Can we use covered call writing and selling cash-secured puts to generate profits when share price declines by 10% in two months in a bear or volatile market environment? I am writing this article on January 5th, 2015, the worst day the market has experienced in over three months. This hypothetical trade represents an unscientific study based on a real-life options chain and many of the BCI guidelines and rules. Here are the assumptions for this 2-month trade:

- We are in a bear or volatile market environment that will last for at least two months

- Share price will decline 10% in two months, we’ll assume 5% per month

- Market concern dictates the use of out-of-the-money puts (strike price below stock price) and in-the-money calls (call price below stock price)

- We will estimate monthly returns for the calls and puts by using a 6-week options chain and converting to monthly percentages

- We will assume no exit strategies will be required

- The stock selected is KORS as of 1-5-15

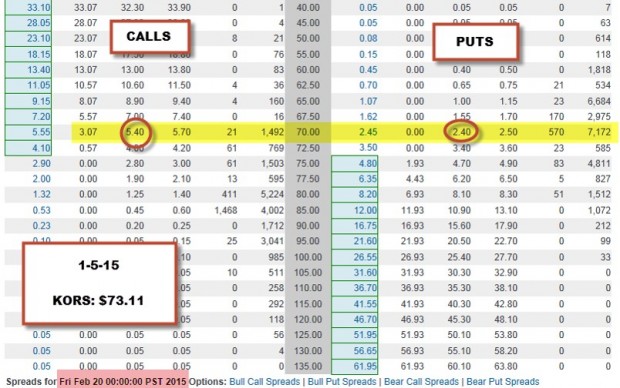

With the price of KORS at $73.11 near market close on 1-5-15 this is the real-life options chain for the 6-week February expiration:

KORS options chain on 1-5-15

Initial trade

Since we are concerned about current market conditions, we will start by selling an out-of-the-money cash-secured put and converting the 6-week return into a one-month return. With KORS trading at $73.11, the $70 out-of-the-money put generates $2.40. Let’s take off our shoes and socks and do the math:

$2.40/($70 – $2.40) = 3.55%, six-week return = 2.6%, one-month return. Note that our breakeven is $70 – $2.40 = $67.60. If share price declines by 5% to $69.45, we are still in a profitable situation.

Status at first month expiration

Let’s assume share price drops by 5% and the shares are put to us at $70. Since we are still concerned about the overall market environment, we will write an in-the-money covered call. Using the same formula as we did for the put calculations, we see a six-week return for an in-the-money call of $5.40. Since the current call is more than $3 in-the-money, we will assume the call strike to be $66 (not scientific but hopefully meaningful enough to make a point). The six-week return for the above $70 in-the-money call is ($5.40 – $3.11)/($73.11 – $3.11) = 3.27% which converts to a one-month return of 2.36%. Note that our new breakeven is between $64 and $65 dollars with current share value at $$69.45. Once again, we will assume another 5% decline in share value from $69.45 to $65.97, near the $66 in-the-money call strike and well above breakeven.

What is our cost basis?

Let’s calculate without using time value profit to reduce our cost basis (don’t do this for tax purposes!). Shares were put to us at $70 and the intrinsic value of the call premium “bought down” our cost basis to about $66. This is very close to the current projected price of $65.97. Our two-month profit is 2.6% + 2.36% = 4.96% which annualizes to 30%. Now, even if the numbers fall less favorably for us, we still have plenty of room for a palatable outcome in a bear market environment.

Summary

Option selling can result in monthly profits even in bear and volatile market conditions. Thios article, although unscientific in nature, represents some general points to support this conclusion.

Next live seminar:

