The Poor Man’s Covered Call (PMCC) is a covered call writing-like strategy where the underlying security is a LEAPS options (1 -2 years expirations) rather than the stock itself. The technical term is a long call diagonal debit spread. Since the cost of the option is lower than the price of the stock, the return on capital (ROC) is higher. On the other hand, we must be comfortable accepting a long-term commitment to a particular stock. The initial trade set-up formula must meet the following criteria:

[(Difference between strikes) + (initial short call premium)] > Cost of the LEAPS option

This ensures that if the price of the stock accelerates exponentially, we can close both positions (long and short calls) at a profit. The first tab of the BCI PMCC Calculator facilitates proper trade entry.

In July 2019, Sunny shared with me a PMCC trade he executed with SPDR Gold Shares (NYSE: GLD) where he added a protective put component to this PMCC trade. I agreed that this is a sensible approach and so I was inspired to write this article.

Sunny’s trade

- 7/22/2019: GLD trading at $134.47

- 7/22/2019: Buy January 2020 $120.00 LEAPS at $16.10

- 7/22/2019: Buy January 2020 $120.00 protective put at $0.32

- 7/22/2020: Sell-to-open the 8/16/2019 $136.00 covered call at $1.75

Initial trade calculations without the protective put

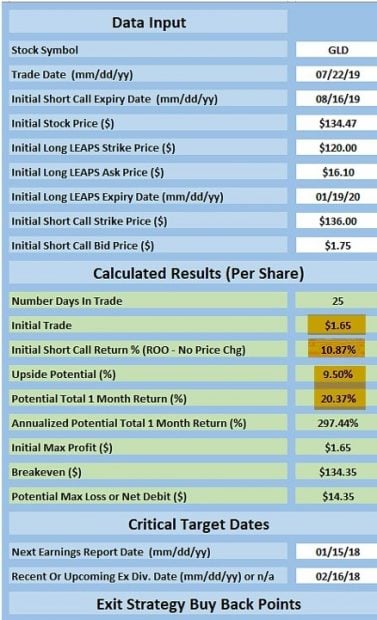

PMCC Trade with GLD without a Protective Put

The initial trade meets our required formula with an initial credit of $1.65 if the trade is forced to be closed early. The initial 1-month return (ROO) is 10.87% with an additional 9.50% of upside potential. These returns highlight the benefit of using a low-cost substitute for stocks in the form of the LEAPS option. We must also keep in mind the disadvantages of employing this strategy (detailed in my book, Covered Call Writing Alternative Strategies, co-authored by me and Barry).

Initial trade calculations with the protective put

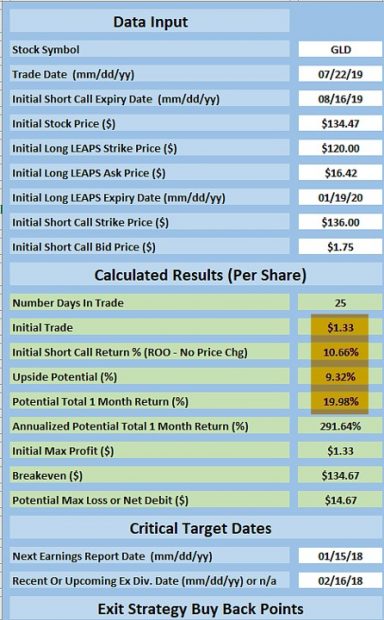

PMCC with Protective Put

The cost of the protective put was so far out-of-the-money that the cost impacted the initial returns minimally. We change the cost of the LEAPS from $16.10 to $16.42 by adding in the cost of the protective put. The initial trade meets our required formula with an initial credit of $1.33 if the trade is forced to be closed early. The initial 1-month return (ROO) is 10.66% with an additional 9.32% of upside potential.

Discussion

Adding a protective put component to the PMCC strategy will protect against a catastrophic decline in share value at a very low cost. When entering the cost of the LEAPS, we add the cost of the protective put and then use the PMCC Calculator to monitor our trades.

