Technical analysis or fundamental analysis…which should we use in the stock selection process for covered call writing? Many sophisticated investors can make an impressive argument for one or the other. I say why not use both? As most of you know, in the BCI methodology we use actually three types of screens: fundamental analysis, technical analysis and common sense principles (like avoiding earnings reports). Most would agree that institutional investors (mutual funds, hedge funds, banks and insurance companies) have a major impact on the price of our shares. These players love companies that produce strong earnings and revenues. They scrutinize the 3 major financial statements of these corporations before delving in. In my view, since fundamentals are important to these impact players, it should also be important to us. So our first series of screens are fundamental in nature. Common sense principles are just as critical as the other two screens and are detailed in my books and DVDs and perhaps will be the subject of a future blog article.

That leaves technical analysis, the subject of this week’s article. If a company is fundamentally sound, why bother? The reason has to do with the myriad of other factors that can impact share price in between financial statement reporting. Global issues, political factors, economic reports and corporate news to name a few. Technical analysis will alert us to changes in market analysis of a particular equity. A company can be fundamentally sound but technically collapsing.

Enter Sodastream International Ltd. – Ordinary Shares (NASDAQ: SODA). This company was previously on the Blue Collar Premium Watch List and once responsible for some pretty terrific returns for many of us. At the end of June, SODA was removed from our “running list” because of a complete technical breakdown. It wasn’t fundamental-related because the earnings report is not due out until July 31st. It appears that the collapse and subsequent share depreciation was related to corporate news and perhaps some market psychology (fear based on rumors). There was an analyst downgrade and rumors regarding a potential acquisition by Coca Cola. Remember, the fundamentals of this company are still strong. Let’s look at the technical chart using the parameters detailed in my books and DVDs:

SODA as of 7-18-13

Note the following technical events:

- The vertical green line shows the price breaking through the support of the 20-d EMA in very early July, a bearish flag

- The price breaks through support of both the 20-d EMA and then the 100-d EMA as shown by the top 2 broken red arrows

- The MACD Histogram turned bearish in mid-June (broken red arrow in middle of chart) predicting a possible price trend reversal

- The stochastic oscillator showed a double-dip below 80% (green circle) also in mid-June also a bearish technical signal and before the actual price decline

- All these bearish signals took place on high volume, confirming these red flags

How do we manage a covered call position when there is a complete technical breakdown?

The first step to take is to follow the 20/10% guideline as set up in the BCI methodology. Curling up into the fetal position and feeling sorry for ourselves is not one of our choices! Following this guideline is easy and automatic. Next we research the cause of the collapse. An excellent site I use for researching stock news is:

www.finviz.com

Most of the time, when there is a total technical breakdown we are going to close our entire position…buy back the short option and sell the long stock. Then immediately put this cash to work in a completely new covered call position. I call this “converting dead money to cash profits”

What if the collapse was due to a market over-reaction?

We must still take action to protect our hard-earned money. They say, “You can’t fight city hall” Once again, we buy back the option and, at least, roll down to generate some additional downside protection of our investment. If the price continues to decline, sell the stock or roll down again but don’t freeze and take no action. A complete technical breakdown in conjunction with negative news is too serious a circumstance for us to freeze and take no action. We all work very hard for our money and should protect it in every way possible.

Technical analysis and the Premium Report:

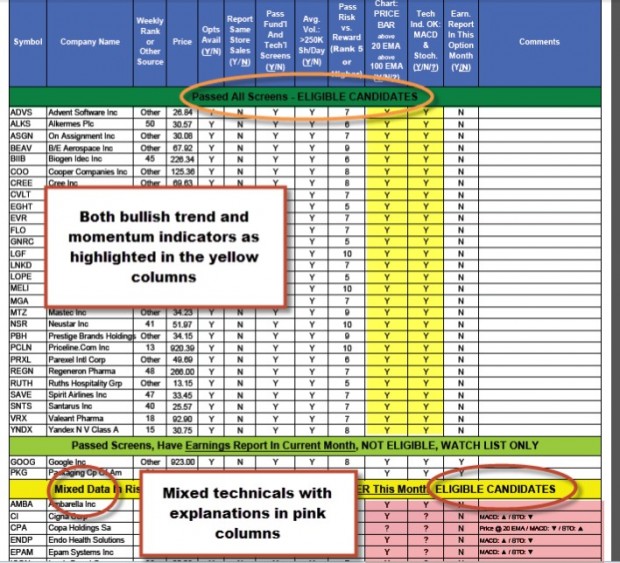

A stock that is experiencing a complete technical breakdown will be removed from the Premium “running list” as was SODA. The BCI team does a complete technical analysis on all covered call candidates after 4PM EST on Friday and the report shows those stocks that passed all technical screens and those with “mixed technicals” as shown in the screenshot below:

Technical analysis and the BCI Premium Report

Conclusion:

A complete technical breakdown, especially in conjunction with negative corporate news, is a serious matter that requires us to be proactive in our position management. At the very least, rolling down with share depreciation is required. Most of the time unwinding the entire position and using the cash to establish a new position is most appropriate.

