Knowledge is Power. This article demonstrates how I accumulated 1.2 million dollars worth of real estate without taking one penny from my savings account. I call this Commingling of Asset Classes whereby I used my knowledge of the Stock Market and Real Estate Market to accumulate this wealth.

My story begins in 1999 when my son Craig was entering his first year at Brooklyn Law School. Looking to rent a studio apartment for him within walking distance to the Law School, I realized that it would cost the same to buy an apartment as it would to rent one. The only difference would be the down payment. Well, this was a time when I was honing my skills of selling covered call options. I had generated $35,000 profit at that point in time. That cash was utilized as a downpayment on a $90,000 co-op. Well six years, one law degree, and one business degree later, that unit was valued at $350,000! During that time frame, I paid off the mortgage using the cash I generated from the sale of stock options.

Now I had all this capital gains cash with Uncle Sam hovering over my shoulders with a large empty sack. Would I fill it for him? The answer is NOT YET! I used my knowledge of real estate investing to defer the capital gains tax.

A 1031 Exchange: Under Section 1031 of the Internal Revenue Code (26 U.S.C. § 1031), the exchange of certain types of property may defer the recognition of capital gains or losses due upon sale, and hence defer any capital gains taxes otherwise due. If the equity is exchanged into another property of similiar or greater value I could avoid paying these taxes. I did my due-diligence in much the same way as I do locating stocks and decided on three office condominiums in Austin Texas. The real estate market in this city was smoking hot at that time and still isn’t bad considering these economic times.

At this point, I owned 3 properties and still haven’t spent down one cent from my savings account. But I still wasn’t satisfied. I had too much cash in these properties. As a real estate investor, I normally try to put only 20% into each asset. I feel that if I did adequate due-diligence, each property should cash-flow with a 20% investment. So how was I going to get my hands on the extra cash while still deferring taxes? The answer was to refinance. Refinancing is a loan. You don’t pay tax on a loan. Out of these properties came $100,000. I put $50,000 down on a single family home and on a residential condo. Now I own 5 properties in Austin, 3 cash flowing positive and 2 breaking even but appreciating in value.

Here is a flow chart showing how these deals transpired:

The current market value of these 5 units is 1.2 million dollars with several hundred thousand in real equity. Checking my savings account I see that I still haven’t taken out one penny to make these deals happen. Once the real esate market turns around, and it will, I will look to do more 1031 Exchanges and refinances. It will be interesting to see where this leads to 5-10 years down the road.

Knowledge is Power because it allows you to do things like commingling of asset classes which can lead you to become CEO of your own money and ultimately to financial independence.

History Tells Us Not to Worry:

For those of us who have been through dramatic downturns in the economy and the stock market, recent events have not been as traumatic than it has been to newer investors. It would be wrong to give up on investing in the stock market or the real estate market for that matter. If we had an initial investment of $100,000 and lost 50% in a severe market downturn, we would now have $50,000. In order to restore our investment back to it’s original amount, that $50,000 would have to increase by 100%. What chance do we have of accomplishing that with a 3% CD or treasury note?

Admittedly, this past year has been challenging and difficult. It is an aberration brought upon us by a legion of people who are both greedy and incompetent. The recent approval of the “Rescue Package” is a step in correcting the problem. It’s hard to believe that history is telling us that the market appreciates 11% per year when we look at the 1-year chart of the S&P 500:

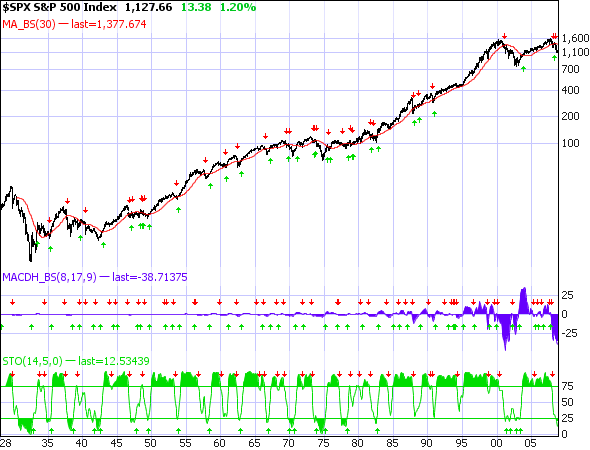

How many of you remember the “Crash of 1987”? Doom and gloom overwhelmed the market. Investors were swearing they’d never again invest in the market. Well, let’s see what would have happened had they never again invested in the Stock Market:

