Unlock The World of Credit Spread Trading With The New BCI Credit Spread Management System

6-Tab calculator with context-sensitive help and the new BCI book, “The Blue Collar Investor Guide To Conservative Credit Spread Trading”.

The BCI Credit Spread Management System

for Just $379

Important Note: After you make your payment, you will be redirected to a download page. Save this page immediately. You only have one download available.

Comprehensive Features of Our System

Our package offers a powerful blend of educational resources and practical tools to enhance your trading expertise.

6-Tab Credit Spread Calculator

In-Depth Credit Spread Guide

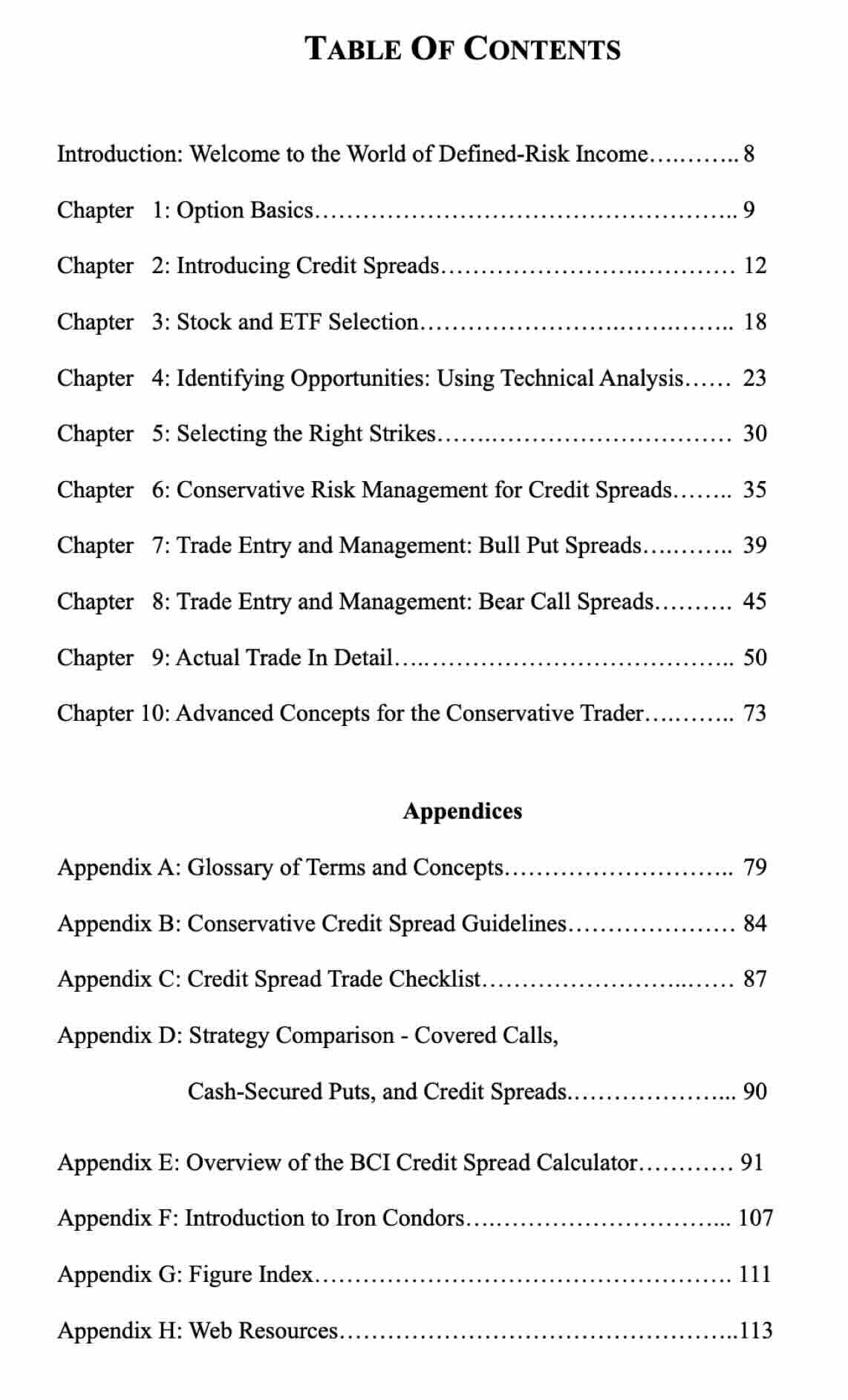

Our book provides a step-by-step approach to mastering credit spreads with real-life examples.

