One of the more common oversights made by retail investors is their focus on premium dollar amounts rather than annualized returns. I consider this “dollar distraction” the shiny object that prevents us from focusing on the more pertinent annualized returns. In this article, I will be analyzing real-life examples with NVIDIA Corp. (Nasdaq: NVDA) to demonstrate how to avoid these shiny objects.

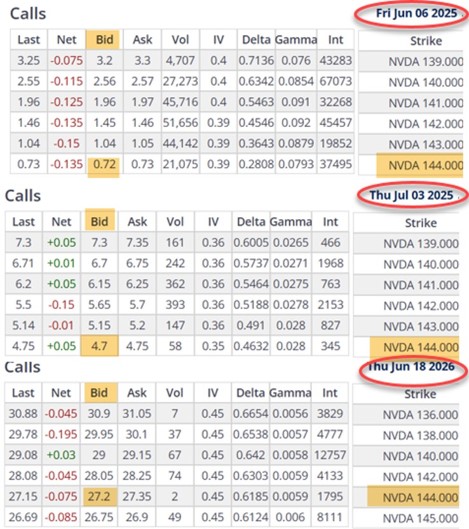

NVDA data on Jun 4, 2025

- NVDA trading at $141.39 on 6/4/2025

- The 6/6/2025 $144.00 call has a bid price of $0.72

- The 7/3/2025 $144.00 call has a bid price of $4.70

- The 6/18/2026 $144.00 call has a bid price of $27.20

- Can you see how enticing that 6/18/2026 premium can be for retail investors? Me too

NVDA 3-Option-Chains on 6/4/2025

NVDA Initial Calculations of the 3 Expiration Dates

- Calculations using the BCI Trade Management Calculator (TMC)

- The shortest-term 6/6/2025 expiration shows an initial 3-day return of 0.51%, 61.96% annualized

- The 30-day initial return is 3.32%, 40.44% annualized

- The longest-term, 380-day LEAPS initial return is 19.24%, 18.48% annualized

- We must avoid the “shiny object” dollar amount return from long-dated options and focus on the annualized returns

Discussion

When crafting our covered call trades, we must concentrate on the annualized returns, not the actual premium dollar amount. Even the initial % return must be viewed in the context of the time frame of the trade. For example, a 2% initial return r a 1-month contract obligation is appropriate for many of us. However, a 2% 6-month return just doesn’t cut it for a majority of retail investors. Watch out for the shiny object!

Covered Call Writing Package

Covered Call Writing Package – 5 Part Streaming Video Series + 137-Page Downloadable Companion Workbook

Our objective was to create the most complete and comprehensive video program on covered call writing found anywhere. The 4-set video curriculum takes us through the 3-required skills: stock selection, option selection, and position management. The 4th section highlights special circumstances like writing calls against long-term buy-and-hold portfolios.

You Will Learn:

– How to locate the greatest performing stocks for option-selling

– Which Is the best option to sell

– How To calculate your returns

– How To utilize exit strategies – Decrease losses & enhance gains

Free E-book on covered call writing

Use in conjunction with our Beginners Corner free video series on covered call writing (Free training link above)

Your generous testimonials

Over the years, the BCI community has been incredibly gracious by sending our BCI team email testimonials sharing stories as to what our educational content has meant to their families. Moving forward, we have decided to publish several of these testimonials in our blog articles. We will never use a last name unless given permission:

Alan & Barry,

I hope this finds you both well.

| Month | Trades | Winners | Losers | Income |

| June | 17 | 13 | 4 | $ 3,174 |

| July | 16 | 16 | 0 | $ 1,737 |

| August | 19 | 17 | 2 | $ 2,962 |

| Sept | 15 | 15 | 0 | $ 2,231 |

| October | 9 | 9 | 0 | $ 2,045 |

| 5 Mo. Totals | 76 | 70 | 6 | $ 12,149 |

1. Money Masters Symposium Sarasota Florida

December 1 – 3,2025

Setting Up Option Portfolios Using Stock Selection, Diversification, Cash Allocation and Calculations

Analysis of 6 covered call writing trades

Minimize risk and maximize returns. These are our 2 main goals when crafting our option portfolios. There are several factors we can utilize which will put ourselves in an outstanding position to achieve these objectives. Here is a summary of those factors which will be addressed during this presentation:

- Select elite-performing stocks and ETFs

- Diversity stock positions as well as their industries

- Allocate a similar amount of cash per-position

- Ensure that initial calculations align with strategy goals and personal risk-tolerance

- Once trades are entered, go into position management mode- be prepared for exit strategy opportunities

2. BCI Educational Webinar #9

Thursday January 15, 2026

8 PM ET – 9:30 PM ET

Topic, description and registration information to follow.

3. Long Island Stock Investors Meetup Group: Part I

Thursday February 12, 2026

7:30 PM ET – 9:00 PM ET

Topic, description and registration information to follow.

4. Long Island Stock Investors Meetup Group: Part II

Thursday March12, 2026

7:30 PM ET – 9:00 PM ET

Topic, description and registration information to follow.

Premium Members,

This week’s Weekly Stock Screen and Watch List has been uploaded to The Blue Collar Investor Premium Member site and is available for download in the “Reports” section. Look for the report dated 10/31/25.

Be sure to check out the latest BCI Training Videos and “Ask Alan” segments. You can view them on The Blue Collar YouTube Channel. For your convenience, the link to the BCI YouTube Channel is:

https://www.youtube.com/user/BlueCollarInvestor

Barry and The Blue Collar Investor Team

Premium members:

This week’s 4-page report of top-performing ETFs, along with our sample trade of the week, has been uploaded to your premium site. The Select Sector SPDR section is now crafted to align with our streamlined (CEO) approach to covered call writing. The report also lists Top-performing ETFs with Weekly options, mid-week market tone as well as the implied volatility of all eligible candidates.

We have also included a sample trade taken from one of our BCI watchlists.

Premium member video link:

https://youtu.be/EXMO-KwZuJs

For your convenience, here is the link to login to the premium site:

https://www.thebluecollarinvestor.com/member/login.php

NOT A PREMIUM MEMBER? Check out this link:

https://www.thebluecollarinvestor.com/membership.shtml

Alan and the BCI team