Jan 3, 2026 | Covered Call Exit Strategies, Exit Strategies, Investment Basics, Option Trading Basics, Options Calculations, Options Trade Execution, Stock Option Strategies

click ↑ 4 Featured When we execute multiple exit strategies in the same contract cycle using the same cash investment, the TMC will provide us with accurate individual trade calculations. But, what about total portfolio calculations? Yes, our TMC will also afford us...

Nov 22, 2025 | Covered Call Exit Strategies, Exit Strategies, Investment Basics, Option Trading Basics, Options Calculations, Options Trade Execution, Stock Option Strategies

click ↑ 4 Featured When a covered call trade is expiring in-the-money (ITM), we may have an opportunity to retain the underlying shares by rolling-out or rolling-out-and-up. The latter is a more aggressive form of rolling. This article will scrutinize a series of...

Nov 8, 2025 | Exit Strategies, Fundamental Analysis, Investment Basics, Option Trading Basics, Options Calculations, Options Trade Execution, Stock Option Strategies

click ↑ 4 Featured Portfolio overwriting is a covered call writing-like trading strategy. There are 2 distinctly defined goals: generating cash flow + retention underlying shares. Since deep out-of-the-money (OTM) strikes are used to align with the goal of share...

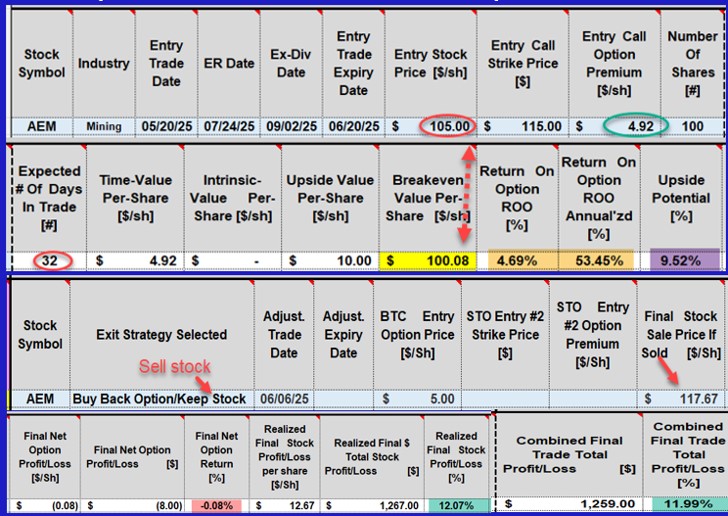

Oct 11, 2025 | Exit Strategies, Investment Basics, Option Trading Basics, Options Calculations, Options Trade Execution, Put-selling, Stock Option Strategies

