Covered call writing is not a zero-sum strategy. Both the option-seller (call writer … us) and the call buyer can be successful. This article will provide a hypothetical example, demonstrating a scenario where both call buyer and seller end up with substantial 1-month returns.

Hypothetical covered call writing trade

- 9/18/2023: Buy 100 x BCI at $48.00

- 9/18/2023: STO 1 x 10/20/2023 $50.00 call at $1.50

- 10/20/2023: BCI trading at $52.00 on expiration Friday

- 10/20/2023: Take no action and allow exercise of the $50.00 call, selling shares for $50.00.

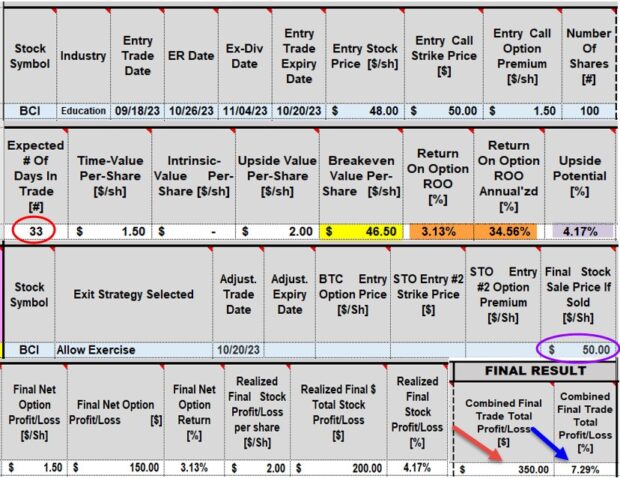

Calculations with the BCI Trade Management Calculator (TMC)

- Top row shows the initial trade entries.

- The 2nd row shows the trade to last 33 days, if taken through contract expiration (red circle).

- The breakeven price point is $46.50 (yellow cell).

- The 2nd row shows an initial return of 3.13%, 34.56% annualized, based on a 33-day trade (brown cells)

- The 2nd row shows an upside potential of 4.17%, if BCI moves up to, or beyond the $50.00 call strike (purple cell)

- The 3rd row shows that the option was allowed to be exercised and shares sold at the $50.00 agreed-upon sale (strike) price (purple circle)

- The 4th row shows a final cash return of $350.00 (red arrow) or 7.29% (blue arrow) for the 33-day trade.

Covered call trade from the option buyer’s perspective

- 9/18/2023: 1 contract of the BCI 20/20/2023 $50.00 call purchased at $1.50 per-share or $150.00 for the 1 contract

- 10/20/2023: With BCI trading at $52.00 at expiration, the $50.00 call option is valued at $2.00 of intrinsic-value + minimal time-value, let’s say $0.02 for a total sale value of $2.02 per-share, $202.00 per-contract

- Based on an investment of $150.00, the final result is a return of 135% for the 33-day trade

Discussion

Covered call writing is a strategy where both the call seller and buyer can be successful. Of course, there is risk from both perspectives and not all trades will turn out as favorable as this hypothetical, but many do.

BCI Annual Premium Membership: $100.00 discount (See the video below for details)

Use promo code: Annual100 (valid through midnight October 6th))

Let us do the stock & ETF screening for you. 4 reports + more than 250 training videos + dozens of resources & downloads all for 1 price of $657.40. This includes 1 free month, so the annual subscription is for 13 months. Your price after the $100.00 discount for the 1st 13 months is $557.40. This will renew at $695.40 in 13-months, should you opt to continue premium membership. Here are just some of the benefits of our premium membership:

- Annual Premium Membership (valued at $657.40)

- Weekly stock and ETF reports

- Monthly Blue-Chip Stock report

- Quarterly dividend investing report

- 250 educational videos with additions each month

- Large number of reference and resource files

- Quick-start videos explaining use of BCI reports

- Quick-start e-books to help launch your understanding of the BCI methodology

- Guaranteed no price increase as long as membership is active

- Use promo code: Annual100 (valid through midnight October 6th)

- Click here for 13-month subscription

Click here for 13-month subscription.

Your generous testimonials

Over the years, the BCI community has been incredibly gracious by sending our BCI team email testimonials sharing stories as to what our educational content has meant to their families. Moving forward, we have decided to share some of these testimonials in our blog articles. We will never use a last name unless given permission:

Alan,

Your CEO video yourself and Barry did was amazing.