Your generous testimonials

Over the years, the BCI community has been incredibly gracious by sending our BCI team email testimonials sharing stories as to what our educational content has meant to their families. Moving forward, we have decided to share some of these testimonials in our blog articles. We will never use a last name unless given permission:

Hi Alan,

Love your videos. This is phenomenal stuff. Should be taught in schools.

Thanks,

Bob

Upcoming events

1. Tuesday March 10, 2020 Long Island Stock Traders Meetup Group

7 PM – 9 PM

Plainview- Old Bethpage Public Library

Covered Call Writing Blue-Chip Stocks to Create a Free Portfolio of Large Tech Companies

2. Wednesday April 8, 2020 Options Industry Council (OIC) Free Webinar

4:30 ET

Covered call Writing to Generate Monthly Cash-Flow:

Option Basics and Practical Application

***********************************************************************************************************************

Market tone data is now located on page 1 of our premium member stock reports and page 8 of our mid-week ETF reports.

*********************************************************************************************************************

Hi Alan

Terrific article, thanks!

I currently have LEAPs on Next Era Energy expiring in 2022 (210 calls) and sold the $290 calls for March, collecting $44 per contract.

My question is:

When my goal is portfolio overwriting with LEAPs, can I execute exit strategies like “hitting a double” or “rolling down” if my primary goal is not to lose the shares but gradually lower my cost basis? I figured out that within 5 years or so, I will have accumulated time value worth the premiums I paid to buy the LEAPs, so I doubt whether extra cash from rolling down is going to make a difference if my goal is to hold onto the stock (long-term view). In other words, I don’t want to lower my upside during a correction whereafter I lock in losses because of my short-term calls being in-the-money. This is especially true since I choose low-volatility, high-quality and excellent momentum stocks which decline less during corrections.

Thanks for all you do.

Best

Hamish

Hamish,

Yes, I believe we should take advantage of all exit strategy opportunities. If rolling down, you may want to look at rolling down to OTM strikes to coordinate with your strategy goals… Alan

Alan,

Just want give you one more big thank you for the advice concerning below sold puts. SNAP tanked after its earnings report but i still managed a 42 dollars of profit on my cash covered puts and I dodged a big bullet I am also studying your beginners courses very closely. NO More playing near earnings!!

Regards and Go Army

Jeff

Jeff,

The best way to learn a lesson is to master it while still making a profit. I have fond memories of my days as an officer in the Army.

Alan

Alan,

No wonder you are so methodical and disciplined. An Army officer and a dentist!

I have a granddaughter who is a dentist. Her practice is in a small rural town and county. She has practically no competition and operates one of the most successful practices in the nation. She has the latest technology, hi-speed internet and a network of other dentists and teachers with whom she can share info to be able to make major decisions on complicated issues while the patient is still in the chair. I have spent over a hundred thousand dollars on my mouth over time and have seen many dental offices, none hold a candle to the efficiency and thoroughness of hers. She stresses patient care and support and has the most awesome reviews. She also runs a tight ship.

Sounds sort of like BCI, doesn’t it.:)

Hoyt

Hoyt,

A sophisticated investor AND a proud grandfather… life is good.

Alan

Hi Jeff,

You will be fortunate indeed if all your lessons learned result in a profit! I know mine sure did not :).

Your learning about the importance of earnings reports is a good one. I don’t mind holding stocks through earnings, I have stocks I have held for decades and a few just a couple years or less that I have no intention of selling. I just don’t over write them or have a csp open to perhaps acquire more at lower price and be paid to wait during an earnings report – price might go too low then I will sell a new csp even lower!

I think the strategies Alan and Barry talk and write about here are so conservative and so appropriate for IRA investors I do not even consider them “trading” and absolutely not “gambling” in any sense of how I use those terms. I am a retiree who uses the options market as a hobby and income source trading daily, weekly, monthly and LEAP options on both the buy and sell side, often in combination. So this stuff is in my blood 🙂

The methods BCI teach can enhance yield and reduce risk with only a modest expenditure of time after initial study. The only “risk” here is if a stock goes down more than you wanted. Selling an option did not cause that :). Or it out runs your cc upside coverage disappointing you for selling it – but you still profit!