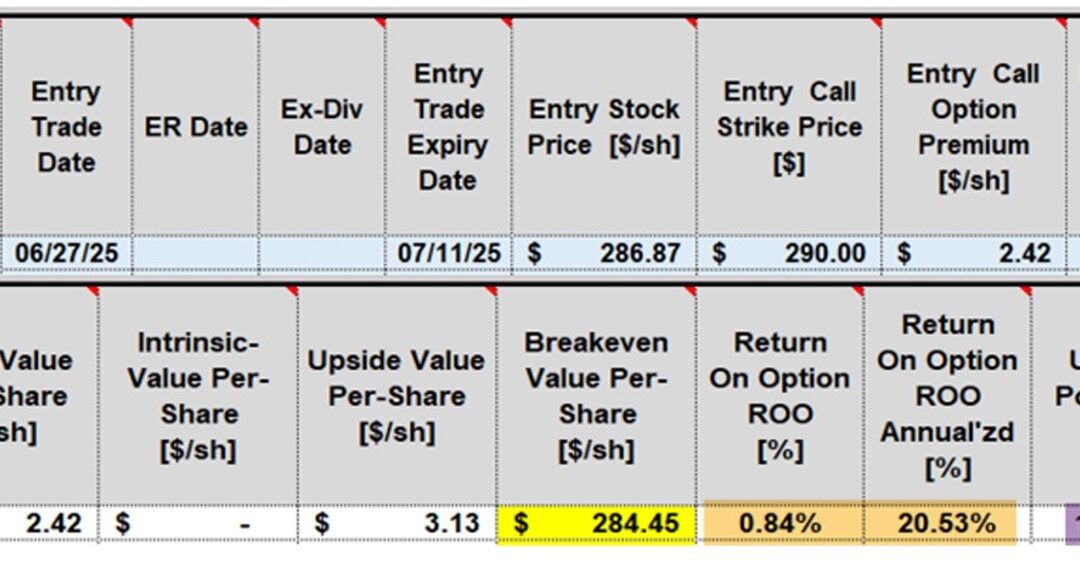

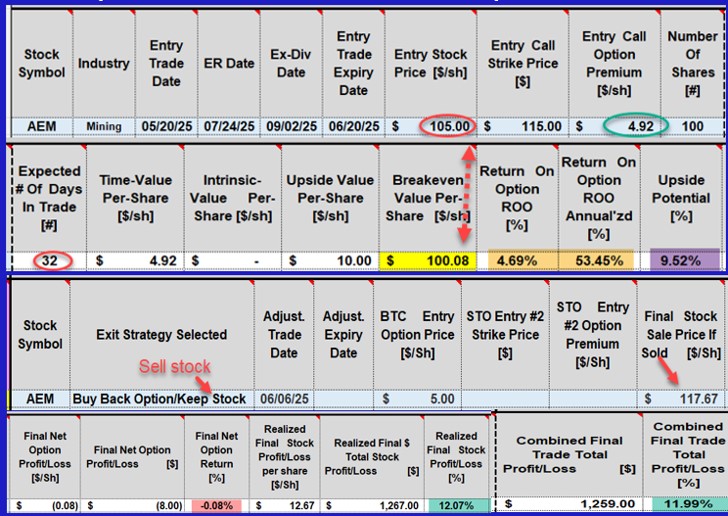

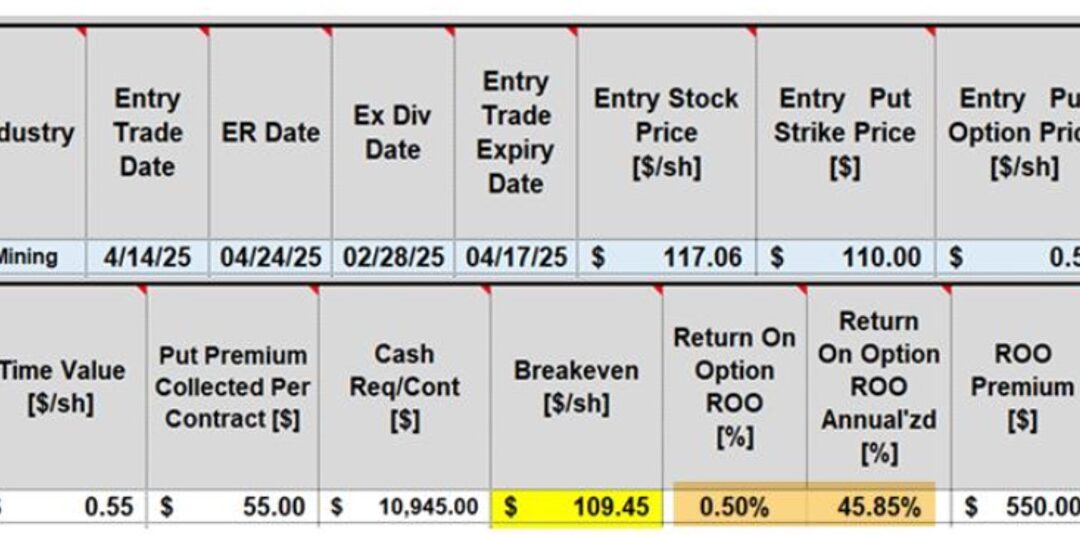

click ↑ 4 Featured Calculating our covered call writing and cash-secured put trades can range anywhere from really simple to way too complicated. In this article, an example of the latter will be analyzed. Thanks to our BCI Trade Management Calculator (TMC), these...