There is so much information and a short comment you and Barry made on bids with the market makers worked out for me today.

Sold about 15 contracts various stocks I owned with the placing of my trade higher above the bid by 0.20-0.40 cents more than I might usually would. I calculated an extra $250 in premiums by being a little patient. All trades went through and was a great day.

John

Upcoming events

1. Orlando Money Show Live Event

45-minute workshop: Monday October 30th 2:10 PM ET – 2:55 PM ET

Selling Cash-Secured Puts and Strategy Choices After Exercise

2-hour MoneyMasters Class: Tuesday October 31st 9:30 AM ET – 11:30 AM ET

How to Master Covered Call Writing:

A detailed start-to-finish analysis using real-life examples.

Details & Registration information here.

2. BCI-only webinar (all invited to our 500 Zoom maximum)

Thursday November 9, 2023

8 PM ET – 9:30 PM ET

Zoom link will be sent to all on our mailing list as event approaches.

Join our mailing list on the blog link of this site- right side scroll down.

Selling Cash-Secured Puts: Multiple Applications

Selling cash-secured puts is a low-risk option strategy geared to generating cash-flow, but always with capital preservation in mind.

This presentation will detail the strategy, incorporating the 3-required skillsets necessary to achieve the highest levels of returns … stock selection, option selection and position management.

If and when we allow exercise of the put options, shares are put to us at a price we agreed upon. What is our next step? This seminar will discuss potential paths we can take and the rationale behind these decisions, using real-life examples and calculations.

Q&A will include covered call writing, cash-secured puts and related strategies.

Zoom link will be sent to all on our mailing list as event approaches.

3. AAII Orange County, California Chapter

AAII Investment Club members only

Saturday November 11, 2023

Details to follow.

4. Long Island Stock Traders Meetup Group

Thursday February 15, 2024

7:30 PM ET – 9:00 PM ET.

Details to follow.

Hi Alan & Barry,

I am intrigued by this implied volatility strategy and particularly the standard approach you mentioned using DOTM Cash Protected Puts and DITM Covered Calls, as it seems to fit my risk tolerance philosophy.

I have 2 Q’s:

#1. After determining the low expected price range of the stock (using your calculator..thank you btw), I see that I can use the same strike for either the call or put.

What would you recommend as the better strategy? From my limited experience, the put seems to be a better way of potentially hitting a double if the stock rises whereas the call is pretty much dead money.

I also see that the premium is slightly higher using the calls.

#2. Seems in order to use this approach, the Implied volatility needs to be fairly high. Do you recommend an implied volatility range to make this approach effective seeking a 1.5-3% monthly premium or am I dreaming that a premium such as this is possible?

Sorry for the long question.

Sincerely,

TOM

Tom,

#1: Using implied volatility and the BCI Expected Price Movement Calculator, will result in (approximately) 84% probability of success trades. In return for lowering our trade risk, we are accepting lower returns than from traditional covered call writing or from selling cash-secured puts. That’s the tradeoff.

In bear and volatile markets, or if we simply sleep better at night using this strategy approach, I prefer cash-secured puts to initiate my trades and then can move to DITM covered calls if and when exercised. This is known as the PCP (put-call-put or “wheel”) Strategy, in our BCI community.

If we want to leverage shares, we already own, DITM covered calls is the route to go. We must be prepared to roll the options (if we want to retain the shares) or allow exercise (if we are willing to sell our shares) as the call strike will likely expire ITM.

#2: Since we are trading much lower risk for lower returns, an initial time-value return of 1 1/2% – 3% per-month is unrealistic. Unfortunately, we can’t have both. A more achievable goal is 0.75% – 1.25% per-month. This still annualizes to a significant return, while keeping our risk factor down to (approximately) 16% and that is without our use of our exit strategy arsenal which will bring our risk factor down even lower.

Bottom line: Very low risk, but risk, nonetheless. There is no such strategy where we can achieve better-than-risk-free-returns with no risk.

