You do your due-diligence and select a great performing stock in a great performing industry. Once you have determined that this equity meets all of our system requirements, you head off to the option chains to check the calculations. Since the stock is trading @ $39 per share you check the $40 call. This can’t be…there are two call options with a $40 strike price. They have different symbols, volume, open interest and bid-ask prices. One has a bid of $1 and the other a bid of $12. You think to yourself that the market makers must have been out late last night partying and made a huge mistake. I’ll sell the $12 option and make a huge profit. Better yet, I’ll buy thousands of contracts of the cheaper and sell the same number of the more expensive, offset my positions and pocket a fortune. I’m going to be rich! The truth of the matter is, NO YOU’RE NOT! You have entered the world of non-standard options.

What are non-standard (NS) options? :

These are options that don’t have the standard terms of an options contract, namely 100 shares as the underlying asset. They are normally created as a result of a specific event such as a merger, acquisition, spin-off, extraordinary dividend or stock split. As a result of the changing circumstances, the contract is adjusted to be equitable to both the option buyer and seller by equating the new underlying asset(s) of equal value as the owner of 100 shares. The Depository Trust Company (DTC) determines how the shares will trade pre-event while the Options Clearing Corp. (OCC) decides how these changes will be reflected in the options. Each situation is unique and therefore non-standard. This makes them difficult to understand and therefore risky to most investors. In the above hypothetical, one contract was a standard options contract, the other non-standard. The standard contract represents 100 shares of the underlying, while the NS contract does not. As an example, when BAC took over Merill Lynch, the owner of 100 shares of Merill received 85 shares of BAC stock plus $13.71 in cash. NS contracts of BAC now would deliver 85 shares of BAC + the cash as opposed to the standard contracts which represented 100 shares. The obvious rule is avoid all non-standard options. Let me add another: if an option value seems too good to be true, it is. These contracts will also show odd strike prices and different root symbols.

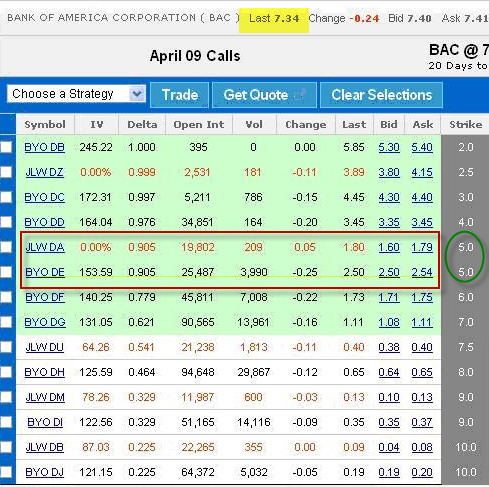

Real life options chain for BAC showing standard and NS options:

I have highlighted the two $5 strike options. BYO DE is the standard option which represents 100 shares of BAC while JLW DA is the non-standard reprersenting 85 shares of BAC + cash. An uninformed investor looking to buy an option would think the NS option is a much better deal, costing $179 per contract as opposed to $254 per contract. The caveat is that the former will deliver only 85 shares (+ cash), not 100 shares.

Liquidity of NS Options:

These contracts are often illiquid and difficult to trade. In this chart, we can see the volume of the standard contract is 3990 compared to the 209 for the NS contract. When evaluating the liquidity based on open interest, one can easily be deceived as many of those option holders had their contracts since prior to the merger. Most likely there has been little activity in them since.

Timing of contract adjustments:

When contract adjustment is needed as a result of the aforementioned events, the standard (“plain vanilla”) options are adjusted accordingly. When a new option comes into existence after the event, it will appear as a standard option. ****Check with your brokerage company to make sure that you will be notified, prior to execution, if attempting to trade a NS option.

Free information on contract adjustments:

http://www.cboe.com/tradtool/contracts.aspx

Conclusion:

Non-standard options result from an asset-changing event like a merger or spin-off. They are difficult to understand because each is unique to its particular situation. When we see a premium that makes no sense and there are two similar strikes, avoid the NS option and stick to the one we know and understand.

