Covered call writing can be crafted to meet a multitude of trading styles, goals and personal risk tolerances. In this article, I will highlight yet another situation where we may utilize this great strategy. In this common hypothetical, we are preparing to sell a stock that has substantially appreciated in value and represents a source of long-term capital gains (LTCG) since we’ve owned the shares for more than a year and a day. I will use Nvidia Corporation (NASDAQ: NVDA) as a real-life example to discuss this strategy.

Setting up the trade

500 shares of NVDA were purchased in June of 2016 for $49.00 per share in a taxable account. On June 12, 2017 the stock had appreciated to $149.67. It was determined that shares should be sold for long-term capital gains of $100.49 per share. Since we are already in a favorable tax category, let’s evaluate if selling call options will enhance gains even more.

Possible strike price expiration results

- If the short call strike ends out-of-the-money on expiration Friday, the option trade represents short-term capital gains and we still own the shares in a LTCG category. Shares can be sold or leveraged to write 5 more calls for the following contract month

- If the short call expires in-the-money and no action is taken to buy back the 5 contracts, shares will be sold at the strike and the option premium will be incorporated into the stock sale as part of the long-term capital gain. If we decide to buy back the option at a loss (could be a gain as well) to avoid exercise, that potential loss can be used to offset part of the capital gain from share appreciation.

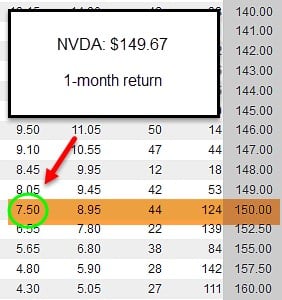

Option chain for NVDA on 6/12/2017

NVDA: Option Chain Evaluation when Capturing Long-Term Capital Gains

We see that $750.00 per contract can be generated by selling the near-the-money $150.00 strike. This amount potentially can be even higher by leveraging the Show or Fill Rule.

The Ellman Calculator results

NVDA Calculations and Long-Term Capital Gains

The Ellman Calculator shows a potential 5.2% (5% + 0.2%) additional 1-month income stream by incorporating covered call writing into our long-term capital gain trade.

Discussion

Covered call writing can be tailored to enhance returns on a stock that has dramatically increased in value over a time frame of more than 1-year. This article portrayed a scenario where we are prepared to sell the stock in the near-term from a taxable account. The risk is in the stock price declining by more than the premium generated from the sale of the short call.

*Since I am not a tax expert, please check with your tax advisor before making any tax-related decisions.

**Thanks to Matt for inspiring this article.

Next live event

AAII National Conference

November 3rd – 5th: Loews Royal Pacific Resort Orlando Florida:

Exhibit Hall # 303

Workshop presentation Saturday 10:30 – 11:45 AM

Market tone

Global stocks reached new highs this week as US interest rates pulled back from recent highs. Oil moved higher to $51.50 per barrel from $49.50 last Friday. Equity volatility remains steady, little changed from last week’s reading of 9.50. This week’s economic and international news of importance:

- US retail sales rebounded in September, rising 1.6%. Higher gasoline prices in the wake of Hurricane Harvey and a jump in auto sales were major contributors

- Higher gas prices also contributed to a 0.5% advance in the Consumer Price Index in September

- The International Monetary Fund (IMF) and World Bank, IMF economists released their latest World Economic Outlook. The fund’s growth forecast was slightly more upbeat, with global gross domestic product expected to expand 3.6% this year and 3.7% in 2018, a 0.1% increase from the last update in July

- European Commission president Jean-Claude Juncker said on Friday that the United Kingdom would need to pay its “divorce bill” before discussions can proceed on trade and future relations between the UK and the European Union

- Minutes from the September meeting of the US Federal Reserve’s Federal Open Market Committee show that “many” members thought another rate hike was likely to be warranted late this

- With efforts to repeal and replace the Affordable Care Act stymied in Congress, President Trump this week issued an executive order to reform the health care sector. The order allows employers to band together to form groups, potentially lowering the cost of coverage. It also allows insurers to offer coverage across state lines

- The European Central Bank appears to be shifting its exceptionally easy stance toward monetary policy before the end of the year. One proposal is to cut in half the rate at which it buys European bonds

