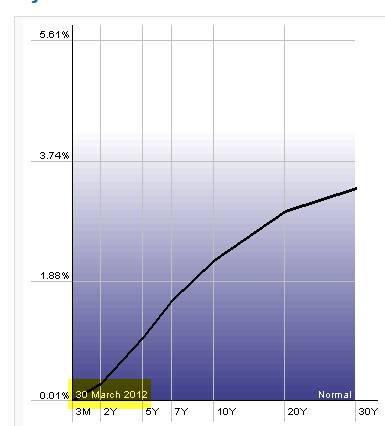

Normal Yield Curve

Normal Yield Curve

There are, however, several shapes a yield curve can take. Here are some of the most important:

Normal Curve:

As seen above, this scenario is when investors are anticipating the economy to expand at normal growth rates without significant inflation or capital availability issues. This defines a period of economic and stock market expansion and good news for investors and economists. The yield curve slopes gently upward as bond (longer term treasuries) investors demand more of a return to counterbalance interest rate risk in the future.

Steep Curve:

Steep Yield Curve- 1992

Steep Yield Curve- 1992This results when we have a greater-than-normal gap between the shorter and longer term treasuries as we see here in April of 1992. This marks the beginning of an economic expansion shortly after a recession. By 1993, the GDP was expanding by 3% per year and by the following year short-term interest rates had increased by 2 percentage points. That’s why investors were demanding greater long-term returns. Those investors who used this curve to increase their stock holdings were rewarded with a 20% return over the next two years (Russell 3000).

Inverted Curve:

Inverted Yield Curve- 2000

Inverted Yield Curve- 2000This occurs when long-term yields fall below shorter-term yields. Long term investors are betting that the economy will decline in the future. An inverted yield curve has predicted a worsening economy in the future 5 out of 6 times since 1970. The NY Federal Reserve regards this yield shape to be predictive of recessions two to six quarters ahead. Stock investors should take this situation seriously. These curves are rare but are almost always followed by economic slowdown or even recession.

Flat or Humped Curve:

Flat or Humped Yield Curve-2008-09

Flat or Humped Yield Curve-2008-09In the case of a flat curve, all maturities have similar yields. For humped curves, short and long term maturities are the same while intermediate maturities are higher. It is important to note, that for a yield curve to become inverted, it must pass through this phase first. Now, not all flat or humped curves become inverted but most are predictive of economic slowdown and lower interest rates. Like inverted curves, it is a red flag for stock investors.

Recent Yield Curve:

Yield Curve as of 4-2012

How would you classify this yield curve? If you read it (as I do) as a steep yield curve than this is one indicator of economic expansion after a recession. This is another reason I have been defining my market outlook as moderately bullish.

Here is a free website to access the current yield curve:

http://www.bloomberg.com/markets/rates/index.html

Event updates:

1- Last weeks interview with Kerry Lutz of the Financial Survival Radio Network has been uploaded to YouTube:

http://www.youtube.com/watch?v=JdK9Qj1npfc&feature=email

2- This Saturday, April 14th:

I will be the keynote speaker for the American Association of Individual Investors/Atlanta Chapter at the Cobb Galleria. The meeting runs from 10AM to 1PM EST and everyone is invited. The club charges $10 for pre-registration and $15 at the door. Here is the link to register:

Market tone:

This week’s reports were mixed to negative but not game-changing:

-

In the minutes of its march policy committee meeting the Fed seemed less inclined to institute another round of bond purchases to loosen credit

-

The Fed re-iterated its intention to keep its target interest rate near zero until late 2014

-

There was a slight rise in the broad manufacturing index in March

-

The Commerce Dept reported that February’s rise in overall factory orders more than made up for January’s decline

-

The ISM manufacturing index came in at 56, slightly below the expected 57

-

Although construction remains relatively depressed it is still ahead of its pace of a year ago

-

On Friday, a weaker-than-expected jobs report came in at 120,000 new jobs added, less than expected as the unemployment rate dropped to 8.2%. This news was NOT a game-changer because:

-

Unseasonably warm weather in December through March resulted in fewer layoffs and therefore fewer hires in March

-

60% of all industries are actually adding jobs

-

The trend is positive as the labor force has expanded an average of 273,000 jobs/month over the past 3 months

For the week, the S&P 500 fell by 0.7% for a year-to-date return of 12%.

Summary:

IBD: Market in correction

BCI: Moderately bullish selling an equal number of ITM and OTM strikes

Happy holidays to all our members and your families,

Alan, the BCI team and our families (alan@thebluecollarinvestor.com)

With the Fed looking to keep target rates near zero through the end of 2014 as you stated in “market tone” it appears that the yield curve will remain favorable to the stock market for the next 3 years. Interesting!

Happy holidays to all BCI members.

Fred

Fred,

Another way to view this is that with real estate still depressed (but perhaps bottoming) and bonds returning next to nothing, the stock market is our best chance to generate palatable returns. The Fed projecting low target rates for the next 2 1/2 years is favorable for the stock market.

Alan

Premium Members,

The Weekly Report for 04-06-12 has been uploaded to the Premium Member website and is available for download.

