Our covered call writing and put-selling options can be exercised at any time from the moment we sell these options until 4 PM ET on expiration Friday. This is the definition of American Style Options, the type associated with our stocks and exchange-traded funds. Early exercise (prior to contract expiration) is rare because option holders have control of the contract obligations up to contract expiration. The cash required to purchase shares can be left in interest-bearing accounts and capital-risk can be minimized by waiting until the last minutes of the contract. There are times, however, when options are exercised early and this article will highlight the 3 main reasons for early exercise from the perspective of option holders:

- Basic Call (Discount) Arbitrage

- Dividend arbitrage

- Investor miscalculation

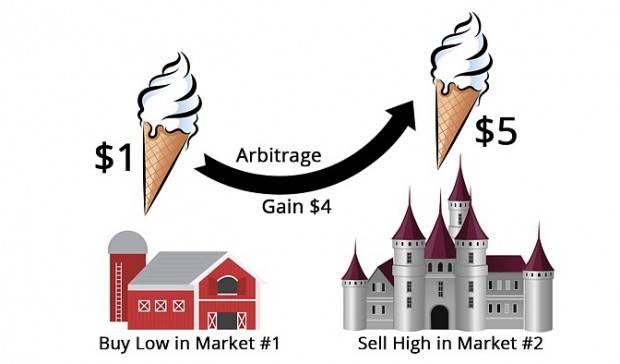

What is arbitrage?

This is the simultaneous purchase and sale of an asset in order to profit from a difference in the price. It is a trade that profits by capitalizing from price differences of identical or similar financial instruments, in different markets or forms.

How Arbitrage Works

Basic Call (Discount) Arbitrage

The arbitrageur can buy a call option at a discount (below parity) and simultaneously sell the underlying stock:

- Stock XYZ: $50.00

- $40.00 call trades at $9.75 (below parity)

- Risk-free profit = $0.25 (stock is purchased at $40.00 and sold at $50.00, less the cost of the option)

Dividend arbitrage

Buying in-the-money put options and buying equivalent amount of underlying stock before the ex-dividend date and then exercising the put after earning the dividend. The time value of the put must be less than the dividend distribution:

- Stock XYZ: $50.00

- $60.00 put trades at $10.10 (time value = $0.10)

- Dividend = $0.50

- Risk-free profit = $0.40 (stock is purchased at $50.00 and sold at $60.00 + the dividend is captured, less the cost of the put)

Investor miscalculation

Retail investors may exercise a call option with time value remaining prior to the ex-date to capture a dividend without realizing that a better approach would be to sell the option, buy the stock prior to the ex-date and capture the dividend. The criteria used is that early exercise makes sense if the time value of the premium is less than the impending dividend distribution. However, there is a better way:

- Stock XYZ: $50.00

- $40.00 call trades at $10.25 (time value = $0.25)

- Dividend = $0.50

Early Exercise = $10.00 (intrinsic value…buy at $40.00 as shares are currently worth $50.00) + $0.50 (dividend) = credit of $10.50 as shares are currently valued at $50.00-per-share.

Sell option, buy stock, collect dividend = ($10.25 + $0.50) = credit of $10.75 as shares are currently valued at $50.00-per-share.

Discussion

Early exercise is rare and generally does not benefit option holders. Arbitrage opportunities are uncommon exceptions. However, early exercise may occur due to investor error and we must be aware that ex-dividend dates (the day prior to the ex-date is the most common day for early exercise) are times when early exercise may take place even if the option buyers have better alternatives. This may be particularly important to those of us who prefer to retain our shares, perhaps to avoid negative tax issues.

My recent interview with NASDAQ reporter Jill Malandrino in New York City

Click here to view the interview

Upcoming events

The Association for Technical Analysis (AFTA): Dallas Texas

“How to Generate Monthly Cash Flow and Buy a Stock at a Discount Using Two Low-Risk Options Strategies”

Tuesday April 17, 2018 6:30 PM – 9 PM

Crowne Plaza 14315 Midway Rd Addison, TX 75001-3505

Market tone

This week’s economic news of importance:

- Case-Shiller home price index Jan 6.2% (6.3% last)

- Consumer confidence index March 127.7 (131.0 expected)

- GDP revision Q4 2.9% (2.8% expected)

- Pending home sales Feb 3.1% (-5.0% last)

- Weekly jobless claims 3/24 215,000 (230,000 expected)