THE WEEK AHEAD

Sun Oct 15th

- Yellen speech at G30 International Banking Seminar

Mon Oct 16th

- China: Consumer Price Index

- Japan: Industrial production

Tue Oct 17th

- UK: Industrial production

Wed Oct 18th

- UK: Consumer Price Index

- Eurozone: Consumer Price Index

- US: Industrial Production

Thu Oct 19th

- China: GDP, retail sales, industrial production

- UK: Retail sales

Fri Oct 20th

- US: Existing home sales

For the week, the S&P 500 rose by 0.15% for a year-to-date return of 14.04%

Summary

IBD: Market in confirmed uptrend

GMI: 6/6- Buy signal since market close of August 31, 2017

BCI: I am currently moving to a neutral market assessment with an equal number of in-the-money and out-of-the-money strikes.

WHAT THE BROAD MARKET INDICATORS (S&P 500 AND VIX) ARE TELLING US

The 6-month charts point to a slightly bullish outlook. In the past six months, the S&P 500 was up 10% while the VIX (9.61) moved down by 31%.

Much success to all,

Alan and the BCI team

Premium Members,

This week’s Weekly Stock Screen And Watch List has been uploaded to The Blue Collar Investor Premium Member site and is available for download in the “Reports” section. Look for the report dated 10/13/17.

Also, be sure to check out the latest BCI Training Videos and “Ask Alan” segments. You can view them at The Blue Collar YouTube Channel. For your convenience, the link to the BCI YouTube Channel is:

http://www.youtube.com/user/BlueCollarInvestor

Since we are at the beginning of Earnings Season, be sure to read Alan’s article,

“Constructing Your Covered Call Portfolio During Earnings Season”. You can access it at:

https://www.thebluecollarinvestor.com/constructing-your-covered-call-portfolio-during-earnings-season/

Best,

Barry and The BCI Team

[email protected]

Friends,

As always I am looking forward to a new market week and a new week of posts. Monthly expiry is Friday, of course, and I certainly hope this expiry is kind to all.

I have some CSP’s that look safe for Friday. Depending on how this week goes I probably would have been better off buying the underlying and over writing for Friday but I was seasonally cautious which is fine since I stand to make a buck or two.

I am bullish aerospace, defense, internet and, believe it or not, banks in the 4th quarter. I want to be bullish retail with XRT for the Holiday Season.

But I feel like Kevin Bacon’s character in Animal House pleading “Thank you Sir, may I have another?” as he gets paddled on the fanny and asks for more during fraternity hazing every time I go long XRT :). – Jay

The IRS has a “qualified/unqualified rule” designed to prevent traders/investors from using options to realize current year losses and carry profits into a later year, thereby avoiding taxes in the current year. The rules are complex (Google it for details) and in the context of this article, it pertains to selling ITM covered calls.

If a call sold is too deep in the money, it’s deemed an unqualified covered call. The stock’s holding period is then frozen. This situation applies to a stock that you have held for nearly a year and it is assigned after you have held the stock for more than a year. The stock is then taxed at ordinary, short-term rates.

As an example, you have a large paper profit on a stock that you have held for 11 months and you sell a two month unqualified covered call. When the call is assigned, the assigned stock is treated as short-term because the holding period stopped at 11 months.

Another situation where this gets complicated is when the stock’s price rises and you roll a qualified covered call forward and inadvertently replace it with a deep ITM unqualified covered call.

For the locals, don’t you just love the IRS?

Spindr,

Interesting comments on the IRS qualified / unqualified short term vs. long term rules.

Those rules generally ill not apply to many of us who are dealing with short term month to month covered calls and also religiously unwind the stock position to avoid the Earnings Report event.

Where it can apply is for some of us who are overwriting stock already owned for a while and do not care about the Earning Report surprise issue.

I gather the rules apply for OTM covered calls as well that go ITM by Expiration date. Do not understand why you mentioned only just Deep ITM calls unless you were just not getting detailed enough.

Looking at the big picture, when you get your year end statements from your broker(s), they normally separate long term vs short term trades in the report. Are you saying the brokerage statements do not take into account the complex aspects of the unqualified / qualified rules and that it is up to you or your accountant to realize the trade niceties.

Or are you finding out that the brokerage statements are generally accurate for IRS purposes? If not, in what areas do find the brokerage statements lacking?