Market tone:

There were two major headlines this week. First, Fed Chairman Ben Bernanke told the House Financial Services Committee that he will consider slowing QE (bond buying) only when economic conditions justify. He does not foresee this happening in the near future. The other event was the Chapter 9 bankruptcy filing by Detroit. The reports show a sluggishly improving economy:

- Fed Chairman Ben Bernanke stressed that the Fed will consider slowing its quantitative easing policy of bond buying (to keep interest rates down making it cheaper for consumers and businesses to borrow money) only when economic conditions justify it

- The Chairman also reiterated his stance to keep near-zero interest rates for an extended time frame

- Mr. Bernanke also stated that the slowing of economic growth in 2013 was, in large part, related to federal spending cuts known as sequestration

- Detroit’s Chapter 9 filing for bankruptcy protection made this city the largest US city to ever do so. Detroit is $18 billion in debt and has a declining population with high unemployment

- The consumer price index (CPI-A widely followed indicator of inflation. The CPI is a measure of the average change over time in the prices paid by urban consumers for a fixed market basket of consumer goods and services. The “core” CPI excludes food and energy prices, which account for roughly one-quarter of the broad CPI and tend to fluctuate widely, providing a truer reflection of inflationary trends. ) increased by 0.5% in June, higher than the 0.3% expected. This largely due to a 6.3% increase in gas prices

- Core CPI rose by a slight 0.2% in June and up a low 1.6% year-to-year

- Business inventories (A report of the dollar value of product inventories held by manufacturers, wholesalers, and retailers. Included in the report is the inventories/sales ratio, a gauge of the number of months it would take to deplete existing inventories at the current rate of sales, which is an important indicator of the near-term direction of production activity) increased by 0.1% in May slightly higher than expectations

- The Beige book reported “modest to moderate” growth in June

- Retail auto sales rose by 0.4% in June, lower than the 0.8% anticipated

- The Conference Board Leading Economic Index (LEI) was unchanged in May but up over a 6-month time frame

- Housing starts dipped by a surprising 9.9% in June but up 10.4% year-to-year

- Industrial production rose 0.3% in June after a decline in April and a flat month in May

- Initial jobless claims for the week ending July 13 came in at 334,000, less than the 343,000 expected

For the week, the S&P 500 rose by 0.7% for a year-to-date return of 20%, including dividends.

Summary:

IBD: Confirmed uptrend

BCI: Moderately bullish favoring out-of-the-money strikes 3-to-2

Thank you for your continued support.

My best to all,

Alan ([email protected])

Alan,

Which site do you use to create price charts? Is it free?

Thank you for your help.

Erin

Hello Erin,

There are two great free sites:

http://www.stockcharts.com –

This is the site that Alan uses in his books, articles, presentations, etc.

http://www.freestockcharts.com –

This site gives you more tools and flexibility…you easily save your chart formats , as well as the ability to easily annotate your charts, draw trend lines, etc.

Best,

Barry

Alan,

At which point in the chart would you have rolled down or sold the stock. My thought it would be when it broke through the lower moving average. Thanks.

Gail

Gail,

Following the 20/10% guideline will generally keep us out of trouble. At that point, with a moving average breach and momentum indictors all negative, rolling down or selling the stock would make sense. A subsequent breach of the 100-d EMA usually will motivate me to sell the stock but rolling down again is another choice. Selling a losing stock is one of the most difficult decisions for an investor but sometimes the best and most appropriate action. Doing nothing at all is the worst thing we can do in this scenario.

Alan

Premium Members,

This week’s Weekly Stock Screen And Watch List has been uploaded to The Blue Collar Investor premium member site and is available for download in the “Reports” section. Look for the report dated 07-19-13.

