One of our covered call writing exit strategies is converting dead money to cash profits (CDMCP). When share price is declining and under-performing the overall market, we first close the short call and then sell the stock. The cash generated from the sale of the underlying is then used to enter a new position. Another approach we can employ is closing the short call and then implementing the stock repair strategy to lower our breakeven point and perhaps mitigating losses on the stock side. In some cases, we may turn losses into gains. This article will highlight a real-life example with Adobe, Inc. (NASDAQ: ADBE).

Initial covered call trade and closing the short call

- 7/23/2018: Buy 100 x ADBE at $259.77

- 7/23/2018: Sell 1 x 8/17/2018 $260.00 call at $5.95

- 7/30/2018: Buy-to-close the $260.00 call at $0.82 (stock declined in price to $242.32)

- 8/8/2018: ADBE price moved to $253.83 and a decision was made to employ the stock repair strategy

Calculations through 7/30/2018 using the multiple tab of the Ellman Calculator

ADBE: Initial Calculations with the Ellman Calculator

When the trade was initially executed, the time value return of the option was 2.3% with an additional 0.1% of upside potential (yellow cells). After buying back the option, the option return was reduced to 2.0% (brown cell). On 8/8/2018, the shares loss was $5.94 or 2.28%. Commissions aside, there was a net total position loss of 0.28%. A decision was made to mitigate the loss by employing the stock repair strategy to lower the breakeven and allow time for additional share recovery.

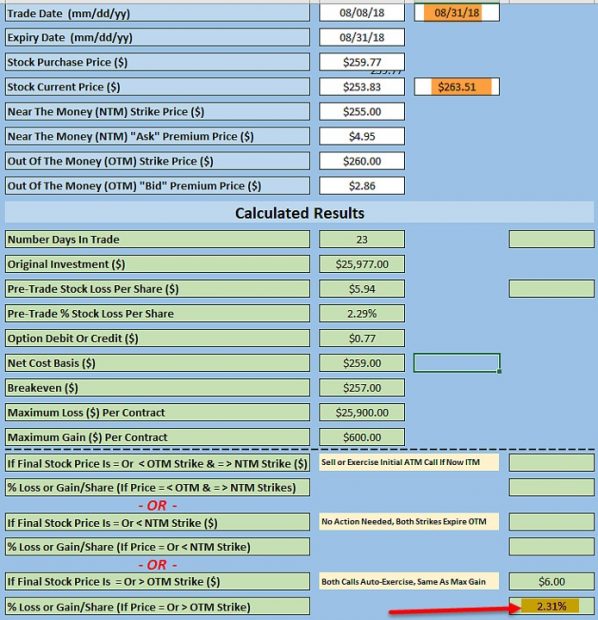

BCI Stock Repair Calculator

- 8/8/2018: Buy 1 x ADBE 8/31/2018 $255.00 call at $4.95

- 8/8/2018: Sell 2 x ADBE 8/31/2018 $260.00 calls at $2.86

- Breakeven lowered from $259.77 to $257.00 (mid-section of spreadsheet)

- 8/31/2018: ADBE trading at $263.51 resulting in a stock repair profit of 2.31% or a total trade profit of 4.31% when adding in the option profit

ADBE: Stock Repair Final Calculations

ADBE price chart during the series of trades

ADBE Price Chart from July to August 2018

Discussion

When a covered call trade turns against us, we can mitigate by closing the entire position simultaneously or do it in stages. The latter approach involves closing the short call and then implementing the stock repair strategy.

*** For more information on the Stock Repair Calculator, click here.

Your generous testimonials

Over the years, the BCI community has been incredibly gracious by sending our BCI team email testimonials sharing stories as to what our educational content has meant to their families. Moving forward, we have decided to share some of these testimonials in our blog articles. We will never use a last name unless given permission:

Alan,

I’ve read all your books. I like your system and look to fully implement it. Thanks for all the work you have done to help us retail investors.

Sincerely,

Michael M

Upcoming events

-May 8th

Alan will be hosting a free webinar for the Options Industry Council (OIC) on generating income from selling options. Click here to register for free.

