Jan 24, 2026 | Covered Call Exit Strategies, Exchange-Traded Funds, Investment Basics, Option Trading Basics, Stock Option Strategies

click ↑ 4 Featured Covered call writing ETFs are exchange-traded funds consisting of a portfolio of stocks that are leveraged to generate income by selling call options against those shares. As investors strive to generate high yield returns, these securities have...

Jan 17, 2026 | Fundamental Analysis, Investment Basics, Option Trading Basics, Options Trade Execution, Stock Investing, Stock Option Strategies

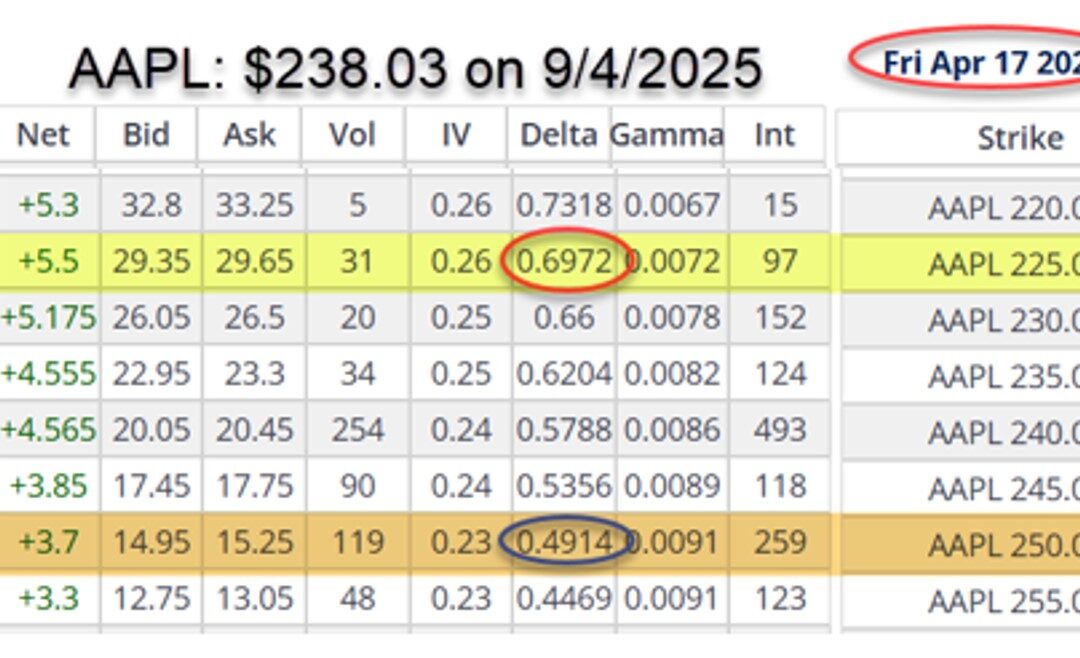

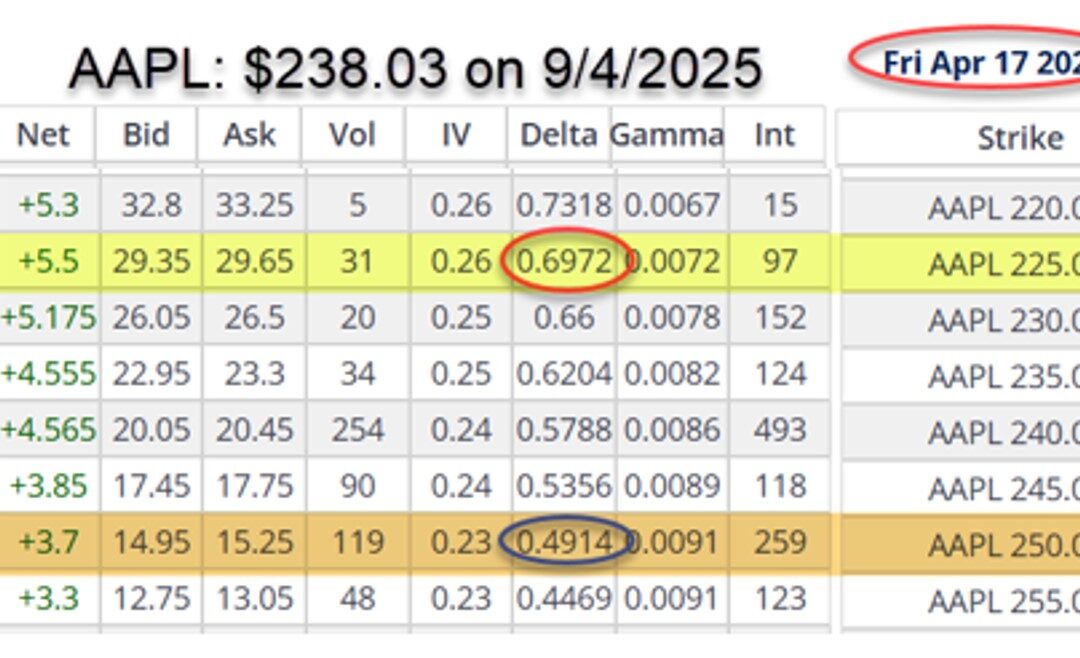

click ↑ 4 Featured Covered call writers (put sellers, too) may analyze Delta stats prior to executing option trades. This article will explore the relationship between Delta and time-to-expiration. Who thinks Delta goes up over time? Who believes it goes down over...

Jan 10, 2026 | Fundamental Analysis, Investment Basics, Option Trading Basics, Options Calculations, Options Trade Execution, Put-selling, Stock Option Strategies

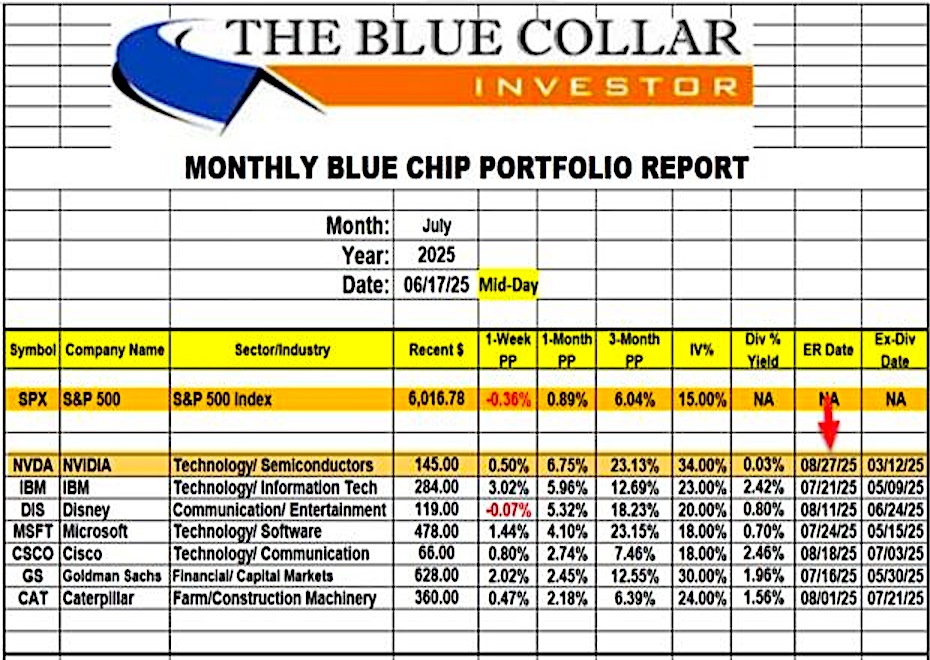

click ↑ 4 Featured When establishing our covered call writing & cash-secured put portfolios, there are several metrics we should use to minimize risk and enhance our overall returns. This article will identify and explain these critical resources. Checklist for...

Jan 3, 2026 | Covered Call Exit Strategies, Exit Strategies, Investment Basics, Option Trading Basics, Options Calculations, Options Trade Execution, Stock Option Strategies

click ↑ 4 Featured When we execute multiple exit strategies in the same contract cycle using the same cash investment, the TMC will provide us with accurate individual trade calculations. But, what about total portfolio calculations? Yes, our TMC will also afford us...

Dec 27, 2025 | Fundamental Analysis, Investment Basics, Option Trading Basics, Options Calculations, Options Trade Execution, Put-selling, Stock Option Strategies

click ↑ 4 Featured It is not uncommon to attain greater than maximum returns when implementing our covered call writing exit strategies. In this article, a series of trades will be analyzed where the mid-contract unwind (MCU) exit strategy was employed to perfection....

Dec 13, 2025 | Fundamental Analysis, Investment Basics, Option Trading Basics, Options Calculations, Options Trade Execution, Stock Option Strategies, Technical Analysis

click ↑ 4 Featured Buffer ETFs have become popular over the past few years. Covered call writers can draw a reasonable analogy between the collar strategy and these buffer securities. This article will highlight the similarities and draw some conclusions. What is a...