When we integrate both covered call writing and selling cash-secured puts into one multi-tiered option selling strategy, we have our Put-Call-Put or PCP Strategy. Outside the BCI community, this is often referred to as the wheel strategy. Since we are utilizing 2 option strategies over multiple expiration cycles, it is important to properly enter, calculate and archive our trades. This will allow us to accurately assess our trade returns. This article will set up a hypothetical series of trades that starts with an out-of-the-money (OTM) cash-secured put trade and moves into an OTM covered call trade.

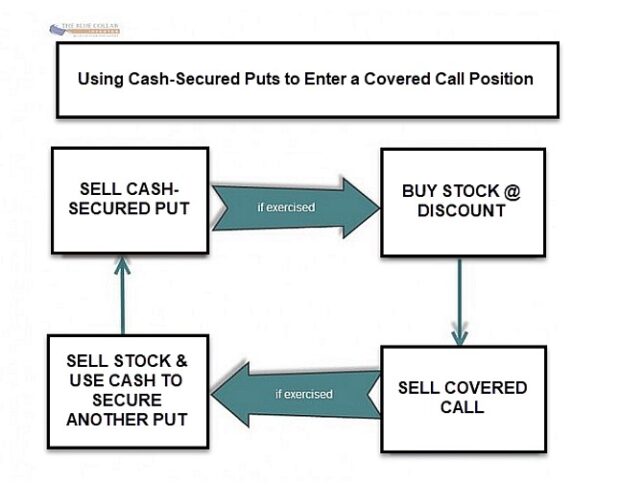

Graphic view of the PCP strategy

Hypothetical series of trades with BCI

- 7/24/2023: BCI trading at $75.00

- 7/24/2023: STO 1 x $72.50 OTM put at $2.00

- 8/18/2023 (expiration Friday): Allow exercise of the put with BCI trading at $71.00

- 8/19/2023 (Saturday after expiration Friday): Shares are put to portfolio at $72.50

- 8/21/2023: STO 1 x $75.00 OTM call at $1.50

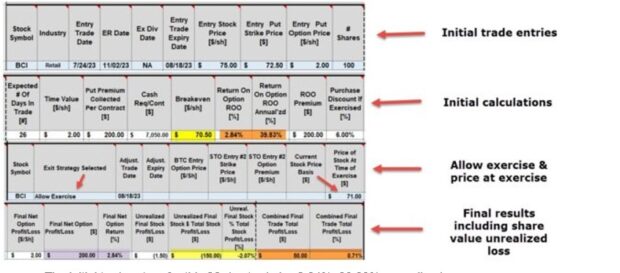

Put leg of PCP with initial and final results using the BCI Trade Management Calculator (TMC)

- The initial trade return for this 26-day trade is 2.84%, 39.83% annualized

- The exit strategy dropdown choice is to allow exercise with shares trading at $71.00

- Since shares are put to the portfolio at $72.50 when trading at $71.00, the spreadsheet shows a debit on the stock side of $1.50 per-share and a credit on the option side of $2.00 per-share, resulting in a net final unrealized (shares not sold) credit of 0.71%

- Since the unrealized share loss is incorporated into the put expiration cycle, we will enter the stock price in the next (call) leg as $71.00

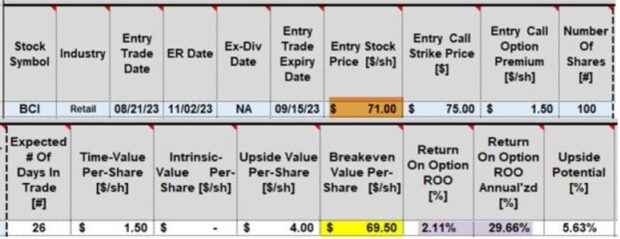

Call leg of PCP with initial and final results using the BCI Trade Management Calculator (TMC)

- The stock entry price is $71.00, moved from the price when the put expires

- Selling the OTM $75.00 call strike for $1.50, results in a 26-day initial return of 2.11%, 29.66% annualized

- Any share price gain or loss will be based on this $71.00 price point

Discussion

When using the PCP strategy, care must be taken to make precise entries such that all gains and losses are accounted for and there is no duplication of trade results. The BCI Trade Management Calculator will facilitate all these trades and calculations.

Alan Ellman’s Complete Encyclopedia For Covered Call Writing Volume-2

Education is power. That’s the premise of the Blue Collar Investor. When the Complete Encyclopedia for Covered Call Writing was published at the end of 2011 and immediately became the best-selling book on this great strategy, I realized that eventually there would be a Volume 2. It took me four years to gather the information for the original version and I projected four years down the road and realized that more information would become available, more examples could be provided to clarify certain issues and BCI members would make me aware of tangential topics of interest. I also write weekly newsletter articles for the BCI site as well as for other US and international financial venues. It didn’t take a stroke of genius to craft a plan that would allow me to provide new and enhanced information and keep it within the framework of the Complete Encyclopedia for Covered Call Writing, a format you have embraced more than I could ever have imagined. Volume 1 (classic edition) should be read first.