-May 13th

All Stars of Options

Bally’s Hotel, Las Vegas

10 AM – 10:45 AM

How to Select the Best Options in Bull and Bear Markets

Free event

-May 14th

Las Vegas Money Show

Bally’s/ Paris Hotel

12:15 – 3:15

Master class encompassing covered call writing, put-selling and the stock repair strategy

This is a paid event hosted by The Money Show

***Alan will also be doing book-signing event at The Las Vegas Money Show

***Market tone data is now located on page 1 of our premium member stock reports.

Alan,

thanks for this timely article.

I have used the stock repair strategy successfully some time ago, and was forgetting to use it lately.

Thanks for the reminder. There are so many different things to remember while trading full time the BCI covered call methodology.

Roni

Roni,

My articles and videos, and is some cases, books are motivated from member feedback and my team and I feel so fortunate to have members like you who share your questions and comments in this forum. Please keep them coming.

Alan

Premium Members,

This week’s Weekly Stock Screen And Watch List has been uploaded to The Blue Collar Investor premium member site and is available for download in the “Reports” section. Look for the report dated 04/26/19.

Also, be sure to check out the latest BCI Training Videos and “Ask Alan” segments. You can view them at The Blue Collar YouTube Channel. For your

convenience, the link to the BCI YouTube Channel is:

http://www.youtube.com/user/BlueCollarInvestor

Since we are in Earnings Season, be sure to read Alan’s article, “Constructing Your Covered Call Portfolio During Earnings Season”. You can access it at:

https://www.thebluecollarinvestor.com/constructing-your-covered-call-portfolio-during-earnings-season/

Best,

Barry and The Blue Collar Investor Team

Hi Barry,

I hope that your knee surgery went well, and hope you are having a smooth recovery.

Roni

Hi Roni,

The rehab is going well. I started physical therapy this past Wednesday. I’m moving from a “walker” to a cane. Still some pain but that is expected.

It is a bit difficult to do the weekly report right now. I can only be at my computer for about an hour at a time before I need to get up and move…so the report takes longer to complete. This will get better over the next few weeks, however.

All in all, I’m pleased with my recovery process.

Best,

Barry

All members,

watch out : TTD has confirmed ER for May 09.

It was expected for May 23 in last week estimates.

Roni

Alan,

Looking into keeping track of taxes and wondering if using your Sch D is necessary. I use Fidelity and am thinking they will issue me all the info I need for tax preparation at year end, but not sure as I haven’t used the covered call strategy with them just yet.

Any info would be appreciated.

Thanks a million and enjoying the BCI membership a ton! Was up half the night last night studying 🙂

Kurt

Kurt,

I believe you are on the right track here. I’ve been told by CPAs who are members of BCI that brokerages are getting better at providing accurate tax information to its clients and Fidelity does have a stellar reputation in the field.

However, whenever I receive a tax-related question, I always recommend seeking the advice of your tax advisor.

By the way, covered call writing can be used in self-directed IRA accounts and then tax concerns are eliminated.

Alan

Kurt,

I receive 1099B from Fidelity each year and it details all you trades which you can import into Turbotax or other tax program.

I made comments about my Tax Return issues this year in a blog post on 4/10/18. To quickly find it, use the Google search in BCI using keywords ….. mariog trading experiences … OR …. mariog 1099B ….

A lot of information is their by searching the BCI blog history.

I also made comments on Etrade and Fidelity application process and upgrading your accounts on on 4/19/19 10:10pm. Search for … mariog trading experiences fidelity etrade ….

This is my 3rd year with BCI. Used Turbotax Home and Business for many years. Works well.

Good luck with your studies. I spent 4 months preparing for my first CC trade! Still there is some tension as you make those first trades and you find out what your read you have to review again and again to understand all the nuances.

Mario

Why would you buy back an option that is going to expire worthless? Confused.

Thanks,

Mike

Hi Mike,

There can be several reasons.

I will give you one that happened to me last Friday, 4/26/19.