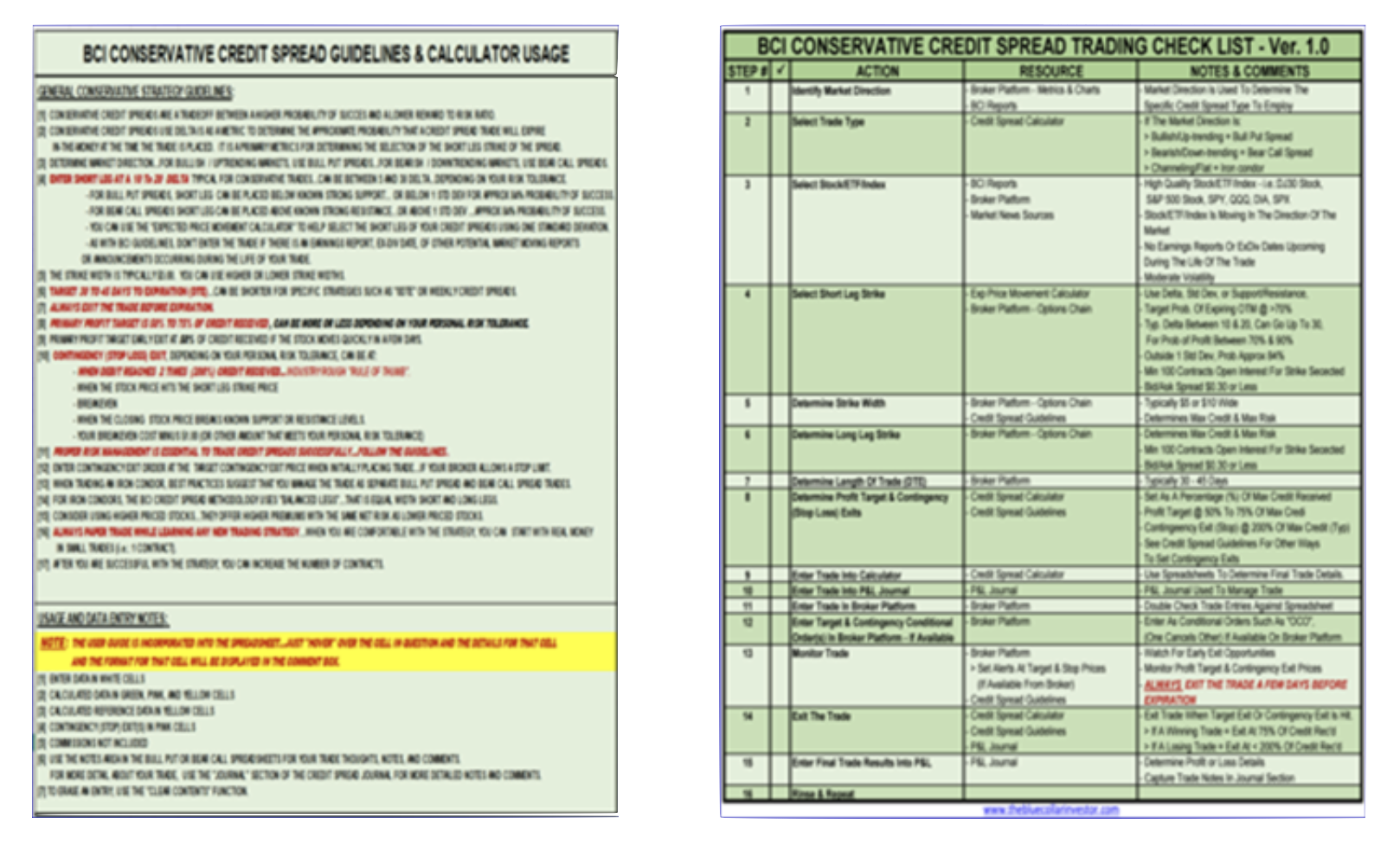

Strategic Trade Management

Learn to manage trades effectively with guidelines and checklists for optimal decision-making.

