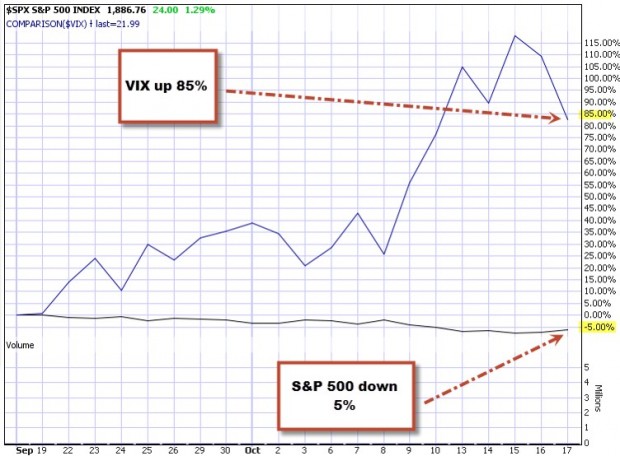

With the stock market declining over 5% in the past month as a result of geo-political and global concerns exacerbated by the fears of an Ebola epidemic we find ourselves in a position that may lead to “panic” in our investment decisions. The stock market seemed to stabilize a bit on Friday but we are not out of the woods yet based on just that one day. Whether you are an experienced investor who has “been there, done that” or a newbie who is experiencing this discomfort for the first time, patience and non-emotional responses are the most prudent. In this article I will highlight strategies to manage existing positions in these extreme circumstances and strategies to initiate new positions for those who want to “stay in the game”. Much of the information has been taken from my books and DVD Programs as well as articles I have published in the past.

Managing existing positions

1- We always buy back the option when it approaches our 20%/10% guidelines (declines in value to 20% or 10% of initial sale value depending on when in the contract cycle that decline takes place). This frees us up to sell another option or to close our long stock position.

2- When market tone is negative (which it currently is) and equity technicals are also negative, we sell the stock. Many investors will also use a percentage price decline to dictate when to sell a stock. This percentage will usually range between 8% to 10% of the initial stock purchase price. Once sold, a personal decision needs to be made as to whether you want to “stay in the game” and enter a new position. See below for some strategies to consider. Many investors are more comfortable staying in cash until a firm bottom is identified.

3- Rolling Down:

Rolling down occurs when we buy back a previously sold option (buy-to-close our short position) and simultaneously sell another option at a lower strike price in the same contract month (open a new short position).

We lean towards implementing a rolling down strategy when the market tone and technicals are mixed to negative. I would also be more inclined to use this strategy later, rather than earlier, in the contract period (late in week 2 and week 3, rather than week 1of a 1-month contract).

Entering new positions- staying in the game

For those who have a higher risk tolerance and want to remain in the market, it is prudent to implement strategies that are appropriate for current market conditions, especially extreme ones like we are experiencing now. Selling out-of-the-money strikes may work out but it makes little sense to take an aggressive stance until the market tone improves and stabilizes. Here are a few strategies that will allow us to generate an initial profit and provide us with some protection of that profit:

1- Sell only in-the-money strikes:

If we buy 100 shares of XYZ for $32 and sell a $30 call for $3.50, we have sold an in-the-money call option because the strike price of the call option ($30) is lower than current price of XYZ ($32). The sale of this call option obligates us to sell 100 shares of XYZ for $30/share (or $3,000 in total) if the option is exercised. Should XYZ increase in price from $32 to $40, we make no additional income due to our obligation to sell our shares @ $30. The option premium we receive from the sale of this option has $2 of intrinsic value ($32 – $30). The remainder of the option premium is solely time value, which represents our true initial profit (ROO). Thus, if we received $3.50 in total option premium from the sale of the $30 call option, the $3.50 premium we receive consists of $2 of intrinsic value and $1.50 ($3.50-$2) of time value. Because our true profit is represented by time value only, in this example we generated an option profit of $1.50/share or $150 per contract, which represents a 5% ROO (the $2 intrinsic value “buys down” our cost basis to $30) per share). The protection of that 5% initial profit is the intrinsic value divided by the current market value or $2/$32 = 6.25%

2- Buy protective puts- the collar strategy:

As safe a strategy as covered call writing is there is some risk; the risk is in purchasing the stock, not in selling the option. For this reason, some investors who sell covered calls also buy protective puts to alleviate some of the risk. A protective put is a put option that is purchased for an underlying stock that is already owned by the put buyer. It defends against a decrease in the share price of the underlying security. When a protective put is used in conjunction with covered call writing, the strategy is referred to as a collar strategy. A collar is the simultaneous purchase of a protective put option and the sale of a covered call option. In a true collar strategy, the puts and calls are both out-of-the-money and have the same expiration dates and an equal number of contracts. Thus, we sell an out-of-the-money call and add additional downside protection for the underlying equity by purchasing a protective put option. This strategy protects against catastrophic share devaluation but also decreases our initial option profits.

