Latest Insights in Stock Market Investing

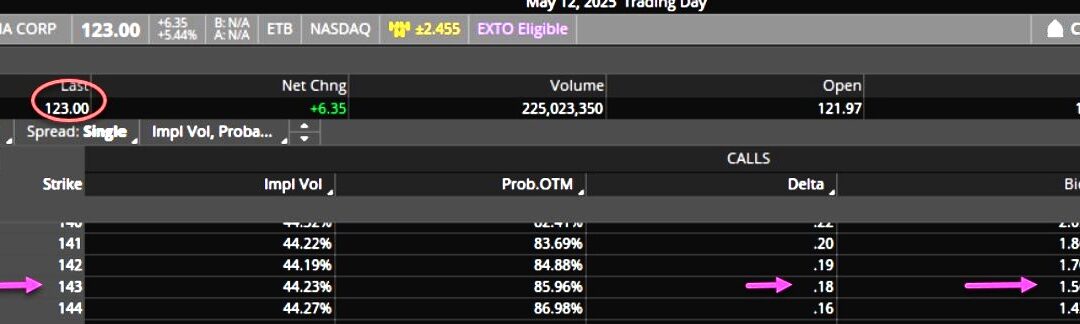

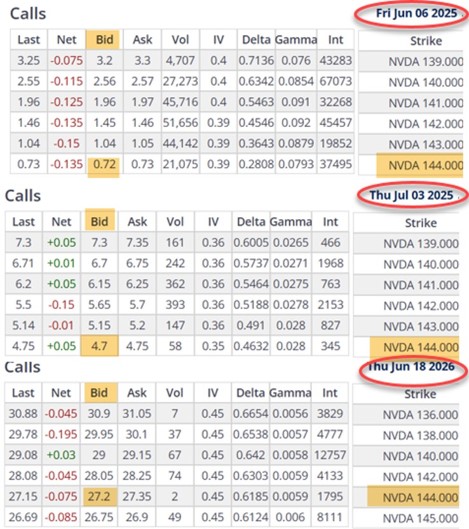

BCI PODCAST 160: Comparing Implied Volatility and Delta for Projected Option Trading Ranges

This podcast will detail how to craft 84% probability of success trades using Delta and implied volatility (IV). A conversion formula and spreadsheet will be discussed how to generate an IV for a specific option contract. Real-life examples with option-chain data are...

How to Earn More than a Maximum Return with a Defensive Covered Call Trade

click ↑ 4 Featured When crafting our covered call trades to offer greater protection to the downside, we favor in-the-money (ITM) call strikes. These provide lower breakeven price points because ITM strikes consist of both time-value and intrinsic-value. At-the-money...

Strike Selection After Rolling-Out Our Portfolio Overwriting Trades

click ↑ 4 Featured Portfolio overwriting is a covered call writing-like trading strategy. There are 2 distinctly defined goals: generating cash flow + retention underlying shares. Since deep out-of-the-money (OTM) strikes are used to align with the goal of share...

BCI PODCAST 159: Understanding 1-Time Special Cash Dividends and Our Current Trade Status

Corporate events such as stock splits, mergers& acquisitions and special 1-time cash dividends may change the parameters of our covered call writing and put-selling contracts. This podcast will focus in on a real-life example with OMF and a special 1-time cash...

Beware of the Shiny Object When Establishing Covered Call Trades

click ↑ 4 Featured One of the more common oversights made by retail investors is their focus on premium dollar amounts rather than annualized returns. I consider this "dollar distraction" the shiny object that prevents us from focusing on the more pertinent annualized...

Achieving Our Goal When Selling a Defensive Covered Call

click ↑ 4 Featured When we structure our covered call trades in a defensive manner, we have 2 main goals in mind. We seek greater protection to the downside than traditional put trades and we strive for significant, although lower returns. We accomplish these goals by...

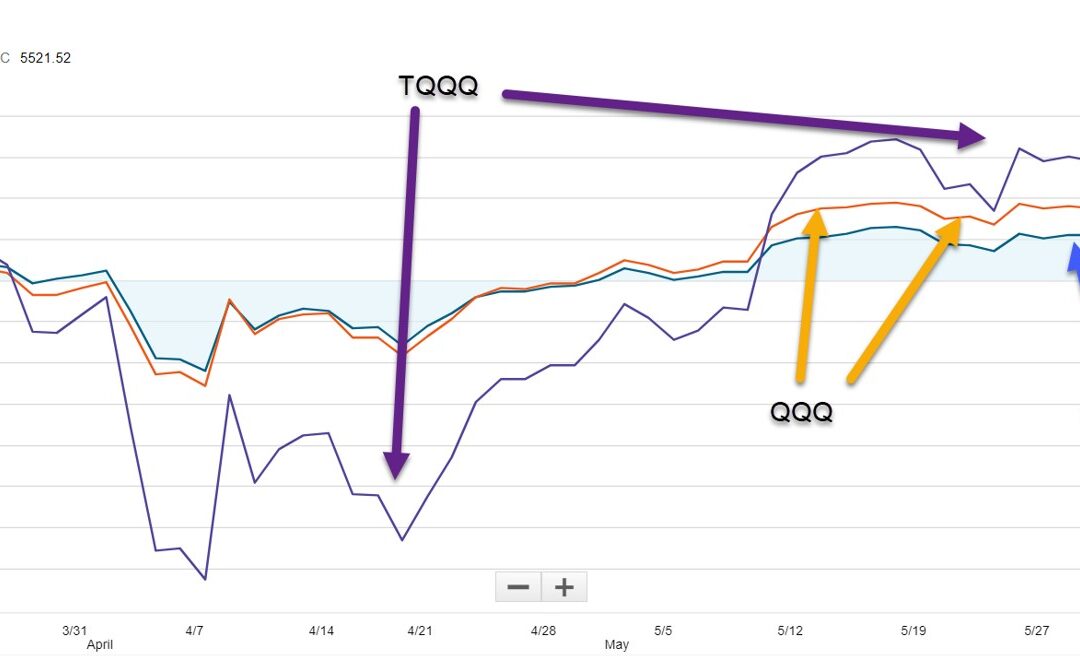

Pros & Cons of Leveraged ETFs When Selling Stock Options

click ↑ 4 Featured Retail investors may become enticed to use leveraged exchange-traded funds (ETFs) when writing covered calls or selling cash-secured puts. The reason is that the option returns are generally so much greater than traditional ETFs. This article will...

