Exit strategy execution is a critical skill every covered call writer should master. In addition to managing positions where share price has decreased there are also situations where we can benefit when price has dramatically accelerated. Let’s look at a trade recently executed by one of our Premium Members:

Covered call trade with SODA

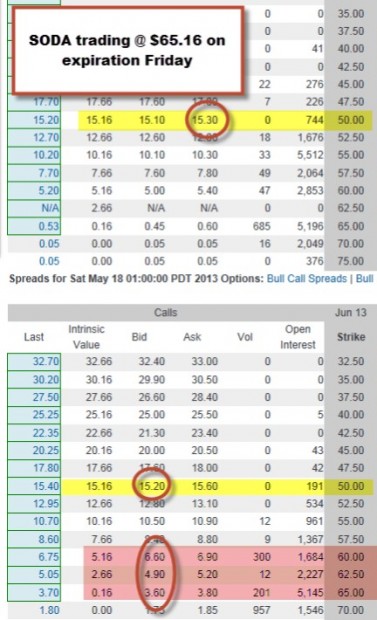

Our member generated a nice 1-month return with downside protection of that profit. However, on expiration Friday the price of the stock has accelerated all the way up to $65.16 and the $50 call was very deep in-the-money. The question is “to roll or not to roll” let’s look at the options chain on this expiration Friday (May 17, 2013):

SODA options chain

To buy back the $50 call (BTC) will cost $15.30. Let’s look at the trade if we roll out to the June $50 call:

Rolling out generates no option profit

What if we roll out and up to the $60, $62.50 or $65 strike choices? These scenarios will normally result in a net debit on the options side, but a net credit on the share price side as our $50 obligation to sell is eliminated and share value is enhanced to the new strike or current market value whichever is lower. Let’s look at the trade if we rolled out and up to the $62.50 strike:

SODA: rolling out and up-

The trade results in the following scenario:

We are guaranteed a 1-month return of 4.2% as long as share value does not depreciate by more than 4.1% by expiration Friday because we rolled out and up to an in-the-money strike. In my books and DVDs I give examples of rolling out an up to at-the-money and out-of-the-money strikes as well.

Conclusion:

When a stock price moves up dramatically it usually does NOT pay to roll out as the option credit is negligible or non-existent. Rolling out-and-up may make sense because appreciation of current share value may surpass the option debit.

Next live seminar:

Thursday May 23rd Plainview, NY:

https://www.thebluecollarinvestor.com/event/long-island-stock-traders-meetup/

***A special thanks to BCI members who attended my presentation in Las Vegas for The Money Show. I can’t tell you how great a speaker feels when you’re given a double room and there is still standing room only.

Market tone:

This week’s economic reports put economists at ease regarding the fact that inflation does NOT appear to be rearing its ugly head:

- According to the Labor Department, the Consumer Price Index (CPI-A widely followed indicator of inflation. The CPI is a measure of the average

change over time in the prices paid by urban consumers for a fixed market basket of consumer goods and services. The “core” CPI excludes food and energy prices, which account for roughly one-quarter of the broad CPI and tend to fluctuate widely, providing a truer reflection of inflationary trends) declined by 0.4% compared to the previous month. A decline of 0.2% was expected - Core CPI was up 0.1% half the amount anticipated

- The Producer Price Index (PPI) declined by 0.7% in April more than the 0.5% projected

- Core PPI was up 0.1% in April, half the amount anticipated

- Housing starts in April dropped by 16.5%

- Single and multi-family housing starts in April rose by 13.1% compared to a year earlier

- Building permits form privately-owned homes rose 14.3% in April compared to March and up 35.8% compared to April, 2012

- The Conference Board’s index of economic indicators rose by 0.6% in April following a 0.2% decrease in March

- Business inventories were flat in March while economists were expecting a 0.3% increase

- Industrial production fell 0.5% in April more than then 0.2% decline economists were anticipating

- Initial jobless claims for the week ending May 11th came in at 360,000 more than the 330,000 projected

- April retail sales rose by 0.1% much better than the 0.3% decline economists had projected

For the week, the S&P 500 rose by 2% for a year-to-date return of 18%, including dividends.

