Oct 11, 2025 | Exit Strategies, Investment Basics, Option Trading Basics, Options Calculations, Options Trade Execution, Put-selling, Stock Option Strategies

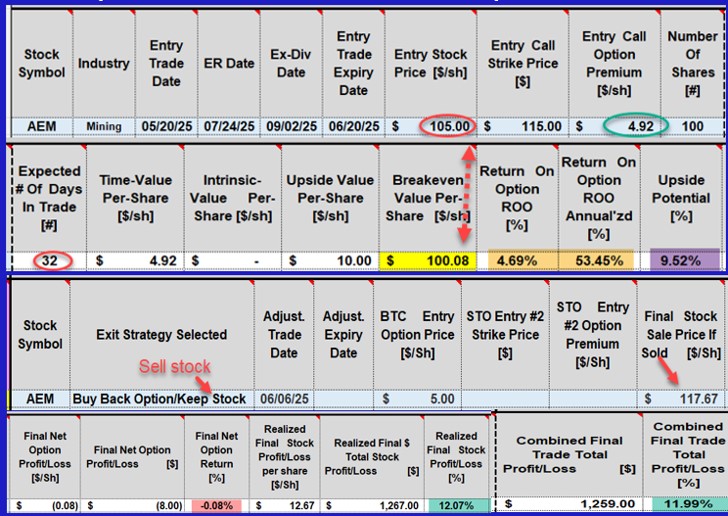

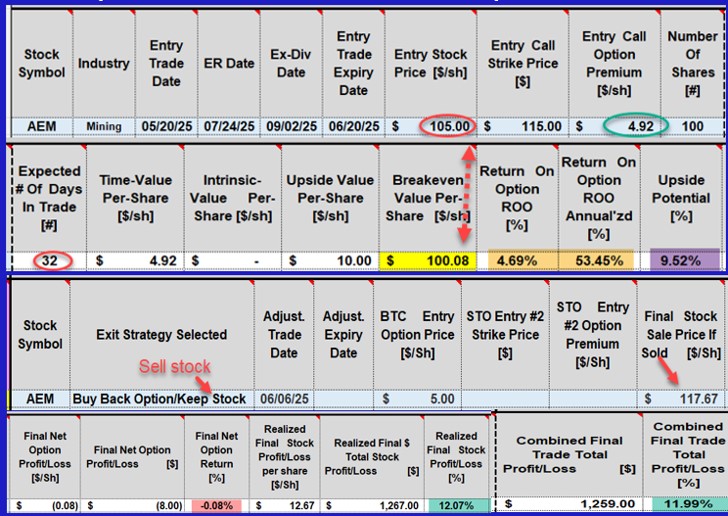

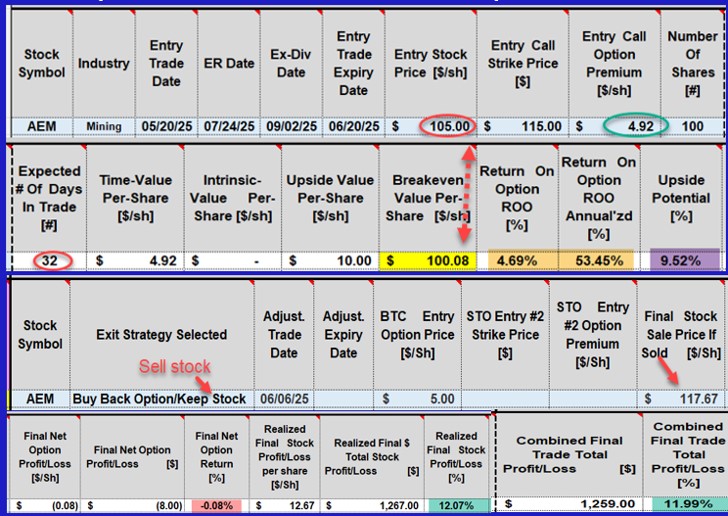

click ↑ 4 Featured Calculating our covered call writing and cash-secured put trades can range anywhere from really simple to way too complicated. In this article, an example of the latter will be analyzed. Thanks to our BCI Trade Management Calculator (TMC), these...

Oct 4, 2025 | Investment Basics, Option Trading Basics, Options Calculations, Options Trade Execution, Stock Option Strategies

click ↑ 4 Featured A common misconception made by many retail investors is that they make more money selling longer-dated options because the dollar amount is so much greater than shorter-dated choices. This article will provide an analysis to refute this fallacy. A...

Sep 27, 2025 | Fundamental Analysis, Investment Basics, Option Trading Basics, Options Calculations, Options Trade Execution, Stock Option Strategies, Technical Analysis

click ↑ 4 Featured Cash-secured put trades can be crafted conservatively by using deep out-of-the-money (OTM) strikes. On 5/27/2025, I executed such a 4-day trade with NetEase Inc. (Nasdaq: NTES), a stock on our premium member watch list at the time. This article will...

Sep 20, 2025 | Fundamental Analysis, Investment Basics, Option Trading Basics, Options Calculations, Options Trade Execution, Put-selling, Stock Option Strategies

click ↑ 4 Featured When establishing our covered call portfolios (cash-secured puts, too), our strike selection is influenced by current market conditions. In normal-to-bull markets, we favor out-of-the-money (OTM) strikes which allow for a 2-income stream potential...

Sep 13, 2025 | Investment Basics, Option Trading Basics, Options Calculations, Options Trade Execution, Put-selling, Stock Option Strategies

click ↑ 4 Featured When a cash-secured put is sold, we agree to buy the shares at the strike price by the expiration date. We, the option-sellers, determine those 2 parameters. In our BCI methodology, we favor out-of-the-money (OTM) put strikes. In bear and volatile...

Sep 6, 2025 | Fundamental Analysis, Investment Basics, Option Trading Basics, Options Calculations, Options Trade Execution, Put-selling, Stock Option Strategies

click ↑ 4 Featured In a recent article titled What is Quantifying Risk: Part I- Using Delta, one methodology of measuring the risk of our covered call writing and cash-secured put trades was analyzed. In this article, implied volatility (IV) will be investigated as...