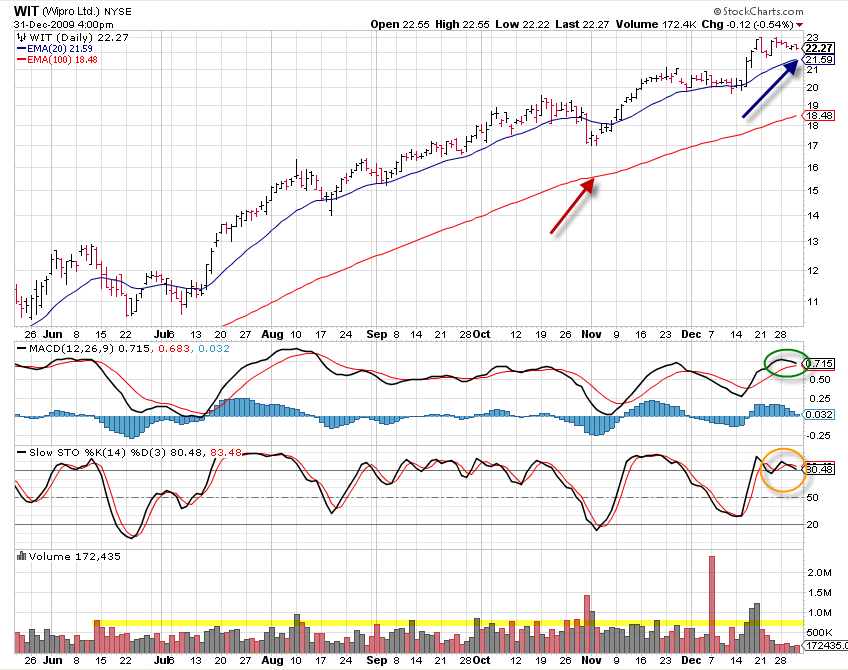

Chart of the Week- WIT:

The following points should be noted:

- This stock passes our system screens as described in my first book, Cashing in on Covered Calls

- The blue arrow shows the price bars at or above an uptrending 20-d ema

- The red arrow shows the 100-d ema below the shorter-term ema, also uptrending

- The green oval shows the MACD positive as is the histogram below it

- The orange oval shows the stochastic oscillator in the overbought, but holding position

- Note that volume declined during the holidays as it dropped below the average volume (yellow line)

Economic News of the Week:

Consumer confidence rose for the second consecutive month demonstrating a more positive outlook for the future. The index, however, is still historically low. For the week, the S&P 500 declined by 1.0% for a total year return of 27%.

Next Week’s Economic Reports:

- Monday: Latest survey of the manufacturing sector, construction spending

- Tuesday: Factory orders

- Wednesday: FOMC minutes, latest survey of the service sector

- Friday: Consumer credit, payroll jobs, unemployment rate

Video currently playing on the homepage:

Exit Strategies for Covered Call Writing

Wishing you all a happy, healthy and wealthy 2010,

Hello Alan,

Your latest article covers an easy to misunderstand issue. Sounds like a wonderful explanation.

I have read that the new option symbols coming into play this month have this covered – they will use a number 1 to represent these. I note, even so, that it would be easy to miss the digit since the symbol will be quite long.

My attitude til now on those has been that if it looks too good to be true, then it probably is!

Don B.

WIT has an earnings report due on January 19th in the next contract period. Would you wait until the March options for this stock?

Thanks (just getting started)

Frank

Frank,

When a company reports EARLY in a contract cycle (Feb. contracts), I wait until the ER passes and any price volatility subsides. All system criteria must be re-evaluated as the fundamentals may have changed. If you still like the stock, it IS now eligible for the February contracts especially since that would be a 5-week contract and generating more than 2% in one month should be achievable.

Alan

Early morning check of some of the stocks YOU have been talking about on this site:

MELI- just downgraded by JP Morgan to neutral from overweight. Stock down about $1.50 but still slightly above the $50 strike.

RAX, MED and SXCI all up nicely so far today.

Alan

when looking at IBD 100 list, do you suggest looking at it in certain order? Investors.com has 3 dropdowns to sort by: fundamentals, smartselect and price/volume – let us know. thx.

Joshua,

Of the three dropdowns, the SmartSelect is the most important. HOWEVER, you will be screening a lot of stocks that do not have options. The best way to screen is to first look at the printed version of the IBD 100 and circle the stocks that have an “o” adjacent to the price on ther upper right corner of the chart. This tells us that the stock does have options available. Then run these through the SmartSelect screen and so on.

