Fundamental analysis, technical analysis and common sense principles make up the 3-pronged screening system used in the BCI methodology for locating option selling stocks. We start with the IBD 50 and move to the other screens from there but I always encourage the use of additionalther resources to locate elite candidates to serve as the underlying securities. Over the years, the BCI team has identified a database of over 3000 stocks that have been, at one time, excellent option-selling securities. Each week, we screen that database plus the IBD 50 for our Premium Members. In this article, I will demonstrate one way to form your own database of fundamentally sound stocks which are then ready to continue through our technical and common sense screens.

(Premium members need not go through this process as we do it for you).

Fundamental analysis is all about earnings and revenues growth and the associated ratios gleaned from corporate financial statements (see Chapter 3 in the Complete Encyclopedia for Covered Call Writing). An excellent free site to generate this information is:

www.finviz.com

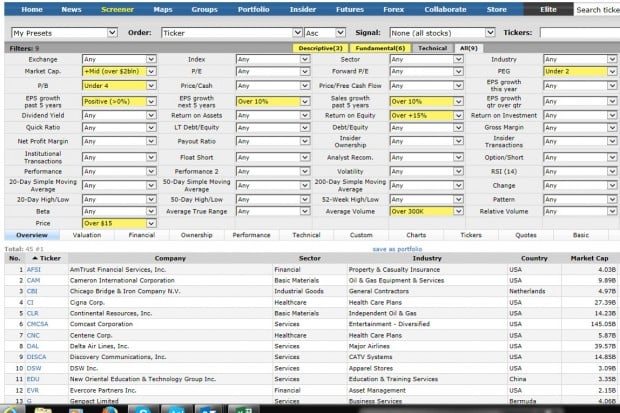

In the figure below, there is a screenshot of fundamental screens that generated 45 candidates. Adjustments in the screening criteria can be made to be stricter of less challenging to pass:

FINVIZ screen for fundamental analysis

In this screen, I set up 3 descriptive screens and 6 fundamental screens highlighted in the “yellow cells”:

Descriptive screens (avoid thinly-traded and penny stocks)

- Market cap: mid-cap and larger

- Price: over $15

- Average volume: over 300k shares/day

Fundamental screens

- Price/Book ratio: under 4

- Earnings/share growth past 5 years: positive

- Earnings/share growth projected over next 10 years: over 10%

- Sales growth the past 5 years: over 10%

- Return on equity: over 15%

- PEG ratio: under 2

Terms are defined in detail in Stock Investing For Students.

The criteria set up in this screen can be adjusted but I’ve shown several elite requirements from a fundamental perspective and it generated 45 candidates some of which are shown below the screening criteria. The next step would be to add in the 50 stocks from the IBD 50 (minus those that have no options) and move on to the technical and common sense screens. Ultimately, we will create a watch list of high-quality candidates for our option-selling strategies.

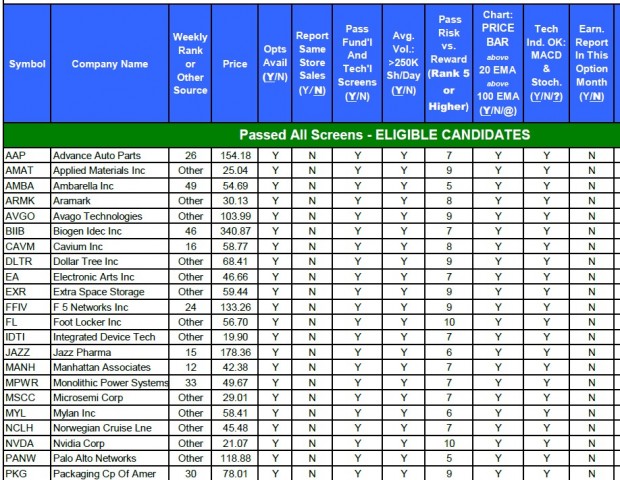

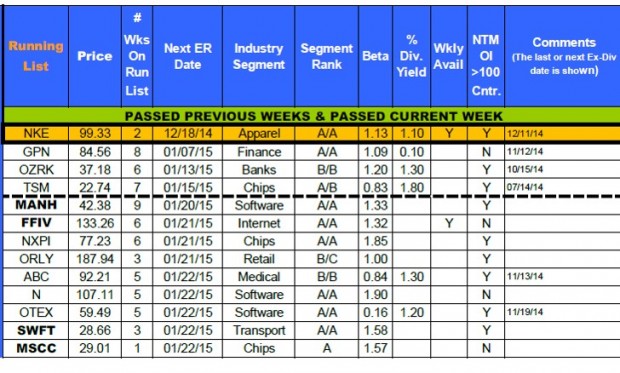

The screenshots below demonstrate the screening process used to craft our premium reports and a sample of a partial watch list (generated a few months ago) developed from the process:

Premium report screening process

BCI Premium Watch List

Conclusion

In the BCI methodology we begin the screening process for option-selling candidates using fundamental analysis. This is done for BCI Premium members on a weekly basis and can be accomplished without membership with such free sites as finviz.com.