Cisco systems has been a core holding of mine since 2009. Dead money some of that time.:)

On 04/01/19 I sold 10 contracts on Cisco, CSCO Apr 26 ’19 $56 Call. CSCO was trading $54.95 at the time. This three weeks ended up being more volatile than normal for CSCO. There were times when this trade was doing real good and times not so good. The option price never got to the 20/10 rule stage. Due to the volatility the time value did not drop as fast as normal. Even Friday the stock bounced around $56 all day with the time value ranging from $0.12 to $0.17, unbelievable! I felt like something weird was going on, like “pinning the strike”. Finally at around 3:45 pm there was a sudden drop to $0.01 with the stock at $55.91. As I had my order ready to press execute I did at $0.01. It cost me $10.00, With Etrade there are no commissions or fees to BTC at $0.10 and under.

Now, why did I buy them back. Because there was a danger that they would go into the money either right at the close, or for 5-6 minutes after the close and I would be assigned. It wouldn’t have been the end of the world but I didn’t want to buy them back Monday at a higher price. By the way CSCO was up $0.16 after the close to $56 05. I probably would have been assigned.

Now why did I allow my self to get in this position for a few dollars. Sometimes I do it just for the thrill, the adrenaline rush, Sometimes just to see if I can beat the machines.

I would never advise anyone to play that near to the close. Sort of like the old quote from Hunter S Thompson, “I hate to advocate drugs, alcohol, violence, or insanity to anyone, but they’ve always worked for me.” 🙂

If you don’t know, and you probably do know, the character “Uncle Duke” in the comic strip “Doonesbury” was based on Hunter S Thompson. Uncle Duke even looked like Thompson.

Anyway that’s one reason to buy back a short call that appears to be going to expire worthless. If it’s close the market can bite you right at the close.

This coming week will be exciting for me. I hope it will be dull, boring and very profitable for you.

Best of luck,

Hoyt T

Mike,

Let me add this to Hoyt’s outstanding response:

In the BCI methodology, a short call is closed when premium approaches our 20%/10% guidelines. In this case the premium dropped from $5.95 to $0.82, meeting the guideline. At that point, we can evaluate our next-step… waiting to “hit a double”, rolling down, selling the stock or, in this case, instituting the stock repair strategy. By closing the short call and retaining a minimum of 80% of our original option profit, we are in a position to take action that we may not be able to take advantage of had the option not been closed.

Alan

Hi Mike,

CSCO is down $0.18 in premarket trading. Doesn’t mean it will open there but does sort of confirm that there was probably “machine” based “pinning to strike” going on Friday.

Alan explained “pinning to strike” much more succinctly than I did either in a previous blog, Ask Alan segment or Blue Hour presentation. Can’t remember which.

Hey, I found it. Go to the search bar on the home page and type in ““Pinning the Strike”: A Covered Call Writing Consideration” and read Alan’s Excellent article. The search function on BCI can bring up encyclopedic articles on all aspects of CC and CSP trading.

Education is always cumulative and knowledge of something that we don’t trade in can help us be better traders in that which we do trade.

Jay is way over my head in nuanced trading but his sharing has helped me make better timing trades. Many others offer golden nuggets as well.

Hoyt T

Thank you Hoyt,

As always I appreciate your kind words. I love this group and learn far more than I contribute. – Jay

To all members.

Just saw where Bart Chilton, former U.S. CFTC Commissioner died at age 58 of pancreatic cancer. A good guy.

I was disappointed that he did a gig for RT America. But I didn’t let that change how I felt about him.

Hoyt

Trading Experiences … 4/29/19 … XLF Overwrite

After 7 months from 9/26/18, XLF price has recovered. Filled open order to fill Strike 28 at 9:45am when it was over 1% and sold STO at U=28.07.

On 4/24 last Wednesday it was at 27.43 and I extrapolated at what price I need to make an open order to still make a gain on the trade and taking into account the current Breakeven point which was 27.3636. I noticed ATM trades were selling around 0.40. I then placed an STO open order for 0.40. Filled today at a peak in the AM. Making that open order payed off.

After commission the 0.40 yielded 0.3869 after a Fidelity commission of 10.15 + 0.32. Using my BEP of 27.3636, my Gain was 1.0233. With my return cost basis of 28, the current ROO% is 1.0233 / 28 = 3.65%. I am satisfied with that.

