Wait a minute! What if I buy a call option instead of the stock and then sell a call option on that option? I’ll be spending less money than outright purchase of the equity and still generate cash from the sale of the call option! This idea has come to many of you and as a result of your inquiries, this article had to be written. Although not a true covered call write, purchasing a long-term option (more than one year out), called LEAPS, and then selling call options against that position, is an alternate strategy similar to CC writing. Technically, these trades are known as calendar spreads so perhaps we should start off with some definitions:

LEAPS– Long-Term Equity Anticipation Securities. These are option contracts with expiration dates longer than one year. Not all stocks and ETFs have these type of options associated with them.

Calendar Spread– Simultaneously establishing long and short options positions on the same underlying stock with different expiration dates. For example, you buy the December, 2010 $20 call and sell the April, 2010 $20 call on the same equity.

Horizontal Spread– A spread where both options have the same strike price as in the above example but different expiration dates. The terms calendar and horizontal spreads are interchangeable.

Diagonal Spread– A long and short options position with different expirations AND strikes. For example, you buy the December $20, 2010 call and sell the April, 2010 $25 call.

Concept behind this strategy:

The investor establishes the long option position by purchasing (usually) I-T-M LEAPS and then selling a near-term, slightly O-T-M call, the short position. Trades are constructed such that, if assigned, the difference between the spread ($5 in the above case where the $20 call was bought and the $25 call was sold) + the short premium collected, exceeds the cost of the long option. If unassigned, where the price of the stock does not exceed the strike price of the short call, we then continue to write calls and generate a monthly cash flow. The problem in this second scenario is that if the stock price falls, the premiums generated from the short call drops unless we write for a lower strike, which may result in a loss for this long-term strategy as the spread (difference between the two strikes) declines.

Let’s take a look at the options chain for a highly traded equity, INTC:

The January, 2012 $10 strike is purchased for $10.60, $10.43 of which is intrinsic value and only $0.17 is time value. Minimal time value is a characteristic of deep I-T-M LEAPS options.

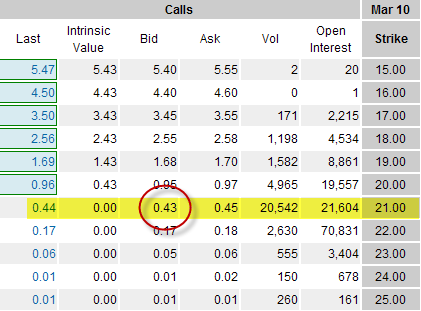

Next let’s check the near-term, slightly O-T-M strikes:

The next month, $21, slightly O-T-M strike can be sold for $0.43.

Let’s do the math, if assigned:

We collect the difference in the spread ($21 – $10 = $11) + the short option premium = $0.43 for a total of $11.43. We deduct the cost of the long call ($10.60) for a profit of $0.83 per share or $83 per contract. The percentage return is $83/$1060 or 7.8%. All calendar spreads are constructed such that there is a profit if assigned.

If the shares are not assigned (price of stock NOT greater than the strike of the short call ($21), our profit is $43/$1060 = 4.1% and we’re free to sell another option. As noted above, this works well as long as the share price does not dramatically decline thereby reducing the returns on the short options. We also must bear in mind that the long call (LEAPS) is a decaying asset and there will become a time when we no longer own the right to purchase INTC at the $10 strike (when the option period expires). If we continue to generate monthly returns of $43, how long will it take us to retrieve the $1060, if never assigned? Here’s the math:

$1060/$43 = 24 months, not counting any difference in the spread.

Our option is good for about 22 months, so if the option ultimately expires worthless and the spread has decreased, we lose! Diagonal spreads work best for rising stocks where we can take advantage of the difference in the original strike prices.

Advantages of using LEAPS:

- Less costly than purchasing stock; remaining cash can be used to generate additional cash

- A declining stock will have time to recover

- Low time value of deep I-T-M LEAPS make option ownership similar to stock ownership where intrinsic value changes dollar-for-dollar.

