Dec 30, 2023 | Uncategorized

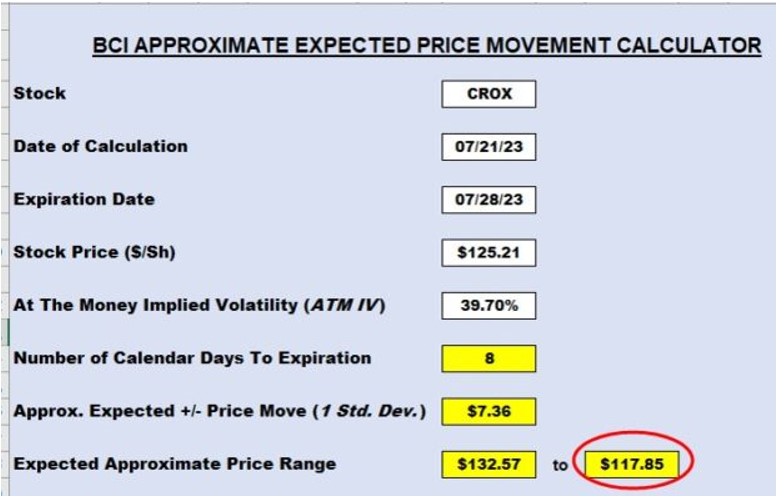

click ↑ 4 Featured BCI Rule: Never write a covered call or sell a cash-secured put if there is an upcoming earnings report prior to contract expiration. All other parameters in our BCI methodology are guidelines, giving the investor some flexibility within...

Dec 23, 2023 | Exit Strategies, Investment Basics, Option Trading Basics, Options Calculations, Put-selling, Stock Option Strategies

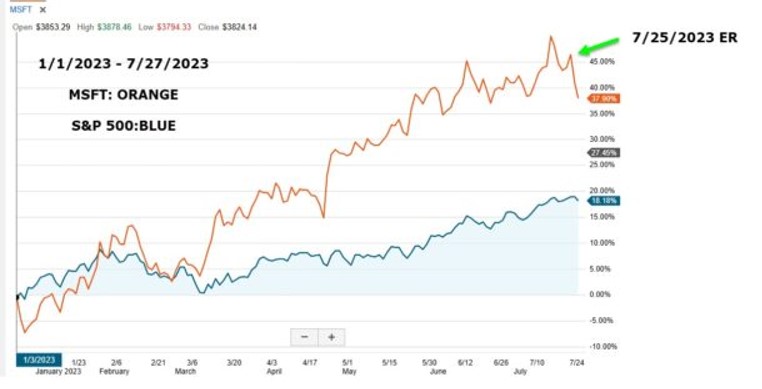

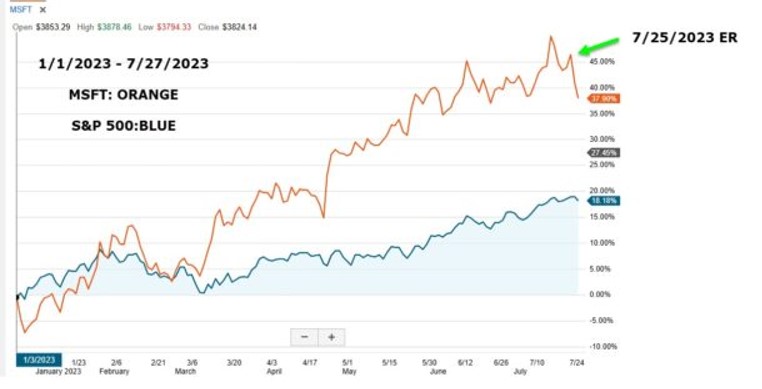

click ↑ 4 Featured We can leverage our knowledge of cash-secured puts to take advantage of common scenarios. In this article, we will detail how to take advantage of a disappointing earnings report from a stellar blue-chip company. On 7/25/2023, MSFT reported earnings...

Dec 16, 2023 | Exit Strategies, Investment Basics, Option Trading Basics, Options Calculations, Options Trade Execution, Put-selling, Stock Option Strategies

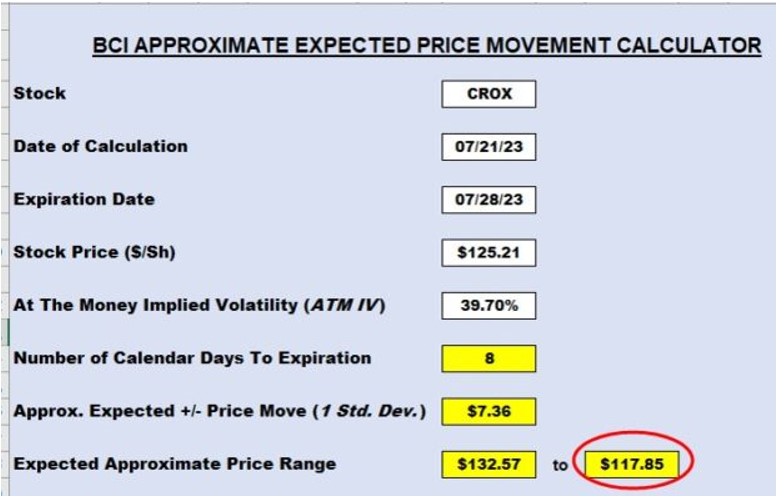

click ↑ 4 Featured When selling cash-secured puts, a common strategy goal is to avoid exercise and having shares put to us. This means selling out-of-the-money (OTM) strikes that have a low probability of exercise or expiring in-the-money (ITM) or with...

Dec 9, 2023 | Covered Call Exit Strategies, Investment Basics, Option Trading Basics, Options Calculations, Options Trade Execution, Stock Option Strategies

click ↑ 4 Featured Populating our covered call writing and put-selling monthly portfolios during earnings season can be challenging as we seek to avoid companies about to report earnings. This is the most important rule in the BCI methodology. All other...