When a cash-secured put is sold, we agree to buy the shares at the strike price by the expiration date. We, the option-sellers, determine those 2 parameters. In our BCI methodology, we favor out-of-the-money (OTM) put strikes. In bear and volatile markets, deeper OTM strikes will offer greater protection to the downside. In this article, a real-life example with Palantir Technologies Inc. (Nasdaq: PLTR) will be analyzed to demonstrate trade entry and management as share price accelerated and the option was rolled-up for additional cash premium returns.

Real-life weekly example with PLTR (from1 of Alan’s portfolios)

- 4/21/2025: PLTR trading at $90.49

- 4/21/2025: STO 4 x 4/25/2025 deep OTM $79.00 put strike at $0.52 ($208.00)

- 4/23/2025: BTC 4 x 4/25/2025 $79.00 put at $0.02 (as share price rose exponentially)

- 4/23/2025: STO 4 x 4/25/2025 $98.00 puts at $0.33 for an additional net credit of $124.00 ($31.00 x 4)

- 4/25/2025: PLTR closed at $112.78 causing the $98.00 put to expire worthless, the best-case scenario

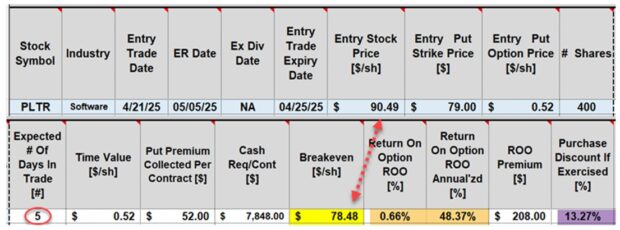

PLTR initial trade calculations with our Trade Management Calculator (TMC)

- Red circle: 5-day trade

- Yellow cell: Breakeven price is $78.48 (from $90.49)

- Brown cells: Initial 5-day return is 0.66%, 48.37% annualized

- If share price dips below the $79.00 strike and no exit strategy intervention is executed, the share will be put to us at a discount of 13.27%- purple cell ($78.48)

Broker statement confirmation of rolling-up trade

Final realized trade results

- Total premiums: $340.00 ($208.00 + $132.00, less miniscule trade commissions)

- Cost basis: $38,868.00 (cash required to secure 4 puts)

- 5-day realized, unexercised return = 0.88% = 64.24% annualized

Discussion

Significant returns can be generated even with a 5-day defensive cash-secured put trade. Option trades can be crafted to align with all market environments. In the case of PLTR, returns were still robust due to the high implied volatility and the rolling-up opportunity.

Alan Ellman’s Complete Encyclopedia For Covered Call Writing- Classic Edition

- Over 500 pages packed with solid information, no useless filler material

151 charts and graphs most of which are in color for better visualization

Chapter outlines to summarize the material located in each chapter - Questions and answers at the conclusion of each chapter to highlight the key points

14 appendixes to supplement the information found in the 20 chapters

4 flow charts that summarizes the stock selection and exit strategy processes.

Your generous testimonials

Over the years, the BCI community has been incredibly gracious by sending our BCI team email testimonials sharing stories as to what our educational content has meant to their families. Moving forward, we have decided to publish several of these testimonials in our blog articles. We will never use a last name unless given permission:

Hi Alan – thank you so much…I appreciate you, Sir!

Upcoming events

1. BCI Educational Series Webinar # 8: New Credit Spread Calculator

Thursday September 18,2025

8 PM ET – 9:30 PM ET

Over the past 2 years, BCI has been developing and beta-testing a 1-of-a-kind spreadsheet for entering and adjusting our credit spread trades. Like our Trade Management Calculator (TMC), our goal was to make it the industry standard. Only you can decide if we accomplished our mission.

Alan & Barry will introduce this product, review all the tabs inherent in the spreadsheet and demonstrate how to use it. A 1-time early order discount will also be offered.

For those who trade, or are interested in learning how to trade, credit spreads, this is a must-see webinar.

Click here to register for free.

2. Orlando Money Show

Orlando Resort @ ChampionsGate

October 16 – 18, 2025

- Opening ceremony keynote address

- 45-minute workshop class: Traditional & Low-Risk Covered Call & Cash-Secured Put Trades

3. Money Masters Symposium Sarasota Florida

December 1 – 3,2025

Setting Up Option Portfolios Using Stock Selection, Diversification, Cash Allocation and Calculations

Analysis of 6 covered call writing trades

Minimize risk and maximize returns. These are our 2 main goals when crafting our option portfolios. There are several factors we can utilize which will put ourselves in an outstanding position to achieve these objectives. Here is a summary of those factors which will be addressed during this presentation:

- Select elite-performing stocks and ETFs

- Diversity stock positions as well as their industries

- Allocate a similar amount of cash per-position

- Ensure that initial calculations align with strategy goals and personal risk-tolerance

- Once trades are entered, go into position management mode- be prepared for exit strategy opportunities

Registration link to follow.

Premium Members,

This week’s Weekly Stock Screen and Watch List has been uploaded to The Blue Collar Investor Premium Member site and is available for download in the “Reports” section. Look for the report dated 09/12/25.

Be sure to check out the latest BCI Training Videos and “Ask Alan” segments. You can view them on The Blue Collar YouTube Channel. For your convenience, the link to the BCI YouTube Channel is:

https://www.youtube.com/user/BlueCollarInvestor

Barry and The Blue Collar Investor Team