100% compatible with the BCI methodology which it now is. The DCCC gives us an accurate view of our current covered call writing positions and several “what if” scenarios. As you will see, there is a lot of flexibility in terms of the range of input we can enter.

Login to the member site and scroll down the “Resources/Downloads” section on the right to “D” There is also a user guide associated with the spreadsheet.

CLICK ON IMAGE TO ENLARGE & USE THE BACK ARROW TO RETURN TO BLOG

Alan

I understand the BCI methodology regarding earnings. If we cover the underlying through an earnings event which is a high risk for larger price moves we have absorbed all of the downside risk and capped our upside which is not smart.

Here is my question then regarding the UNDERLYING during earnings season. Among my positions is one which has earnings out early next week. The covered position will expire this week. With this issue in particular, my feeling is that earnings could be a very good or very bad event and with the stock highly valued I believe there may be greater downside risk than upside risk.

Do you tend to exit the underlying ahead of earnings announcements?

Geoff,

Yes, that is how I generally handle these scenarios. There are rare exceptions where I hold a stock through the report and then write the call after the report passes with a goal of getting the best of 2 worlds…share appreciation from a positive report and then additional premium from the call sale. Years ago I did this with Apple and Cisco which consistently beat analyst projections.

In the situation described in your question, there is a bearish tone with high risk…not for conservative retail investors in my view.

Alan

Premium members:

This week’s 8-page report of top-performing ETFs and analysis of ALL Select Sector Components has been uploaded to your premium site. The report also lists Top-performing ETFs with Weekly options.

For your convenience, here is the link to login to the premium site:

https://www.thebluecollarinvestor.com/member/login.php

NOT A PREMIUM MEMBER? Check out this link:

https://www.thebluecollarinvestor.com/membership.shtml

Alan and the BCI team

Alan,

When calculating the ROI on a new position when the stock purchase from the previous month was not called away, Do we use the initial price that we bought the stock at to compute the return?

Nehemiah,

When calculating returns for current positions, we use current market value, not a price of the underlying at some time in the past. This will help us decide the best action to take today, right now. For example, selling a near-the-money call on our current underlying will generate _______________. However, if we sold the underlying and used a new underlying with the cash available we can generate _________________. We are comparing “apples-to-apples”

Alan

Running list stocks in the news: GRUB:

Grubhub Inc., is a recent entry onto our Premium Watch List. GRUB is the nation’s top online and mobile food ordering company. It is ranked # 14 on the current IBD 50.

On July 28th, GRUB reported a stellar 2nd quarter earnings report beating both EPS estimates ($0.23 versus $$0.19) and revenue estimates ($120 million versus $114 million). As a result, the analysts have been jumping on the GRUB bandwagon and raising 2016 and 2017 guidance.

Our BCI Premium Watch List shows a recent price at $38, an “A” ranking for its “Internet” industry, and a beta of 0.98. The next earnings report is projected to be on 10/27 and there is adequate open interest for near-the-money strikes.

Below is a screenshot of the good-looking price chart on 8/4/2016.

For new members: “running list stocks in the news” comments are not necessarily recommendations but rather interesting news events regarding stocks that have passed the rigorous BCI screening process.

CLICK ON IMAGE TO ENLARGE & USE THE BACK ARROW TO RETURN TO BLOG

Alan

Alan:

I have options where the option cost dropped to 20% in the 3rd week of a 5 week contract. They didn’t stay there long and went back up. I could have bought them for even less than 20% at one point. Is it advisable to put in a GTC during this week to buy back the options at the 20% price? It seems safe but I thought you might have some experience or thoughts on the matter.

Peter

Peter,

A BTC limit order can be set immediately after entering a trade. For example, let’s say we sold a call for $2.00. We can then immediately set a limit order to BTC at $0.40. Midway through the contract, change the $0.40 limit to $0.20. This way the trade will be executed even if we are not in front of our computer.

Alan

Alan, for your 2nd answer to mine above, do you mean to try each virtual trading platforms on the Cboe.com and finance.yahoo.com websites, or to compare the option prices on the option chains from these websites? thanks

Adrian,

I was addressing your concern regarding the reliability of the prices executed on a trading platform. Let’s say the price executed on the platform is $2.00. I would then compare that price to a reliable resource like the ones mentioned in your question to determine the accuracy of the virtual platform.

Even if the pricing is off a slight amount, there is still great value in paper-trading.

Alan