Next live seminars:

Tuesday April 21st

7 PM – 9:30 PM

***Brand new seminar on selling cash-secured puts.

2- Denver, Colorado

Monday May 18th…details to follow

7 Pm – 9 PM

Market tone

Corporate merger & acquisition activity has been on a roll and on a pace for the 2nd busiest year since 2007. This is a bright spot for the US stock markets. This week’s reports:

- The minutes of the March FOMC reflected a bias NOT to raise interest rates in June, a short-term positive for the stock market

- The Market Services Purchasing Manager’s Index rose to 59.2 in March, the best level since August, 2014

- The ISM Services gauge fell from 56.9 to 56.5 but still reflecting signs of expansion

- The US jobs openings report hit a 14-year high in February despite a week jobs report last week

For the week, the S&P 500 rose by 2%% for a year to date return of 2.1%, including dividends.

Summary

IBD: Uptrend under pressure

GMI: 5/6- Buy signal since market close of January 23, 2015

BCI: This past week off the next earnings season which I believe is especially significant because the weekly economic reports have been leaning slightly negatively of late. Corporate earnings is what may determine how nervous the institutional investors become in the near-term in addition to possible FED action in June. Let’s keep a close eye on earnings surprises. In the interim, I am taking a defensive posture and favoring in-the-money strikes 2-to-1. An alternative would be to sell out-of-the-money cash-secured puts. This site remains long-term bullish and expects a resurgence of our economy in the second half of the year.

Wishing you the best in investing,

Alan ([email protected])

Premium Members,

This week’s Weekly Stock Screen And Watch List has been uploaded to The Blue Collar Investor premium member site and is available for download in the “Reports” section. Look for the report dated 04-10-15.

Also, be sure to check out the latest BCI Training Videos and “Ask Alan” segments. You can view them at The Blue Collar YouTube Channel. For your convenience, the link to the BCI YouTube Channel is:

http://www.youtube.com/user/BlueCollarInvestor

Since we are in Earnings Season, be sure to read Alan’s article, “Constructing Your Covered Call Portfolio During Earnings Season”. You can access it at:

https://www.thebluecollarinvestor.com/constructing-your-covered-call-portfolio-during-earnings-season/

Best,

Barry and The BCI Team

Hi,

It is interesting to note that some of the stocks in your screenshot are also in the IBD50, which I presume means you are more of a growth investor than value.

Is this a fair assessment?

rgd

Gary

Gary,

I would not want to box myself into one or the other category. Since we are short-term option sellers, the eligible candidates are elite performers from a fundamental, technical and common sense principle perspectives at that point in time whether others would classify these securities as growth or value stocks.

Our lists typically have both.

Alan

HI Alan,

I have been watching your videos on youtube regarding the writing covered calls process. I must say they are well done, congrats even though the video series is now 4 years old is pretty well done.

However I have a technical question from a beginners perspective and please forgive me is the question is trivial for you.

When mentioning the ITM covereal calls writing, you said “Money can be lost if share prices declines more than the premiun collected”. Even though I agree with that sentence, Are not we mixing different things together? The loss is unrealized loss , a paper loss so to speak, while the premium was received in hard cash, on that moment in time it was a loss but if you are a long time investor on that stock, you could even buy more to lower you dollar cost average or wait for a rebound.

Also another technical question, I am reading a book from Michael Thomsett, and he was mentioning one thing you did not mention on your videos and confused me, he was saying that stock prices can affect the option price (premium) in a way the option price will increase as the stock price will increase. But what happens with the time decay of the option?? How these two concepts compete to each other in defining the option price.

Appreciate your insight on that.

Thanks

Alex

Alex,

My responses:

1- It is true that the option premium is realized profit on the option side of the equation and share loss is unrealized if the stock is retained. However, I believe it would be a mistake when evaluating our monthly returns, not to incorporate unrealized share loss into our calculations at that point in time. I also feel that it would be a mistake to hold onto a losing security to “get our money back” if there is a stronger candidate available. Because of earnings reports we are rarely in a stock for more than 2 months at a time anyway unless we are portfolio overwriting (writing out-of-the-money calls on a long-term buy-and-hold portfolio).