In a few weeks, those interested in taking advantage of our premium membership will have all this done for you by my team of experts.

Alan

Separate issue:

What does it mean if there is no scouter rating for a stock? I noticed that a few seemingly quality stocks on the IBD 100 do not have a rating. If everything else is a go, are theses stocks possible?

BUCY was upgraded today and was up over 11%.

Rob,

Money Central does not rank most ADRs (American Depository Receipts). These are foreign companies that trade on U.S. exchanges. If the stock meets all other system criteria, it stays in consideration.

Alan

Hi Alan…

What do you mean by premium membership? (6)

You got me curious…

Dave

Alan,

Thanks for the great books.

I would like your input.

I have 200 shares of GMCR @$68.72 and sold 2 Jan2010 70 Call for $2.10

The cuurent price is $83.34

The Jan2010 70 Call is currently sold for $13.70.

The fundemental is still good but the technical is way overbought. I am thinking roll forward the 70call to the Feb month.

What would you do? Please share your math, I am still learning.

Thanks,

Dave,

For the past eight months the BCI team has been developing a premium site that will provide its members a weekly screening of all IBD 100 stocks. It will show which stocks passed all screens and where those that didn’t fell short. It will also provide information on the following:

ERs

Same Store Sales

Trading volume

Chart trends

Technical analysis with comments

In addition, it will show you the same watchlist that I use for my stock selections along with this additional information:

Sector

Industry

Beta

Industry Rank

We are also developing some great ideas for future expansion of this site.

We are close to completion as the programmers are working to physically expand this site to accomodate the premium link. Those on my mailing list will be the first to see the product and have an opportunity to join. You can join this list from a link on this site’s homepage.

This site will continue to welcome and appreciate all members both general and premium.

Alan

Phil,

I will respond to your question with the current option chain figures at the time of this post with these caveats:

1- There is an upcoming ER in the next contract cycle and therefore dangerous to be in a covered position.

2- The very best way to understand these rolling opportunities is to plug in the option chain figures into the blue section of the “what now” tab of the Ellman Calculator and study the results. After a short while it will become crystal clear to you.

3- It is not necessary to institute an expiration Friday exit strategy this early in the contract cycle.

Here are the current calculations:

Roll out to $70 strike:

B-T-C @ $14.70

S-T-O @ $15.70

Profit = 1570 – 1470/7000 = 1.43%

Downside Protection = $1438/contract

Roll out and up to the $80 strike (you can also check the 75,85 strikes):

B-T-C @$14.70

S-T-O @ $8.40

Option loss = $630

BUT now your shares are worth $80, not $70 because you have raised the ceiling by $10 or $1000 of increased portfolio value.

Total profit = 1000 – 630 = 370

Percentage return = 370/7000 = 5.3% with downside protection of $438 per contract.

Conservative investors will opt for the first choice, more aggressive for the second. Check the other choices, it will be a great learning experience.

Alan

Am reading your book exit strategies and its enlightening to say the least…one question on page 34-35 –

you give an example of selling option for $2, buying back for $0.40 and reselling it for $1 a week later – this generates an additional $60 per contract – I am having trouble understanding how you got to that $60. $2 less $0.40 = $1.60 or $160 per contract and adding $1 of premium would be $160 + $100 per contract = $260

am i missing something here?

Josh

Josh,

This one is a little tricky and you did mis-read the second option sale which was also $2, a week later. Here are the calculations (assuming the shares are sold as stated at the end of the first paragraph on page 34):

We buy the shares @38 and they are untimately sold for $35. That’s a loss of $300 per contract.

Our option sales:

$200 profit for sale # 1

$160 profit for sale # 2 (the “roll down”) which results from a sale of $200 less the cost to buy the option back of $40.

Our total option profit is $360. Deduct the loss of $300 from share depreciation and the result is a PROFIT of $60 on a stock that lost $300 in value.

This is a great example of how valuable exit strategies can be.

Alan

Hi Alan,

Just had two ideas for you. (You may already have these in your plans.)

1) The ‘Exit Stratergies’ book really deserves to have a DVD/CD/manual to go along with it. The original series which I got is so good and I feel that the sequal will be just as good as the original! When do you have a release date in mind?