The Blue Collar Investor

Guide To Conservative Credit Spreads

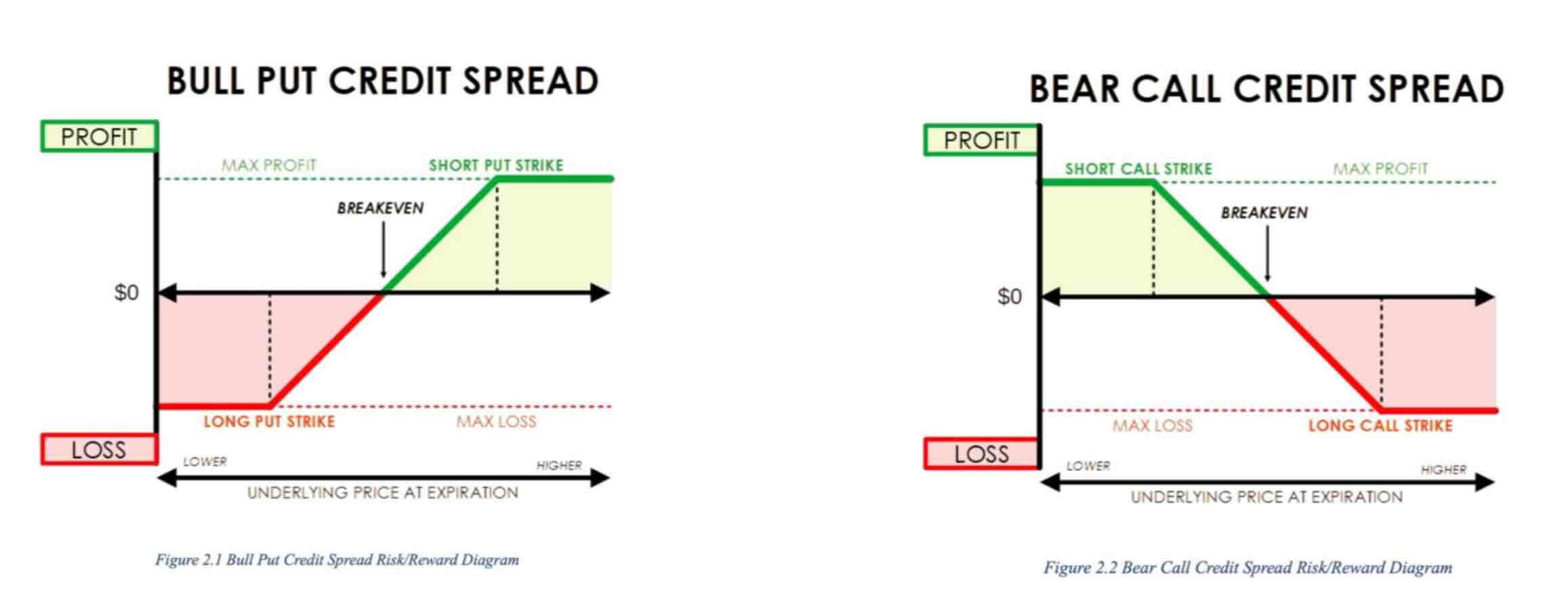

The book is a detailed analysis of low-cost, defined risk strategies that provide the opportunity to profit from time decay and volatility.

This resource explores how to use bull put spreads in favorable market conditions and bear call spreads in bear and volatile market environments.

This book offers a step-by-step approach to credit spread trading using real-life and hypothetical examples, which gives the reader the ability to understand the risk and potential outcomes.

