I favor cash-secured put trades in volatile, bearish and volatile market conditions. I also use puts to enter covered call trades (PCP, Put-Call-Put or “wheel” strategy). In this article, real-life examples with Celestica Inc. (NYSE: CLS) will be analyzed to demonstrate how to enter such trades with initial and final calculations.

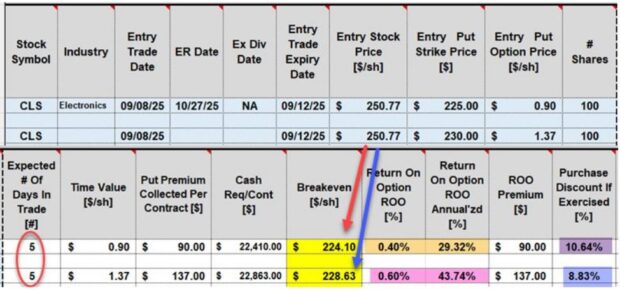

Real-life example 5-day trades with CLS from 9/8/2025 – 9/12/2025

- 9/8/2025: CLS trading at $250.77

- 9/8/2025: The 9/12/2025 $225.00 put strike had a bid price of $0.90

- 9/8/2025: The 9/12/2025 $230.00 put strike had a bid price of $1.37

- 9/12/2025: At contract expiration, CLS closed at $241.77, down substantially from the price at trade entry but well above both OTM put strikes

CLS 3-month comparison price chart with the S&P 500 at trade entry

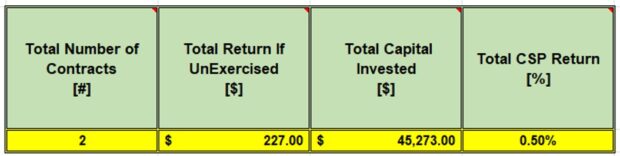

Initial & final trade calculations (both strikes expired OTM and worthless): Trade Management Calculator

- OTM $225.00 put: $90.00 time-value premium (1 contract)

–0.40%, 29.32% annualized

–Protection to BE ($224.10): 10.64%

- OTM $230.00 put: $137.00 time-value premium (1 contract)

–0.60%, 43.74% annualized

–Protection to BE ($228.63): 8.83%

- Total time-value premium collected for 2, 5-day contracts: $227.00

5-day initial & final returns

- 0.50% (max return) annualized = 52% annualized

Discussion

- Significant returns can be generated with 5-day defensive cash-secured put trade

- Option trades can be crafted to align with all market environments and personal risk tolerance

- In the case of CLS, significant initial 5-day returns were captured and realized

- These are low-risk, not no-risk trades

- I refer to the process of using multiple strikes with the same underlying security and expiration date as laddering strikes

Selling Cash-Secured Puts

The purpose of this book is to give the reader the tools to master a conservative stock and option strategy with the goals of generating monthly cash flow and focusing in on capital preservation. Selling cash-secured puts is a low-risk strategy that leverages high-quality stocks and exchange-traded funds to accomplish these objectives.

Click here for more information.

Free training resources

Your generous testimonials

Over the years, the BCI community has been incredibly gracious by sending our BCI team email testimonials sharing stories as to what our educational content has meant to their families. Moving forward, we have decided to publish several of these testimonials in our blog articles. We will never use a last name unless given permission:

1. Long Island Stock Investors Meetup Group: Part I

Thursday February 12, 2026

7:30 PM ET – 9:00 PM ET

Credit Spreads for Bull & Bear Markets

Introducing Our Latest Products, Creating New Investment Opportunities

2. Las Vegas Money Show- 2 presentations

February 23 – 25, 2026

The Collar Strategy: Covered Call Writing with Protective Puts

Protecting covered call trades from catastrophic share loss

This is the strategy Bernie Madoff pretended to use. He called it the split strike conversion strategy, but it was simply a collar. The covered call sets a ceiling on the trade and the protective put guarantees a floor on the trade

Topics discussed

- What is the collar strategy?

- Uses for the collar

- Entering a collar trade

- Option basics for calls

- Option basics for puts

- Real-life example with NVDA

- What is an option-chain?

- Real-life example using the BCI Trade Management Calculator (TMC)

- Strategy pros & cons

- Educational products & discount coupon

- Q&A

Selling Cash-Secured Puts to Buy a Stock at a Discount or to Enter a Covered Call Trade

2 outcomes & 4 applications

Selling cash-secured puts is a low-risk option-selling strategy which generates weekly or monthly cash-flow. This presentation will detail how to craft the strategy to generate cash flow, buy a stock at a discounted price or to initiate a covered call trade. Topics included in the webinar include:

- Option basics

- The 3-required skills

- 4-practical applications

- Traditional put-selling

- PCP (Put-Call-Put or wheel) Strategy

- Buy a stock at a discount instead of setting a limit order

Real-life examples along with rules, guidelines and calculations are included in this presentation.

Time, date & registration link.

3. Palm Beach Traders Club

March 10, 2026

6:30 PM – 8 Pm ET

Private Investment Club / guests are welcome (free)

Wine-tasting event follows for those interested.

4. Long Island Stock Investors Meetup Group: Part II

Thursday March12, 2026

7:30 PM ET – 9:00 PM ET

Ultra-Low-Risk Approaches to Covered Call Writing & Selling Cash-Secured Puts

Introducing Our Latest Products, Creating New Investment Opportunities

5. Hollywood Florida Money Show

April 10, 2026

11:40 AM – 12:25 PM

The Put-Call-Put (PCP) or Wheel Strategy

Using Both Covered Call Writing and Put-Selling to Generate Monthly Cash Flow

Selling stock options is a proven way to lower our cost-basis and beat the market on a consistent basis. Two such low-risk strategies are covered call writing and selling cash-secured puts. This presentation will detail how to incorporate both strategies into one multi-tiered option-selling strategy where we either generate cash-flow or buy a stock at a discount. I refer to this as the Put-Call-Put (PCP) Strategy, also referred to as the wheel strategy.

The basics and pros and cons of low-risk option-selling strategies will be discussed as well as an analysis of a real-life example and introduction into the BCI Trade Management Calculator (TMC). This seminar is appropriate for those who look to generate modest, but consistent, returns which will enable us to potentially beat the market on a consistent basis while focusing on capital preservation.

More details to follow.

6. Young Investor’s Club at The University of Central Florida

April 16, 2026

Private student investment club.

7. Sarasota Investment Group

Portfolio Overwriting: A Form of Covered Call Writing

Wednesday April 22, 2026

Details to follow.

8. BCI Educational Webinar #10: The Put-Call-Put (PCP) or “Wheel Strategy”

Thursday May 14, 2026, at 8 PM ET

Using both covered call writing & cash-secured puts in a multi-tiered option selling strategy. A 68-day real-life example taken from one of Alan’s portfolios will be analyzed.

BONUS: Barry will share a real-life credit spread trade using our BCI Conservative Credit Spread Management System.

Discount coupons a live Q&A session will follow the presentation.

9. Orlando Money Show

October 5 – 7, 2026

Details to follow.