Alan

Alan,

Thank you very much. I completely agree. I will start with the cash protected put (OTM) with a higher delta of approx 20-30 to gain better premiums and then either use an exit strategy or allow exercise and play the wheel strategy. Makes complete sense that I’ll need to up my risk tolerance to get to the 2-3% per month return.

Thank you very much!

Ps, I live in Tampa and may come to meet you at the money show in Orlando, but not sure yet.

Sincerely,

TOM

Tom,

That would be great, if you can work it out.

I’m hosting 2 presentations and we’ll be at Booth # 507.

Alan

Alan,

Perfect, thanks for the info. I will be there on Monday, but cant make it on Tuesday.

BTW, I’m super excited about placing OTM put trades and implementing the wheel strategy (starting tomorrow) if exercised rather than my past strategy of OTM calls.

I also looking forward to attending your 2:40 talk on Monday

Sincerely,

TOM

Alan,

I’m re reading three of your books at the same time 🙂 to clarify some details and get a better perspective. (I would self classify as a true believer at this point. ).

In the Encyclopedia, you write, ““Get out of your stock/option position when new information becomes available.” And you then describe a hypothetical news event. So I understand the idea.

I want to ask you this: Does ‘new information becomes available’ include a stock falling off the watch list. For example, TSLA was on a recent watchlist. Then the next week, it didn’t make the grade. Does the change from week to week qualify as ‘new information’?

And, I want to review ALL of your articles that you’ve listed on one of the docs in the premium member site ( I am one) but I don’t see all of them on any of the pages.

I think I would learn more about how you look at things after reading them. But I don’t see them ALL.

Rgds,

John

John,

1. No, a stock getting “bumped” from our watchlist of eligible securities, is not a reason to automatically close that trade. Once we enter a trade, we manage it using our archived exit strategy arsenal. Now, if the situation does call for the trade to be closed, based on our position management skillset, we use our most recent stock or ETF watchlist for a security replacement.

2. If you are referencing our “Ask Alan” video library, where I break down real-life trades from my portfolios or from those of our members who have shared trades with me, login to our member site and scroll down on the left side (as shown in the screenshot below). The 1st 10 trades are shown and click on the link below #10 for the remaining 200+ videos.

You will note that in the topic list (right side of page), there are a few, yet to be published videos. We add 1 new “Ask Alan” video to the premium member site on the 2nd Wednesday of each calendar month.

CLICK ON IMAGE TO ENLARGE & USE THE BACK ARROW TO RETURN TO BLOG.

Alan

Thank you, Alan,

It’s quite interesting to re read your books and pick up new insights each time. Today I’m going over technical analysis again 😄.

John

John,

I’m impressed with your drive and due diligence.

Keep up the great work!

Alan

Premium Members,

This week’s Weekly Stock Screen And Watch List has been uploaded to The Blue Collar Investor Premium Member site and is available for download in the “Reports” section. Look for the report dated 09/29/23.

Also, be sure to check out the latest BCI Training Videos and “Ask Alan” segments. You can view them on The Blue Collar YouTube Channel. For your convenience, the link to the BCI YouTube Channel is:

https://www.youtube.com/user/BlueCollarInvestor

Reminder: Premium Member’s pricing is locked into your current rate and will never see a rate increase as long as the membership remains active.

Best,

Barry and The Blue Collar Investor Team

Premium members:

This week’s 4-page report of top-performing ETFs has been uploaded to your premium site. The Select Sector SPDR section is now crafted to align with our streamlined (CEO) approach to covered call writing. The report also lists Top-performing ETFs with Weekly options, mid-week market tone as well as the implied volatility of all eligible candidates.

Premium member video link:

https://youtu.be/EXMO-KwZuJs

For your convenience, here is the link to login to the premium site:

https://www.thebluecollarinvestor.com/member/login.php

NOT A PREMIUM MEMBER? Check out this link:

https://www.thebluecollarinvestor.com/membership.shtml

Alan and the BCI team

Alan ,

Your notes on the premium report 1st page especially BCI comments have really helped in this current market.

My trades are all positive gains in the short time I have been using the Trade Management Calculator.

In the money calls are managed so much better now .

Thanks

John

John,

Thanks for the feedback.

So pleased you are integrating ITM calls into your strategy approach. Too many covered call writers, outside the BCI community, are unaware or avoid this defensive procedure in crafting our covered call trades.

Alan