Take a look at the big dip that occured on the chart in 1987. Had an investor thrown in the towel after the “crash” he would have missed out on a 5-fold increase in his portfolio as of today even after the recent decline. History tells us that the market will increase in value 11% per year in the long run. Our economy is resilient and seems to recover even when the picture appears to be hopeless. We, as investors, have to make a decision. Are we able and willing to withstand the risk of the short term volatility of the market? If the answer is yes, then decades of the stock market performance bodes well for the long term success of our portfolios. The decision is a personal one. If you are losing sleep and have developed a personality disorder from the current crisis, money markets and treasuries are probably best for you. Otherwise, stay the course because history is telling us not to worry.

Last Week’s Economic News:

Yet another roller-coaster ride is how I would describe the financial markets last week. Monday, the S&P 500 declined -8.8%, the largest single-day drop since 1987 ( the crash alluded to earlier in this article). The unemployment rate held steady @ 6.1% for September despite the fact that employers made larger than expected job cuts.. Manufacturing and factory orders were well below analysts’ expectations. For the week, the S&P 500 dropped 9.4% for a year-to-date return of -25.2%. Friday’s approval of the “Rescue Plan” gives us hope (along with the change in the administration) that the economy will start turning around.

Stocks Recently Added to my Watchlist:

EZPW

PSYS

*PRGO

CHTT

FLO

*GIS

* Also on this week’s CANSLIM LIST

My best to all,

Alan

For those of you who want to simplify your real estate investments (i.e. retiring) without paying the capital gains I suggest a little known trick. The IRS allows a 1031 exchange of a piece of real estate for a “tenant-in-common” investment in another property. That means that you could exchange your building for part of another building owned with somebody else as tenants in common.

Carrying this concept one step further you can exchange your building for a single member LLC which is a tenant in common investor in, say, a shopping center in Atlanta. You get professional management, a check every month and no tenant headaches.

Get professional help if you do this because your basis in the new investment will not be what the management company shows as your investment amount.

I am very optimistic about the market. In fact, I see significant opportunity with these 4 year lows. The problem is finding the cash since it is tied up in the “hold” pattern until it comes back. Any ideas?

Hi Jim,

Good to hear from you. Since most equities are NOT going to look very pretty technically, I turn to fundamentals. I go the the Stock Check-up and Scouter ratings. All equities that have broken down dramatically (fundamentally) get the proverbial “boot”. They are replaced with stocks that have the highest ratings. The “cream of the cream”. My thinking is that when the institutional investors return to the table, the stocks that are strongest fundamentally are going to appeal to them first. Once that happens the technicals will strengthen. As always, I only want stocks in the top-performing industries. One expression I always used with my sons is that there may not be a great answer but there’s always a best answer.

Best of luck,

Alan

Recent email question regarding my article on corporate bonds:

Alan, what exactly is a (MBS)? do they have a name on the market? and how did these mortgages go from a bank or a mortgage broker to the financial institutions to be sold in the first place?

Tony

My reponse:

An MBS is a type of asset-backed security that is covered by a collection of mortgages. They are also referred to as “pass-through certificates”.

Individual mortgages are pooled, repackaged, and sold to the public as collateralized securities. They are issued by government agencies (Ginnie Mae, Fannie Mae, Freddie Mac) and represent an investor’s ownership in a mortgage pool and the cash flows arising from that pool. You are in essence lending money to a homebuyer and receiving principal and interest in return ususally in coupon form.

They are issued to “select” broker-dealers known as “fiscal agents” and are normally sold to institutional investors. They do trade in the secondary market exclusively in the OTC market (computerized markets) and sold in $25,000 and up increments.

The process is called “securitization” whereby an illiquid asset (mortgage) is converted to a liquid one like a bond (in this case a MBS).

Tony, that’s pretty much the extent of what I know about these securites. If any of my readers are considering investing in this arena I would contact someone with more expertise in the field.

Alan