February 6, 2015

The World Money Show Orlando, February 6, 2015 at The Gaylord Palms

Friday February 6th

4PM – 6PM

Market tone

What’s up with all this market volatility? As I have been reporting since March of 2009, the economic reports have shown signs of recovery and expansion. In the past year, we have seen four spikes in the VIX that make conservative investors like us uneasy. Another spike occurred this month but why? US economic reports continue to show bullish signs on the economy , lately even with jobs growth. Investors are always looking for reasons to be nervous, after all, we’re risking our hard-earned money. Global weakness is a valid consideration as is uncertainty exacerbated by terror attacks in France and the tenuous status of the Euro. One of the reasons, in my view, volatility has reared its ugly head is that economists and investors are not sure how to interpret certain measurable changes. For example, oil prices have been dwindling dramatically…good or bad? Will it lead to regional weakness and impact certain nations negatively thereby having a bearish influence on the global economy? Or will it put additional cash in the pockets of consumers allowing them to enhance the economy to even higher levels? Bulls interpret one way, bears the other. Volatility spikes and then it subsides. Same thing with low interest rates and low inflation…good or bad for our economy? So while the market is making up it’s mind, I am taking a cautious approach with my positions but remain bullish on our economy as I have been for the past 5 years…just one man’s opinion.

- According to the US department of Labor, 252,000 jobs were added in December, above the 245,000 expected

- For the year, 3 million jobs have been added to our economy

- The unemployment rate has dropped to 5.6%

- The ISM non-manufacturing index came in at 56.2, below expectations, but still reflecting expansion. This represented the 59th straight month of growth

- According to the Federal Reserve Board, consumer credit slowed to + $14.1 billion in November (+ $15 billion was expected)

- According to the Department of Commerce, new orders for manufactured goods was down 0.7% in November

- The trade deficit declined to $39 billion in November from $42,2 billion in October, the 3rd straight decline and lowest reading since December, 2013

For the week, the S&P 500 decreased by 0.7%%.

Summary

IBD: Confirmed uptrend

GMI: 4/6- Sell signal since market close of January 6, 2015

BCI: Cautiously bullish selling equal numbers of in-the-money and out-of-the-money strikes. Selling out-of-the-money puts is another way to navigate markets of concern.

My best to all,

Alan ([email protected])

Premium Members,

This week’s Weekly Stock Screen And Watch List has been uploaded to The Blue Collar Investor premium member site and is available for download in the “Reports” section. Look for the report dated 01/09/15.

Also, be sure to check out the latest BCI Training Videos and “Ask Alan” segments. You can view them at The Blue Collar YouTube Channel. For your convenience, the link to the BCI YouTube Channel is:

http://www.youtube.com/user/BlueCollarInvestor

Since we are about to begin Earnings Season, be sure to read Alan’s article, “Constructing Your Covered Call Portfolio During Earnings Season”. You can access it at:

https://www.thebluecollarinvestor.com/constructing-your-covered-call-portfolio-during-earnings-season/

Best,

Barry and The BCI Team

I enjoyed Dr. Ellman’s presentation in Paradise Valley AZ on Saturday. This BCI service is exactly what I have been looking for. I have been trading options for 10 years, but “by the seat of my pants”. I have had no system. Though I have done well, I also have been caught in bad trades a couple times due to lack of discipline. I hope to avoid that in the future.

I am hoping to see both buy suggestions (the stock screens) but also sell suggestions each week. If there are several parameters to get into a stock position and the associated options, what would be the requirements to get out? I would sell the underlying when closing the option. The times today, like in late 2007 to early 2009 require such a discipline. Please provide guidance along with great option strategies.

Thanks for this great post..

I know you prefer covered calls, but I was wondering, what is your opinion on credit spreads? Do you think it is more risky than a covered call strategy? Isn’t this a better strategy in terms of capital allocation?

I am sure there would be some set of rules and exit strategies for this strategy just like covered calls.

Thanks

hrkstox

Hello Rohit,

Credit spreads are an excellent strategy. They can produce excellent returns. Comparing credit spreads to covered calls, there are some key differences. For example:

– Covered Calls can be used inside an IRA at most brokerage houses, where Credit Spreads are typically not allowed.

– At most brokerage houses, you will need a higher level of account approval and permissions to trade Credit Spreads.

– Credit Spreads are a more involved trade and require a deeper understanding of options in general and an understanding of a set of options metrics usually referred to as ” The Greeks”.

– Credit Spreads typically require more management and an a good working knowledge of adjustment techniques.

– Credit Spreads require a deeper understanding of chart analysis.

– Credit Spreads are more commission and time intensive.

– Many credit spread traders exit prior to expiration (usually when they achieve 75 to 80% of the target return…so they will usually consume more time more time to enter, manage, and make exit decisions .

– Many market professionals do not like the risk/return ratio(s) for credit spreads, but they trade that off for a higher probability trade.