Disadvantages of using LEAPS:

You do NOT capture stock dividends

- To stay active, you must sell options in cycles that report earnings, taking on additional risk

- LEAPS have a delta of approximately .50 to .60 making it difficult to close a position at a profit for A-T-M and O-T-M strikes (option value has not moved up in step with share value). This is less of a factor for I-T-M LEAPS.

- A higher level of approval will be required by most brokerages to allow this type of trading

- The long calls will ultimately expire, stocks will not

- Forced assignment may not allow for a profitable trade

Conclusion:

Purchasing LEAPS and selling a call option on that position is NOT a true covered call write. It is an alternate strategy that has its pros and cons. For most Blue Collar Investors, covered call writing is the better path to take. But to some investors who fully understand the nuances of diagonal spreads, this may be a viable alternative.

Sleeping with the PIIGS?

An unflattering acronym!

On many financial programs recently we have heard experts discussing whether companies had exposure to the “PIIGS”. Is this a misspelling of a bad joke? Actually it isn’t. PIIGS is an unflattering acronym for the Eurozone countries of southern Europe known for similar economic environments, high spending, large public sector workforces and high debt:

- Portugal

- Italy

- Ireland

- Greece

- Spain

Since these nations use the euro as their currency, they cannot use independent monetary policy to counteract the economic downturn. Europe isn’t thrilled with the term “PIIGS” so Jamie Dimon, J.P Morgan CEO made matters worse by referencing these countries as the “GIPSI” nations (not sure who should be upset here). Is there not a voice of reason out there? How about Citigroup officials who recently called these the GIIPS countries? That may work but then we need a board meeting to decide if the first letter has a soft “J” or a hard “G” sound. Anyway, exposure to these countries is a negative for a corporation and that is why this discussion has become so prevalent.

Market tone:

With the European debt crisis, our debt ceiling issues, our politicians appearing to get crazier every day and earnings season upon us, we continue our bumpy ride in the stock market. This week’s economic reports leaned to the negative with some calming news regarding inflation:

- US retail sales increased by 0.1% in June, better than anticipated

- Industrial production also increased by 0.1% but that was less than expected

- The trade deficit widened in May to $50.2 billion the highest since October, 2008 and well above analysts’ expectations

- Business inventories rose 1% reflecting a soft economy

- The Producer Price Index (PPI) fell 0.4% in June after rising for 12 straight months and the Consumer Price Index (CPI) also declined for the first time in a year. These stats allayed fears of inflation

For the week, the S&P 500 was down 2.1% for a year-to-date return of 5.7% including dividends.

For the past year this site has been bullish on the market but in times of volatility selling in-the-money strikes to garner additional protection. A 1-year, longer-term chart explains my bullish position:

1-year chart of the S&P 500 vs. the VIX

This chart clearly reflects a calming VIX and an ascending S&P 500, the market benchmark.

However, a look at the shorter term, 3-month chart highlights the market benchmark in a trading range (relatively flat) and the VIX in a volatile yet ascending pattern:

3-month chart of the S&P 500 vs. the VIX

So we have a longer term bullish picture with a shorter-term riskier pattern.

Summary:

IBD: Uptrend under pressure

BCI: Cautiously bullish, expecting another positive earnings season and selling predominantly in-the-money strikes.

The best in investing to all,

Alan ([email protected])

Alan,

Is there a list on your site for stocks that have LEAPS? Are there a lot of choices?

Thank you for all you do.

Karen

A hidden disadvantage of LEAPS is that it gives you the temptation to over-leverage yourself. The returns are so sexy, and the risk seems so manageable, that you can easily get in over your head. This is what happened to me:

When Google was trading around $620, I bought deep ITM LEAPS at a strike of $550. I could leverage the fat call premiums with an equity investment of only $80. How could I lose? GOOG is considered one of the premier tech companies and although I expected that the stock could very well dip below $580, I never expected the blood bath than ensued.

GOOG went steadily down to below $580, but then started a comeback. I held onto the LEAP, and even took advantage of the really fat call premiums before the earnings report in March.

GOOG then gapped down to $540 and eventually dipped below $520 before it started to recover. I now had NEGATIVE EQUITY in my LEAPS, and couldn’t write a call for less than $550. My GOOG position was essentually wiped out, and I had no means to generate any income stream. For those of you who haven’t experienced it, waking up in the morning and seeing your position wiped out by an overnight gap-down is a sickening feeling that is difficult to describe.