I was an Air Cav Officer so I second your nod to the Army. it’s great to see all service members now get more respect and thanks than in my day back in the mid 70’s, early 80’s. Jay

Alan,

I roll over weekly calls (income 200+ percent greater then using monthly); I keep the stock and strive for long term tax treatment (GTE 1 year).

Example: Price is $53.32..I buy an OTM weekly call @ $54 for 1.0…buy back at 1.5 (price rapid rise of now @ $55.50 on Friday)…then I buy a higher call next week for around 1.0.

My point…as I understand it above example…for that one weekly period it s a .50 loss. Correct?

I have found it is not reasonable to not expect the stock price to always rise slower then the OTM strike price.

Each stock I find has a different threshold of OTM positioning based on volatility (Beta).

Then, total gain or loss for the year is total of the gains versus losses over a year. Maybe with time I’ll find a “sweet spot” for each stock (an art it seems)?

For instance, on E*Trade on-line, my account, it shows a smaller gain for the year. Weekly gains are 2 times more then the weekly losses for the year of 6 weeks (4 positive weeks and 2 negative weeks) of 2020.

I just want to fully grasp the concept of understanding occasionally having losses weekly reducing and/or possibly being more than the weekly gain over a tax year.

If you can provide insight how I write always a covered call without sometimes having to buy back at a higher price due to a rapid rise. I do use overbought/sold metrics like MACD & Stochastics as help positioning each strike price.

I have found with time the stock settles out (more gains versus losses).

This the first year doing this and I want to understand how the IRS will treat this when I have to file.

Finally, am I on the proper thinking here?

Thank for your time and attention in this matter,

Best Regards,

Bill

Bill,

What you are doing is similar to “portfolio overwriting” as discussed in my books/DVDs. Generate premium and look to avoid assignment or having the strike move ITM by expiration. Using Weeklys makes management more intense.

One of the definitions of Delta is the % chance a strike expires ITM. The deeper OTM we go, the lower the Delta, the lower the chance of the strike expiring ITM but also the lower our premium. This is the balance you are seeking.

The key question here is whether we should focus our strategy on tax implications? This approach will tweak our strategy protocol perhaps to our disadvantage like never using ITM strikes. I once heard a comment from a seasoned CPA/Attorney/long-term stock investor who told me that his goal in life is to pay $1 million in taxes in his investment portfolio.

Alan

Hi. I looked at this trade with a few different stocks. My question is that a deep OTM put does not provide much protection against a fall in the underlying. The delta on such a put is much lower than the delta on the long ITM call. If the underlying goes up there is still a nice % gain, even with an expensive ATM protective put. But using the OTM put doesn’t give you much of a hedge, as far as I can see.

Hi Max,

I’m sending hypothetical LEAPS (CALL + protective PUT) loss graph on QQQ I created in July 2019. This is how it looked when QQQ traded at $195. Long call was $145 and protective put was $175. The more OTM put will be the less hedge we will have. The problem is that if we’ll use puts near ATM the trade probably will never meet formula described in Alan’s books and this article.

Sunny

(Still thinking) What would seem to make more sense is using collars around the deep ITM call, where the cost of the long put is reduced on a weekly or monthly basis by buying it several months out, and profiting from weekly short calls and advance in the underlying.

Max,

You make an astute point that by purchasing a longer-term protective put we are averaging down the cost against our weekly or monthly short calls. That’s the good news.

Sunny’s point is also important because we may be taking ourselves outside the formula that protects us against closing the trade at a loss when share value accelerates exponentially. Since the strategy, by definition, takes us through multiple earnings reports (a strategy disadvantage), this is a reasonable possibility.