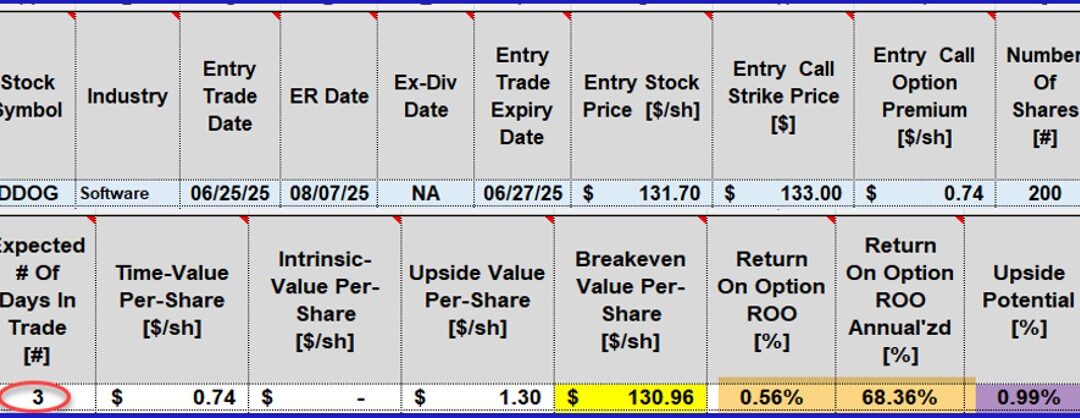

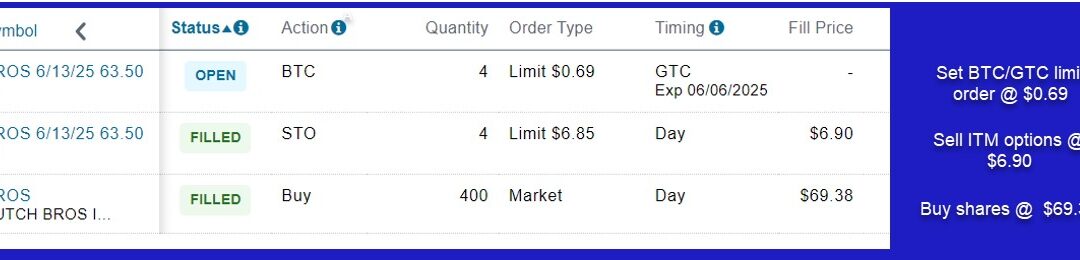

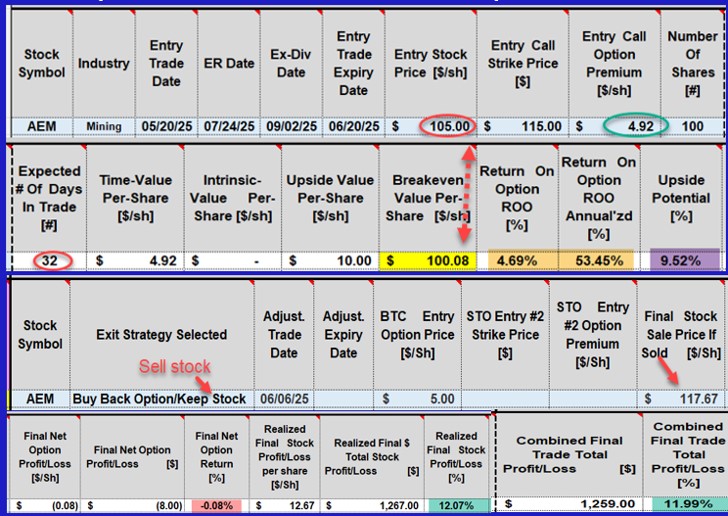

Calculating Multiple Call & Put Trades with the Same Stock in 2 Expiration Cycles

click ↑ 4 Featured Calculating our covered call writing and cash-secured put trades can range anywhere from really simple to way too complicated. In this article, an example of the latter will be analyzed. Thanks to our BCI Trade Management Calculator (TMC), these...

Ask Alan 235 Comparing Covered Call Writing & Cash Secured Puts in Bull Market Environments

---------- Hi Alan, In a really strong bull market, do you favor covered call or cash-secured puts and why? I’ve been doing mostly puts but maybe I should consider calls instead. Thanks a lot. Antonio (Italy) Covered call writing versus cash-secured puts in bull...

Explore Investment Topics

Covered Call Exit Strategies

Exit Strategies

Upcoming events

Our Journey and Mission

The Blue Collar Investor was founded with a simple mission: to empower everyday individuals with the knowledge to invest wisely in the stock market. Our blog focuses on demystifying stock options, providing readers with the tools they need to succeed. We believe that anyone can learn to invest effectively, regardless of their background or experience.

Our story began when our founder Dr. Alan Ellman, realized the lack of accessible resources for average investors. Determined to bridge this gap, we created a platform that offers comprehensive guides, expert tips, and real-world strategies. Today, The Blue Collar Investor is a trusted resource for thousands of readers seeking to enhance their financial literacy and achieve their investment goals.