Because the LEAP only cost me about $80, I was highly leveraged. For the percentage position I had in GOOG, I could only support holding 100 of the real shares. But, I could buy 5 LEAP contracts and essentially control 500 shares.

If I had held the GOOG shares, I most likely would have hung in through these dark times. I had faith in the company. But, I had to get out of my LEAP position for whatever I could in order to salvage some equity and start generating some sort of meager income stream.

In a nutshell, I got taken in with the sexy, seemingly easy money and over-leveraged myself.

It was bad enough I had a percentage of my portfolio in GOOG. I also had a percentage in APPL, and the lastest downturn from $350 to $310 was almost as painful.

Just one man’s experience.

Karen (#1),

There is an 18-page file in the “resources/downloads” section of the premium site with such a list. Although the percentage of securities with LEAPS is small the number is growing as the demand for option-related products is groing exponentially.

Alan

I bought some SLB ITM about six months out in a qualified account and decided to sell diagonals. At one point I had a big gain on the options, but decided to continue to sell diagonals. SLB dropped quite a bit and I lost the gain in the options but got most of it back selling the calls. Should have taken my profit at the time. As above just one man’s experience.

Any comments on the up coming potential disaster if they don’t renew the federal loans? Should we sit out and wait to see what happens – I don’t trust congress to act in our best interest.

Larry–excellent post, and I’ve felt your pain (but I was dealing in T-Bond futures at the time…).

Leverage is so very important to keep in the forefront of your mind AT ALL TIMES when dealing in options and futures. And if you’re buying/selling using margin in conjunction with leveraged instruments….oh boy it can be so good when it’s good, but you sure can wake up to find that you’re wiped out!

Anyway, my original reason for coming to the comment section was simply to say this: Alan, I believe you already wrote this post a year or two ago…in fact, I’m positive you did! Not that it doesn’t deserve a re-read…

Paco

Frank & Larry,

First Larry…been there and have the T-shirt…very expensive tuition payment…but that’s the way I can “retrospectively rationalize” my early trading blunders. Since becoming a BCI, i haven’t had those kind of big losses ever again. Occasionally have some small losses…but overall positive expectancy.

As for the situation in DC, my plan is either to sit on the sidelines or do DITM calls with low beta stocks…if I can find decent returns. I’ll be spending a lot of time with Alan’s calculator.

Best,

Barry

Paco (#6),

Absolutely. I will update and re-publish articles that are one or more years old based on the needs and requests of our members. We are so fortunate to have such a constant flow of new members as well as our base of long term (and much-appreciated) membership. I receive dozens of emails each week requesting information on various topics and I will oftentimes base my decision on which topic to publish based on those emails. The BCI team makes every effort to respond to the inquiries of our membership and the feedback from our longer-term members has been all positive. As a matter of fact I find it an attribute to my own investing to re-write and re-read an article I published more than a year ago. Based on your final comment I am pleased to see that you do as well.

Alan

Premium Members,

The Weekly Report has been uploaded the the Premium Member site.

Best,

Barry

regarding ditm calls in leiu of a stock position, i too have used this approach, having been lure in by the increased return possibilities.

i generally used ditm calls with a delta on 0.90 or greater. this generally allows one to establish a 100sh equivalent position for about 1/2 to 1/4 the cost of stock. (not all leaps will have strikes lkow enough to get the delta that high)

in my accounting of my positions i watch both the value of my investments (say 30% options and 70%cash) and the market value of the underlying positions i control. if i were to go 100% options with ditm calls, i could control 3-4 times the stock that i could outright purchase. the result is that a 25-33% stock market decline would totally wipe me out. i don;t like that idea.

using stop losses can be problematic, as i’ve seen the stock for which i’ve had stops in place open down a buck or two, just enough to trigger the stop loss, then pop back up that buck or two. this locks in my loss. ouch.

Mike (#10),

In my comment #7, I mis-stated what I would do in this environment, re: Debt Ceiling issue. I meant to say would do DITM covered calls, not DITM calls.

