When selling covered calls or cash-secured puts, we must be appropriately diversified, as well as allocating a similar amount of cash per position. This will protect our portfolios from significant price decline in 1 or 2 of our positions.

When we sell multiple contracts using the same underlying security, we can also diversify strike prices within those trades. If we are selling 5 contracts using the same stock and the same expiration date, there is no reason to feel we have to use the same strike price for all 5 contracts. We can diversify those as well.

This article will highlight real-life trades using Iron Mountain Inc. (NYSE: IRM), a stock on our premium member stock watch list on 3/11/2024. We will sell 5 contracts and establish trades with both moderately bullish and bearish market assumptions.

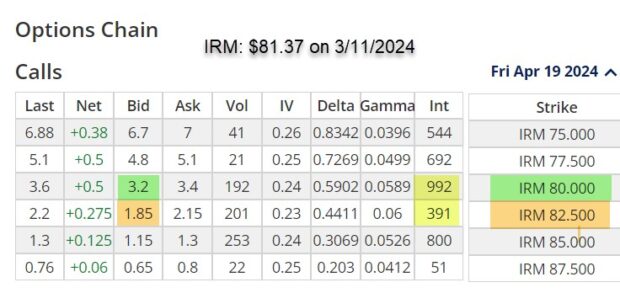

IRM Option-Chain on 3/11/2024 with IRM Trading at $81.37

- The $80.00 in-the-money (ITM) strike (bearish or defensive posture) shows a bid price of $3.20 (green cells)

- The $82.50 out-of-the-money (OTM) strike shows a bid-price of $1.85 (brown cells)

- Both strikes show more than adequate liquidity or open interest of > 100 contracts (992 and 391 – yellow cells)

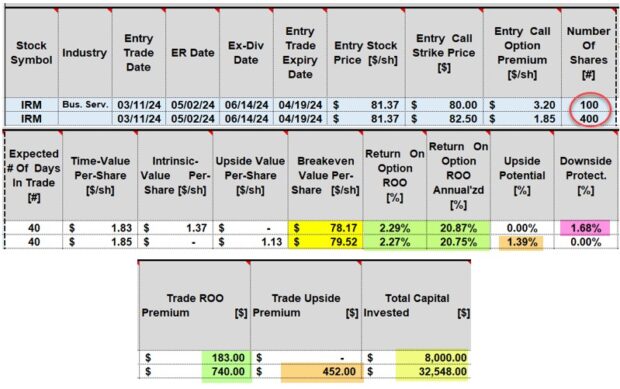

A reasonable bullish market assessment approach (4 x OTM and 1 x ITM)

- Sell 1 x $80.00 call and 4 x $82.50 calls

- The $80.00 has $8000.00 tied up (deducting the intrinsic-value component of the premium)

- The $82.50 call has $32,548.00 tied up (yellow cells on bottom for both)

- Both strikes have annualized returns near 21% (green cells in middle section)

- The ITM $80.00 call has downside protection of the time-value profit of 1.68% (pink cell)

- The OTM $82.50 call has upside potential of 1.39%, resulting in a potential 40-day return of 3.66% (2.27% + 1.39%)

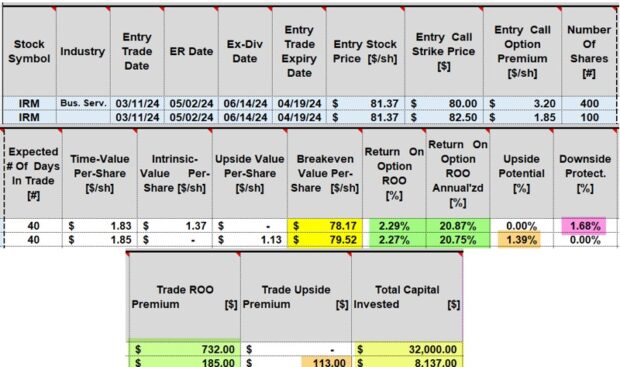

A reasonable bearish market assessment approach (1 x OTM and 4 x ITM)

- Using the BCI Trade Management Calculator (TMC):

- Sell 4 x $80.00 calls and 1 x $82.50 call

- The $80.00 has $32,000.00 tied up (deducting the intrinsic-value component of the premium)

- The $82.50 call has $8,137.00 tied up (yellow cells on bottom for both)

- Both strikes have annualized returns near 21% (green cells in middle section)

- The ITM $80.00 call has downside protection of the time-value profit of 1.68% (pink cell)

- The OTM $82.50 call has upside potential of 1.39%, resulting in a potential 40-day return of 3.66% (2.27% + 1.39%)

Discussion

When selling covered calls or cash-secured puts, diversification and cash allocation are critical to crafting trades that will result in the highest possible returns. In addition to stock (or ETF) diversification and allocating a similar amount of cash per position, we can also diversify strike prices when selling multiple contracts with the same underlying security and the same expiration date.