I created a real-life example with Amazon (AMZN) which had a huge gap-up after the latest earnings release. Let’s say we entered a PMCC trade when AMZN traded at $1900.00 and bought the 2-year $1850.00 LEAPS at $350.00. We then purchased a 2-year $1850.00 protective put for $340.00, averaging out to $14.00 per-month. Next, we sold a 1-month $1925.00 call for $50.00…then comes the post-earnings gap-up to $2133.91. The intrinsic-value cost-to-close the $1925.00 call is $208.00 per share. Are we willing to put an additional $20,800.00 + time-value per contract into this trade?

Closing the entire trade will result in a loss because the required formula was not met:

[($1925.00 – $1850.00) + ($50.00 – $350.00)] < $350.00 See the screenshot below to visualize this trade. Bottom line: Long-term protective puts have advantages and disadvantages as does the PMCC strategy itself. We must view our trades through the lenses of short-term risk versus longer term benefits. CLICK ON IMAGE TO ENLARGE & USE THE BACK ARROW TO RETURN TO BLOG. Alan

Alan,

You have written that on rare occasions you will hold a stock through an earnings report and then write the call after the report passes. Can this apply to the pmcc strategy as well?

Thanks for all you do.

Marsha

Marsha,

Yes, I would incorporate this guideline into the PMCC strategy with the understanding that we continue to be susceptible to gap-downs related to a disappointing report. If the stock has weekly options, these can be useful in circumventing ERs.

Alan

(Thanks, Sunny)

From the graph, it looks like the trade makes money above $195, aside from the short call, if there is a short call.

I assume a gap up can hurt because the benefit from the directional move is more than offset by a crunch in volatility. Otherwise a move up with that kind of diagonal spread should usually make money, right?

Max,

The trade Alan describes in this article is GLD Jan 20 $120 call/$120 put. I bought call for $16.20 and put for $0.29 ($16.49 total). GLD was trading at $134.70 when I entered the position.

I closed trade at 2019/08/16 when GLD was trading at $142.75, I sold call for $22.70 and put for $0.12 ($22.82 total). GLD increased 6% and my combined LEAPS position increased 38%. (LEAP call I sold was all intrinsic and had no time value left, but this was only because I rolled up to Jan 21 $125 strike in one transaction, have I closed it without buying new Jan 21 LEAP the result would be better).

If there is significant gap up LEAP call will be deep ITM (delta 1.00) and put will probably lose most of it’s value slowly approaching to 0. The volatility might decrease, but position itself will be profitable and will increase in value if underlying will keep going up.

Sunny

Premium Members,

This week’s Weekly Stock Screen And Watch List has been uploaded to The Blue Collar Investor premium member site and is available for download in the “Reports” section. Look for the report dated 02/07/20.

Also, be sure to check out the latest BCI Training Videos and “Ask Alan” segments. You can view them at The Blue Collar YouTube Channel. For your convenience, the link to the BCI YouTube Channel is:

http://www.youtube.com/user/BlueCollarInvestor

Since we are in Earnings Season, be sure to read Alan’s article, “Constructing Your Covered Call Portfolio During Earnings Season”. You can access it at:

https://www.thebluecollarinvestor.com/constructing-your-covered-call-portfolio-during-earnings-season/

Best,

Barry and The Blue Collar Investor Team

barry@thebluecollarinvestor.com

Alan,

Should we avoid high priced stocks like AMZN, GOOG, or AAPL just due to the large capital requirement for buying the shares for covered calls even if they meet the screening?

Ed

Ed,

These stocks can still be appropriate for portfolios with large amounts of cash available. It’s all about % returns. That is the basis of The Ellman Calculator. The answer will vary from one portfolio to others.

Alan

Premium members:

This week’s 8-page report of top-performing ETFs and analysis of ALL Select Sector Components has been uploaded to your premium site. The report also lists Top-performing ETFs with Weekly options as well as the implied volatility of all eligible candidates.

Also included is the mid-week market tone at the end of the report.

For your convenience, here is the link to login to the premium site:

https://www.thebluecollarinvestor.com/member/login.php

NOT A PREMIUM MEMBER? Check out this link:

https://www.thebluecollarinvestor.com/membership.shtml

Alan and the BCI team