3- Sell out-of-the money cash-secured puts:

With this strategy we are selling the right, but not the obligation, for the buyer of the put to sell a stock to us at a specified price, by a specified date. In return for undertaking this obligation, we also receive a premium. For example, a stock is trading at $32 per share and we sell a $30 out-of-the-money put for $1.50, receiving a return of $150 per contract. The returns in these scenarios are generally similar to the returns of generated from selling covered calls, and if the put is exercised, we are required to buy the stock for $30, meaning we purchase the shares at a cost basis of $28.50 ($30 less the $1.50 premium). Some investors consider this “buying at a discount” from the original $32 share price. We can then write a covered call on the newly-acquired shares.

4- Use inverse ETFs:

Inverse ETFs use derivatives to bet against the direction of financial markets. These are known as short or bear ETFs and will make money if markets decline in value. They will lose money, however, if markets move against the bet. Covered call writers who have a bearish market outlook may find these funds useful.

Many sophisticated covered call writers can benefit from the use of inverse ETFs in the short run when the market is bearish.

Inverse ETFs with options to consider:

- PSQ: short QQQ

- DOG: short Dow 30

- SH: short S&P 500

- RWM: short Russell 2000

Summary:

What is transpiring now is an aberration. Market forces are being torn between both positive local economic news and negative geo-political and global economic influences. This will pass because it always does. The greatest error we can make is to act emotionally without employing the critical investment parameters that will make us all succeed in the long run…fundamental, technical and common sense principles. In challenging times there may not be great choices to make but there will ALWAYS be the best choices to make under the circumstances. Finding these and implementing the most sensible strategies are some of the prime mission statements of Blue Collar Investors all over the world. The purpose of this article was to summarize and highlight these doctrines.

***Premium members: A more detailed version of this report is located in the “resources/downloads” section of the premium site and look for an updated version as well in the next few days.

Next live seminar:

Monday, October 27, 2014

Austin, Texas

Market tone:

Despite a nice market rebound on Friday, fears of a global slowdown rocked the stock market this past week. Additional concerns regarding a possible Ebola pandemic and global conflicts are making investors extremely nervous and pessimistic. However, our US economy continues to roll on the road to expansion:

- The Federal Reserve’s Beige Book stated that the US economy grew at a “modest to moderate” pace from mid-August through September

- Labor markets also showed continued improvement

- Business inventories rose by 0.2% in august, below expectations

- Initial jobless claims for the week ending October 11th came in at 264,000, well below the 290,000 predicted

- Industrial production rose by 1.0% in September, the largest increase since November, 2012 and exceeding expectations

- Industrial production rose by 4.3% year-over-year

- Retail sales in September fell by 0.3%, the first decline since January when weather was a major influence

- The Producer Price Index (PPI), a leading indicator of inflation, dropped by 0.1% in September, mainly due to a decline in food and energy prices

- US housing starts were up a robust 6.3% in September to an annual pace of 1.0 million units. The number of building permits also rose

For the week, the S&P 500 declined by 1% for a year-to-date return of 3.7%, including dividends.

Summary

IBD: Market in correction

GMI: 0/6- Sell signal since market close on September 26th (http://wishingwealthblog.com)

BCI: Cautiously bullish but favoring in-the-money strikes until the market volatility subsides and an evaluation can be made from the current earnings season. Here is a look at the S&P 500 and the VIX (market volatility) during the past one month:

My best to all,

Alan ([email protected])

www.thebluecollarinvestor.com

Premium Members,

This week’s Weekly Stock Screen And Watch List has been uploaded to The Blue Collar Investor premium member site and is available for download in the “Reports” section. Look for the report dated 10-17-14.