When I used Turbotax for last year’s income tax, I did not assume everything was correct (my first year with options). After checking in detail my statement from Fidelity and Optionshouse, I thought I found some errors since the numbers did not jive. But when I called the broker and they followed up with their accounting department they explained the numbers to my satisfaction.

Mario

Mario,

The rule applies to anyone who writes an unqualified covered call (UCC). The effect of the violation is only where the UCC’s time period carries a short term holding into long term holding ( 1 year).

The rule does not apply to OTM covered calls. IOW, if you write an OTM CC and it goes ITM, there is no consequence other than be happy, you made the maximum profit :->)

The rules are complex. There are time points (30-90 days, more than 90 days) and price points $25.01 to $60, $60.01 to $150, and above $150). In general, the option must have more than 30 days remaining and the strike cannot be lower than the one immediately below the closing price of the stock on the day before opening the CC. There are a few situations where it can be two strike prices below that closing price but not more than 10 points in the money. If you write monthly, this is much ado about nothing.

I do not know whether different brokers properly report this violation since I don’t see their reports. I don’t even know if mine does since I don’t write deep ITM CCs. If I’m bearish, I hedge in another fashion or get out of the way.

In years when I have traded heavily, especially when I have incurred large numbers of wash sale violations with carryover issues, I have used a tax accounting program called Tradelog. Another popular one is Gainskeeper. I also maintain my daily spreadsheet record and usually, at EOY, none agree. It’s never anything ginormous but when all is said and done, Tradelog has always gotten it 100% right. Last year, my broker reported an option gain incorrectly. My accountant insisted that paying the larger tax amount was appropriate until I showed him the statement confirmations. It was small potatoes (a few $100) but if they can err small, they can err big – so don’t assume.

At the bottom of my broker’s 8949 it says:

“This statement has been prepared in accordance with our records, is provided for information purposes only and is not intended to constitute tax advice which may be relied upon … We recommend that you consult your tax advisor as to the correct reporting of these items on your tax return. This statement has been prepared solely as an accomodation…”

Hmmmm, d’ya think that someone is absolving themself of reliability? Liability?

If the discrepancy b/t 2 of these is the tax on a few hundered dollars, it might be worth the savings in time and headache to just pay the taxes on the cap gains your broker reports. For a larger sum, not so much. It’s probably not the smartest thing to do but I don’t ignore headaches :->). If you’re lucky, it goes the other way and they under report!

If you get big enough and do it long enough, it’s worth considering applying for Trader Status, if eligible. A description in minimal detail is that you value you portfolio on the last day of each year and the difference is the taxable amount (obviously, adjusted for deposits, withdrawals, etc.). It’s MTM accounting.

Spin

Spin.

It is a pleasure to read and learn from your posts.

Do you remember in the 1980 Presidential debates when Ronald Reagan told Jimmy Carter “There you go again” after Carter gave a detailed answer? I feel that way reading your posts. But that is a sincere compliment because they are always well informed and I voted for Carter twice 🙂

Hope you have a great expiry Friday and a nice weekend, – Jay

Jay, you may be a frugal old b*stard ( you said it first :->) but you’re very generous with the kind words! TY.

If you do this stuff long enough, you pick up a lot of useful info as well as a lot of trivia that is only appreciated at a covered call reunion party.

Spin

Thanks Spin,

I love this comment board. It can be anyone from you to the raw beginner. But I know there is always a well meaning person on the other keyboard! – Jay

Spin,

Good morning, happy Monday and thank you for the tax insight!

I live in the states, I love the IRS (not) but for every reason you suggest and more I have never sold a covered call or cash secured put outside my IRA accounts. Selling options in cash accounts in the US is just too much of a tax mess for my small mind :). – Jay

Alan,

I have looked through all of the videos and am somewhat familiar with selling covered calls but not with the strategy that you proposed.

What I don’t understand is how one prevents the call option from being executed and taking the underlying before expiration when one doesn’t want that to happen. Can you answer this or direct me to what books/products of yours I should look at?

Thanks,

Carl

Carl,

There are several reasons why call options are generally not exercised early. The 2 main reasons:

1- Call buyers rarely want to take control of the underlying stocks. They are looking for share value to appreciate and then sell options at a higher price than the original cost basis. Although option buyers do have the right to exercise early, that is not typically the target goal. Only 10-20% of options are exercised and most take place after expiration when strikes are in-the-money.