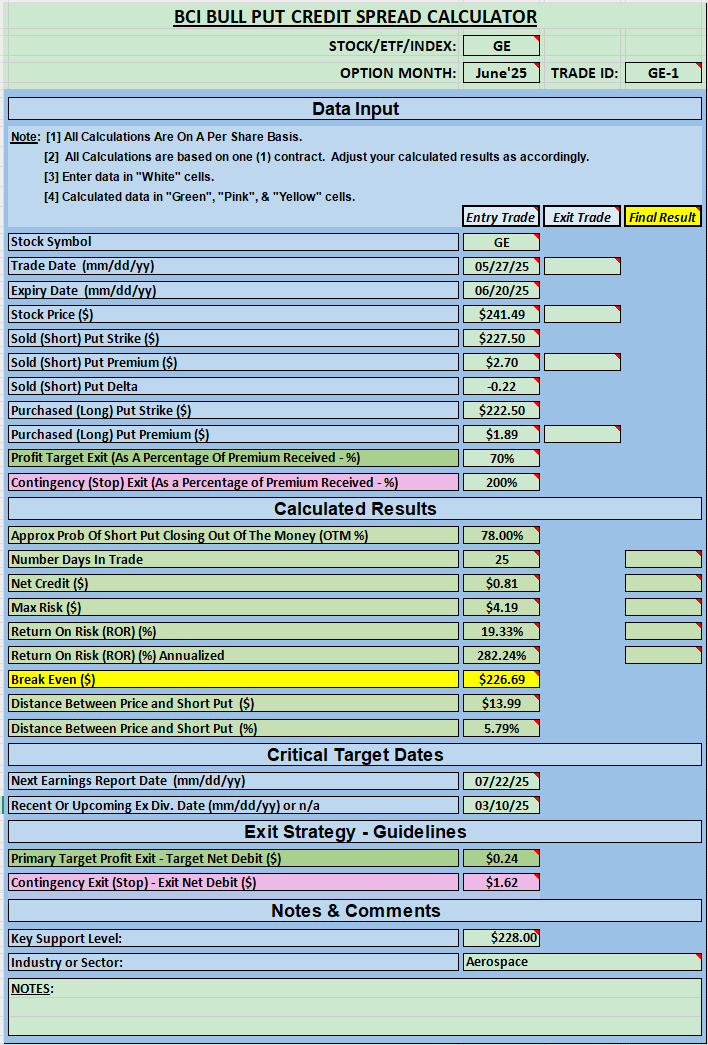

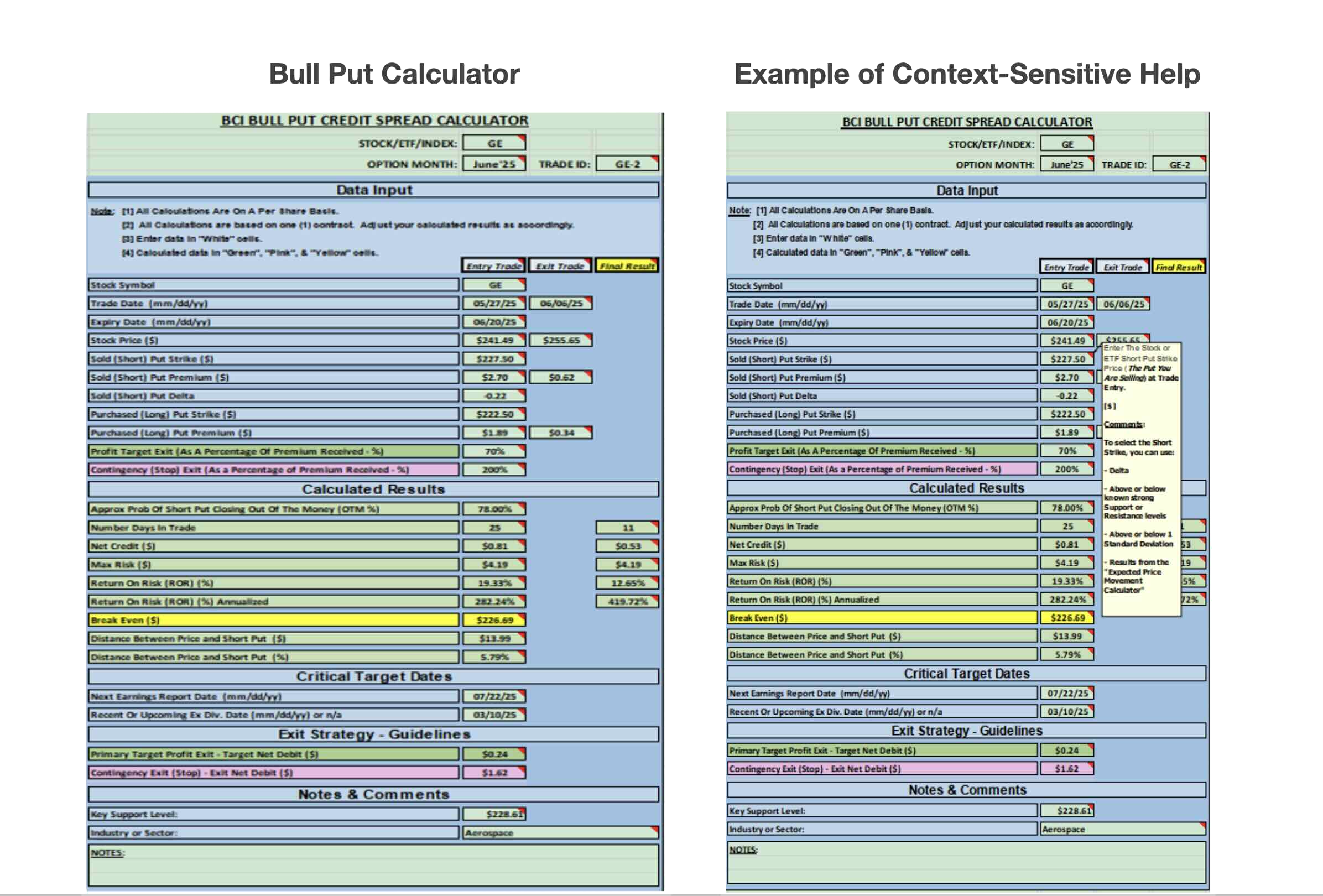

The Calculator

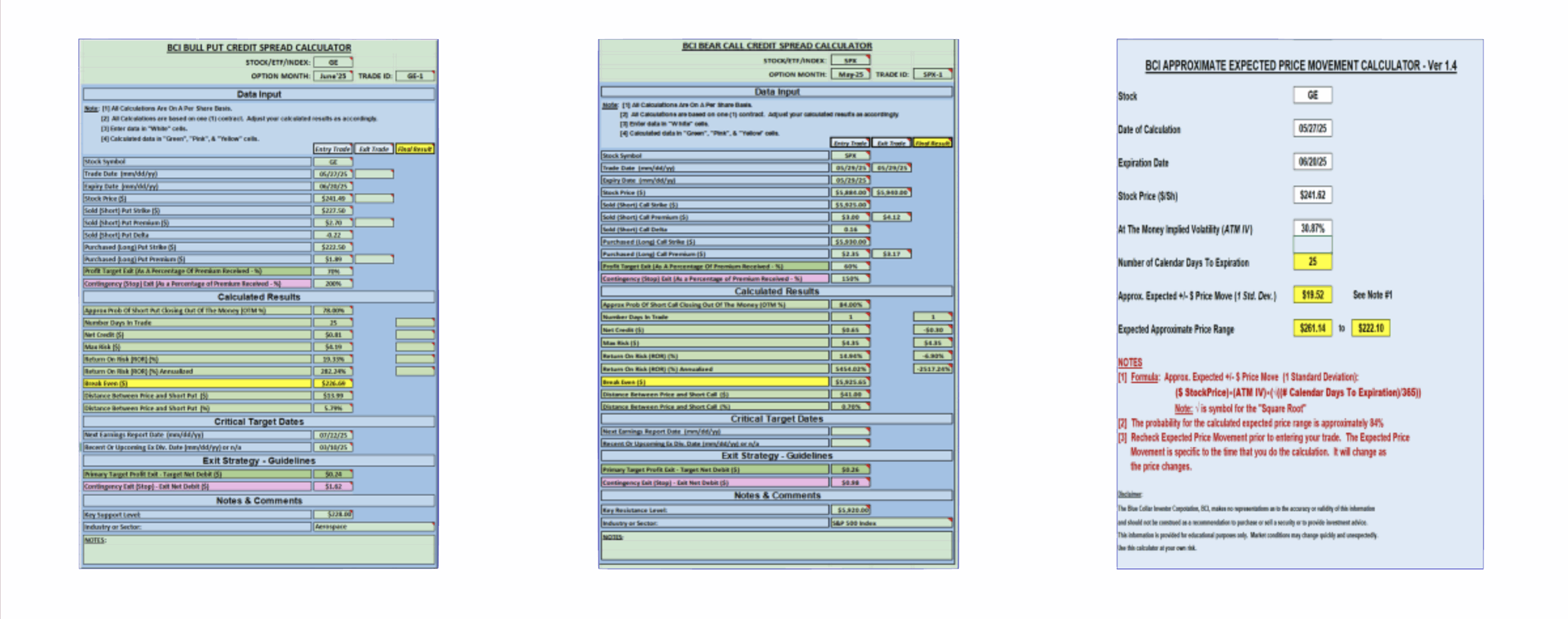

The Credit Spread Calculator (CSC) is similar to our popular Trade Management Calculator (TMC) for covered call writing & selling cash-secured puts. This new calculator package does it all. It provides sections for trade entries (data input), initial and final trade results, exit strategy guidelines for profit target and stop loss exit target trade entries and final results. In addition, there are sections for important trade dates and a section for comments.

What is included in the BCI Credit Spread Management System Calculator?