Also, be sure to check out the latest BCI Training Videos and “Ask Alan” segments. You can view them at The Blue Collar YouTube Channel. For your convenience, the link to the BCI YouTube Channel is:

http://www.youtube.com/user/BlueCollarInvestor

Since we are in Earnings Season, be sure to read Alan’s article, “Constructing Your Covered Call Portfolio During Earnings Season”. You can access it at:

https://www.thebluecollarinvestor.com/constructing-your-covered-call-portfolio-during-earnings-season/

Best,

Barry and The BCI Team

Alan,

I ordered your Encyclopedia yesterday. Do you explain how to set up the chart you showed in this article in one of the chapters? Can’t wait to get the book!

Martin

Hello Martin,

If you scroll up to the grey box under Alan’s picture, you will see an article entitled “Setting Up A Technical Chart…”. Click on that entry and it will take you to an article that gives you all of the details.

Best,

Barry

Thanks Barry. I didn’t see that link.

Martin

Premium Members:

This week’s Weekly Stock Screen And Watch List has been revised and uploaded to The Blue Collar Investor premium member site and is available in the “Reports” section. There was a typo for LGF, causing it to be placed in the wrong category in the Stock Screen section of the report. LGF

was/is correct on the Running List,

Look for the report dated 07-19-13-RevA.

For your convenience, here is the link to login to the premium site:

https://www.thebluecollarinvestor.com/member/login.php

Best,

Barry and the BCI Team

LGF Earnings date:

There are conflicting dates from various resources as to when LGF will report. Earningswhispers.com has it as 8/29, others as 8/9 or 8/12. The last report was on May 30th. I have a call into corporate headquarters for Lions Gate and will post on this blog any additional information I can provide.

Alan

LGF:

Corporate headquarters told me that no ER date has been made public as of yet but I am pursuing further.

Alan

Premium members:

This week’s 6-page report of top-performing ETFs and analysis of ALL Select Sector Components has been uploaded to your premium site. The report also lists Top-performing ETFs with Weekly options.

For your convenience, here is the link to login to the premium site:

https://www.thebluecollarinvestor.com/member/login.php

NOT A PREMIUM MEMBER? Check out this link:

https://www.thebluecollarinvestor.com/membership.shtml

***LGF is listed in our latest stock report as “eligible” Earningswhispers.com has the report date as 8/29. Other sites have it as 8/9 or 8/12. I called corporate headquarters and was told that the date has not been released and they would send me an email when it was. The last report date was 5/30. I will keep our members informed as I receive more information

Alan and the BCI team

Hi Alan, here are some more questions I earlier promised to ask you mainly about price declines and what to do, etc

– If I could again start by asking you how you suddenly tell the difference between whether the market is going into a correction, or if it is just part of a pullback?,- what are the things that you need to see and know from charts and market?(so you can change from high to low beta stocks, and sell ITM options and viceversa)?

– When thinking of using the ‘convert dead money to cash profits’ strategy, you said that this is used if the share is underperforming the market. Would you then compare it to the price performance chart to see this?(I’m guessing you won’t)

– Is there any way that you can prepare for any potential market crash(eg. 1987,etc)?, and what would you most likely do beforehand?(maybe sell all shares?)

– As a share price goes down, then should we need to do intraday rolldowns if share price drops a lot in the day?,- are there alert signals for doing this?

– Lastly a fundamental question I will throw in, is of how often should I need to read the company news reports, just in case of any bad news that may come out?

Your articles have been very helpful for me to learn this great strategy, but of course they have also raised lots of questions to ask you, – so I’m sorry I’ve had to ask so many lately, but thanks.

Fred,

My responses:

1- A market correction is generally considered a decline of 10% or more and a bear market is a decline of 20% or more. But we make weekly assessments of the overall market since our strategy is extreme;y short-term. I use the charts of the S&P 500, the VIX and weekly economic reports to make my weekly assessments and strategy adjustments.

2- I will sometimes use a comparison chart and overlay the price performance of a stock to the S&P 500. This will help me decide whether to roll the option or sell the stock. Sometimes the decline is such that a chart comparison is not needed.

3- Years like 1987 and 2008 were aberrations and impossible to foresee in my view. However, as the market declines we are taking action to mitigate losses by using some of the strategies you mentioned in your question. We may still get hurt but not nearly as much as those who took no action at all.

4- I use the 20/10% guidelines described in my books and DVDs to determine when to close the short options position. The next step is based on several factors like the time in the current contract, chart technicals, news etc.

5- I look at company news when there is an unexpected substantial price change, either way. Normal whipsaws and small price changes do not motivate me to review the news of the day for a corporation.

Alan