- Consumer spending Feb 0.2% (expected)

- Consumer sentiment index March 101.4 (102.0 expected)

THE WEEK AHEAD

Mon April 2nd

- Markit manufacturing PMI March

- ISM Manufacturing March

Tue April 3rd

- Varies motor vehicle sales March

Wed April 4th

- ADP employment March

- Markit services PMI March

- ISM non-manufacturing index March

- Factory orders Feb

Thu April 5th

- Weekly jobless claims through 3/31

- Trade deficit Feb

Fri April 6th

- Non-farm payrolls March

- Unemployment rate March

- Consumer credit Feb

For the week, the S&P 500 rose by 2.03% for a year-to-date return of (-) 1.22%%

Summary

IBD: Market in correction

GMI: 1/6- Sell signal since market close of March 23, 2018

BCI: Selling all in-the-money strikes for all new positions. Currently fully invested and rolling down to out-of-the-money strikes (as they relate to current market value) when opportunities arise. Will re-adjust when the market settles.

WHAT THE BROAD MARKET INDICATORS (S&P 500 AND VIX) ARE TELLING US

The 6-month charts point to a bearish sentiment. In the past six months, the S&P 500 was up 4% while the VIX (19.97) moved up by 110%. Historically, the VIX and S&P 500 are inversely related.

Wishing you much success,

Alan and the BCI team

Premium Members,

This week’s Weekly Stock Screen And Watch List has been uploaded to The Blue Collar Investor premium member site and is available for download in the “Reports” section. Look for the report dated 03/30/18.

Also, be sure to check out the latest BCI Training Videos and “Ask Alan” segments. You can view them at The Blue Collar YouTube Channel. For your convenience, the link to the BCI YouTube Channel is:

http://www.youtube.com/user/BlueCollarInvestor

Best,

Barry and The Blue Collar Investor Team

[email protected]

Hello Alan. I’m considering signing up for the premium membership, but my account size is small and not sure if i can make enough from covered call to cover the monthly subscription.

Do you have suggested account size to make the subscription worthwhile?

Thanks,

Yus

Yus,

The minimum cash requirement for proper diversified traditional covered call writing is $10k – $15k when using exchange-traded funds…higher for individual stocks.

To build portfolio net worth up to these levels, consider a longer-term approach to investing:

https://www.thebluecollarinvestor.com/stock-investing-for-students/

Alan

Thank you, Dr. Ellman for the weekly premium report.

I have a question:

What do we do when I sell a covered call against a stock which was in the running list last week but failed screening this week?

I sold a covered call on GOOS last week.

Vasanthi

Vasanthi,

Once a trade is entered, it is managed precisely as described in the exit strategy sections of my books and DVDs and not by its removal from our watch lists.

If we are entering a new position, it will benefit us financially in the long run to use the most recent stock or ETF reports.

Alan

Alan:

Please cast some light on a point of confusion I’m trying to resolve regarding the weekly stocks report.

In the instructions it states:

► (@) Indicates Price Bar (Or Candle) On 20 Day EMA…OK For Watch List

► (?) Indicates Technical Indicators Mixed…OK For Watch List

Does this mean that any stock in the white area with either of those two indicators is ONLY suited for the Watch List, and not the Running List?

I’m confused. The latest (3/30/18) issue of the report shows a total of 20 companies in the white area, and virtually ALL but one (Five Below Inc) contain at least one of the above mentioned indicators. The implication being that FIVE is the only stock that has passed all the screens and fit for purchase in order to sell its options.

Is that interpretation essentially correct, or am I misreading the instructions? The previous week’s report was similarly restricted by the same (perceived) restrictions.

Your response would be greatly appreciated.

Kindest regards,

Bert

Bert,

All stocks in the “white cells” are eligible as long as there is adequate option liquidity (open interest…OI). You are describing mixed technicals versus all-bullish technicals. With mixed technicals, we are more likely to favor in-the-money strikes as opposed to the more bullish out-of-the-money strikes. It is one of the guidelines that assist us in our strike price selection.

Alan

I’ve been a member almost two years and have greatly enjoyed the service. I came across you mentioning CDMCP as an exit strategy.

Somehow, I couldn’t think what that stood for. I’ve got your Exit Strategy book on Kindle, so I searched for CDMCP and couldn’t find it. I see that there’s a tab on the web site for “Glossary For Covered Call Writing”. I went there and searched for CDMCP and didn’t find it. Looking through the “C” section of the glossary, I came across “Convert Dead Money to Cash Profits”. Eureka! Suggest adding CDMCP to the glossary definition to help us who search for the acronyms.