- Bull Put Spread

- Bear Call Spread

- Expected Price Movement Calculator (using implied volatility to determine the trading range)

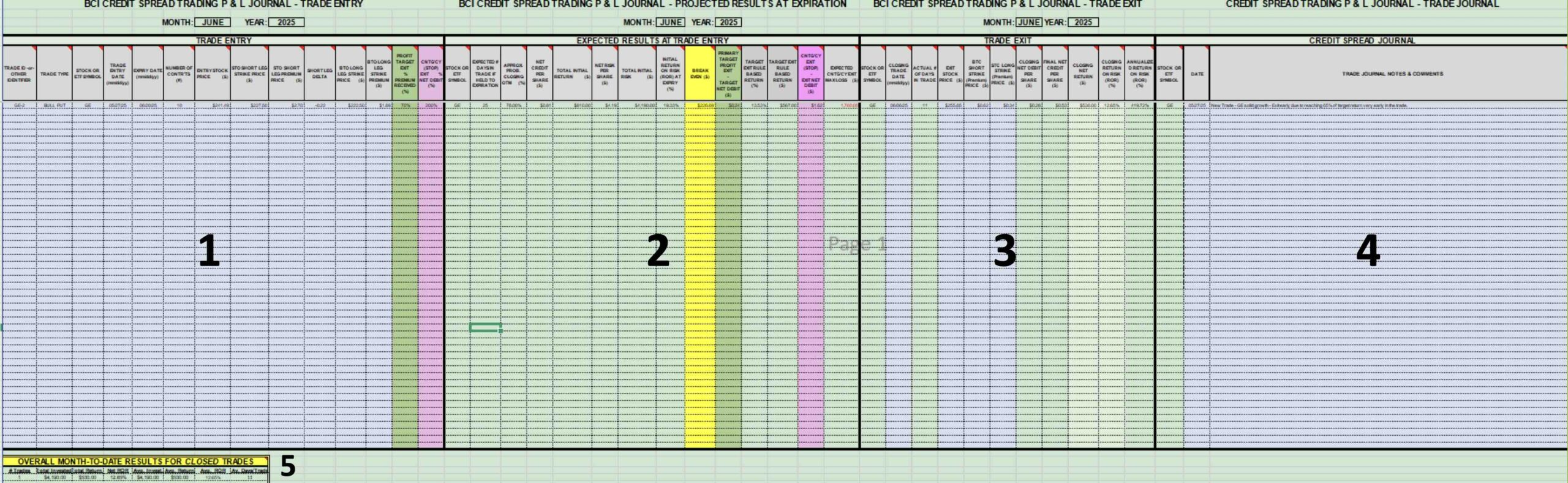

- Profit & Loss Trade Journal

- Credit Spread Guidelines & Calculator Usage

- Step-by-Step Checklist

6 tabs of the BCI Credit Spread Calculator (CSC)

Is credit spread trading right for you and your family? This package will provide the information to allow you to make that determination and if the answer is “yes”, will provide the blueprint and potential to achieve the highest possible returns.

With the BCI Credit Spread Management System. Equip yourself with the knowledge and tools to maximize your returns. Take the first step toward a more profitable trading future.

The BCI Credit Spread Management System

for Just $379

Important Note: After you make your payment, you will be redirected to a download page. Save this page immediately. You only have one download available.

Common Questions About Our Credit Spread System

Explore answers to frequently asked questions about our comprehensive credit spread management system, designed to enhance your investment strategies.

What is included in the BCI Credit Spread Management System?

The package includes a 6-tab calculator with context-sensitive help, and the book ‘The Blue Collar Investors Guide To Conservative Credit Spreads’, providing a thorough understanding of credit spread strategies.

How does the Credit Spread Calculator assist in trading?

Our calculator offers sections for trade entries, initial and final trade results, and exit strategy guidelines, helping you manage trades effectively and maximize potential returns.

Who can benefit from this credit spread package?

This package is ideal for investors looking to engage in low-cost, defined-risk strategies, suitable for both novice and experienced traders aiming to profit from market volatility.

What types of credit spreads are covered in the book?

The book covers bull put spreads and bear call spreads, providing insights into how these strategies can be applied in various market conditions for optimal outcomes.

Is prior experience required to use this system effectively?

An understanding of basic options trading is important. Experience with BCI’s covered call and cash-secured methodologies is a perfect starting point for credit spread trading. The step-by-step guide and real-life examples make it accessible for beginners while offering advanced concepts for seasoned traders.

How does this system align with BCI's investment philosophy?

Our system aligns with BCI’s philosophy by focusing on conservative, defined-risk strategies that empower investors to make informed decisions and achieve consistent returns.