After selling an out-of-the-money (OTM) cash-secured put and then stock price accelerates substantially, the put value will decline. Share price and put value are inversely-related. This allows us to take advantage of our 20%/10% put-selling guidelines exit strategy discussed on pages 141 – 143 of my book, Selling Cash-Secured Puts. With this exit strategy, if we can retain 80% – 90% of our original option credit mid-contract, we close our short put position and use the newly freed up cash to secure a new put with a different underlying security. In April 2019, Haltore wrote to me with a put trade he was in with Nvidia Corp. (NASDAQ: NVDA). After entering the trade, NVDA moved up in price and Haltore was considering rolling up to a higher strike with the same expiration date. This would result in an additional option credit but the question he posed was is this a viable exit strategy maneuver?

Haltore’s trade with NVDA AS OF 4/16/2019

- 3/29/2019: NVDA trading at $177.25

- 3/29/2019: Sell-to-open the 1/17/2020 $155.00 OTM put for $12.07 (a LEAPS option was sold)

- 4/16/2019: NVDA is trading at $187.42

- 4/16/2019: Haltore is considering closing the $155.00 put strike and opening a $175.00 put strike expiring on the same date for an additional option credit

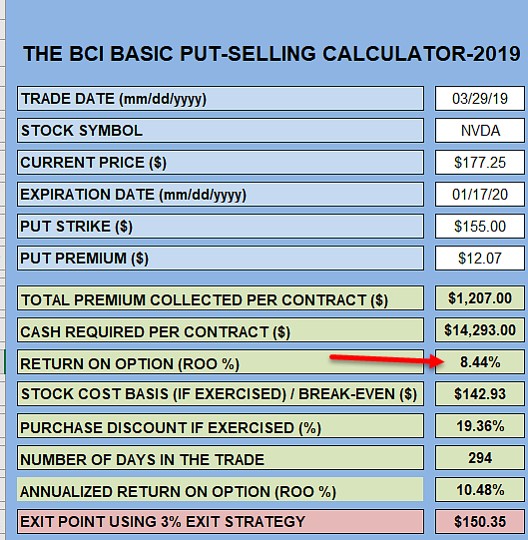

Initial trade structuring using the BCI Put Calculator

NVDA: Put Calculations with the BCI Put Calculator

The red arrow highlights the 294-day 8.44% initial time value return. With the stock currently trading at $187.42, the maximum return is looking good. The question is: should we roll up to a higher strike to generate an even higher return?

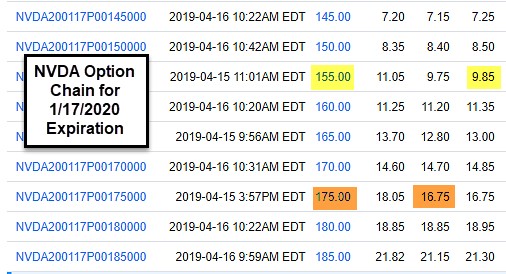

Option chain to roll up from the $155.00 strike to the $175.00 strike (1/17/2020 expirations)

NVDA: Put Option Chain for 1/17/2020 Expirations

Rolling up results in an option credit of $6.90 ($16.75 – $9.85) so why not pull the trigger?

Additional capital will be required to execute the second trade

Brokers will require cash to secure these puts using the following formula: (put strike – put premium) x 100 per contract

This comes to $14,293.00 for the $155.00 strike but the higher strike will require more capital:

($175.00 – $16.75) x 100 = $15,825.00 or an additional $1532.00 per contract

The breakeven moves up creating more risk

The breakeven (BE) is the (put strike – the put premium) x 100 per contract.

For the $155.00 strike the BE is $155.00 – $12.07 = $142.93

For the $175.00 strike the BE is $175.00 – 16.75 – $158.25, more than $15.00 higher.

Is there a better way to enhance results?