2- The factors that impact option premium are known as the “Greeks” Delta describes how much an option premium will change for every $1 change in share price. ITM strikes are impacted more than OTM strikes by share appreciation. Theta or time value erosion effects the time value component as does vega (implied volatility of the underlying security).

For a detailed discussion of the Greeks, see pages 156 – 166 of “The Complete Encyclopedia for Covered Call Writing” and pages 195 – 212 of “Selling Cash-Secured Puts”

BTW: I have produced over 300 videos over the past 8 years so some are 4 years old, some 8 years old and some 4 weeks old. I have actually produced a few more that will be published in the near future and more to come after that…hope you benefit from them.

Welcome to the BCI community!

Alan

Charlotte seminar:

It is truly a humbling experience to see so many people pack a room to hear me speak. I especially enjoyed meeting our BCI members who live in the Charlotte area and those who traveled such a long distance to attend…thank you.

CLICK ON IMAGE TO ENLARGE & USE THE BACK ARROW TO RETURN TO BLOG.

Alan

Allan,

Thanks for the great article on cash secured put selling !

I have a question here which needs your help.

Supposing I am selling cash secured BX april 39 put for 0.55 .While I do not mind to buy the stock if BX drops below 39 at expiration, I prefer to buy back the put and close the trade even at a loss. Since I cannot be sitting in front of the computer all day to watch the stock, I need to set a stop order to buy back the Put. There are two alternatives :

(a) set a stop order to buy back the put when the stock drops to less than 39

(b) set a stop order to buy back the put when the premium exceeds say 2 times of 0.55 or 1.1 This is to allow for the possible stock reversal above 39,meaning I am prepared to take loss of about 0.55 .

Which alternative do you think is safer or better ? I am using Optionxpress.com platform.

Best regards

Charles

Charles,

We have 2 separate issues here. First, you may not want the shares “put” to you and second we want to mitigate any losses for a declining underlying security.

In my latest book, “Selling Cash-Secured Puts”, I discuss a 3% guideline, where the put is bought back automatically if share price declines by more than 3% below the strike price. That would bring us to $37.83. We can set a limit order to buy-to-close @ $37.50 and not be in front of our computer to mitigate any potential losses from a declining underlying security.

If that threshold is not reached, then on or near expiration Friday we can buy back the option is share price is below the strike and roll it to the next month or simply use the cash to secure another put trade.

Alan

thanks, Alan for your kind advice.I will get a copy of your book through Amazon.com.

One of my fear to set stop loss at stock price eg. 37.83 (3% down from strike) is that the premium will increase dramatically high to more than 2x orginal premium that I sold and collect when I entered the position as IV increases as stock declines. Based on your past experience , what was the range of premium that you bought to close a particular position at 3% below the strike ?

Best regards

Charles

Charles,

Your assumption is that as share price declines, IV rises significantly. This may or may not be the case but let’s assume that it does. In addition to vega (volatility) impacting premium we also have theta working for our team. So the percentage increase (if an increase at all) will depend where in the contract this price decline occurred. Theta will offset vega to some extent.

As our OTM put becomes an ATM put as share price declines, the delta approaches (-) .50. This means we are losing twice as much on the share side as on the option side.

The 3% guideline is a protective maneuver used to mitigate losses and sometimes turn losses into gains because if a position is closed early, the cash freed up can be used to secure another put option.

Alan

Hi Alan,

Thanks for another great piece of information.

One question: what is “Pass risk vs reward >5” in your first table?

I remember you used to use MSN money StockScouter for their 1-10 rating but that’s not around anymore.

Thanks ,

Steve

Hello Steve,

Since MSN updated their website, they did, in fact, drop StockScouter. However, we have stayed in contact with the provider of the StockScouter data, and they send us the StockScouter ratings twice a month.

As soon as they complete negotiations with another website to host their data, we’ll let you know where to find it. In the meantime, we will continue to provide the data as we get it from the provider.

Best,

Barry

Hi, it’s been a while since I posted you questions so here are some more I have thought of.

1. If the stock is going sideways in an uptrend then should I still think of selling ITM options, as you had told me that you would more likely sell ITM options if the stock is in a s/ways channel?

2. When rolling down a stock, then is selling a strike at a support level(or below it) really a good idea, as the stock could bounce up from it – instead of going down to or below it?

3. Also what would you say is the latest time in a contract that I could rolldown any stock I have?, – would this also be the same time for if I were to buy a stock and then sell the option?