2- Early exercise results in capture of intrinsic value (amount the strike is in-the-money) only with loss of any time value. For example, if a stock is trading at $32 and the $30 call option is trading at $3, the option holder can exercise and realize a $2 benefit ($32 – $30) or sell the option for $3…$3 or $2….

When options are exercised early, it is usually related to an ex-dividend date and even then it is not in the best interest of the option holder to exercise early but some do anyway.

Bottom line: early exercise is extremely rare.

Alan

Carl,

There are several reasons for early assignment of a call. The most common is:

(1) Discount Arbitrage where an ITM call trades below parity (the bid price is less than intrinsic value). If the owner takes the haircut by selling the call to close, the market maker will exercise it to book the risk free difference. To avoid this loss, the call owner can exercise the call and immediately sell the stock.

Far less common reasons are:

(2) Risk Arbitrage: A bet that the stock does not drop as much on the ex-date or it recovers after the ex-date sufficiently to make exercise profitable.

3) Inexperience: The call has time premium remaining and the owner doesn’t realize that he can close the option in the option market, realizing a greater return.

(4) The call buyer actually want to own the stock.

According to the CBOE, about 10% of options are exercised (60% are closed before expiration and 30% expire worthless). When short the call, you cannot prevent assignment but you can reduce the chance of it by closing your short call if it has little to no time premium remaining or there’s a pending dividend. The dividend doesn’t cause the exercise directly. It’s the selling of calls by owners in anticipation of the ex-dividend share price reduction by the stock exchange that leads to the aforementioned intrinsic shortfall and subsequent Discount Arbitrage.

AFAIC, early assignment is a good thing because you make the greatest amount in a shorter period of time.

Premium Members,

The Weekly Report has been revised and uploaded. The Risk/Reward data, as of 10/16/17, has been updated. There was only one stock that was impacted. UCTT went from pass to fail. Look for the report dated 10/13/17-RevA.

Best,

Barry and the Blue Collar Investor Team

[email protected]

Dr Ellman, in the last week of a contract cycle, do you ever unwind the contract to lock in profits and remain in cash until the next cycle? I have a couple of stocks that are in ITM, less than 1% of time value left, but are quite volatile and I am worried the price could move in the other direction and I would lose my gains. thanks.

Ed,

There is nothing wrong with closing positions when our market assessment is unusually bearish and capital preservation is a concern. For me, moving to cash is a rare event that is related to unique market circumstances. Two examples:

1. I moved to 50% cash pre-Brexit

2. I moved to 100% cash pre-election

Such circumstances are aberrations in my portfolios and reserved for uncommon scenarios.

Alan

Ed,

Evaluate the premium per day remaining for the current open position and the premium per day for next month’s position. Next month could be rolling the option forward in the same stock or opening a new position in another stock.

IMO, if the premium per day for the new position is significantly higher than that of the current open position (net of commissions), it makes no sense to hang around for the last week to capture pennies/nickels, risking giving back the gain that you have achieved.

Mr. Ellman,

I have a simple question.

Normally how many of your trades are OTM? And as the breakeven point of OTM are very small and narrow what is the point for rolling down the call position on OTM covered call in case of market down?

Thank you in advance

Keivan

Keivan,

The percentage of OTM strikes I use is directly related to my overall market assessment and the chart technicals of the underlying stock. I publish this information in our weekly newsletters. The more bullish the market tone and price chart, the more OTM strikes are in my portfolios. In bear and volatile markets the percentage of ITM strikes increases.

Exit strategies on declining securities is managed with the 20%/10% guidelines detailed in my books and DVDs.

Alan

I am a frugal old bastard who tries to spend as little as possible each month. Fortunately that is helpful trying to cover spending by portfolio over writing in a declining premium environment :).

I have a friend who owns rental property. I told him he should look at his stocks the same way and rent at least half of them out every month. There is no lease agreement and few idiot tenants :). – Jay

Premium members:

This week’s 8-page report of top-performing ETFs and analysis of ALL Select Sector Components has been uploaded to your premium site. The report also lists Top-performing ETFs with Weekly options as well as the implied volatility of all eligible candidates. For your convenience, here is the link to login to the premium site:

https://www.thebluecollarinvestor.com/member/login.php

NOT A PREMIUM MEMBER? Check out this link:

https://www.thebluecollarinvestor.com/membership.shtml

Alan and the BCI team

Alan,

I have an unique option based supposedly on an volatility fund. The only problem is there is no volatility, not in the traditional manner. Any volatility in the market is shrugged off within a day and the fund continues to decay. In fact since it’s inception this fund has done nothing but decay and reverse split once or twice a year and is coming up on its next reverse split. It makes no difference if the markets it bull or bear, down it goes it is just the rate at which it goes depending on the type of market. If this is truly the way this is set up there must be a way to make money on the options with the next split coming up. Any ideas??