– As mentioned earlier, you need to be much more expert in using chart analysis and knowledge of Greeks for proper trade set up.

– As for risk, with credit spreads, you know exactly what your max return and max loss will be when you enter the trade. Both trades are more forgiving than pure directional trades and have well defined exit/adjustment strategies. A more detailed discussion of the risk profile details are beyond the scope of this blog.

If you are interested in credit spreads, the Weekly Report can be used to find excellent Bull Put Spread (credit spread) candidates…as well as calendar spreads, diagonal spreads, bull call spreads (debit spreads), and of course…Cash Secured Puts.

We have been thinking about providing training and educational products for both credit and debit spreads, but we are still early in our planning.

Feel free to email me directly at [email protected] if you have more questions on the topic.

Best,

Barry

Hi Barry….I brought up my interest in call spreads (and put spreads) to Dr. Ellman at the AZ seminar. I have been trading them for 10 years. I normally trade debit spreads with the first leg DITM to eliminate as much time premium as possible. I use the 2nd leg (short) to cover any additional time premium and perhaps get a little extra intrinsic profit. This approach creates a synthetic margined equity position but with well defined risk and a built-in exit.

I have found I can roll these up and down and out to manage market conditions. As long as I have dry powder, I can roll down to protect myself if my thesis was wrong and the stock price drops. The only time this didn’t work was 2010 when the flash crash led to a 25% market drop that flushed me out due to its severity, at a time when I had a large number of debit call spreads on (too much it turned out). But more recently I have had a lot of success with EUO (and considered YCS). I got the timing on EUO wrong in 2013 (way too early) and the Euro moved from 125 to 140 by mid 2014. But I was able to roll my DITM call spreads down with no loss of time premium. Then, by July, my thesis on a weak Euro was proved correct and I have rolled up and collected my gains along the way.

I normally use longer term calls and puts to reduce the cost of churn. I go out 6 months or even a year (LEAPs). I am also using a debit put spread on EEM right now as I believe the strong dollar will damage emerging markets over the next year.

I have not done credit spreads before but am very interested in the concept. I would be interested in further discussions and trade ideas on this topic from BCI.

Hello Brian,

I appreciate your experience and trading approaches. Based on the trades that you reviewed above, I have a few observations:

[1] Debit spreads are interesting. Typically you can look at debit spreads, particularly Bull Call Spreads, Calendars, and Diagonals as “stock substitution” type trades…that is using the long call as a substitution for long stock (that is used in a covered call). A very interesting approach that can take advantage of the data that we provide in the Weekly Premium Report.

[2] These type of trades require a higher level of knowledge and skill level than Covered Calls and Cash Secured Puts require.

[3] When considering trades, I try not to guess on the direction of the market or the outcome of geopolitical/economic events. One of my key personal rules (really “laws”) is that I only trade in the direction of the market and not predict where the market is going. I try to find stocks that are moving with the major trend of the market. Strong charting.skills are critical here.

[5] I personally find that credit spreads are more intuitive and easier to understand…but that is a personal perspective. I also like stock substitution trades. We’re thinking about offering education in this area, but that is out a bit. We have some interesting things coming in 2015.

Thank you for spending a part of your weekend with Alan in AZ…and welcome to the BCI Community.

Best,

Barry

Hi Barry….regarding 3), I am trading currency using EUO (strong dollar / weak Euro) using calls. While this is a directional trade and a macro trade, it seems and has been a very confident trade. Calls are very efficient for something like EUO. Even though a synthetic short equity (using forex futures contracts as underlying) it does not have much time premium in any near term ITM contract. I suppose the reason is that implied (and actual) volatilities for currency trades are low. Also, there is no dividend and no earnings to cause price fluctuations.

I had looked at YCS, the yen short, back a couple years ago (late 2012) but did not pull the trigger (time premium was higher than EUO, so harder to be efficient). But Abe has proven to be good for his word and has cut the value of the yen in half as compared to the dollar since late 2012. It is a much more dramatic price move than the Euro. Had the trade been executed with rolling calls on YCS, it could have yielded 100%+ annual returns the past two years with little risk (the only risk being that Japan decided to suffer with a strong currency)

The key to these currency trades is that the leaders of the currency (Central Bankers) have promised the investing community to push the currency in the desired direction. When the person who prints the currency promises to do more of it and has the required authority, they can be believed and trusted to do so.