On the subject of using DITM calls by themselves as a stock substitution strategy, I sue them frequently for stocks with very well defined uptrends. I use them with a delta of .8 or better and after legging in, I place a trailing stop. The size of the stop depends on the particular stock and how volatile it is. However, a put would be more of a guarantee of protection to the downside.

Best,

Barry

Not sure if this is an inconsistency on the premium report, but I see both dllr and dltr. Are both supposed to be on the list or just dltr?

Alan,

Any update when your new book will be available? Looking forward to it.

Fran

Patricia (#12),

BOTH stocks were screened. DLTR because it was #25 on the IBD 50 and DLLR because it passed our screens the previous week and is part of the BCI database of thousands of stocks. DLTR was eliminated from consideration because it reports same store monthly retail sales (a “banned” stock) and DLLR is an eligible stock.

Alan

Fran (#13),

The book is at the publisher for formatting and cover production. It should be available no later than September. I will send out emails to all those on my mailing lists when I receive the first shipment of “author copies”. Thanks for asking.

Alan

EBAY:

A stock currently on our premium watch list in early May reported an outstanding earnings report with revenues up 16% and registered PayPal accounts up 16% as well. There is also a bullish 17% growth projection for next year. As a result the share price is near a multi-year high. Despite the strong price appreciation EBAY trades at a reasonable PEG ratio of 1.15. Our premium watch list shows an industry rank of “A” and a beta of 1.22. Check to see if this equity deserves a spot on your watch list.

Alan

Alan,

Why aren’t there any stocks in bold (under week4) on this weeks stock list? I know I’m missing something.

Fred

Fred,

Good observation! If you look at page 1 of the premium report you will see that NO stocks passed ALL screens but 27 equities passed all screens except the earnings report which is due out this cycle. Once the ER passes and the stock still meeets our system criteria, it becomes eligible and will appear in bold in our next report.

Alan

FOSL:

This stock has been one of my best performers in 2011. Even a 2-year chart of this stock has been impressive. This is why the BCI system requires trend and momentum identification. FOSL has been on our premium watch list for 5 months. In the past year, the S&P 500 is up 25% while FOSL is up 10x that amount. The ride won’t last forever but its been fun for quite a while! See the chart below (click on chart to enlarge and use the backarrow to return to the blog).

Alan

CMG

I sure am glad I let it get called last Friday! Have to wait a couple of days to decide if I want to get back in.

Owen, I hope you are not on the wrong side of AAPL

Mark Tooker

Mark,

No. I have faith in Apple. I had a couple of put spreads around $340 area. The stock jumped $20+ in after hours trading, so those put spreads are probably going to be cents in the morning. Time to close them and see how much faith I have in NFLX earnings next week.

Also, I opened a GOOG put spread yesterday after GOOG’s $70 jump on Friday. Some talking head actually said it will be a $700 stock.

Alan (#14)

Thanks for the clarification on DLLR and DLTR. I was looking at DLLR because it was one of the few that doesn’t have an earnings report on the list of Passed Previous Week and Passed Current Week. It doesn’t have an earnings report until after this option cycle. So wanted to be sure I was looking at the right stock.

Patricia,

In the upcoming report (7-22-11) there will be many more candidates as we will have a week of earnings reports behind us. Since the reports have been predominantly positive, my expectation is that many of our watch list stocks that have reported will still meet our system criteria. Also, we will still have 4 weeks of time value to capture because the current contract cycle is for 5 weeks.

Alan

I getting more and more concerned about the lack of movement on raising the debt ceiling. The market seems okay with the situation so far but what will actually happen if no action is taken by August 2?

Barbara

Barbara,

Although I also can’t imagine the debt ceiling issue not being resolved by Augsut 2nd I decided to stay on the sidelines until it is. Good luck.

Pat

Hello all,

Wanted to put my two cents in since Ive been researching this strategy recently. I think its a good strategy if applied properly.

Since its easy to see the benefits in the large % returns through selling calls against the LEAPS, I’ll just layout what I see as the risks, and then respond with ways to mitigate those risks:

-Risk that Implied Volatility will decrease

Mitigation: Only consider stocks with IV below 30%—in the example above with Google, I think the idea was good, however Google is far to volatile a stock to consider this strategy. The farther out the LEAPS I purchase, the lower the IV I want at the time of purchase.