Mitch R

Mitch,

Money can certainly be made selling options with the appropriate underlying security so we must define the reasons why we selected any particular stock or ETF. If those reasons no longer exist, we need to re-evaluate our bullish assessment and move on to a different underlying.

Market volatility is historically low as reflected in the VIX (CBOE Volatility Index…”investor fear gauge”). If our goal is to select the underlying based on a high level market volatility (the greater the volatility, the higher our premiums but the more risk we are incurring), we may need to re-evaluate this underlying. Also, reverse stocks splits are huge red flags for an underlying usually implying declining share price, potential exchange-listing problems and the need for price window-dressing.

Bottom line: Evaluate if the reasons we selected an underlying are still in place. If not, move on.

Alan

Mitch,

Many ETFs are subject to decay and there are several reasons for it, especially the more exotic as well as leveraged ones. The main reasons is something called the contango/backwardation which affects futures as well as volatility based ETFs. Leveraged ETFs have a higher amount of fees as well.

I have no experience with leveraged ETF’s so take my thoughts with a grain of salt…

If an ETF has a decay rate, you better have a good reason for owning it since it’s a wasting asset. It’s also a timing issue. Though not necessarily as advertised (a 3:1 ETF actually achieving 3:1), leveraged ETFs perform spectacularly when the event that they’re advertised to capitalize on occurs but at other times, not at all.

As a weak analogy, consider the buying of calls to profit to the upside. If you get that big move, the leverage generates a large ROI. More often than not, you don’t get it and you watch your position decay slowly.

the upcoming split is irrelevant. Splits do not change the inherent value of one’s position. One advantage of the upcoming reverse split is that by increasing the price via reducing the number of shares, you incur less slippage when you take a position.

Yes, there must be a way to make money on the options but you have to get the timing and direction of the underlying right, even more so with exotic products.

Hey Mitch,

To build on Alan and Spin’s great points I suggest if you are dealing with options on a long VIX futures product like VXX or UVXY please avoid them unless you understand their design and use them as trading vehicles.

The better play I have had success with in the volatilty ETF’s is SVXY which gains by shorting the almost ever present contango in the VIX futures curve. If that sentence is foreign language please stick with stocks :). – Jay

Alan I purchased IBM on 2/29/2016 for 131.30. I learned about covered calls before discovering your site and becoming a member. On 9/27/17 I sold a $150.00 Oct.27 2017 generating a $1.55 profit. As you know the stock went up during the ER and my question is should I buy back the stock and roll up? It would cost $10.93 to buy back the shares.

Thank You

Brian

Brian,

When a strike moves deep in-the-money (stock price rises well above the strike sold), the time value cost-to-close approaches zero making closing positions early more palatable.

Here are the stats after market close on Thursday:

IBM: $160.90

Cost-to-close (call “ask” price): $11.15

Share value: $150.00 because of the option obligation

Share appreciation if short call is closed: $10.90

Time value cost-to-close: $0.25 ($11.15 – $10.90)

If we wait closer to expiration the time value cost-to-close will decrease even more.

The decision at this point in time is whether we want to retain IBM. If yes, buying back the option makes sense. If not, we can allow assignment and shares will be sold for $150.00 next week resulting in a 16%, 8-month return.

In the BCI methodology, it is important to avoid selling calls or puts with an upcoming earnings report prior to contract expiration.

Keep up the good work.

Alan

Brian,

I do not roll options up at a loss in order to defend paper profits (I’ll do the opposite though). The market has a perverse way of making you pay for that.

Closing it early is another story. Evaluate the premium per day remaining for the current open position and the premium per day for a potential position for next next month (ROI).

If the premium per day for the new position is significantly higher than that of the current open position (net of commissions), it makes no sense to hang around for the last week to capture pennies/nickels.