Also, be sure to check out the latest BCI Training Videos and “Ask Alan” segments. You can view them at The Blue Collar YouTube Channel. For your convenience, the link to the BCI YouTube Channel is:

http://www.youtube.com/user/BlueCollarInvestor

Since we are in Earnings Season, be sure to read Alan’s article, “Constructing Your Covered Call Portfolio During Earnings Season”. You can access it at:

https://www.thebluecollarinvestor.com/constructing-your-covered-call-portfolio-during-earnings-season/

Best,

Barry and The BCI Team

Hi Alan,

I really appreciate your last post! In keeping with that I was looking at the looking at HAWK as a potential candidate for an ITM covered call. This morning I thought I’d try a little analysis on my own and came across TSM on the IBD 50 list. It’s a bit cheaper than HAWK so I could buy more shares. TSM’s technicals look good (I think) and it seems to be trending up. It’s beta is higher than HAWK so that’s a negative in this market. With the potential upside of TSM would I be better off going with an OTM strike on TSM or an ITM strike with HAWK given current market conditions. My instinct is to go with an ITM on HAWK based on the market, but I wanted to see what you and others think. Thanks!

Dennis,

I cannot give specific financial advice in this venue but I can tell you that I base my strike selection on 3 factors:

personal risk tolerance

chart technicals

overall market assessment

If I am on the fence (that’s rare), I will split up ITM and OTM strikes (2 and 2 for example) or favor ITM strikes, the more conservative approach.

Alan

Thanks Alan. Didn’t mean to put you on the spot. I was really only speaking hypothetically as I try and learn the system, still not ready to dive in head first yet! I appreciate the insight.

Hi Alan,

With the Collar strategy, is the stock automatically sold for you by your broker if the stock price at expiration is below your protective Put, or do you need to inform the broker to do so? Also are you better buying the “package” or separately in order to negotiate better prices for the Call and Put?

Thanks, regards,

Martin

Martin,

The manner in which put exercise is managed is broker-specific and depends on a myriad of factors. Check with your broker before entering into a protective put position.

Hate to be repetitive but the answer to your 2nd question is also broker specific. The good news is that you can get both answers with one call!

My personal preference is 2 trades rather than the package (with my broker). This allows me to leverage the “Show or Fill” rule I have written about. The “package” may be more advantageous with other brokers.

Alan

Hi Alan,

I am starting paper trading shortly and do not have enough experience yet to correlate stock price changes with their corresponding option price changes. My thought however is that given the low delta of OTM calls, the underlying may need to drop very sharply and uncomfortably so before the option price reaches the 20% buyback level. Might one decide to use a higher buy-to-close level instead if one is risk averse?

Thanks for your suggestion and

all the best

Frank

Frank,

Great question and I will respond in 2 parts:

1- OTM strikes do have a lower delta than ITM strikes but the cash generated is much less. Let’s say we recived $3 for an ITM strike and $1 for an OTM strike. To reach the 20% threshold the OTM strike would have to drop in value by $0.80 and the ITM strike by $2.40. Although it not not an exact science, it is universally applicable.

2- The reason I call this a “guideline” is to encourage members to adjust the model I use to their specific needs. i tried every combination over the years and the 20/10% guidelines work best for me. These stats are not etched in stone. I may close @ 25% or 22%…it’s a guideline not a rule (like the one about earnings reports…definitely a rule).

I commend you for taking your time and paper-trading.

Alan

ALAN,

I HAVE BEEN REFERRING EVERYBODY TO YOUR SITE AS I LOVE DOING OPTIONS AND NOW ALSO SELL CASH COVERED PUTS CALLS IN ADDITION TO SELLING CALLS.

I HAVE BEEN UP ABOUT 10% ON MY $20,000 BUT I HAVE A QUESTION.

PRESENTLY IN PANDORA LONG AT $25.78 AND IN THE LAST TWO WEEKS I MADE $300 ON CALLS BUT THE STOCK IS DEPRESSED TO ABOUT $22.

NOT GOING TO PANIC BUT HOW ABOUT A LONG TERM CALL OPTION? I NOTICED THE OPEN INTEREST IN DEC OR JAN ON A $26.00 OPTION IS QUITE LARGE. IS THIS BECAUSE THERE IS A BELIEF THE STOCK WILL COME BACK OR DOES IT MEAN NOTHING IN ANALYZING THE STOCKS FUTURE WORTH?

THANKS IN ADVANCE

MARK

Mark,

You ask 2 important questions:

1- I don’t like long-term options because the annualized rate of return will always be lower than short-term options even though you will receive more premium initially. It will appear as a quick fix from a cosmetic, not a practical standpoint, in addition to having a long-term position on a disappointing investment. It also obligates you to hold your position through earnings reports.