Best,

Barry and The BCI Team

Just want to wish you all a VERY HAPPY EASTER.

Don B

Alan, Barry,

I see there are many more eligible stocks on this weeks list compared to last week and yet the market was flat last week. Is this a positive sign? Thanks for all your help.

Barbara

Barbara,

I can’t say for sure if the market has changed…only offer my opinions and observations. So from my perspective:

– Last week was the end of the (first) quarter. Big funds and institutions tend to “clean up” their portfolios at the end of the quarter. Some call this “window dressing” to make sure that their portfolios look good to their clients and other stake holders. So, in this case, you see selling of losers and some buying.

– There was also anticipation of what was in the minutes of the recent Fed meetings. As Alan noted in his Market Tone comments, the Fed this week restated its’ intention to keep interest rates near zero until 2014…hence the market appears to be a better place for institutional money.

– The economic reports released this week were a bit better than last month.

– Last week was the start of a new quarter for the institutions.

– Earnings season starts this coming week with Alcoa (AA) reporting on Tuesday.

One of the best features of Alan’s methodology is to be able to “trade what you see” vs. trying to interpret the myriad of reports, many of them conflicting,

Although I don’t think I answered your question, hopefully you can get a sense of what might be causing the current market behavior.

Happy Holidays,

Barry.

Thank you, Alan for the great answer and visual on #16 of last weeks question of mine. I am a ‘visual’ learner, so that was appreaciated. A few more questions (they will probably slow down as I ‘set up shop’ for cc writing…) and I am repeating most of them here, since l probably asked too late on last weeks post.

1) I tried plugging in the quotes to the Elite Calculator in preparation for this week, and got back some negative ROO values. I think that is because the option chain quotes you see over the weekend are whacky… My Fidelity option chain quotes are now ‘zeroed out’ because the market is closed, I tried Yahoo and the CBOE site and, for example, for DISCK 45 strike shows 0.80 even though it is ITM. Kind of hard to prepare a battle plan!

Is there a better way to get quotes on the weekend since the Premium Report is understandably not generated until after Friday Market close?

2) Volume of calls in option quotes: Is there a multiplier involved?, I.E., does 7 really mean only 7 lonely contracts, or does it mean 700, so I can judge selling activity more accurately.

3)Speaking of Owen, When will he be coming out with his first book, or did I miss it ? Seriously, I think many more of us would trade outside of our sheltered accounts also if the reporting/tax consequences didn’t seem so daunting (or maybe it is???)

I realize the tax codes/consequences change so that a book can become ‘outdated’ quickly… But that would mean an annual ‘revenue’ stream for Owen 😉 , and all he would likely have to do is update pertinent’s on his end, while we would gain by having another book focused more on an important housekeeping topic.

4) I think it would be helpful/interesting to see what other BCI folks are using for portfolio management. I saw a reference in a 2010 comment to Otrader, which led me to investigate it, and I am likely to try it… other software I should consider? Anyone here using Otrader? (comments appreciated).

I’ll throw out one… I was looking for an iPhone app that might just serve as a quick way to steal a look at my portfolio/watchlist if I have just a minute break while at work. I was finding it tedious to log in to my brokerage account and pull up a watch list, then to try and look at the charts with no MAs, MACD, etc. I didn’t have that much time or patience. So I looked at the iTunes store and found Portfoliomobile (by BareReef) and ponied up 19.95, because it offered charting. I’m happy with this because now, I just click on the app on my iPhone, it pulls up my portfolios (I set up manually), and it gives me an instant snapshot while the market is open. Prices are updated (Yahoo! feed) and instantly so by just swiping down on the screen, AND I can look at the charts which I have set up (you can create templates) with EMAs in the colors I pick, MACD, sloK%, volume, just like Alan suggested in his first book. This keeps me in touch with my portfolio and the market and a big picture view very quickly. $19.95 may look very steep for an iPhone App, but it has saved an immense amount of time I don’t really have while at work, gives me peace of mind, and is a bargain compared to the sticker shock of one time events like $6 for a small bag of popcorn at the movie theatres.

(Thanks Barry, I downloaded one of the mentioned iApps)

5)Would there be consideration for adding a line to the What Now of the Elite Calculator to show the Time Value (Extrinsic Value)??

All the variables are already plugged in (current stock price, strike price, Ask price). It would help thinking all from one place, as I’m finding myself constantly going to the calculator to also find the Time Value so I can see how close it is/isn’t to the ‘zero’ price to see if unwinding makes sense. For ITM: Ask – (current stock price – Strike) = TV

6)Lastly, there was a question (#45 by Eddie Q in Owen’s Guest Article of December 2010) that I skimmed further Archives up to the present and didn’t see any comments/answers to… did I miss where that was? I think it was very easy to overlook this, since Eddie posted his March 20, 2012 question in a blog entry of 2010!

Nevertheless, again because I currently view management of trades outside of my IRA daunting (yearly reporting requirements, etc), I wondered if Eddie’s question regarding paying a 6% penalty on additional deposit amounts to an IRA (he stated Roth IRA, but mine is a traditional IRA) being worth the penalty if he could more than make up for it in returns made (I presume BCI strategy) in the IRA account. This would seem a possible way to keep trading in an IRA…that was worth investigating.