2) The premium site that you have in mind. Will it track the trades? If it did so, it would be great to see exactly how the exit stratergies are made and why certain stratergies are chosen. Eg: Market tone, technicals analysis, news ect…

3) How about a live call once a month. Everyone can call in and you can be the moderator. Everyone could ask questions (1 at a time) and the anwsers would be given 2 ways

a) Verbally through the phone/skype

b) Visually through their computer screen. (charts, screening, calculations ect)

A great hands on way for everyone to learn and share ideas. (and profit mind you!)

All the best for 2010

Dave

Hi Alan,

Post 12: Sounds like an excellent tool.

Keep up the good work …

Jim

Hi Alan,

I saw that BUCY, with 9 days to go is offering 3% for an OTM strike price…

What do you think of the chart?

Thanks Alan

Dave

Dave and Jim,

Thanks for the kind words and I will give your suggestions serious consideration.

Dave,

BUCY has been on an absolute tear. It passed the moon and is headed for Pluto! However, only those with strong risk tolerance will enter an A-T-M position with 9 days remaining on a stock that has gone up so much, so fast. The great return from the $65 strike tells us that the market is anticipating volatility that can be in either direction. Will investors in long positions start cashing in? Factor into your decision the fact that there will be negligible time left for exit strategy repair.

A conservative investor may consider the $60 strike and generate near 1%, 9-day return with tremendous downside protection of the option profit. Doesn’t seem like much, but it will take 6 months to get this type of return with a CD.

Alan

Alan,

You are a very wise educator…

Thanks for your insights…

Dave

Hi Alan:

I started accumulating the Q’s last July, thanks to your book, and selling cc’s on them monthly. I now hold 1000 shares with a cost basis of 40.51 per share. today I rolled as follows:

btc 10 Jan45 @ 1.61

sto 10 Feb47 @ .87

for a called out return for the period of about 2.6% or so.

I have made almost zero on cc income for the position, but they have appreciated nicely. I plan to continue to evaluate this position monthly and keep rolling as long as I get a decent return. Am I on the right track with this one? I know you trade these in you Moms account. Thanks again.

Steve

I am one who is anxiously awaiting the premium site. 🙂

Alan,

Per you post 19 I would like to add that BUCY is expected to post it’s earnings report on 2/18/10 after the close. Thus I am not going to roll up and out. I am going to let the position get called away. However, I will revisit after the report comes out…

Chris

Steve,

It seems to me you answered your own question:

$40, 510 invested is now worth $46, 140 for a profit of $5630. That’s 14% in 7 months. Imagine the line outside of your local bank offering a 7-month, 14% CD! You utilized dollar-cost averaging, covered call writing on ETFs and then rolling out-and-up. Think about how many investors are capable of that. Well done.

Congratulations!

Alan

OFFSITE EMAIL QUESTION:

Alan,

I’ve read both of your books on covered calls and enjoyed them greatly. I’m paper trading your methods currently. One topic I did not see addressed directly in your Exit Strategies book is exactly when to bail out and buy back an option and sell the corresponding stock. How many days of negative technical indicators should we endure before getting out of a position? For example, currently I own 100 shares of ASIA which I bought on 12/30 as it seemed to meet the system criteria. Withn the past 2 – 3 days especially the technicals have turned down for this stock – the price has dropped, the 20 day EMA has turned down, stoch have dropped below 20, and the MACD hist is increasingly negative. Would you buy back the option (Jan 30 call) and sell the stock at this point, wait for it to come back, or do something else? Thanks

MY RESPONSE:

I am currently in the same situation (but real) with 400 shares of ASIA. Our decision is between #s 3 and 4 on pages 35-36 of Exit Strategies….The first thing I do is try to figure out why the sudden drop, so I check the news. Sure enough Goldman Sachs downgraded this stock from buy to neutral and it took a hit. Now this is just the opinion of one man…he could be right and he could be wrong but the market reacted. If it was a specific news item about the finances of the company or some such thing, I would “convert dead money to cash profits” and unwind my position. Next I look at the numbers. I sold an I-T-M strike so my cost basis is $30 and my option PROFIT was $142 per contract. This means my break-even is @ $28.58, still a little below the current market value of $28.68. To B-T-C will cost $65 per contract. We’re better off taking no action as long as our stock does not decline by more than this amount.