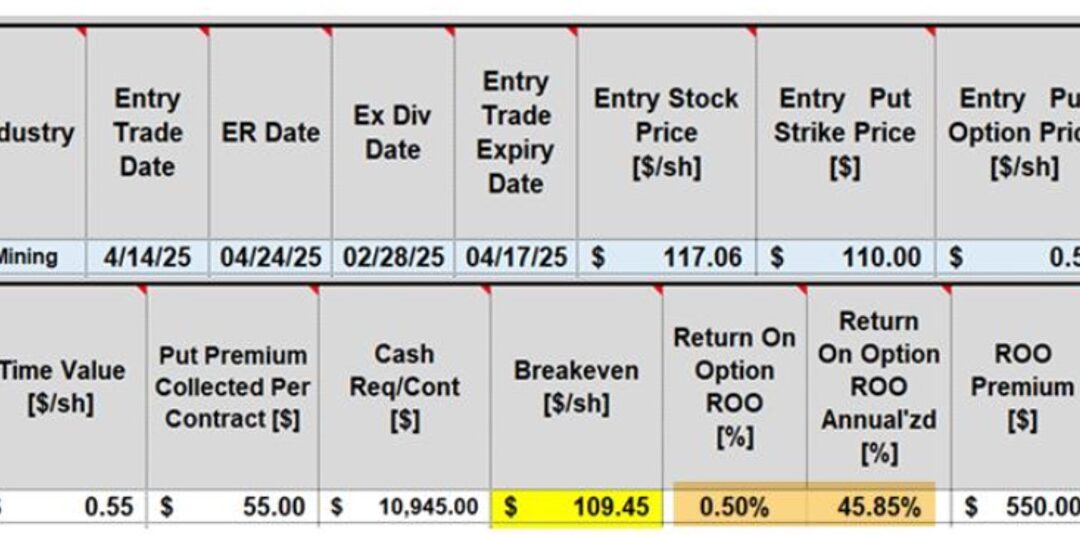

Aug 21, 2025 | Exit Strategies, Investment Basics, Option Trading Basics, Options Calculations, Options Trade Execution, Put-selling, Stock Option Strategies

click ↑ 4 Featured In bear and volatile markets, our cash-secured put trades (covered calls too) should be structured in a defensive manner. Greater protection to the downside typically means lower returns. That’s the tradeoff. We may opt for weekly trades which...

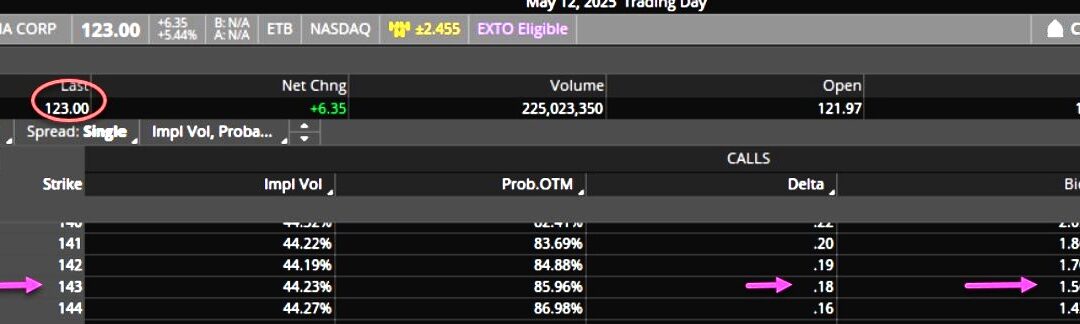

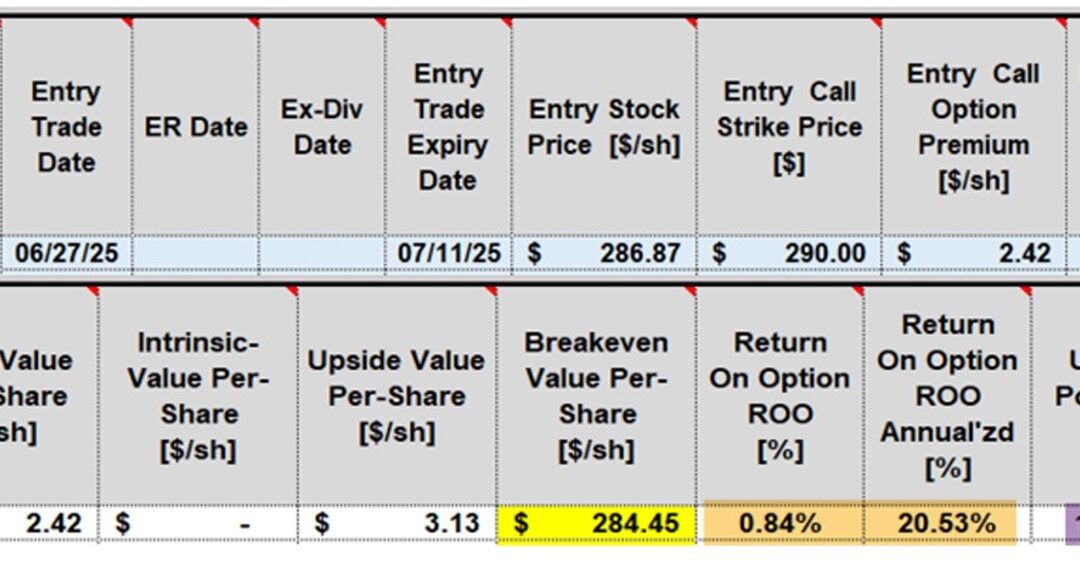

Jul 19, 2025 | Exchange-Traded Funds, Exit Strategies, Investment Basics, Option Trading Basics, Options Calculations, Options Trade Execution, Put-selling, Stock Option Strategies

click ↑ 4 Featured The most well-known form of cryptocurrency is Bitcoin. I am frequently asked about the use of crypto with our covered call and cash-secured put trades. In this article, a 1-week cash-secured put trade is analyzed, using Bitcoin, to construct a...