Consider selling shorter-term option, like Monthlys. If we annualize Monthlys versus longer-term expirations, we will win every time. Let’s view the option chain for the $175.00 1-month out NVDA put:

The 1-month option generates $3.85 or a 2.2%, 1-month return. This annualizes to 26.4% compared to the 10% annualized return that the original 10-month 8.4% return originally offered.

Discussion

Rolling up a deep OTM put option will add an additional option credit but will require additional cash added to the trade and additional risk as the breakeven price rises. Monthly options will offer greater annualized returns than longer-term options in addition to allowing us to re-assess our bullish assumption on the stock more frequently.

FREE Beginner’s Corner Tutorial for Covered Call Writing has Been Enhanced and Updated

Check it out: https://www.thebluecollarinvestor.com/beginners-corner/

0% Broker commissions

Almost all of the major brokerage firms—Charles Schwab (ticker: SCHW), E*Trade Financial (ETFC), Interactive Brokers Group (IBKR), and TD Ameritrade Holding (AMTD)—slashed equity-trading commissions to zero this week. (Fidelity and Vanguard seem to be holding out—for now.)

Your generous testimonials

Over the years, the BCI community has been incredibly gracious by sending our BCI team email testimonials sharing stories as to what our educational content has meant to their families. Moving forward, we have decided to share some of these testimonials in our blog articles. We will never use a last name unless given permission:

Alan,

I received on Friday at The Money Show your “best package” and the book, Stock Investing for Students. I am very excited on the new direction I am starting… You were by far the best presenter at The Money Show.

Thanks,

Andrew

Upcoming event

October 25th – 27th American Association of Individual Investors National Conference @ The Orlando Omni Resort @ ChampionsGate

BOOTH 314

Saturday October 26th workshop presentation: Covered Call Writing & the Stock Repair Strategies: 10:30 -11:45 AM

***********************************************************************************************************************

Market tone data is now located on page 1 of our premium member stock reports.

***********************************************************************************************************************

Hi Alan,

I am trying to use the Stock Repair Strategy with Option but I can not buy the option. Is this because I have Level 1 option trading with my brokerage (Vanguard). Do I need to get higher level?

With Level 1 , I can only Write Covered Calls, Buy Protective Puts and Write Covered Puts.

Thanks,

Ashvin

Ashvin,

Yes, you are correct. When we adopt the stock repair strategy, we are in a covered call position (log stock/short call) and in a call spread trade (long call/short call). The latter will require a higher level of trading approval which varies from broker-to-broker.

Call your broker to get the appropriate form to fill out to allow for this strategy.

Alan

Alan,

Would you have any comment or any training material on the strategy of combining covered call writing and cash secured put selling.

How to allocate assets between the two approaches.

Thanks

Clyde

Clyde,

We must select the strategy that meets our goals, trading style and personal risk-tolerance. For me, it’s covered call writing in most market conditions and the “PCP” strategy(combining put-selling with covered call writing) in bear and volatile markets. See the graphic below.

With the PCP strategy, we first sell an out-of-the-money cash-secured put which, if exercised, allows us to enter a covered call trade with the shares “put” to us. The percentage of call and put positions will be dictated by the number of put contracts exercised.

For more information on this PCP strategy see Chapter 16, pages 231 – 237, of my book, “Selling Cash-Secured Puts”

CLICK ON IMAGE TO ENLARGE & USE THE BACK ARROW TO RETURN TO BLOG.

Alan

Alan,

I’m new to options trading in the last 11 months and learning a lot via your books and membership to BCI. My whole life I’ve been a stock buyer and holder of equities. I have focused on “Dogs of the Dow” and low Price/Earnings stocks to be a value investor. I always know where the trailing 12 months PE ratio is for the S&P 500 and want to be below it in the stocks I pick to buy and hold.