Summary:

IBD: Confirmed uptrend

BCI: Moderately bullish favoring out-of-the-money strikes 2-to-1

Wishing you the best in investing,

Alan ([email protected])

Here is an offsite Q&A about dividends that I thought would interest many of our members:

Alan, I’d appreciate your comments on the following:

I own Altria ( MO).

On April 15th I wrote a 30 day call which will expire worthless on May 18th. Altria pays a dividend of five per cent per year. For the second quarter, it goes ex div on May 10th and dividend which is declared on May 10th is paid on June 10th and payments are made to all persons who were stockholders as of June 10th.

Usually, I write calls for 30 days and if I did that here, that would mean I will write the call on May 20th and the call will expire on June 20th. The stock goes ex-dividend on June 10th and in turn, that means it is likely that the stock will be called away a few days before June 10th and in that case I lose the ividend.

So here is my question:

As noted, I usually write calls for 30 days. But if a stock pays a healthy dividend, it seems to me it makes sense to write the call for a longer period, like 3-6 months as doing that would mean that on the next two ex-dividend dates, I will be the owner of record and therefore, at least for the next two quarters, I will not risk losing the dividend.

Your opinion ???

My response:

You are spot on in your assessment that writing calls MAY result in early exercise. When this occurs it is usually the day prior to the ex-date. The specific criteria you should use to determine the “chance” of early exercise is as follows:

If the time value of the premium is less than the anticipated dividend distribution, the possibility of early exercise is much higher but not guaranteed. This is because many options traders are retail investors who may not even be aware of ex-dates. Rolling the option 2 days prior to the ex-date will usually avoid early exercise when the time value meets the above criteria. That being said, let’s address two issues:

1- The possibility of missing out on a dividend:

To maximize our chances of attaining the highest level of success we must identify the strategy we are using and the goals we are setting to achieve. Is it cc writing or dividend capture? Or is it both? If it’s cc writing dividends are a non-issue. If called, we have maxed our trade and use the cash to enter a new position. If its dividend capture, don’t write calls. If it’s both, understand that juggling two strategies in the same portfolio will have benefits to one and mute the possibilities of the other. Some members set up separate portfolios and focus in on the main strategy they are employing in each.

2- 3-6 month time frames:

This is a perfect example of how using two strategies in one portfolio may result in decisions that will prevent the highest possible returns. In this scenario we are holding a cc position through one or two earnings reports or creating way too much risk. We are also now accepting a lower annualized return because 1-month options will generate a much higher annualized return than longer-term options. All this to capture a dividend which will result in a similar decrease in share value. I strongly believe that we should focus in one strategy and maximize the returns based on sound fundamental, technical and common sense principles.

Respectfully,

Alan

Premium Members,

The Weekly Report for 05-17-13 has been uploaded to the Premium Member website and is available for download.

Also, be sure to check out the latest BCI Training Videos and “Ask Alan” segments. You can view them at The Blue Collar YouTube Channel. For your convenience, the BCI YouTube Channel link is:

http://www.youtube.com/user/BlueCollarInvestor

Best,

Barry and The BCI Team

Hi Alan,

In the above scenario, when the CCs are Deep-in-the-money, I have two specific questions:

1) time-to-roll: would it not be better if one rolls out and/or up just as soon as the stock price crosses the strike price, regardless of the hopefully during the near expiration months? This leads to the next question:

2) What if there are no more time periods available to roll-up and out (i.e. one has reached all future expiry dates)?

Thanks,

Manohar

Manohar,

Here’s my thinking on these 2 issues:

1- Rolling strategies are to be used on or near expiration Friday so we can keep our risk obligation to short 1-month time frames. Sometimes we use in-the-money strikes where the price of the stock is higher than the strike when the position is initiated. If we sold an out-of-the-monmey strike and the price moves above the strike, we have (at that point in time) maximized our returns and begin to generate downside protection OF THE OPTION PROFIT. This is a great position to be in…why mess with it? By rolling out and up early in the contract we are incurring additional risk, creating an option debit (in most cases) and depending on continued share appreciation to be successful. In a sense this is converting cc writing into simple share ownership. Instead, my preference would be to generate an inital 2-4%, 1-month return and manage that position as detailed in my books and DVDs.