Alan Ellman’s Complete Encyclopedia for Covered Call Writing Volume-2

Education is power. That’s the premise of The Blue Collar Investor. When the Complete Encyclopedia for Covered Call Writing was published at the end of 2011 and immediately became the best-selling book on this great strategy, I realized that eventually there would be a Volume 2. It took me four years to gather the information for the original version and I projected four years down the road and realized that more information would become available, more examples could be provided to clarify certain issues and BCI members would make me aware of tangential topics of interest. I also write weekly newsletter articles for the BCI site as well as for other US and international financial venues. It didn’t take a stroke of genius to craft a plan that would allow me to provide new and enhanced information and keep it within the framework of the Complete Encyclopedia for Covered Call Writing, a format you have embraced more than I could ever have imagined. Volume 1 (classic edition) should be read first.

Click here for more information and purchase option.

Premium Membership Price Increase Notification: No Rate Increase for Current Members

On September 1, 2024, BCI will be raising membership rates for new members only. This will not apply to current members. It has been 3 years since we had a rate increase. In that period, we have added dozens of training videos, additional downloads and resources and more quality data to our stock and ETF reports. We are fortunate to have such a robust and expanding membership and strive to provide the best high-quality information and tools at the lowest industry prices.

This price increase will not apply to current active members as you are grandfathered into the current rate for life or as long as your membership remains active. This is our loyalty pledge to you.

The increase for new members will go into effect on September 1, 2024, as follows:

Monthly: $19.95 for the first (trial) month and $69.00 each 30-days thereafter (currently $57.95).

Annual: $778.95 for the first 13 months (includes a reduced first month and a free last month) and then $828.00 every 13 months thereafter (includes 1 free month). Currently $657.40 and $695.40.

All new members who subscribe between now and 8/31/2024 will be grandfathered into the current rate and will see no price increase on 9/1/2021.

Thanks to all our loyal members for your support over the past 17 years and for putting BCI on the financial map.

Click here for member benefits video.

Click here for membership information.

Your generous testimonials

Over the years, the BCI community has been incredibly gracious by sending our BCI team email testimonials sharing stories as to what our educational content has meant to their families. Moving forward, we have decided to publish several of these testimonials in our blog articles. We will never use a last name unless given permission:

Alan,

I really appreciate your mission and the respect and care you express toward all of us retail investors. It’s very refreshing. Thank you so much for all your help.

Greg

Upcoming events

1. Mad Hedge Investor Summit

September 10, 2024

11 AM ET – 12 PM ET

Zoom webinar.

Tuesday September 10, 2024

11 AM ET – 12 PM ET

How to Generate Greater than Maximum Covered Call Writing Returns Using Exit Strategies

Incorporating the mid-contract unwind (MCU) exit strategy into a 12-day trade

More information & registration link to follow.

2. Stock Traders Expo- live event in Orlando Florida

October 17 -20

Details to follow.

3. American Association of Individual Investors/ Los Angeles Chapter

November 9, 2024

12 PM ET – 1:30 PM ET

Private webinar for members of this AAII investment club

4. Long Island Stock Investor Group Part I

Zoom

February 13, 2025

7:30 – 9:00 ET

Details to follow.

5. Long Island Stock Investor group Part II

March 13, 2025

7:30 – 9:00 ET

Details to follow.

Alan,

I have about 25k to invest. What is the best stock to start with?

Appreciate any help.

Glenn

Glenn,

With $25k available, proper diversification must be addressed.

The BCI guideline for individual stocks is ” a minimum of 5 different stocks in 5 different industries”. With $25k available, these equities would have to be priced (on average) under $50.00 per share. That may be challenging.

A better consideration may be exchange-traded funds (ETFs).

These are baskets of stocks, similar to mutual funds, but trade like individual stocks. Many have options.

Use of BCI ETF Reports to access the best-performing ETFs each week and check for 2-3 that fall into the appropriate price range.

Alan

Premium Members,

This week’s Weekly Stock Screen And Watch List has been uploaded to The Blue Collar Investor Premium Member site and is available for download in the “Reports” section. Look for the report dated 08/09/24.

Be sure to check out the latest BCI Training Videos and “Ask Alan” segments. You can view them on The Blue Collar YouTube Channel. For your convenience, the link to the BCI YouTube Channel is:

https://www.youtube.com/user/BlueCollarInvestor

Reminder: Premium Member’s pricing is locked into your current rate and you will never see a rate increase as long as the membership remains active.