Setting immediately a BTC 20% rule (0.07) on the trade for a possible reversal

The price chart history show it is rising steadily since 3/28/19, so it should continue to do well. (Watch it fall now.)

The only issue I have with open orders (Long and option) when I make them is to recheck them regularly so you do not make an unfortunate trade. That has surprised me before. The 3rd week of a 4 week cycle I need to change my buy back rule from 20% to 10%. On the last 1 or 2 days before the last week of a cycle I need to cancel my buy back order.

Mario

Alan,

I wanted to ask this question. In a case like Visa, if it doesn’t meet the criteria of 2 to 4% in 1 months’ time, do you pass on it? Premium 1.3% in 25 days or 1.5% in 32 days, and it’s a strong candidate to get called away giving you another ½ percent pulling you closer to the 2%. Thank you!

Rob

Rob,

The 2% – 4% range represents guidelines that I use for initial time-value returns in my portfolios. We have members that target more or less depending on personal risk-tolerance. As a matter of fact, I target 1% – 2% in my mother’s more conservative portfolio.

Visa has been an amazing performer over the past 2 years and earned its way into our reports on a consistent basis aside from the severe market downturn at the end of 2018 (that was fun, wasn’t it!).

Once we have established our target goals, any stock or ETF that has passed the rigorous BCI screens and meets our target initial returns should be given consideration.

Alan

I wonder does it make sense to buy protective puts before the earnings report? I’d prefer not to own stock during ER, but if we do, what is better, buying protective put or, if stock price declines after ER, implement stock repair strategy? Puts might be expensive, but even blue chips go down significantly sometimes (INTC this quarter or FDX and AAPL in late 2018 are good examples of this).

Sunny

Sunny,

We must first define our goal. Is the stock a long-term hold? Are we looking to avoid exercise that will lead to negative tax consequences? Are we looking to generate income by selling options and having our portfolios constantly changing to avoid greater risk?

If it’s a long-term hold, there will be more positive than negative surprises because companies have been muting guidance over the past several years. Protective puts may help us sleep better at night and, in these cases, would be appropriate. In return, our long-term returns will be lower.

Stock repair implies that we would be okay selling the stock and so I would question why be in the position to begin with as it relates to known upcoming earnings report dates? Let the report pass and then re-enter when the risk is lower.

Bottom line: To avoid risk at no cost, do not own the stock prior to the report. For long-term holdings, buy a put for those with a low personal risk-tolerance. Nothing wrong with this but, depending on the number of holdings, it could become expensive. The stock repair strategy has more application for stock-only portfolios but can also be used with option accounts as highlighted in this article.

Alan

Everyone,

I came up with a harebrained idea over the weekend. That’s not necessarily unusual but this one may be.

I decided I would execute a John Templeton like strategy. Since most earnings reports exceed expectations, the very reason we don’t hold short options during earnings reports, I decided to take long positions on all the Gold Bold equities on the Running list of 04/26/19 and let the results speak for themselves . The long positions would be at the money (ATM).

Of the twelve issues four either had excessive bid ask spreads or were excessively priced. Two of the four went up tremendously today TTD and CYBR. Both, in hindsight, would have been excellent purchases today. But I ruled them out early this morning. May add them tomorrow. One was really a duplicate issue, DISCA and DISCK . Both were a different class stock of Discovery Inc., formerly Discovery Communications. I chose DISCK as it turned out today the wrong one.

So I ended up with seven stocks. I decided to go with equal weight investments as MA would have really skewed capitalization weight. I went with roughly $500.00 per issue. All had May 17 expirations except for AKAM which had May 03.

Sometimes I get a wild hair like this and try something weird. Sometimes I just need to get it out of my system I guess.

The seven stocks chosen were AKAM, MA, VICI, DISCK, FND, FTNT and ESNT. The four not chosen were CYBR, TTD, EPAM and PAYC. PAYC earnings are for 4/30 so it will not be added. There is still time for the other three.

Invested today including commissions and fees $3,296.25.

I will let you know how it ends.

Hoyt

Good luck Hoyt!