–Risk that the stock heads south

Mitigate: Purchase in the money LEAPS, and stocks with good fundamentals/technicals that have a clear upward trend.

–Risk of being assigned early in LEAPS contract

Mitigate: Apply exit strategies by rolling out/rolling out & up, etc. Additionally, make sure to use a stock with a large open interest on many different strike prices, so you don’t get caught trying to apply an exit strategy with no liquidity.

I think stocks that are blue-chippers are a good place to scan for this strategy, such as MO, KO, MSFT. Just my two cents from my own personal research.

Joel

Barbara and Pat,

An interesting fact regarding this issue is that PIMCO, the world’s largest bond manager, recently increased its holdings of US government debt.

Alan

BIDU:

This recent entry to our premium watch list reported a stellar 1st quarter earnings report in late April with a revenue increase of 88% and an earnings surprise of 7%. In the past4 quarters this company has averaged a 9% positive earnings surprise. In addition there is a bullish 51% growth projection and that is why the company trades at a reasonable PEG ratio of 1.07. BIDU sits on $1.3 billion in cash with a minimal debt of $41 million. Our premium report shows an industry rank of “B” and a beta of 1.54. Does this stock deserve a place on your watch list?

Alan

HAL:

Another covered call candidate from our watch list reported an 11% rise in revenues in the 2nd quarter ER. Earnings surprised by 12.5%. The average earnings surprise of the past 4 quarters averages out to 7.3%. There is also a bullish growth projection of 26%. HAL trades at a forward PE of 17x compared to its industry average of 20x and a PEG of an outstanding 0.65. Our premium watch list shows an industry rank of “A”, a beta of 1.46 and a % dividend yield of 0.70.

Alan

Premium members:

This week’s 6-page report of top-performing ETFs and analysis of ALL Select Sector Components has been uploaded to your premium site.

For your convenience, here is the link to login to the premium site:

https://www.thebluecollarinvestor.com/member/login.php

Not a premium member? Check out this link:

https://www.thebluecollarinvestor.com/membership.shtml

Alan and the BCI team

How long do you usually wait before buying a stock after the earnings report. Is the next day too soon?

Thank you.

Paula

Paula (#31),

This is where art vs. science comes into play. i personally wait a few days ( 2 to 3) before I would trade a stock after their ER. Is sometimes takes some time before the stock “settles in”. The reason I suggest waiting is that it takes time for the analysts to comment, review, and possibly change their views…which impact the stock.

Just my opinion…

Barry

Thanks Barry. Your comments make perfect sense.

Paula

Alan,

Great article as always. Good to read your stuff again!

Kind of an older article, so hopefully you guys see this..

I don’t really understand how the LEAPs cover the near term call. If the near call gets assigned, do you have to exercise the LEAP to buy the stock and then fulfill the assignment of the near term call?

Josh,

You don’t need me…you answered your own question!

Nice work.

Alan

Thanks for the reply Alan. Say you buy 5 LEAP contracts and sell 5 short term ones, and the short term 5 are assigned. This means you would have to exercise the 5 LEAPs, which means you basically spent/lose the premium, then you have to buy 500 shares of the U/L to cover the 5 short term calls you sold. So this could end up being a pretty costly strategy then, right? Or am I missing something?

Josh,

I am not a big fan of this strategy mainly because of the long-term commitment but like most strategies, it can work if mastered.

The key to success is to properly structure the trade initially:

Make sure:

Short call premium + difference between the strikes > cost of the LEAP

Alan

Oh, I see, so if the short call premium + difference in strikes is great than the cost of the LEAP, then you won’t get blown out if the short call is exercised

Couldn’t you just also close the LEAP and short term call before expiration Friday? What you would lose on the short term call, you would gain on the LEAP (minus time decay, if much on the LEAP)?

Steve,

Yes, since we are dealing with American Style options, the positions can be closed at any time. Short calls can also be “rolled” without selling the LEAPS. Since near-the-money strikes tend to have greater liquidity and tighter spreads generally, we would get more favorable pricing on the short call than the LEAPS.

Alan

Thanks Alan. Good thought on rolling the short call also.