So how seriously should we take an analyst? I refer you to a list of the 8 following this stock:

http://finance.yahoo.com/q/ao?s=ASIA

4 strong buys and 4 buys (one of these is now a neutral).

Because of these factors, I am staying with this stock but keeping a close eye on it. As of this moment, we haven’t lost any money, just haven’t made any.

Alan

Chris,

Excellent point on the ER. Thanks for re-enforcing.

Alan

BCI community,

Understanding your comfort level is key to your exit deccisions. As for me…I’m very conservative. I have been in BUCY and FFIV for the JAN’10 option month. I exited both positions today. Speccifically, with BUCY Jan30, based on my initial entry point, I was able to get approx 79% of my target return a week and a half early. With FFIV Jan50, I got a 5.5% return which was approx 93% of my target return. I can now use that cash for other trades in Jan. I was concerned that tech took a down turn today so I exited…didn’t want to be greedy. Back to the watch list.

Barry

Barry

All,

One of my positions is also with ASIA in almost the same situation as Alan.

One thing that helps me is setting Alerts when I open a position. Here are the Alerts that I set up. I am alerted via my cell phone if: (1) the breakeven price of the stock or ETF is hit (as with ASIA) , (2) the option falls to 20% of the original premium in the first 1, 2 or 3 weeks, or (3) the option falls to 10% of the original in week 3 or 4.

I try to keep a close eye on my positions, but it is comforting to know I will be notified if these things happen so I can take the appropriate Exit Strategy. Most brokerages have alert capabilities that you can use easily.

There is something else I do that cannot be controlled by alerts to my knowledge. If the underlying stock surges so much that there is almost no time value in the option premium at any time prior to expiration, I will likely buy back the option if I have the cash to do so. This gives me more time to look for a position in next months cycle with probably higher returns. In a rising market this can happen more than you would imagine.

Thanks to all contributors to this great blog and website.

Sam

Sam, you can still buy back the option with very little cash.I executed two complex buy-writes resulting in a net credit today,where the stock was sold and the option was bought back, to close the position.I then used these funds for an entry into 2 new positions. Brian K (long time follower, first time blogger)

Sam,

What broker do you use? Did they only charge one commission for the buy-write unwind?

Barry

Brain K,

When you say you initiate two new positions. Do you mean you sell the Feb month right away?

I thought we wait and initiate the new positions the following week after the expriation Friday.

I am still learning.

Thanks,

Phil

Question for everyone…

Does anyone in this forum use Zecco for their brokerage? They seem very cost efficient (10 free trades a month, after that its 4.50 for stocks, $4.50 for options)…

Would you please share your experience with Zecco…

Thankyou

Dave

Check out http://www.interactivebrokers.com/en/p.php?f=commission. I’ve cut transaction premiums by 95%. Be warned though, the Trader Workstation interface has a steep learning curve. Watch all the free training videos many times. Follow Alan’s wisdom and use their paper trade system for several months.

Barry,

I am with Fidelity and Scottrade. Fidelity offers a buy/write trade but Scottrade does not.

Sam

Hey all,

I just wanted to let people know that I sent an email to IBD customer service asking for the “o” to be included in the IBD 100 stock screener (as opposed to just in the eIBD “paper” version). Not sure if they will do it, but if you have the time, drop them a line. They will probably be more inclined if they get more inquiries about it.

Rob

To all,

I want to thank you for participating and sharing information on this blog. We have a great group of both beginner and experienced investors with a common thread… all motivated and willing to help one another.

There is one comment I want to highlight in case you missed it and that was the last paragraph of Sam’s comment # 28. If a stock takes off and heads to the moon, the strike price is left deep I-T-M. Time value, to a great extent measures risk or “what are the odds that the option strike will end up I-T-M”. In a case like this (let’s say the strike is $50 and the stock is @ $70) there is very little risk that this won’t occur and therefore the time value apporoaches zero. If the option premium was about $20 ( all intrinsic value and no time value) to close, our stock is now worth $70, not $50 (current market value without the option restriction) and therefore a wash. It costs us nothing to close the position. This cash can then be used to generate additional income. Closing a winning position prior to expiration Friday needs to be evaluated with consideration to the amount of time value we are paying to accomplish this.