2- I would NEVER roll out (and up) to further than the next month…again too much risk and we will begin writing through earnings reports a major break in the BCI methodology rules. By staying with 1-month options we will easily be able to avoid these reports and generate the highest annualized returns.

I commend you for thinking outside the box and offer my thoughts for you consideration.

Alan

Alan in the scenario above with the substantial move and increase in share price at what point do you make the call to just close the position and find another soldier and eliminate the risk of a sell off in the current stock due to profit taking?

Thanks,

Gene

Hi Gene,

I have a specific exit strategy for the scenario you describe (pages 264-271 of “Encyclopedia….”). Here is the guideline:

As a strike price moves DEEP in-the-money, unwind your total position as the time value approaches zero. If a new position can be opened with the cash generated from unwinding that exceeds any cost to close a second income stream can be set up in the SAME month with the SAME cash.

Alan

In this transaction, when the May $50 SODA call was BTC at $15.30 and the June $62.50 call was STO at $4.90, the net out of pocket for this transaction was $10.40 (as is illistrated) and the potential profit would be the $2.10 in share value increase. But since you have had to add another $10.40 (out of pocket) to the $50 you would have received had you allowed the optionor to exercise the call, wouldn’t your investment be $60.40 ($50 +$10.40), and the potential return be 2.10/60.40=3.5%?

Am I viewing this incorrectly?

Dick Hamrick

Lawrenceville, GA.

Dick,

My calculations are executed, not from a tax perspective, but rather to asist us in making the very besy cc writing decision at any given point in time. In this case, we are faced with the following decision:

Do we allow assignment and have our shares sold for $50 and then use that cash to enter a new position the following week? In this case we can evaluate different trades as to the initial retrurns, downside protection and upside potential. OR…..

Do we roll out or out-and-up? In this case as well, our cost basis is $5o, the current market value, not $51.17. This is what our shares are currently worth…period, so we can compare apples to apples. From here, we have credits and debits if we roll out and up:

Debit: $15.30

Credits: $4.90 + $12.50 = $17.40

Total credit is $2.10 on th cost basis of $50 or 4.2% with downside protection of THAT PROFIT of 4.1%. Now the question: Does that return and protection meet my goals or is the cash better spent in another position? In both cases, once we enter those positions we then enter “management mode”

Alan

THE MATH: Offsite Q&A:

Alan,

Great article as usual, but I’m lost on the math in this particular SODA roll out and up example: On the 5th radio button point I understand the $12.50 increase in net gain but I’m struggling to see where you’re getting + 2.10 on a share value of $50 = 4.2%

I have the books, I’m losing the 2.10 factor somehow

Any light you can shed on it would be greatly appreciated.

Thanks,

Dennis

_______________________________________

Dennis,

I’m happy to clarify:

On or near expiration Friday when share price is above the strike price we are making a decision to “roll” the option or allow assignment. At this point in time our shares are worth the strike price originally sold or $50 in this case. If assigned we get $50/share. If we roll, our cost basis on the net credit is $50…apples to apples. Let’s do the math:

Options debit: $15.30 (to close) – $4.90 (to open) = (-) $10.40 (a loss on the options side)

Share appreciation credit: $12.50 as ceiling is raised to higher strike, still below current market value but our option obligation makes our shares worth no more than $62.50 (a gain on the share price side).

Total credit = $12.50 – $10.40 = $2.10 on a cost basis of $50 = 4.2%

Alan

Alan,

In your calculations you ignore the original option premium of $3.46. Why not add it into the calculation of the “position”?

Options: BTC $15.30 – STO1 $3.46 – STO2 $4.90 = $6.40

then… $12.50-$6.40 = 5.56 on a basis of $50 = 11.12%

As long as you hold the stock, isn’t the “position” still ongoing?

Malcolm

Malcolm,

Good question.

When we are considering the rolling strategy we are deciding whether to “allow” assignment or roll the option. The profit generated from the previous option sale is “in the bank” and now we are looking for the next months decisions. If we allow assignment, we have $5000.00 per contract to invest and generate a 1-month profit. If we roll, our return will be 4.2% with diownside protection. If we add in the previous months 4.6% return we will be skewing the comparison.