These are just my typical situations I have been in while currently papertrading, especially No.2 above of which I am again in with one of my stocks this contract. Thank you

Adrian,

My responses:

1- If a stock is consolidating (moving sideways) I will make my strike selection based on my overall market assessment. If bullish, I lean to OTM, if bearish or volatile, I favor ITM strikes. When in doubt I favor ITM strikes. There is no “cowboy” in me!

2- Rolling down is a defensive maneuver which generally is applied later in the contract. I take the time value credit and downside protection with the understanding that a bounce back is possible but I am still comfortable with this defensive exit strategy.

3- As long as there is a meaningful time value credit (STO > BTC) it makes sense, even in the last week of a monthly. We must also factor in the “locked-in” share loss by rolling down.

Once again, these are defensive moves generally reserved for the later stages of a monthly contract.

Alan

Hi Alan

The finviz parameters that you have stated in this article, are they in any of your books? (particularly the encyclopaedia)

thanks

sean

Sean,

These parameters are detailed in “Stock Investing For Students”

They can also be applied to longer-term investing which is what this book focuses on.

Alan

Dr. Ellman,

I have been a premium member for several years now and thoroughly enjoy all that you do.

I do, however, have a question concerning how best to use the Beta information that is included in the weekly Stock Screen list.

From what I can gather if a company’s Beta is > 1 that is preferred in a bull market? but if it is < then not so much?

Am I figuring this correctly? How should I be using these figures to make the best options choices?

Thanks for you help!

Dr. O

Dr. O,

You do have this correct. High beta stocks tend to outperform in bull markets and low beta stocks in bear markets. However, I consider beta a secondary parameter as we make our investment decisions as these stats are based on historical data volatility. Implied volatility, on the other hand, is based on market expectation of price volatility based on current option pricing. I don’t look up IV stats for each option directly but do look at monthly percentile returns for near-the-money strikes and those stats will reflect IV. For example, I set my goals for initial monthly returns @ 2 – 4% in normal market conditions. I’ll go higher in a bull market environment. That will keep me away from high IV (risky) trades.

So IV is more important than beta for short-term traders like us in my view. So why do we publish beta stats? There are 2 reasons:

1- Member request: Many of our members have asked for these stats to be included in our reports to have an idea as to how these stocks compare with the benchmark (we use the S&P 500 in a 1-year time frame for our beta stats).

2- Beta can be used when deciding between securities that appear to be similar in every other way (fundamental, technical, returns etc.). In this case, favor the high beta stocks in a bull market scenario and vice-versa.

Alan

Alan, If I could just go over one of your answers above, so first if we could rolldown in the final week as calculations will still throw out a credit in premium, then is this something you will do if you know that there is earnings the following contract, because then you will need to buy back the option to then closeout any position?

2. Shouldn’t I work out first that this rolldown credit will also be larger than the commission costs for these 2 trades as well as for another possible ‘buy to close’, in case of not wanting to rollout stock – from any bad technicals, calculations, etc?

3. And this leads me to finally ask, how would I predict an estimated option price for any potential ‘buy to close’ that I may want to do on expiry day, because couldn’t the option value possibly be greater than the option that has just been sold? Thanks

Adrian,

1- If there is an upcoming ER, the stock will be sold. If we roll down, that new strike will end up ITM or OTM. If ITM, exercise is automatic. If OTM, we place a sell order…either way the same steps just one is automatic, the other isn’t.

2- Yes, make sure there will be a net credit.

3- On expiration Friday, the time value will approach zero because of theta (time value decay). That leaves intrinsic value. Any option debit related to intrinsic value is cancelled by the increase in share value due to no longer having the option obligation.

Alan

Premium members:

This week’s 6-page report of top-performing ETFs and analysis of ALL Select Sector Components has been uploaded to your premium site. The report also lists Top-performing ETFs with Weekly options.

For your convenience, here is the link to login to the premium site:

https://www.thebluecollarinvestor.com/member/login.php

NOT A PREMIUM MEMBER? Check out this link:

https://www.thebluecollarinvestor.com/membership.shtml

Alan and the BCI team

Running list stocks in the news: VRX:

Valeant Pharma recently acquired Salix Pharmaceuticals which is expected to move sales up to $10 billion, a 20% increase from 2015 projections. VRX has had positive earnings surprises in 6 consecutive quarters and has crushed estimates by 80% in the past 4 quarters.

Our premium “running list” shows a price per share of $207, in the medical industry segment currently ranked “A”, a Scouter rating of “10”, a beta of 1.09, weeklys present and adequate open interest for near-the-money strikes.

Alan

Where did you source the parameters for descriptive and fundamental screens? I am interested in getting into advanced fundamental analysis.