Each week, BCI provides our premium members with a sample covered call writing or cash-secured put trade taken from one of Alan’s portfolios or from that of a member. These trades are all selected from the BCI premium member reports. In this article, a real-life trade with Broadcom Inc. (Nasdaq: AVGO) will be analyzed regarding initial setup and calculations and final trade results. This is an example of a successful trade. Most are, some are not.

Reasons for selecting AVGO: Information taken from the BCI Stock Screen and Watch List

-

- AVGO: $170.47

- On our stock list for 2 weeks

- #6 on IBD Big-Cap 20

- High implied volatility (IV): 39.8%

- Industry segment rank: B (Chips)

- Mean analyst rating of 1.41 (excellent)

- On balance volume: Bullish

- Next ER on 12/5/2024

- Dividend yield: 1.20%

- Ex-dividend date: 9/19/2024

- $175.00 monthly (10/18/24) OTM call strike has a bid price of $5.05

- Note: OTM call strikes offer time value + upside potential (2 income streams)

Initial trade calculations using the BCI Trade Management Calculator (TMC)

Evaluating initial results

Out-of-the-money strikes can generate significant initial time-value returns (2.96%, 41.59% annualized for the 26-days-brown cells). There is also significant upside (additional) potential of 2.66% (purple cell), if the share value moves higher. Since AVGO has a high implied volatility, premium returns are high, and risk is also greater than lower IV stocks. It’s important to be vigilant regarding exit strategy preparation, including our 20%/10% guidelines. If stock price moves below the breakeven price point ($165.42- yellow cell), we start to lose money if exit strategy implementation is not initiated. The 20% buy-to-close/ good until cancelled (BTC/GTC) guideline limit order is set at $1.01 (20% of $5.05).

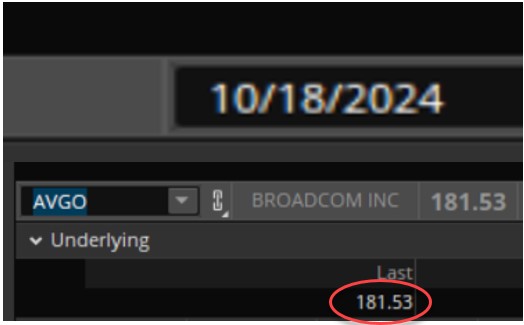

AVGO closing price on expiration Friday (10/18/2024)

AVGO closed well above the $175.00 strike due to a $5.00 increase in share price on expiration Friday. I allowed exercise and share were sold at $175.00. The final realized 26-day return was 5.62%, 78.9% annualized. A decision is made over the weekend as how to best use the cash generated from the sale of AVGO when the market opens on Monday. These decisions are based on the most recent BCI reports of eligible option candidates.

Discussion

This AVGO trade is an example of a winning trade with a maximum return. Other winning trades may not achieve max returns, and some will be losing trades. Mastering our exit strategy skillset is essential although none were needed for this particular trade.

THE POOR MAN’S COVERED CALL

Online Streaming video course with Downloadable Workbook

Covered call writing is a cash-generating strategy that lowers our cost basis thereby improving our opportunities for successful investments. It involves a long stock position (we buy the stock) and a short option position (we sell the call option). The PMCC strategy replaces the long stock positions with long call positions, typically deep in-the-money long-term expiration options known as LEAPS. Because long options cost less than stocks, we are investing less money and the return on our capital increases. As with all strategies, there are pros and cons that must be mastered to determine if this is a proper strategy for our personal risk-tolerance and return goals. This program will highlight in great detail:

-

- PMCC definition

- Pros and Cons

- Risk/reward profile

- Best stocks and ETFs to consider

- How to construct a PMCC trade

- Hypothetical example

- Multiple real-life examples

- The BCI PMCC Calculator

- Option Greeks

- Position management

- Rolling LEAPS

Click here for video & more information.

Your generous testimonials

Over the years, the BCI community has been incredibly gracious by sending our BCI team email testimonials sharing stories as to what our educational content has meant to their families. Moving forward, we have decided to publish several of these testimonials in our blog articles. We will never use a last name unless given permission:

Upcoming events

1. Mad Hedge Fund Traders & Investors Summit

Tuesday June 3, 2025 @ 11 AM ET

Two Covered Call Writing Strategies

Dividend Capture and A Streamlined Approach

Covered call writing is a low-risk option-selling strategy geared to generating weekly or monthly cash flow with capital preservation in mind.

The specific approach used is crafted based on personal risk tolerance, market conditions and strategy goals.

In this presentation, 2 such blueprints are analyzed.

The first, dividend capture, is a method of creating a 3-income stream potential per trade.

The second, the CEO Strategy, is a streamlined approach to covered call writing which is especially appealing to those with busy work and personal schedules. It is based on Dr. Ellman’s 9th book which demonstrates how the market was beaten by > 15% in 2022.

Option basics along with real-life examples and real-time Q&A throughout the entire presentation.

2. Long Island Stock Investors Group

Private club

Thursday June 12, 2025

7:30 PM ET – 9:00 PM ET

3. BCI Educational Webinar Series

Using Cryptocurrency in Our Low-Risk Option Portfolios

Thursday June 19, 2025 @ 8 PM ET

4. Cyber Trading Expo

Wednesday July 23, 2025

3 PM ET – 4 PM ET

Info & registration link to follow.

