Aug 29, 2020 | Investment Basics, Option Trading Basics, Options Calculations, Options Trade Execution, Put-selling, Stock Option Strategies

Selling cash-secured puts is a strategy similar to, but not precisely the same, as covered call writing. In February 2020, Chevy wrote to me asking for an article or video addressing weekly cash-secured puts, a strategy he was using and looking to enhance. The...

Aug 10, 2019 | Investment Basics, Option Trading Basics, Options Calculations, Put-selling, Stock Investing, Stock Option Strategies

Selling cash-secured puts is one of the go-to strategies in the BCI methodology. There has been some confusion for some of our members who conflate this strategy with covered puts, a completely different strategy. This article will define and compare the two...

May 11, 2019 | Exit Strategies, Investment Basics, Option Trading Basics, Options Calculations, Put-selling, Stock Investing, Stock Option Strategies

Selling cash-secured puts can be used to generate monthly cash flow and to buy a stock at a discount. It can also be used to lower the cost-basis of shares already owned. In November 2018, John shared with me a trade he was in with Halliburton Company (NYSE: HAL)...

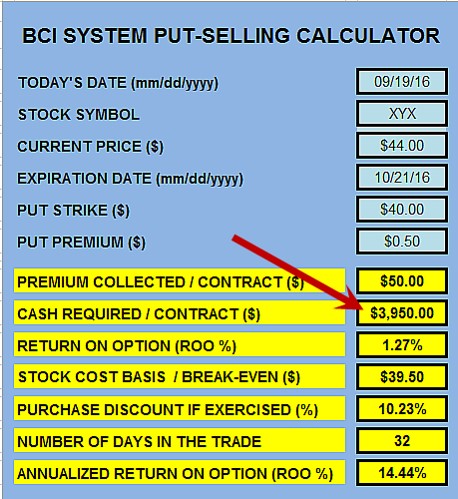

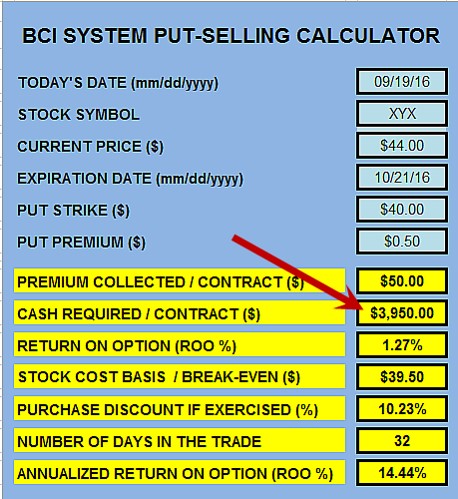

Mar 11, 2017 | Investment Basics, Option Trading Basics, Options Calculations, Put-selling, Stock Option Strategies

Whether I am selling call or put options I prefer to use a cash account. That’s where we invest and utilize only our own cash to purchase stock and secure put trades. More aggressive investors may want to magnify their returns by leveraging margin accounts. This...