Barry and The Blue Collar Investor Team

Alan,

Do you always avoid ex dividend dates with your trades and why?

Thank you.

Jim

Jim,

Ex-dates are the main reason for early exercise.

Now, early exercise is extremely rare even with ex-dates. However, if it is crucial that are shares not be sold, perhaps due to potential negative tax implications, avoiding ex-dates should be given serious consideration.

I, personally, do not avoid ex-dates because I trade predominantly in sheltered accounts and view early exercise as a positive. When it occurs, I have maxed my potential return and now have the cash back from the sale of the stock to re-invest and establish an additional income stream

Alan

Premium members,

The latest Blue Chip Report for the best-performing Dow 30 stocks for the September 2024 contracts has been uploaded to your member site.

Look on the right side in the resources/downloads section and scroll down to “B”

Alan

Premium members:

This week’s 4-page report of top-performing ETFs, along with our sample trade of the week, has been uploaded to your premium site. The Select Sector SPDR section is now crafted to align with our streamlined (CEO) approach to covered call writing. The report also lists Top-performing ETFs with Weekly options, mid-week market tone as well as the implied volatility of all eligible candidates.

We have also included a sample trade taken from one of our BCI watchlists.

Premium member video link:

https://youtu.be/EXMO-KwZuJs

For your convenience, here is the link to login to the premium site:

https://www.thebluecollarinvestor.com/member/login.php

NOT A PREMIUM MEMBER? Check out this link:

https://www.thebluecollarinvestor.com/membership.shtml

Alan and the BCI team

Hi Alan,

I am looking at NBIX to sell a OTM covered call option. 200 shares at 147.22, the strike price is 155 and the premium is 11.00.

If I put this information in the BCI Cal the return is about 8.14%. if we are looking to generate only between 2 and 4% what is the option here?

It looks like I would have to go out to lets say a strike price of 170 to 180 to stay in the 2-4% range.

Is this realistic? If I sold an option closer to the stock price my return would be 8 or more percent higher

Tom

Tom,

If our goal is an initial 1-month return between 2% – 4% (as is mine), we must convert this (apparent) high-risk trade into a low-risk trade.

Before I address this, let me say that not all investors have the same personal risk-tolerance. More aggressive investors may align with a higher initial time-value return and accept the associated risk. Others may set a goal lower (as I do in my mother’s portfolio).

That said, let’s stay with 2% – 4%.

In our latest premium member stock report, NBIX shows an implied volatility of 75.6%, extremely high. This explains the huge into premium returns, but also defines a high-risk trade.

The way to convert this to a low-risk trade is to consider an ITM, rather than an OTM call strike. Going deep ITM will dramatically lower our breakeven price point, give us significant downside protection of the initial time-value return and align with our goal and personal risk tolerance.

By doing so, we are giving up any upside potential if share price rises, while achieving our initial time-value return goal range.

In the screenshot below, I used data from an option chain, premarket this morning. With NBIX trading at $146.70, the 9/20/2024 $125.00 strike shows a bid price (we could negotiate higher) of $25.30. Using our Trade Management Calculator (TMC), the initial 37-day time-value return is 2.88%, 28.41% annualized (brown cells- within our range) and a huge 14.79% downside protection of that time-value premium (purple cell).

The breakeven price point is $121.40 (yellow cell), $25.30 below current market value.

Bottom line: By using deep ITM call strikes, we can convert a high-risk trade to a low-risk trade while still achieving our initial premium return goal.

CLICK ON IMAGE TO ENLARGE & USE THE BACK ARROW TO RETURN TO BLOG.

Alan

Hi Alan,

A follow up to this trade. I looked at the opposite of ITM trade and went further out for an OTM trade using the same parameters of 2 to 4 percent.

If you went to 175 the return was about 2.73%.

What would be the pros and cons of this as compared to ITM trade as you described?

Thanks,

Tom

Tom,

A deep OTM call strike will offer the added benefit of allowing share price to increase up to the strike and have the potential for a huge monthly return.

However, a deeper OTM strike will not mitigate risk to the downside. That’s where the ITM strike will help in the form of intrinsic value, lowering the breakeven price point.

The decision of ITM versus OTM will depend on how aggressive or defensive we want to be.

With a high volatility stock like NBIX, a case can be made to consider ITM.

One other point: You mentioned that you plan to sell 2 contracts. You can also sell 1 ITM and 1 OTM.

Mastering the pros & cons of each approach will help guide us to the best possible trades based on our goals and personal risk tolerance.

Alan