Jldtex,

Thank you for the suggestion. The acronym will be added.

Alan

Alan,

in your summary you say “rolling down to out-of-the-money strikes (as they relate to current market value) when opportunities arise”

It is not quite clear to me. Please explain.

Out of my 9 positions I have bought back all calls except one (INTC), following the 20/10 guideline.

Roni

Roni,

Good going on buying back options.

Example:

Buy a stock at $48 and sell the $50 (OTM) call

Stock price drops to $43

BTC the $50 call and sell the (now) OTM $45 call, thereby rolling down to a (now) OTM strike.

The $45 strike was initially ITM when share price was $48 but is now OTM as share price dipped to $43.

Alan

Alan,

Very clear now.

Thanks – Roni

What is your strategy in Options trading in such volatile market conditions?

I generally either long LEAPS or short Puts but now its getting very risky.

If possible, please recommend some videos in this topic.

Andrey

Andrey,

Here is a link to a series of articles I published on the topic of trading in bear markets:

https://cse.google.com/cse?cx=018435198316587824956%3Aav1xr6fw7oy&q=bear%20markets&oq=bear%20markets&gs_l=partner-generic.12…168670.170964.0.174146.12.12.0.0.0.0.66.616.12.12.0.gsnos%2Cn%3D13…0.2312j573320j12..1ac.1.25.partner-generic..11.1.58.YvyANl7XLrY#gsc.tab=0&gsc.q=bear%20markets&gsc.page=1

Alan

Premium members:

This week’s 8-page report of top-performing ETFs and analysis of ALL Select Sector Components has been uploaded to your premium site. The report also lists Top-performing ETFs with Weekly options as well as the implied volatility of all eligible candidates.

New members check out the video user guide located above the recent reports.

For your convenience, here is the link to login to the premium site:

https://www.thebluecollarinvestor.com/member/login.php

NOT A PREMIUM MEMBER? Check out this link:

https://www.thebluecollarinvestor.com/membership.shtml

Alan and the BCI team

Thanks very much Alan!

One question please! I have bought FB sept 21 Call option and now I want to short April 13 Call (10 days) against it. If all goes well i will of course go on selling small Calls(10 days).

What will be the best scenario for me, if say, when my Long Call’s expiration approaches (sept) and the market price of FB stocks is below my Strike price? Will it be a total loss of my sept Call option or should I sell it? If to sell it,then what can be the ideal time period to sell my sept Call option? Or maybe it would have been better,if I had bought a LEAP Call Option?

Thanks tremendously!

Andrey

Andrey,

It appears that you are executing a long call diagonal debit spread also known as the “Poor Man’s Covered Call” (PMCC) Now, I cannot give specific financial advice in this venue but I can add some general information you should find useful and more details will be found in our upcoming new book, “Covered call Writing Alternative Strategies” (waiting for proof from my publisher).

In its traditional sense, the PMCC involves buying deep in-the-money LEAPS and selling short-term (1-month typically) out-of-the-money calls. So it’s a long-term strategy with the best underlyings being blue chip stocks or ETFs that have both LEAPS and weekly options associated with them. The Weeklys are used to circumnavigate earnings reports and ex-dividend dates.

Based on the nature of Theta (time value erosion), rolling the LEAPS should be executed 3 months prior to contract expiration.

Alan

Mr. Ellman:

In this highly volatile market is it smart to stay out of the market? I’ve always heard that to be in cash is a position too. Is this one of those circumstances?

Martin

Martin,

This is a decision based on our personal risk-tolerance. Those of us who have experienced volatile markets and have a plan to mitigate when trades turn against us are more likely to participate in challenging market environments. Those new to option-selling or have a low risk-tolerance may choose to move partially or fully into cash. There is no right or wrong answer to this question.

For those who choose to stay on the sidelines, I would strongly encourage you to trade in virtual or paper-trade accounts just to get the experience.

Alan

Alan,

by today, I have rolled down 6 of the 8 positions that I had bought back the CCs on April 02.

All theese calls were sold OTM when calculated on the underlying stock value at the moment of the new trades.

I am not sure if I will have a gain by expiry 04/20, but the losses from the correction will certainly be mitigated by following your lead.

Thanks – Roni

Roni,

You made my day. Keep up the great work.

Alan