Since I’ve been subscribed to your service I’ve been applying this same reasoning to the equities in which I sell options. My rule is not to sell options in equities with a PE higher than 20. My question is, does it matter in options trading where the PE is? You have a lot of selections that are BOLDED which have high PE’s, meaning they have better data than many which are less than 20 PE.

I look forward to your input. Thanks so much.

CHRIS

Chris,

Corporate fundamentals are incredibly important in the BCI methodology and PE ratio (price/earnings) is one metric that measures corporate fundamental health.

Many years ago, most investors would not buy a stock until an analysis of PE ratio was made. Then William O’Neil (of Investor Business Daily fame) wrote a series of books making a case for high PE stocks that had substantial growth potential and introduced the PEG ratio (PE/projected earnings growth). This leveled the playing field between blue-chip companies and growth stocks.

These growth companies will allow us to generate higher option returns but also represent higher risk because they tend to have a higher implied volatility (hence the higher premiums). These stocks are found in our weekly stock reports (along with others). For those looking for low PE or blue-chip stocks, I suggest focusing in on the premium Blue-Chip (Dow 30) Reports along with low PE stocks found in our weekly stock reports.

One size does not fit all and there is no right or wrong here. High PE stocks can represent great opportunities if they are consistent with our personal risk-tolerance and trading goals.

Alan

Hi Alan,

It’s me again! I’m very impressed with the stock screener and weekly report. Does each report have a 3 week expiration period?

Also, for covered call writing, I’m looking to earn consistent income from the premiums. Based on this goal, I believe I should only select stocks that are trending sideways so that the contract expires. If they are uptrending, there’s too much of a chance of being called out.

What do you think? (I understand you are not giving individual stock advice).

Have a great day, and thank you.

– Ted

Ted,

Our Weekly Premium Stock reports are structured based on when their earnings reports are due to be made public… by contract (not calendar) month.

Relating to the report that came out last night, the stocks in the gold cells on top (ending in solid black line) report earnings in the current October contract month.

Stocks from EDU through CZZ are due to report earnings during the November contracts and are separated by the broken black lines. This will allow us to plan for when we use these “eligible” candidates.

Sideways-trending stocks are perfectly acceptable but not preferable to uptrending stocks. Let’s say we write an OTM call on an uptrending stock. We now have the opportunity to generate 2 income streams: one from option premium and the other from share appreciation. This best-case scenario can best be realized with uptrending stocks.

Now, if shares are called away (we can always buy back the option to avoid this), so what? We have realized our maximum return goal… it’s all good. One possible exception is if we own the shares at a low cost-basis in a non-sheltered account and may be susceptible to tax consequences. In this case, we “tweak” the covered call strategy to “portfolio overwriting” and take a slightly different approach.

Alan

Hi Alan,

It’s me again. When I do weeklies I usually go out 4 days maybe eleven. Some times 1 or 2 days depending on the premiums, the stock and the markets. If I can pick up 2 to 3 % annualized and get out ahead I’ll write the trade. I only do that with stocks like AAPL, DE, MSFT and similar. I know it sounds like craps at the casino, but I’ve had some good returns. Seldom go out more than 1 or 2 weeks. Also with the present markets swings if the calls are exercised I’ll buy back the stock or roll before they’re exercised with profits and may sell more calls. It keeps me busy.

So when in the week and time of day do you advise writing the call trades?

Best,

Richard

Richard,

Because of Theta (time-value erosion, I like to write Monthly calls on Monday or Tuesday of the new contract (after expiration Friday) and on Monday for Weeklys (I favor Monthlys). I enter these trades between the hours of 11 AM and 3 PM ET to avoid the volatility of early morning and late afternoon computerized institutional trading.

I roll options in the afternoon of expiration Friday when possible.

Alan

Premium Members,

This week’s Weekly Stock Screen And Watch List has been uploaded to The Blue Collar Investor premium member site and is available for download in the “Reports” section. Look for the report dated 10/04/19.