Hey Brian,

The item #3 in ,y reply is just a philosophical discussion point. I tend to be a very conservative trader and follow my trading plan. You need to be comfortable with your own trading plan, trading style, and personal risk.

Best,

Barry

Alan

I am a bit confused as regards the absence of upside potential (in the Ellman Calculator) when rolling out.

Say I buy XYZ for $38 and sell the $40 strike. Price goes above $40 at expiration and I decide to roll out.

Wouldn’t that $2 unrealized capital gain represent upside potential? Or would you consider that profit as attributable to the previous contract period, even though not realized?

(PS I bought the premium membership and noted that you already have exit strategy flowcharts.)

Thank you for your patience,

Regards

Anton

Anton,

Good question…

At the time we are considering rolling the option (on or near 4 PM ET expiration Friday), we are deciding between 2 events:

1- Allow assignment

2- Roll the option

The amount of cash generated in the near month plays no role whatsoever in this decision. As a matter of fact, it may cloud our choice.

In your example, you have maxed the near-month trade (Option profit + max share appreciation to the strike) as the $40 strike moves in-the-money. If you roll the option to the same $40 strike, it will always still be in-the-money initially so there is no upside potential and that’s why it doesn’t appear in the calculator. Now, if you were to roll out and up, you can roll to any type of strike depending on the relationship between the strike and current market value (ATM, ITM or OTM). Check the calculations and exit strategy chapters in the Encyclopedia….

Alan

Alan

Say the price is $43 at expiration of the second contract period and I allow assignment at the strike of $40. I am understanding that there would be a capital gain of $2 between my actual cost of $38 and the $40 strike, no? (in addition to the net premia received). How would you treat this capital gain at the time of rolling out (still unrealised but potential) at the time of rolling out?

Anton

Anton,

All responses that I give as it relates to tax questions must be confirmed by your tax advisor as I am not a tax expert.

My understanding is that the holding period determines short-term vs. long term capital gains (losses). For the 1-month options we sell, the acquisition date is when we buy back the option, after the sale date…short term. On the stock side, the purchase date is the date we initially bought the shares and, when rolling, as yet undetermined regarding the sales date. The cut off time frame is 1 year and 1 day so, for most of us, that too will be short-term.

When possible, trade in a sheltered account for this strategy.

Alan

I use ETrade for my options trading and they have always made the short term vs long term gain assessment for me in my year end Form 1099s that I download from the Etrade website. I would think most trading platforms will do this as it is an IRS requirement on them, I believe.

THANK YOU PHOENIX:

For filling every seat in the house…

CLICK ON IMAGE TO ENLARGE & USE BACK ARROW TO RETURN TO BLOG.

Alan

What about earnings report? Do you sell puts and later disregard(unless two months out or greater) the ER? This scenario would be possible only 4x/year or so. And the timing would be difficult to master given the parameters and weekly reports which are fluid in nature. Or 3 or 4 weeks later would you just disregard the EMA’s, Vol. , MACD and Stoch and sell the calls anyway? Since you would now own the equity. Or do you hold until after ER and then sell calls? Or only use weekly’s on the equity after the assignment? Most are not weekly options but all have changed and still reflect back to the previous 4 week timeframe in which you sold the put.

Joe,

When using the Put-Call-Put strategy, ERs are treated the same as if you were using one or the other.

1- If the cash was available from the exercise of a call option, a put would be secured using a different underlying if an ER was due the next contract.

2- If the stock was owned after being “put” to us or after the call option not being exercised, we either hold the stock through the report and sell the option after the report or sell the stock and use a different underlying.

3- ETFs can be used and the ER becomes a non-issue.

So: PCP continues to generate cash flow but not always with the same underlying due to earnings reports…the same as if only one strategy was being employed.

Good question.

Alan

Alan,

Since I have been with you a while I enjoy reading about your full workshops and ongoing success – congratulations!

To the new readers and contributors I extend welcome . I also suggest you manage expectations when getting started. Investing is, as the Beatles sang, “A long and winding road”.