I am interested in how it turns out.

Best;

Terry

Alan,

Since I started with BCI, I’ve become obsessed with watching CNBC. As I’m watching this morning I’m wondering if there’s any way we can take advantage of fair value and futures information. For example, S&P futures shows +8.25 and fair value shows -0.77. Can we use this information to our benefit?

Thanks,

Marsha

Hi Marsha,

I know this observation and question was directed to Alan and I certainly am not answering for him.

I, too, used to be obsessed with CNBC. I finally weaned myself off and it has added immensely to my life. I am talking about 20+ with being obsessed and about two years off. I now usually watch the last hour only just to get a fill for how the markets acts in the last hour.

Just remember that their(CNBC) biggest task is too fill airtime. I have seen the “regulars” over time and many of them do it for the exposure to the retail investing public. Their good calls are often referred to by the hosts but their bad calls are never mentioned because they would then not return as guests. The producers at CNBC are well seasoned and experienced and do a great job.

As to being able to use “fair value” and futures to our benefit, the answer is no and yes. I intentionally used no and yes rather than yes and no.

First off as you know the the difference between “fair value’ and the futures number is to indicate where the market will open. It’s not an exact science. We retail investors can very rarely use this info as options are not traded prior to the open or even up to three minutes after the market opens. Many stocks are traded before the open but the volume is very low(usually) and the spreads are very wide(almost always). We can use this info to focus our attention as to what to look for when the market opens.

On the other hand very sophisticated investors can use this info for arbitrage. Arbitrage is the buying of a security in one market and selling it in another market at the same time.

We have also seen times when the futures suggested large losses only to see the market turn around very quickly and we have seen the exact opposite.

In short, when futures are positive I feel good. When they are negative I feel bad. Losing money in the market feels worse than making money feels good.:)

My advice is too remain disciplined in the BCI methodology.

Good Luck,

Hoyt

Marsha,

Outstanding response from Hoyt.

Early morning and late afternoon trading can oftentimes be volatile as sophisticated traders with high-speed trading capability look to take advantage of these arbitrage opportunities and position themselves for market-close. Retail investors like us should avoid entering positions during these hours to avoid the potential volatility so share purchase and option sale will not move against us. I enter the bulk of my trades between 11 AM ET and 3 PM ET for this reason. Exit strategy opportunities can be executed at any time.

Alan

Trading Experiences 5/1 XBI Week 2/4

Just filled 32% Rule BTC on 2 accounts at 0.6999 with XBI at 84.48. Strong support there. Tried for 30%. STO was at 2.1835 on 4/20. Take it while I can get it.

Set open orders for 2.14 Strike 88.

Mario

Premium members:

This week’s 8-page report of top-performing ETFs and analysis of ALL Select Sector Components has been uploaded to your premium site. The report also lists Top-performing ETFs with Weekly options as well as the implied volatility of all eligible candidates.

New members check out the video user guide located above the recent reports.

For your convenience, here is the link to login to the premium site:

https://www.thebluecollarinvestor.com/member/login.php

NOT A PREMIUM MEMBER? Check out this link:

https://www.thebluecollarinvestor.com/membership.shtml

Alan and the BCI team

FREE WEBINAR

Next Wednesday, May 8th, I will be hosting a webinar for The Options Industry Council (OIC) from 4:30 PM ET – 5:30 PM ET:

Portfolio Overwriting:

Increasing Profits in Your Buy-And-Hold Portfolios Using Covered Call Writing

Those who register will also have access to the webinar after the live event. Register for free here:

https://www.optionseducation.org/events/a000w00000sx46mqaq

Alan and the BCI team

Hi everyone:

My name is Gonzalo and I am a Premium Member.

I have some experience trading others options estrategies (Iron Condors and Butterflies), but I am newer in Covered Call.

Two days ago I bought 200 shares of Pfizer and after earnings I sold 2 Call 17MAY ATM @40.50 for 0.49.

The following day I thought that I made a mistake as Pfizer is going to pay a dividend shortly (ex-dividend date 09th of May). Tell me if I am mistaken if I think that the most likely I will be assigned before the ex-dividend date, as the sold call is slightly ITM and the dividend is 0.36$, and before the 9th of May the extrinsic value will be less.