Thanks to Sam for a GREAT point.

Alan

Many of our “banned stocks” reported same store sales today. The results were generally positive boding well for the overall economy. A few disappointed and took a hit:

HOTT: Down 8%

GPS: Down 3.6%

These reports usually become public the first or second Thursday of the month.

Alan

Hi Alan,

Chris noted that Bucy reports earnings on 2/18/09 after market close. Since this is on Thursday of the options expiration week, would you still consider selling covered calls on this stock and exiting the position before the market closed on the 18th?

Thx,

Dave

Dave,

I would not. First of all, the stock itself can be volatile leading up to an ER. Also, one of the great advantages we have as CC writers is the devaluation of the option premium due to erosion of time value. If the stock drops in value during the contract cycle, the option premium will also fall, thereby allowing for a profit on the option component when we close (B-T-C).

When there is an upcoming ER, volatility (implied volatility or IV) can be high. This is one of the factors that influences time value. Rumors and talk about the ER can keep that option premium from devaluing until after the event (ER). If the stock has declined in value (or we want to close just prior to an ER) and we want to close our option position to then sell the stock we may be taking a loss on the option as well or at least not in as good a situation as we would be had there been no ER. There are a lot of fish in the sea, so let’s go after another one in this scenario.

One final thought. If the ER was early in the contract cycle, we can let it pass, wait for any volatilility to subside, and then enter our position if we still like the stock.

Alan

Phil (comment # 31),

When we have a situation where we sold an option and the strike price is O-T-M (higher than the current price of the stock), we must allow the option to expire after expiration Friday. Here, we cannot take action until the following week. Now, we have no option obligation and still own the stock and are free to sell another option or sell the stock.

What Brian correctly did was to execute an exit strategy, where he closed his current position and then immediately put his cash to work by opening a new one. Many times that new position is for the same contract cycle. It’s not uncommon to “squeeze out” another 1-2% in 6-10 trading days as long as we have a quality watchlist. Bottom line: Keep your money working at all times. Be a tough boss…no holidays, no sick days!

Alan

RL:

Recently reported a strong ER with increased sales expectations. It’s quarterly dividend was also increased to $0.10. It has outperformed the market by 400% over the past year. Check to see if this equity deserves a spot on your watchlist.

Alan

Alan,

Thanks for the comment #40 and the great web site.

Phil

Thanks Allen. I exited BUCY today with $0 time value (thanks to your advice on playing the Bid-Ask spread). Any thoughts on where I can put this money to work?

DaveP

Hi Alan,

Some confusion here – went to look up RL. I got two stocks – a Renaissance Learning, and a Polo Ralph Lauren. Help!

Don B

Hi Alan,

Well, this follower of yours can be said to do things backwards. I first bot, a few months ago, your second book, the Exit Strategies book, a wonderful work. Got so interested that I bot your first book (CCC} second – and finished it today. Actually I am still reading the astute & illuminating Email alerts in Appendix II. Thanx much.

Don B

Dave (comment #43),

I did the same with BUCY today- nice work. The question is: can we generate some cash with only 5 trading days left? The answer is YES.

Here is where a quality watchlist of 40-60 equities becomes your best friend. Once again, an I-T-M strike is the safest since there is little time for exit strategy repair if the stock heads south. A-T-M strikes will generate the greatest time value and O-T-M strikes can generate some option profit with upside potential.

For example, a stock we have been discussing this week has been ASIA (nice comeback today Mr. Goldman Sachs Analyst!). Currently this stock can generate a 2 1/2%, 5-day return for the $30 call with no protection of that premium.

CTRP, for the I-T-M $70 strike, will generate a 0.7%, 5-day return with 3.8% downside protection of the profit.

With a quality watchlist you WILL find opportunities that are right for you based on your risk tolerance and outlook for the market.

Alan

Don,

These stocks have different tickers:

Polo Ralph Lauren: RL

Renaissance Learning: RLRN

Thank you for your generous comments.

Alan

My next journal article will discuss an SEC regulation that puts extra cash into our pockets. It’s important to understand and utilize this rule. Plus, see what a spreadsheet looks like for a recent month in one of my accounts where I sold ONLY I-T-M strikes.

Alan