Nov 22, 2025 | Covered Call Exit Strategies, Exit Strategies, Investment Basics, Option Trading Basics, Options Calculations, Options Trade Execution, Stock Option Strategies

click ↑ 4 Featured When a covered call trade is expiring in-the-money (ITM), we may have an opportunity to retain the underlying shares by rolling-out or rolling-out-and-up. The latter is a more aggressive form of rolling. This article will scrutinize a series of...

Jul 12, 2025 | Covered Call Exit Strategies, Investment Basics, Option Trading Basics, Options Calculations, Options Trade Execution, Stock Option Strategies

click ↑ 4 Featured The option Greeks are financial metrics that are used by traders to evaluate the risk of our option contracts as well as how option price changes as it related to the price of the underlying security. This article will review the option Greeks with...

Jun 21, 2025 | Covered Call Exit Strategies, Exit Strategies, Investment Basics, Option Trading Basics, Options Calculations, Options Trade Execution, Stock Option Strategies

click ↑ 4 Featured Selling covered calls and cash-secured puts lower our cost-basis and places us in a position to significantly beat the market. Mastering stock selection, option selection and position management are essential in achieving the highest levels of...

May 31, 2025 | Covered Call Exit Strategies, Fundamental Analysis, Investment Basics, Option Trading Basics, Options Calculations, Options Trade Execution, Stock Option Strategies

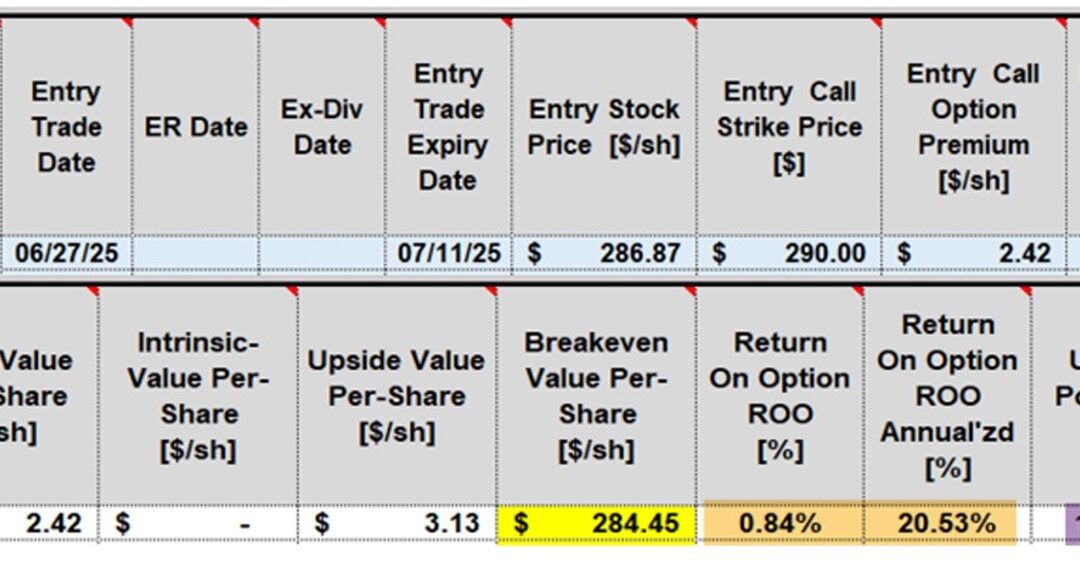

click ↑ 4 Featured Each week, BCI provides our premium members with a sample covered call writing or cash-secured put trade taken from one of Alan’s portfolios or from that of a member. These trades are all selected from the BCI premium member reports. In this...

Apr 12, 2025 | Covered Call Exit Strategies, Exit Strategies, Investment Basics, Option Trading Basics, Options Calculations, Options Trade Execution, Stock Option Strategies

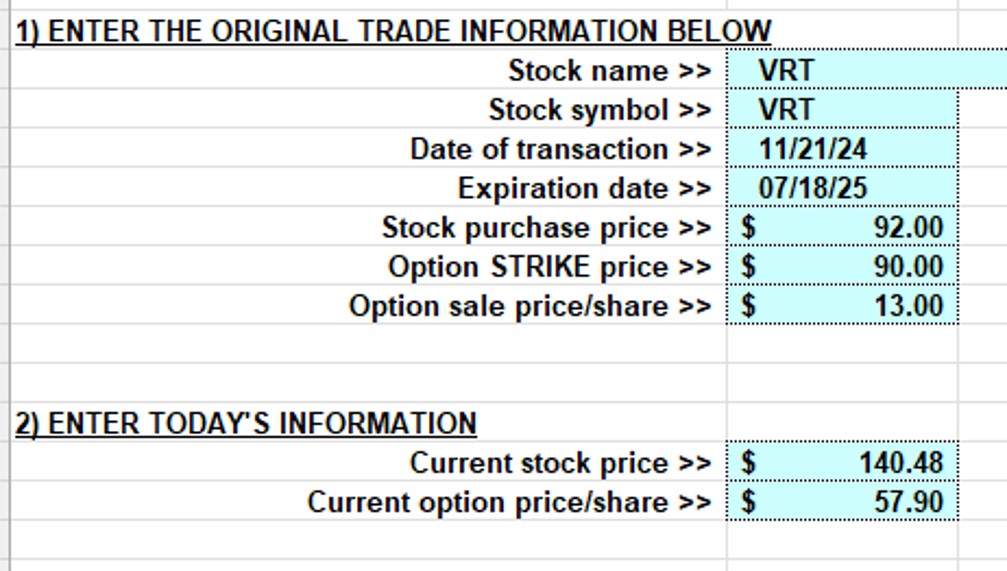

click ↑ 4 Featured The success of our covered call writing trades is, to a great extent, dependent on our position management skill set. One of the strategies in our exit strategy arsenal is the mid-contract unwind exit strategy (MCU). WE may close both legs of the...

Mar 22, 2025 | Covered Call Exit Strategies, Exchange-Traded Funds, Exit Strategies, Investment Basics, Option Trading Basics, Options Calculations, Options Trade Execution, Stock Option Strategies

click ↑ 4 Featured Rolling down is a frequently used covered call writing exit strategy to mitigate when share price declines. The original sold option is closed (bought back), while simultaneously opening another at a lower strike in the same contract cycle. When...