I have recommended Alan’s work to investing friends. Invariably I hear back “I thought you said i would make 3% a month. I am not getting anything near that”.

Well, that is because they are looking at it from a total portfolio perspective. There is nothing easier than buying a stock off Alan’s list and selling a one month call for 3%. The trick is keeping the income! That is difficult when all your winners get called and you keep your losers.

I suspect few investors make 3% a month real portfolio gain.

Alan’s methods work. They produce cash flow. I will always use them.

It is critical (and I think Alan will back me up on this) that you do your homework, read the materials and paper trade first. It is a strategy of active management and “the harder you work the luckier you will get.”

It is not an automatic cash register.

I never expect to “keep” all the income I get selling options each month from a portfolio perspective. Yes, they create cash credits you can immediately re-invest. But also debits which will market fluctuate. So your overall portfolio could go up, down or sideways depending on the underlying stocks.

That fact is often lost on new investors to this method no matter how hard Alan tries to explain it A blind spot in our human nature. We think “Hey, I just made 3% selling a Facebook monthly option. That’s 36% annualized.”

“Well, yes you did. Now let’s see if you keep it.” That 3% monthly income on Facebook will be gone by lunch time on any given day.

Not the end of the world. Just part of the game when we exchange certain income today for an uncertain tomorrow. There should be a place for options selling in everyone’s portfolio.

Just not the only arrow in the quiver! – Jay

Jay makes a good point which relates to the three required skills needed to generate the highest possible returns. The first two, stock selection and option selection, lead to our initial returns, based on each of our goals (mine is 2 – 4% for initial returns). Once a trade is entered the “show” isn’t over because we now move into management mode. Exit strategies or position management is such a critical part of the BCI methodology and the third required skill for this strategy (put-selling has the same required skills). These techniques will allow us to mitigate losses, turn losses into gains and even enhance gains as in the “hitting a double” and “mid-contract unwind exit strategies”

This last skill, along with cooperation from the overall market, will determine our final results.

I always respectfully suggest not to start trading until all three skills are mastered.

Thanks to Jay for giving me an excuse to say it again!

Alan

Alan, thanks for your always kind reply and the time you spend interacting with members. This is a great comment board!

Barry and Brian, thanks also for your excellent discussion of credit spreads. I do them all the time in my IRA with Options House at very low cost and no extra approval required. Good income stream at lowered risk.

Barry, I typically sell an ITM put first on a stock from your weekly list after it takes an initial dip. SWKS a great example today. It was down 2.8% near the close after being featured on the Eligible Candidate list. The put options were up so I sold the February put for a 5% initial return.

Most of the time the stocks on your list go up. Then I can come in and buy protection near the original put sell strike for an almost risk free trade to complete the credit spread. Or just let them run free.

But if SWKS keeps going down I have the same risk and exposure as if I owned it – which I will if I do not close the position.

Did I get initial “income”? Yes. Will I keep it? Who knows? The game has just begun! I have 5 weeks of position management ahead of me.

Alan, since I gave you an excuse to say something again please let me do the same:

The misconception too many newcomers to this strategy have is confusing initial option returns for portfolio gains. They then suffer disappointment if not remorse for having done it in the first place.

Option sales are not “fire and forget” missiles. You gotta’ track ’em to the end :). – Jay

I’m curious how much time you recommend a trader spends watching his trades. Should I sit and watch them everyday to prevent losses, or should they be looked at right before close everyday?

Have you done a video on trading habits?

I’m afraid that once I get into a trade, I will want to sit, watch and obsess.

Chris,

Once you master the strategy, it will not take up that much of your time. Although position management is critical to maximizing returns, we are certainly not day-trading. I believe a portfolio should be looked at least once a day but buying back an option due to share depreciation can be automated. After entering a trade, set a limit order to buy back the option @ 20% or less of the original option sale price. Mid-way through the contract change that order to 10% or less. Make sure your broker sends an email notification if the order is executed.

No obsessing necessary or we may have to add a psychiatrist to our position management arsenal!!

Alan

Alan,

AFSI was on the watch list 12/19/14 then fell off the next week. Does that mean I should get out of my AFSI position?

George

George,

No, the watch list does not dictate sell decisions. Once a position is entered, it is managed as decsribed in our books and DVDs.

Alan