What do you think? Should I roll up as soon as possible?

Gonzalo,

Although early exercise is rare, you have described some of the parameters that make it more likely. Whether we take action depends on if we want to retain the shares. If yes, the option should be bought back and resold on the ex-date. If we are not committed to the stock in the long-term, no action is needed. If the option is exercised and the shares sold, we will have maximized our position returns and have the cash back to re-invest and begin a second income stream.

Alan

Hey Alan,

Hope all is well. Wondered what your thoughts and experience has been with “Sell in May and go away”.

Any thoughts would be great!

Mark

Mark,

I do not subscribe to this concept. I am almost always fully invested. Rare exceptions included the 2016 election (moved to 100% cash), Brexit (50% cash) and September 2008 through March 2009 (100% cash).

Even when there are bearish market conditions there are always sectors and industries that are performing well. It is our mission to find those best-performers and continue to generate cash flow. Of course, we always have our position management arsenal to act if trades turn against us.

Alan

Hoyt,

In a post above you mentioned “Hair Brained Ideas” :). I am full of them! So I thought you might get a kick out of this one:

I have made a sub hobby of trading Fed Day using SPY options that expire that day. I do it every 6 weeks. It’s pure gambling. I have to be right THAT DAY or I lose most of the tiny wagers I make. But It saves me the short drive into my city (New Orleans) to go to Harrah’s!

Yesterday was a head spinner. Going into the announcement 98% of people expected no action on rates. But I saw VIX sneaking up with SPY late morning so I bought a few ITM SPY puts and got stopped out within minutes of the announcement for a 50% loss as the SPY took off and non intrinsic option value evaporated.

Anyway, I have seen those pops before. So I bought another round of puts also expiring yesterday. Well, helpful for my trade, the market tanked and puts went up exponentially by the close for a lucky afternoon in a tiny risk sub hobby I enjoy.

Disclaimer: neither Alan or Barry approved or endorsed this :)!

I know many traders do similar things betting earnings on stocks. I don’t follow any closely enough to try that.- Jay

Jay,

You old rascal!

I have been a long time believer that if one were a master of a “task” one’s brain recognized “patterns” either faster than one could think, or even when one doesn’t think. Brains “see” a pattern, compares it to all similar patterns of the past, analyzes past actions and results on those actions and generates sometimes a “suggestion” and sometimes send “orders” to body parts without any effort on your part. Ducking when hearing a shot fired is one example.

As an aside, my mother who is 98, has dementia. Marie and I have cared for her in our home for 15 years. With her brain in its now state she no longer reacts to external stimuli.

When I sailed many times the hair on the back of my neck would “tingle” and I would find myself adjusting the rudder or my sails before I realized I was doing it.

You seem the have acquired, through years of application, this ability to “read” the VIX, compare to previous events and make fairly accurate predictions as to how the SPY is going to act.

As I feel I am in the presence of greatness with Alan and Barry in the arena of Covered Call Writing, I also feel in the presence of greatness in the arena of VIX SPY correlation. Your trading experiences are illuminating even though I would never “attempt this at home”.:)

Do you stream the VIX on what used to be OptionsHouse?

Thanks again for sharing,

Hoyt

Thanks for the kind comments and insights Hoyt.

No greatness at this end but when on my Options House platform I do watch VIX, the indexes, crude oil, gold and treasuries and look for correlations when doing real short term or day trades. Not that relevant for investments and monthly option selling but helpful for trades. – Jay

Alan,

I’m a new subscriber. Thank you for all the work you’ve put in to making your system available to us. Regarding my portfolio, I have about 20k to start investing with. How do you recommend allocating positions with a smaller account like this?

Thanks,

David

David,

Have a look at exchange-traded funds as underlyings. They offer instant diversification and require less total positions and cash than when using stocks as our underlyings. I use these in my mother’s portfolio. Here is a link to an article I published on this topic:

https://www.thebluecollarinvestor.com/exchange-traded-funds-funding-option-selling-portfolios-with-etfs/

Alan