Also, be sure to check out the latest BCI Training Videos and “Ask Alan” segments. You can view them at The Blue Collar YouTube Channel. For your convenience, the link to the BCI YouTube Channel is:

http://www.youtube.com/user/BlueCollarInvestor

Best,

Barry and The Blue Collar Investor Team

barry@thebluecollarinvestor.com

Hello Alan:

I was wondering how you approach what strike to select for ITM and OTM calls.

I tend to do a lot of laddering. In many cases I own 300 shares and depending on the market environment I will do the following:

In what looks to be a favorable environment I might do 2 delta 0.4 calls and perhaps a delta 0.3 or even a delta 0.27 (or so) call. Of course it depends on what call delta values and what the IV are available when I am opening the position(s).

In a market with an unfavorable bias , but not a heavily one, I might do a 0.58 ITM call, a 0.45 OTM call and a OTM 0.40 call or depending on the IV a 0.35 delta call (reaching in case unanticipated positive action).

In a market where I feel a lot of caution is warranted I might do a 0.62 delta call , a 0.50 and perhaps a 0.45 delta call.

In a very favorable environment I might so a 0.40 delta call, a 0.35 (or so , and then a 0.26 or so.

My question to you is: Do you think this approach is too commission intensive ? More importantly I am concerned that the spread of my ladder may be too tight or perhaps too loose.

Do you have any opinions on this? When you are looking for downside protection on a weekly call how deep in the money do you think its best to go? Because one sacrifices premium for protection, I don’t like to go too deep. Similarly I am wondering about thoughts with respect to OTM calls. Do you have a range limit with respect to the upside strike or upside delta call?

I tend to sell weeklies, but have been venturing into longer dated 2-4 weeks out calls as well. I am inclined to believe that a wider ladder , at least to the upside , might be beneficial on the longer dated calls.

Any opinion you have on this , or if you direct me to any info on the topic, I am grateful.

Asa always….

Best regards,

Ed

Ed,

Your questions reflect a great sophistication and understanding of the covered call writing strategy. I am a big proponent of “laddering strikes” when selling multiple contracts.

Let me offer another approach to strike selection that is related to but not specifically based on Delta. Before we decide on entering our trades, we must set our trade goals. What is the initial time-value return goal range? How much downside protection can I generate at the expense of time-value profit, if bearish. How much upside potential can I generate at the expense of initial time-value profit, if bullish?

1. Determine the “moneyness” or mix of “moneyness” we are seeking based on overall market assessment, chart technicals and personal risk-tolerance. Then check an option-chain for strikes that generate our pre-determined initial time-value return goal range.

2. Let’s say our initial time-value return goal range for Monthlys is 2% – 4%. If we are extremely bullish we would tend to the 2% end of the range which offers greater upside potential. If mildly bullish, lean to the 4% end of the range. If we are extremely bearish, we favor the 2% end of the range for ITM strikes which offers greater downside protection. If mildly bearish we can move closer to ATM.

3. This approach will allow us to set up our trades to achieve our goals without being “married” to specific Deltas although each strike will obviously have a Delta and probably pretty close to the stats you presented in your question.

I believe that by incorporating “moneyness” decisions and initial time-value return goals into our strike selection process, we are structuring our strategy specifically on our investment goals…. here’s our goal and this is the strike that gives us the best chance to achieve it.

Alan

Hi Alan

I have question about sell cover call

I own corning (GLW) stock and I want to sell cover call but Corning earning will be in Oct 29 2019. The current price of GLW is 28.02. I see 2 call that I interest in are the Nov 1 2019 28.50 with price of.86 and Nov 15 2019 29.00 strike price with price of .77. Which call do I can sell?

thanks,

Quan

Quan,

In our BCI methodology, we must avoid earnings reports, 10/29 in this case. The eligible expiration date prior to this report is 10/25. If returns do not meet our target goal range, we wait until the report passes and make our selections based on this initial time-value return goal.

