Jan 10, 2026 | Fundamental Analysis, Investment Basics, Option Trading Basics, Options Calculations, Options Trade Execution, Put-selling, Stock Option Strategies

click ↑ 4 Featured When establishing our covered call writing & cash-secured put portfolios, there are several metrics we should use to minimize risk and enhance our overall returns. This article will identify and explain these critical resources. Checklist for...

Dec 27, 2025 | Fundamental Analysis, Investment Basics, Option Trading Basics, Options Calculations, Options Trade Execution, Put-selling, Stock Option Strategies

click ↑ 4 Featured It is not uncommon to attain greater than maximum returns when implementing our covered call writing exit strategies. In this article, a series of trades will be analyzed where the mid-contract unwind (MCU) exit strategy was employed to perfection....

Dec 20, 2025 | Exchange-Traded Funds, Fundamental Analysis, Option Trading Basics, Options Calculations, Options Trade Execution, Put-selling, Stock Option Strategies

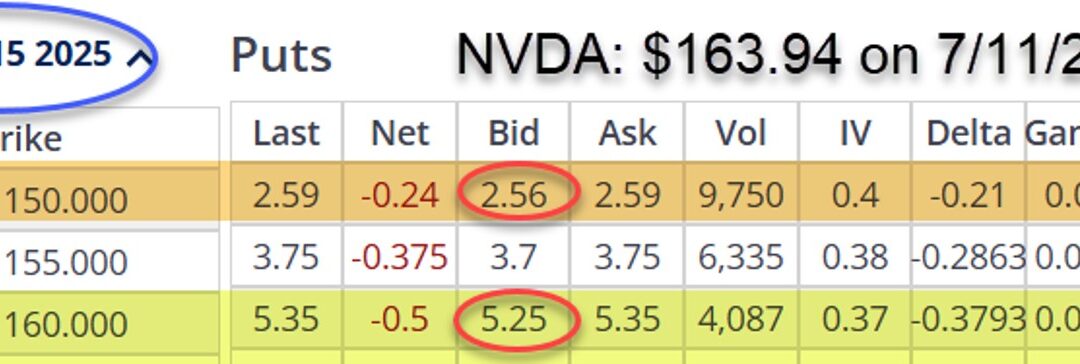

click ↑ 4 Featured When executing our cash-secured put trades in bear, volatile or uncertain market conditions, it is reasonable to structure our trades with lower breakeven price points. This will come at the expense of lower initial time-value returns. It is...

Nov 29, 2025 | Fundamental Analysis, Investment Basics, Option Trading Basics, Options Calculations, Options Trade Execution, Put-selling, Stock Option Strategies

click ↑ 4 Featured We enter a covered call trade and share price declines, but not enough to trigger our 20%/10% BTC/ GTC limit orders (exit strategy buyback price points). The option expires worthless. There may be confusion on 2 fronts: How do we calculate our...

Oct 25, 2025 | Investment Basics, Option Trading Basics, Options Calculations, Options Trade Execution, Put-selling, Stock Option Strategies

click ↑ 4 Featured When we structure our covered call trades in a defensive manner, we have 2 main goals in mind. We seek greater protection to the downside than traditional put trades and we strive for significant, although lower returns. We accomplish these goals by...

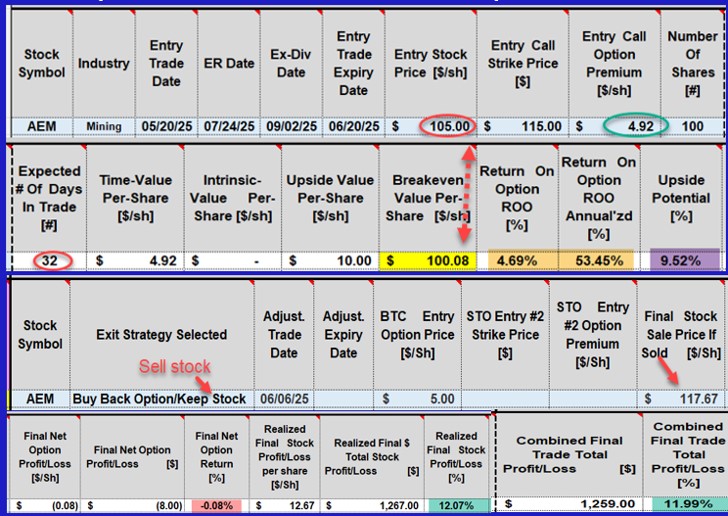

Oct 11, 2025 | Exit Strategies, Investment Basics, Option Trading Basics, Options Calculations, Options Trade Execution, Put-selling, Stock Option Strategies

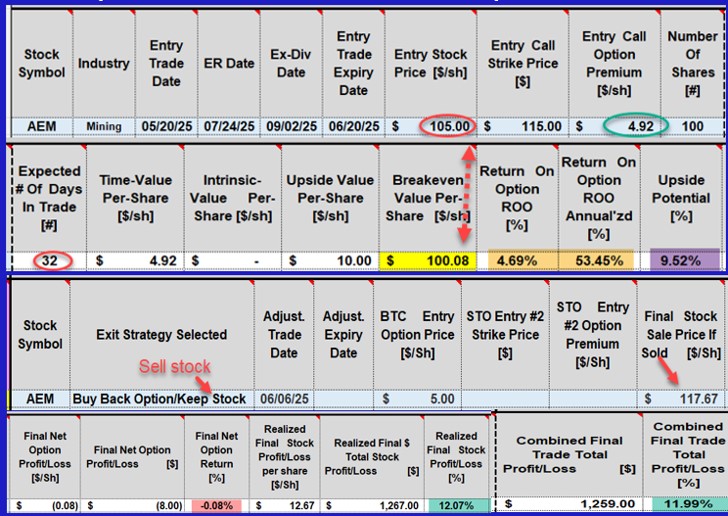

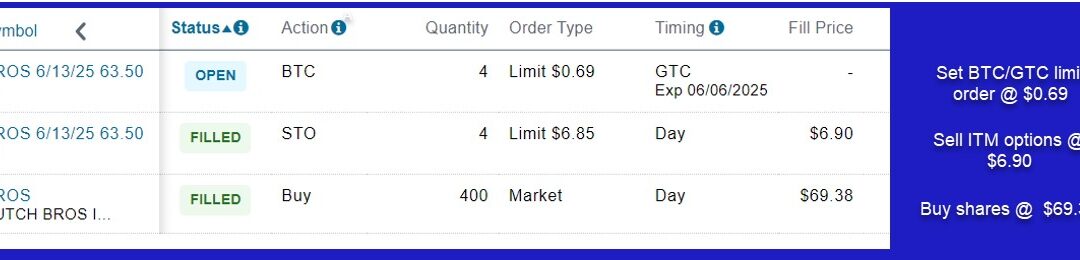

click ↑ 4 Featured Calculating our covered call writing and cash-secured put trades can range anywhere from really simple to way too complicated. In this article, an example of the latter will be analyzed. Thanks to our BCI Trade Management Calculator (TMC), these...