I have no issue calculating cumulative and final returns and for that you can use the Schedule D of the Elite Calculator. But for decision making purposes at any given point in time adding the previous profits generated will cloud the issue.

Alan

Premium members: Just added to your premium site:

Sample Portfolio For Educational Purposes Only: 6-2013

(Stats taken on 5-20-2013 from the Premium Stock Report for the week ending 5-17-2013)

Assumptions

•$50 thousand available cash

•Conservative investor with a above average risk-tolerance

•Market assessment is moderately bullish

•Earnings season has passed leaving about 60 eligible stocks

•This is a new covered call writing portfolio with no other securities available

•We will use individual equities only targeting a 2-4%, 1-month initial return

•We will be using the June contracts

•We will select 5 securities allocating about $10 thousand to each

•We will favor out-of-the-money strikes

•We will favor stocks with industry rankings of “A”

•Proper industry diversification will be followed

These reports are to be used for educational purposes.

Alan

DIVIDENDS: Offsite Q&A:

I’ve been looking at trading some monthly dividend payers that also have options. In particular there is on option MAIN that pays a monthly dividend. The price at this moment is 30.61. I could sell the Jun 29.65 call for 1.30 premium and collect about $15.50 in dividends on the 100 shares. I would get about $34 on the difference between the share price and the call premium and it wouldn’t matter if it got called away before expiration. Would it be likely to be called away because of the dividend. The usual div. date is the 15th of the month which is just before the expiration date. Is this a good idea or am I just spinning my wheels looking for pretty much of a sure thing?

____________________________________________

Dave,

The best way to respond is as follows:

A trade makes sense if the returns meet your goals. My 1-month goal is 2-4%. Others may have higher or lower aspirations. In this case, you are generating a 1%, 1-month return and the possibility of another .5% if you capture the dividend. You also have decent downside protection OF THAT PROFIT. Here is a great guideline to use to determine the chance of early exercise:

If the time value of the premium is less than the dividend about to be distributed, the CHANCE of early exercise is enhanced but not guaranteed.

If early exercise does occur it will usually be the day prior to the ex-date.

Alan

Premium members:

This week’s 6-page report of top-performing ETFs and analysis of ALL Select Sector Components has been uploaded to your premium site. The report also lists Top-performing ETFs with Weekly options.

For your convenience, here is the link to login to the premium site:

https://www.thebluecollarinvestor.com/member/login.php

NOT A PREMIUM MEMBER? Check out this link:

https://www.thebluecollarinvestor.com/membership.shtml

Alan and the BCI team

(We have also uploaded a new Sample Portfolio for the June contracts based on the 5-17-13 stock report. This is to be used for EDUCATIONAL purposes only based on the stated parameters.)

Alan and the BCI team

Alan,

Thanks so much for this article. I’ve always been reluctant to roll out and up, because all I could see was the premium net debit. Never considered the share gain. So this was a real head-smacker “Doh! why didn’t I see that” moment for me.

My question is, how close to expiration do you consider this strategy. e.g. I sold the 6/17 WDC 40 strike. WDC ran up on me, as high as 50 a week or so ago. However, it dropped to the 46’s last Friday. Now (Monday), it’s running again.

What’s the advantage, if any, to waiting until Friday vs taking action now (before it runs back to 50)?

–John

John,

The general advantage of waiting closer to expiration before rolling options is that the time value cost to close will be less due to the impact of Theta (time value erosion) which is greater for the near month the far month we are rolling into.

In this case there is another point we can learn and earn from. When the share price was at $50, the time value remaining on the $40 call was most likely very close to zero, meaning the cost to buy back the call was near $10. Because of share value appreciation negating the cost to close we should always think of and consider the mid-contract unwind exit strategy (MCU) where the entire position is closed and the cash used to establish a brand new covered call position with a different stock.

For more information on MCU:

Complete Encyclopedia-Classic: Pages 264 – 271

Complete Encyclopedia- Volume 2: Pages 243 – 252

Alan

Alan,

Thanks for the quick response. I saw the time value was hovering around 0, so I went ahead and rolled out/up to the 7/15 45 strike. Hopefully that’ll sneak it past the ex-div.

Thanks again.

John