Alan

Hi Alan,

I’m considering placing a covered call trade for TMHC which passed all of the screens. I’m a bit worried that it hit a 52 week high and that the current volume is only 125,000 shares. In terms of the volume requirements, is it better to wait for “Today’s” volume to increase or go with the average 10 day volume? I’m not asking for stock advice, just wondering about volume parameters.

– Ted

Ted,

Early in the trading day, we expect trading volume to be low. We focus more in on average daily trading volume. In the case of TMHC, it’s > 1 million shares per day as shown in the screenshot below. The BCI guidelines is for 250,000 shares per day or more.

Trading volume is not a reason to eliminate this stock from our consideration.

CLICK ON IMAGE TO ENLARGE & USE THE BACK ARROW TO RETURN TO BLOG.

Alan

Alan – what do you think of these online brokerage firms going “commission-free” on trades and options? There’s got to be a catch somewhere. How are they going to do business if they don’t charge for their service? I think they will increase other fees that we aren’t being told about.

Thank you for what you and the BCI team are doing for investors!

Becky

Becky,

The move to 0% commissions was inevitable as brokers fight for our business. The trend was, indeed, our friend. For many of these brokerages, trading commissions represented a small percentage of their revenues.

You do bring out a good point that they will be looking to make up for the losses. I would anticipate a lowering of interest rates on cash balances in our accounts, sale of “order flow” where brokerages sell the right to see the trades they are executing to institutional traders and perhaps making profits on bid-ask spreads.

The competition for our business among brokerages turns out to result in a big win for retail investors. Let’s keep an eye on cash balance interest.

Alan

I think that in Schwab’s case for example that they make money in their banking. The cash in client’s accounts is swept into funds that is in their bank. They pay you 0.55% interest and lend that money out at about 2% interest.

Also in their robo advisor accounts there is always a portion recommended to be in cash. Again that cash goes into Schwab bank.

Best;

Terry

Hi Terry,

Yes you are correct. I saw somewhere that retail trading commissions were 6.8% of their revenues. While that seems small it fact it is not. Most enterprises who lost 6.8% of revenues would hurt immensely and their stock would take a large hit.

Also this 6.8% of revenue(10.13billion in 2018) would equal to $688 million in 2018. Their gross margin in 2018 was 90.25%. Their net profit was 31.85%. While I am sure the gross margin and net profit margin on retail trading commissions was somewhat greater than overall operations if we just left it at overall rates that would represent a $47 million reduction in net profits.

Ooops. Just saw where Schwab said commissions were 4% of revenues or about $100 million per quarter. This is lower than I had originally heard.

Whether or not they will attempt to tweak the margins of retail trading our transaction costs as retail traders has been greatly reduced. Schwab is still maintaining it $0.65 per contract options fee. Most other brokers are at $0.50 per contract. They will also still charge commissions on overseas stock and extremely large transactions which require more attention. Certainly will not apply to me.:)

For me the commission was more of a psychological barrier rather than a financial barrier. Not being computers, try as much as we do, we still allow psychological things to affect our trading. This can only help us be better traders.

Thanks for your input.

Hoyt

Hi Alan,

I’m having trouble understanding the 20/10 rule for buying to close the covered call. If the option premium drops to 20% of what I sold it for, why buy it back? I’m just having trouble understanding the mechanics of it.

I understand Call Option premiums decrease as the stock price decreases.

– Ted

Ted,

By closing the short call mid-contract, we are creating exit strategy opportunities. We can look to “hit a double”, roll-down or sell the stock depending on the guidelines set up in my books and DVDs.

We do so while retaining 80% – 90% of the original option premium profit.

Let’s say we sell an option for $2.00. We buy back the short call at $0.40 or less in the first half of the contract or $0.20 or less in the latter part of the contract.

Once the original short call is closed, we are simply share owners now with the opportunity to mitigate losses or turn losses into gains.

Alan