Click here for more information and purchase option.

Your generous testimonials

Over the years, the BCI community has been incredibly gracious by sending our BCI team email testimonials sharing stories as to what our educational content has meant to their families. Moving forward, we have decided to share some of these testimonials in our blog articles. We will never use a last name unless given permission:

Customer Review

Terry L

5.0 out of 5 stars Additional tools in the toolbox for covered call writers

This book “Covered Call Writing Alternative Strategies” is an excellent resource for information on additional strategies that can be employed for covered call writers.

The author starts with an introduction to the basics of covered call writing and later provides a section explaining the “Greeks”.

The topics covered are Portfolio Overwriting, The Collar Strategy, and Poor Man’s Covered Call. The topics are clearly explained with easy-to-understand examples provided.

Portfolio overwriting shows how to obtain additional income from stocks that you want to hold over the long term.

The Collar Strategy is protection from downside risk that can be employed around uncertainty of world events or during periods that you are away from the market and cannot monitor your trades.

The Poor Man’s Covered call generates a cash flow stream utilizing LEAPS options with less total cash outlay than traditional covered call writing. As the author puts it, for a seemingly simple concept, there are a lot of moving parts that must be mastered. A decision tree flow chart is even provided.

The book is well worth the read, providing additional tools in the toolbox for covered call writers.

Upcoming events

1. Long Island Stock Traders Meetup Group (private investment club- Part I)

Thursday February 15, 2024

7:30 PM ET – 9:00 PM ET.

Club members only.

2. Las Vegas Money Show & Stock Traders Live In-Person Event

February 22 & 23, 2024

Paris Hotel

Thursday, February 22, 2024, at 4:55 pm – 5:25 pm PST

The PCP (put-call-put or “wheel”) Strategy

Friday, February 23, 2024, at 12:00 pm – 12:45 pm PST

Covered Call Writing: A Streamlined Approach

3. Long Island Stock Traders Meetup Group (private investment club- Part II)

Thursday March 14, 2024

7:30 PM ET – 9 PM ET

Club members only

Begin additional segments text here (like testimonials, events, etc.)

Hi Alan:

I recently started my BCI membership. I’ve been very impressed with the content on your website and also enjoyed the webinar last night.

I’ve been trading covered calls and cash covered puts for a few years. My biggest problem by far is knowing when to close out trades that are going against me and just take the loss.

I saw your guideline about buying puts back when the stock price drops 3% lower than the strike price. Is there a similar rule for covered calls?

Thanks.

George

George,

For covered call writing, we have our 20%/10% guidelines, which guide as to when to buy back our short calls, if share price declines. Here is a link to an article I published on this topic:

https://www.thebluecollarinvestor.com/20-10-guidelines-hitting-a-double-in-the-same-day-a-real-life-example-with-consumer-staples-select-sector-spdr-nyse-xlp/

We also have a 7% guideline, which assist us in creating a framework as when to also sell the underlying security:

https://www.thebluecollarinvestor.com/using-the-bci-trade-management-calculator-to-mitigate-losses/

For detailed information on exit strategies, here is a link to my latest book related to position management:

https://thebluecollarinvestor.com/minimembership/softcover-exit-strategies-for-covered-call-writing-and-selling-cash-secured-puts/

Alan

Hi Alan:

Thanks for the quick response. The information you provided is exactly what I was looking for.

I also trade weekly options. I read in the comments of one of the links you provided that you recommend closing out puts when the stock price has dropped below the break even point.

I’m assuming that for covered calls you buy back the option when it drops to 10%. Do you still sell the underlying when it drops 7%?

Thanks again and have a good weekend.

George

George,

Yes, the 7% guideline also applies to weekly options.

Keep in mind that this is a “guideline” and not a “rule”, so investors have some flexibility. For example, if a stock price is declining as a result of an overall market decline, we may choose to stay with the security. We can look at the stock (or ETF) performance in comparison to the S&P 500.

Alan

Hello Alan,

I am a member of the BCI family since November. Purchased the CEO-BCI package and have availed of some of the stocks you’ve evaluated/listed/posted weekly for trades. Grateful.

I have some not so good- in fact bad! losing trades BEFORE I joined which I am trying to repair. (ZIM, IEP, X) I kind of related to two participants last night and heard your response and “philosophical” take clearly. I am giving myself a month to evaluate and decide. Where can I avail of the “stock repairs” and “laddering strikes” you mentioned?

Thank you for sharing your knowledge and helping us learn.