2- High open interest does not necessarily mean investors are anticipating a price increase. For every buyer of a call option, there’s a seller. It means that investors are betting on a price change and perhaps on some event in the future. If OI is extremely high, it pays to check the news:

http://www.finviz.com

is a reliable free site for stock news. You will see high OI prior to an earninmgs report with investors betting both ways. Same prior to an FDA ruling on a new drug…

It’s important to remain loyal to a structutred strategy whether you are in a winning or losing position.

Alan

Premium Members,

As you have seen in the Weekly Report over the weekend, we are now in “Earnings Season”. Please note that 6 companies on our list report this week, you you will have additional stocks to choose from as the week goes by.

Best,

Barry and The Blue Collar Investor Team.

Hi Alan,

I’ve purchased two of you books (The Encyclopedia and the Exit Strategies).

I have been trying to wrap my head around your strategies when writing In-the-money calls.

Here are some concerns:

1. We can get exercised immediately because they are American Options.

2. If we get exercised at anytime during the contract period, we lose the stock.

3. If the premium we’ve received from the call is less than the amount we’ve lost due to the ITM strike then we’ve lost money from the trade and we no longer have the stock for the next month’s contract period.

The only way ITM strikes seem to make sense is if the equity price falls and our option then becomes OTM. We keep the stock and the premium and we can write another call next month.

I’ve read and reread your explanation and looked at the math. The premium in ITM strikes will protect the time value, but that doesn’t make up for the loss in the equity once we are exercised.

What am I not understanding?

Thanks,

Greg

Greg,

I had the same problem understanding ITM strikes when I started teaching myself this strategy over two decades ago. Once you grasp the concepts (and you will) it will put cash in your pocket. Let’s breakdown your comments:

1- You will not get exercised immediately (barring a dividend distribution issue) because the option holder will make more money selling the option rather than exercising it. 99.9% of the time the option will only be exercised the day after expiration Friday and you can avoid that by buying back the option if you choose to.

2- If you allow exercise or even if the option is exercised early (very, very rare) you are not losing the stock…you are selling it at the price you agreed to when you sold the option.

3- The premium received from the sale of the ITM option will always be greater than the amount lost from the stock sale for 2 reasons. First, you wouldn’t have made the trade if there was no time value component to the option and second, almost all options do have a time value component (exceptions are those that are deep, deep ITM). So if a stock is trading @ $32 and you sell the $30 ITM call for $3, you lose $2 on the stock sale (if exercised) and generate $1 time value for a 3.3%, 1-month return.

Keep studying the option chains and use the “multiple tab” of the Ellman Calculator for these ITM strikes and before you know it, the light bulb will turn on.

Alan

Hi Mr Ellman,

My name is Anh and I am a beginner in Covered Call stock trading. In fact, I am attending some paid classes on stock option trading. It has confused me so bad that I have to do my own research on the web.

That is when I bumped into your videos on Youtube about Covered Call Writing – beginner course. That wonderful video series has cleared up almost all of my confusion. I say 95% of questions in my head have been answered through your clear explanations from fundamental terminologies through strategies with needed examples every step of the way.

The only confusion I have left from your video is that you

said the option profit is highest at the money(ATM) or near the money. I thought the premiums are lowest along those lines.

Please clarify this if you have a chance.

Thank you very much for your generosity in sharing your knowledge.

This is the best video on CC writing I’ve seen on the web.

Please keep up the good work.

Regards,

Anh

Anh,

Thank you for your very generous remarks…much appreciated.

ATM strikes will generate the highest time value (actual profit) of all the strikes…100% of the time. ITM strikes will generate the highest premiums but you must deduct the intrinsic value component on the premium to calculate your real initial profit otherwise you will be exagerrating your returns. Each strike offers pros and cons. Use the multiple tab of the Ellman Calculator to break this down before making your investment decisions.

Alan

Premium Members:

This week’s Weekly Stock Screen And Watch List has been revised and uploaded to The Blue Collar Investor premium member site and is available in the “Reports” section. IBD has published corrected Beta statistics and these have been incorporated into the revised Weekly Report as discussed in my email sent out on Saturday.

Look for the report dated 10-17-14-RevA.

Best,

Barry and the BCI Team

Premium members:

This week’s 8-page report of top-performing ETFs and analysis of ALL Select Sector Components has been uploaded to your premium site. The report also lists Top-performing ETFs with Weekly options as well as the implied volatility of all eligible candidates.

For your convenience, here is the link to login to the premium site:

https://www.thebluecollarinvestor.com/member/login.php

NOT A PREMIUM MEMBER? Check out this link:

https://www.thebluecollarinvestor.com/membership.shtml

Alan and the BCI team