Thank you for any thoughts.

Hi Carolina,

My responses:

1- You should be able to get weekend quotes from your online discount brokerage account. Of course, you will need to re-check the quotes on Monday or whichever day you actually plan to enter your trades. I have attached a partial options chain I accessed from my brokerage this morning before market open. I selected TIBX because it was a more liquid example than DISCK.

2- Volume is reset to zero each day so I look at open interest. I like to see an OI of 100 contracts or more and/or a bid-ask spread of $0.30 or less. Here is a link to an article I published on this topic:

https://www.thebluecollarinvestor.com/open-interest-and-volume-plus-non-standard-options/

3- Owen has offered to write an article for this site updating tax-related issues. It may have to wait until after April 17th as he is quite busy until then. He can address your “book” idea as well. Same for Eddie Q question.

4- For the “what now” tab, it is the difference in premiums that is critical, not the TV of the original option. However, I understand and appreciate your suggestion. I will include your idea with other recommendations we have had regarding enhancing the calculator and give it serious consideration (also after the 17th).

5- Back to the screenshot of the TIBX option chain:

I highlighted in green the bid-ask spreads and in yellow the OI. With only 10 trading days remaining in the April contracts, our goal is decreased to 1% – 2%. Click on image to enlarge and use the back arrow to return to this blog.

Alan

The 40 call for QCOR looks pretty interesting.

2.3% 9-day return with 3.1% protection of the profit.

Happy trading.

Barbara

Barbara,

I saw that one and was tempted. Maybe tomorrow if the market quiets. Also check out UBNT a stock discussed last week. About a 3.3% return with 1.6% protection. Good luck.

Stan

Premium members:

Thanks to the suggestion of some of our premium members we have added a direct link from your premium site to the 8-part video Beginners Corner Series. Below is a screenshot showing where to access the videos. Thanks for the feedback. (Click on image to enlarge and use the back arrow to return to this blog).

Alan

Hello Alan

Just doing a little bit of fishing here. Is there a main reason, in your opinion, why there are no Precious Metals stocks showing up of late that look any good at all for writing? Granted, they are not rising, generally speaking, but seem to be holding their own. Thanx.

Don B

Don,

Below is a screenshot of the top 15 industry group leaders over the past 6 weeks. That does not mean that a precious metal stock will not turn out to be a great covered call candidate but rather that statistically they are not among the top-performers at this moment in time. (click on image to enlarge and use the back arrow to return to this blog).

Alan

Alan’

I also want to ask what the feeling is in general with respect to the implications of just what type of accounts one should or should not enlist when writing options. It looks at first glance as tho one should avoid using an open account, with all that is involved with respect to details of tax reporting, and stay with such as IRAs. Comments will be sincerely appreciated.

Thanx.

Don B.

Why does Apple have so many more option months available than other stocks (4-5 months in a row).

Thanks.

David

David,

AAPL was one of 20 securities part of a pilot program called the Additional Expiration Months Pilot Program:

On Monday, November 1, 2010, pursuant to SEC Approval, ISE introduced additional expiration months on 20 actively traded option classes listed on the ISE on a pilot basis until October 31, 2011. Under the pilot, the ISE added up to two new expiration months in addition to the expiration months the exchange currently lists. Pursuant to the pilot, ISE listed four consecutive near-term expiration months plus two months from the quarterly expiration cycle. After the additions were made on November 1, ISE maintained the pilot by adding a single new expiration month at expiration.

Classes selected for the pilot were available throughout the pilot period. Any class that is delisted at the ISE will not be replaced. The pilot program allows ISE to also list additional expiration months for option classes selected by other exchanges if another exchange adopts a similar pilot program (assuming the option class selected by another exchange is listed on the ISE). This program has since been discontinued but the 20 securities continue to retain the additional expiration months.

The list of the 20 securities is archived in the “resources/download” section of the premium site. I’ll be happy to provide this list to general members upon request.

Alan

Running list stocks in the news: ULTA

This company is the largest beauty retailer in the country. Analyst consensus is for earnings growth of 28% in the current year and 26% next year. Same store sales have grown by 11.5%, 9.6% and 11.3% in the past 3 quarters. Over the past year, ULTA has outperformed the S&P 500 by 76%. It has maintained its price strength by outpacing the S&P 500 by 18% in the past 3 months and by 5% in the past 30 days. Our running list shows that ULTA has been on our premium watch list for 10 weeks, has an industry segment rank of “B” and a beta of 1.08. The chart below shows how this equity has had extremely bullish earnings surprises over the past year. (Click on chart to enlarge and use the back arrow to return to this blog).

Premium members:

This week’s 6-page report of top-performing ETFs and analysis of ALL Select Sector Components has been uploaded to your premium site.

For your convenience, here is the link to login to the premium site:

https://www.thebluecollarinvestor.com/member/login.php

Not a premium member? Check out this link:

https://www.thebluecollarinvestor.com/membership.shtml

Alan and the BCI team

We’re looking forawrd to meeting many of you in Atlanta this weekend.