Emelinda

Emelinda,

Here are links to review articles I’ve published on these topics:

https://www.thebluecollarinvestor.com/stock-repair-strategy-a-real-life-example-with-lyft-inc-nasdaq-lyft/

https://www.thebluecollarinvestor.com/covered-call-writing-using-the-multiple-tab-of-the-ellman-calculator/

The BCI Stock Repair Calculator is also part of the BCI package you purchased. I suggest you run some trial calculations with it, as it may be useful in certain losing trade situations.

Alan

NEW VIDEO: How to Use our Premium Member Reports:

https://youtu.be/BPBDuUYeG7E

Alan & the BCI team

Premium Members,

This week’s Weekly Stock Screen And Watch List has been uploaded to The Blue Collar Investor Premium Member site and is available for download in the “Reports” section. Look for the report dated 01/12/24.

Also, be sure to check out the latest BCI Training Videos and “Ask Alan” segments. You can view them on The Blue Collar YouTube Channel. For your convenience, the link to the BCI YouTube Channel is:

https://www.youtube.com/user/BlueCollarInvestor

Reminder: Premium Member’s pricing is locked into your current rate and will never see a rate increase as long as the membership remains active.

Best,

Barry and The Blue Collar Investor Team

Dear Alan,

I have been a member for almost a year now, love all the content you provide.

This question is regarding Ask Alan #214, Selecting the Best Put Strike. When deciding which strike to select, if you don’t mind owning the stock, wouldn’t it be wise to look at the call options for the stock, to see if the volume and open interest is compatible with our strategy?

If I don’t mind owning the stock, but then if I am assigned and can’t sell covered calls for the next option cycle, that wouldn’t make sense, would it?

Thanks again for all you do,

John C

John,

Thanks for your generous comment.

If we are using the PCP (put-call-put or “wheel”) Strategy, we would want adequate option liquidity for both calls and puts.

The BCI guidelines are: Open interest of 100 contracts or more and/or a bid-ask spread of $0.30 or less.

Typically, if we have reasonable open interest or bid-ask spreads for one, we will have it for the other. Certainly, a double check couldn’t hurt.

Alan

Good Afternoon Alan,

I am new to BCI. In fact, I am only half way through my one-month free trial subscription period. I am not new to trading options but I can definitely use some help. I absolutely love the service that BCI provides. The volume of free material that you provide is in itself a gold mine. I am reading and re-reading many of the articles. In fact, I am so impressed that I have already purchase the CEO package.

In many of your articles, you refer to “downside protection” inherent in ITM calls, and in your “Emergency Management Report” and in the calculators you seem to refer to it as part of our profit.

As I understand it, it is really part of our initial investment (intrinsic value portion of the option premium) and so a return of it is not profit. Can you please comment on this? Thanks.

Best Regards,

Edmund

Edmund,

Thank you for your generous remarks.

Let’s set up a hypothetical example (per-share stats) to clarify “downside protection” of in-the-money (ITM) strikes.

BCI is trading at $48.00.

Buy 100 x BCI at $48.00.

Sell-to-open (STO) 1 x $45.00 call at $4.00.

$4.00 = $3.00 of intrinsic-value (amount strike is lower than current market value) + $1.00 of time-value (amount above intrinsic-value.

We cannot count the entire $4.00 as initial profit, because we will be losing $3.00 on the sale of the stock ($48.00 – $45.00, our contract obligation).

Since our initial time-value profit is $1.00, what happens to the other $3.00? We use it to “buy down” our cost basis from $48.00 to $45.00.

The BCI spreadsheets will calculate as follows:

Initial time-value profit = $1.00/$45.00 = 2.22%

Downside protection = $3.00/$48.00 = 6.25%

These stats tell us that we are guaranteed a 2.22% profit as long as share value does not decline by more than 6.25% by contract expiration.

Downside protection is different than breakeven price points (BE) which always are (share price – entire premium). In this case, the BE is $48.00 – $4.00 = $44.00.

Alan

Premium members,

The Blue Chip Report (best-performing Dow 30 stocks) for the February contracts has been uploaded to your member site.

Look on the right side of the member site in the “resources/downloads” sections and scroll to “B”.

Alan & the BCI team

Premium members:

This week’s 4-page report of top-performing ETFs has been uploaded to your premium site. The Select Sector SPDR section is now crafted to align with our streamlined (CEO) approach to covered call writing. The report also lists Top-performing ETFs with Weekly options, mid-week market tone as well as the implied volatility of all eligible candidates.

Premium member video link:

https://youtu.be/EXMO-KwZuJs

For your convenience, here is the link to login to the premium site:

https://www.thebluecollarinvestor.com/member/login.php

NOT A PREMIUM MEMBER? Check out this link:

https://www.thebluecollarinvestor.com/membership.shtml

Alan and the BCI team