Watch Video: Listen To Audio Version: The PMCC allows investors to enter a covered call at a much lower cost than traditional covered call writing. There are pros and cons […]

BCI PODCAST 100: Analyzing LEAPS for The Poor Man’s Covered call Strategy (PMCC)

Posted on March 29, 2023 by Alan Ellman in Podcasts

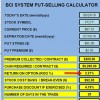

Comparing Call and Put Strategies with Paylocity Holding Corporation (NASDAQ: PCTY)

Posted on March 7, 2020 by Alan Ellman in Investment Basics, Option Trading Basics, Options Calculations, Put-selling, Stock Investing, Stock Option Strategies

Covered call writing or selling cash-secured puts… which is the best strategy? Well, they both offer great opportunities to generate cash-flow in a low-risk manner. I favor the former in […]

Covered Puts Are NOT Cash-Secured Puts

Posted on August 10, 2019 by Alan Ellman in Investment Basics, Option Trading Basics, Options Calculations, Put-selling, Stock Investing, Stock Option Strategies

Selling cash-secured puts is one of the go-to strategies in the BCI methodology. There has been some confusion for some of our members who conflate this strategy with covered puts, […]

Should We Add a Short Put to Our Collar Trades?

Posted on March 30, 2019 by Alan Ellman in Investment Basics, Option Trading Basics, Options Calculations, Options Trade Execution, Put-selling

A collar trade is a covered call trade with a protective put. Jim recently wrote to me asking about the efficacy of also selling an out-of-the-money put to help pay […]

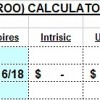

Strike Price Selection When Selling Cash-Secured Puts: A Real-Life Example with WWE

Posted on March 9, 2019 by Alan Ellman in Investment Basics, Option Trading Basics, Options Calculations, Put-selling, Stock Option Strategies, Technical Analysis

Strike price selection is one of the 3-required skills when selling covered calls or cash-secured puts. This article will highlight the choices and rationale for our decisions when selling puts […]

Rolling Down Our Put Positions: When and Why?

Posted on July 14, 2018 by Alan Ellman in Exit Strategies, Investment Basics, Option Trading Basics, Options Calculations, Options Trade Execution, Put-selling, Stock Option Strategies

Rolling Down Our Put Positions: When and Why? When selling cash-secured puts, our breakeven stock price is the (out-of-the-money) strike price less the put premium. Our exit strategy guideline […]

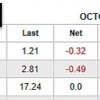

Buying Back Put Options When Share Price Gaps Up: A Real-Life Example with AVGO

Posted on October 7, 2017 by Alan Ellman in Exit Strategies, Investment Basics, Option Trading Basics, Options Calculations, Put-selling, Stock Option Strategies

When selling cash-secured puts our position management skills include buying back the short puts under certain circumstances. These include situations when share price moves up or down dramatically. When share […]

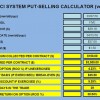

Selecting the Best Put Strike Based on Overall Market Assessment

Posted on September 16, 2017 by Alan Ellman in Investment Basics, Option Trading Basics, Options Calculations, Put-selling

Selling cash-secured puts requires us to master the three required skills: stock (or ETF) selection, option selection and position management. This article will highlight how to select a put strike […]

Setting Up a Covered Call Trade by First Selling an Out-Of-The-Money Put

Posted on May 27, 2017 by Alan Ellman in Covered Call Exit Strategies, Exit Strategies, Investment Basics, Option Trading Basics, Options Calculations, Options Trade Execution, Put-selling, Stock Option Strategies

A covered call trade can be initiated by first purchasing the underlying stock or exchange-traded fund (ETF). It can also be launched by first selling an out-of-the-money (OTM) cash-secured put and allowing […]

Rolling Up When Selling Puts To Buy A Stock At A Discount

Posted on July 2, 2016 by Alan Ellman in Exit Strategies, Investment Basics, Option Trading Basics, Options Calculations, Put-selling, Stock Option Strategies

Selling out-of-the-money cash-secured puts is a fantastic way to buy a stock at a discount. It can be used in lieu of setting limit orders. If exercised, our cost basis […]

Podcast

Podcast

- 124. Dividends and After-Hours News Causing Exercise of OTM Call Strikes

- 123. Implied Volatility, IV Rank and IV Percentile Defined and Practical Applications

- BCI PODCAST 122: Should I Roll-Out My Deep In-The-Money Call Option Mid-Contract?

- BCI PODCAST 121: What is a SPAC (Special Purpose Acquisition Company)?

- 120. Using the Nasdaq-100 Volatility Index (VOLQ) in Covered Call Writing Decisions

- 119. Establishing Our Cost-Basis for Long-Term Holdings

- 118. Adjusting Our Portfolio Mix to Achieve Diversification and Cash Allocation

- 117. When a Covered Call Strike Moves $1000.00 In-The-Money

- 116. How to Execute a Covered Call Trade with a Buy/Write Combination Form

- 115. Establishing Our Cost Basis When Rolling-Out-And-Up On 2 Different Days

Subscribe To Our Free Newsletter

Categories

- Ask Alan (18)

- Covered Call Exit Strategies (233)

- Exchange-Traded Funds (65)

- Exit Strategies (230)

- Fundamental Analysis (52)

- Investment Basics (580)

- Just Alan (8)

- Option Trading Basics (595)

- Options Calculations (411)

- Options Trade Execution (232)

- paper trading (4)

- Podcasts (126)

- Put-selling (99)

- Stock Investing (118)

- Stock Option Strategies (548)

- Stock Trading & Taxes (20)

- Technical Analysis (49)

- Uncategorized (5)

Recent Posts

- BCI PODCAST 124: Dividends and After-Hours News Causing Exercise of OTM Call Strikes

- Evaluating the Time Value Cost-To-Close to Assist in Covered Call Trade Decisions

- Ask Alan # 217: Entering a Poor Man’s Covered Call Trade

- Analyzing and Correcting Our Covered Call Writing Mistakes + Last Chance to Register for BCI Webinar

Premium Membership

How Alan Got Started with Stock Options

Why Covered Call Options May Be Your Best Investing Strategy

Nasdaq Interviews Alan Ellman

© 2024 The Blue Collar Investor. All Rights Reserved.

Beginners Corner Enhanced & Updated

- Lesson 1: Beginner's Corner for Covered Call Writing: 2nd Edition

- Lesson 2: Beginner's Corner for Covered Call Writing- 2nd Edition: Option Basics

- Lesson 3: Beginner's Corner for Covered Call Writing- Stock Selection

- Lesson 4: Beginner's Corner for Covered Call Writing-2nd Edition

- Lesson 5: Beginner's Corner for Covered Call Writing

- Lesson 6: Beginner's Corner for Covered Call Writing

- Lesson 7: Beginner's Corner for Covered Call Writing: 2nd Edition

- Lesson 8: Beginner's Corner for Covered Call Writing

- Video 9: Premium Membership

Beginners Corner Selling-Puts

- Lesson 1: What Is Puts Selling?

- Lesson 2: Puts-Selling Option Basics

- Lesson 3:puts-selling-technical analysis

- Lesson 4:puts-selling-Common Sense Considerations

- Lesson 5:puts-selling-Calculating Returns

- Lesson 6:puts-selling-Executing Put-Selling

- Lesson 7:puts-selling- Exit Strategies

- Lesson 8:puts-selling-Mastering Put-Selling

Recent Comments