5. Orlando Money Show

Orlando Resort @ ChampionsGate

October 16 – 18, 2025

- Opening ceremony keynote address

- 2-hours Master’s Class

- 45-minute workshop class

Details and registration link to follow.

Dear Alan,

I really appreciate that you share some of your trades which give us the possibility to learn more.

A question comes up into my mind: Do you preferably chose those stocks which are in bold in the list so they fulfill all criteria or is this not a point you take into account when choosing a stock?

The main reason I am writing: Sharing the entry is very good however would it be possible to share the exit of the sample trades as well?

This is where money is earned. There are more options to close a trade according the exit strategies but your opinion why and when you choose the one would be extremely helpful.

Thanks a lot, all the best

Greetings from Austria/Europe,

Juergen

Juergen,

The feedback I have received since sharing sample trades from my portfolios with premium members has been encouraging and motivating for me and my team.

I do tend to favor stocks in bold with industry rankings of “A” or “B”. However, since I have multiple option portfolios, I do use many of the eligible securities not in bold (mixed technical indicators) as well. These are also elite performers at the time our reports are crafted, but not as perfect technically.

I will be incorporating more exit strategy execution into my videos and sample trades moving forward. I’ve actually been doing this for nearly 2 decades but will increase the quantity.

These links are excellent resources:

https://thebluecollarinvestor.com/minimembership/softcover-exit-strategies-for-covered-call-writing-and-selling-cash-secured-puts/

https://thebluecollarinvestor.com/minimembership/selling-cash-secured-puts-basic-and-advanced-principles-6-part-video-series-workbook/

https://thebluecollarinvestor.com/minimembership/covered-call-writing-package-4-dvd-series-workbook/

Thanks for your comments, always important to us and appreciated.

Alan

Premium Members,

This week’s Weekly Stock Screen and Watch List has been uploaded to The Blue Collar Investor Premium Member site and is available for download in the “Reports” section. Look for the report dated 05/30/25.

Be sure to check out the latest BCI Training Videos and “Ask Alan” segments. You can view them on The Blue Collar YouTube Channel. For your convenience, the link to the BCI YouTube Channel is:

https://www.youtube.com/user/BlueCollarInvestor

Barry and The Blue Collar Investor Team

Alan,

Have you done an analysis how the stocks you recommend every week have done versus SPY?

Regards

Neville

Neville,

By definition, all the stocks in our premium member stock reports do outperform the S&P 500, because that is a strict requirement to be on this “eligible” watchlist. The BCI team updates this Stock Screen & Watch List every week for our members.

These are the lists we have been providing to our premium members for the past 18 years and I have been using personally for 3 decades. There has never been a year where I haven’t outperformed the S&P 500 and many years, significantly.

In my 9th book, Covered Call Writing: A Streamlined Approach”, I took a screenshot of every trade I executed using the CEO strategy from our ETF Reports in 2022. At the end of the trading year (3rd Friday in December 2022), my portfolio outperformed the S&P 500 by > 15%.

If you’re considering these lists for long-term buy-and-hold portfolios, we have not researched this because our strategies involve short-term trades. My educated expectation would be that this approach would also outperform as long as trailing stop loss orders were incorporated into the strategy.

Alan

Premium Members,

The Weekly Report for 05/30/25 has been revised and uploaded to the Premium Member website. The revision now shows that BROS has Weekly Options. Look for the report dated 05/30/25-RevA.

Best,

Barry and The Blue Collar Investor Team

Premium members:

This week’s 4-page report of top-performing ETFs, along with our sample trade of the week, has been uploaded to your premium site. The Select Sector SPDR section is now crafted to align with our streamlined (CEO) approach to covered call writing. The report also lists Top-performing ETFs with Weekly options, mid-week market tone as well as the implied volatility of all eligible candidates.

We have also included a sample trade taken from one of our BCI watchlists.

Premium member video link:

https://youtu.be/EXMO-KwZuJs

For your convenience, here is the link to login to the premium site:

https://www.thebluecollarinvestor.com/member/login.php

NOT A PREMIUM MEMBER? Check out this link:

https://www.thebluecollarinvestor.com/membership.shtml

Alan and the BCI team

Hi Alan,

Based on your books you recommend the best duration of option contract to be 30 days. However I notice that when the overall market is in decline, and/or volatility is high, the sample trades you share have contract durations of 1 week or 2 weeks.

Is that because it allows for the ability to exit the position through expiration in a shorter period and thus minimize the risk of losses if the market continues its decline, or are their other reasons?

Thank you.

CHRIS

Chris,

Excellent observation.

I have been using more weekly expirations in the past few years. One of the reasons has to do with the explosion of the # of weekly options now available. Simply a greater pool of stocks & ETFs to select from.

Generally, I do both weekly and monthly expirations for both calls and puts, equally distributed. However, in bearish, volatile and/or uncertain market conditions, I do favor weekly expirations because it allows me to re-evaluate my bullish assumptions on the underlying securities more frequently.

Also, in these conditions, I structure my trades defensively, so using weekly expirations will enhance the annualized time-value returns. This way, we’re getting both significant returns + protection to the downside.

Alan

Fantastic. Thanks so much, Alan. Great work.