Call options can be used to reduce losses on long stock positions. Depending on the degree our share value has declined, our target can be to lower our breakeven point or to lock-in but reduce losses. In December 2018, Sunny shared a stock repair trade he was considering involving FedEx Corp. (NYSE: FDX). At the time, FDX was trading at $201.39 after being purchased at $235.00 (ouch!). This article will highlight the stock repair strategy that Sunny was considering and whether a lower breakeven was achievable and the degree of loss-reduction that was possible.

Sunny’s trade and proposed stock repair strategy with FDX

Buy FDX at $235.00

- 12/7/2018: FDX trading at $201.39

- Buy 1 x $200.00 call at $10.90

- Sell 2 x $210.00 calls at $5.45

The long ($200.00) call allows us to buy 100 shares at $200.00, reducing our average cost-per-share to $217.50. The cost to accomplish this is zero (trading commissions aside) because we are paying $10.90 for the long call and receiving $10.90 for the 2 short calls. Both short calls are “covered”… one by the original 100 shares owned and the second by the long $200.00 call.

Strategy overview: What is our realistic objective?

The way this stock repair trade is structured, a loss is locked in but is dramatically reduced if share price moves to $210.00 or higher by expiration. When the trade was entered (before stock repair), the loss on the stock value was $33.61 $235.00 – $201.39).

When we sell the two $210.00 calls, our original shares plus the potential shares if the long call is exercised, can be worth no more than $210.00, our contract obligation. Let’s break down the value of these two positions at expiration given the share price closes at $210.00 or higher (given no additional position management trades):

- The original shares are sold for a loss of $25.00 (buy at $235.00 and sell at $210.00)

- The $200.00 long call is worth $10.00, reducing the net loss to $15.00

- The net cost of the option trades was $0.00 (less commissions)

- Share loss was reduced from $33.61 (14.3% loss) to $15.00 (6.38% loss) by executing the stock repair strategy (assuming a share price of $210.00 or higher)

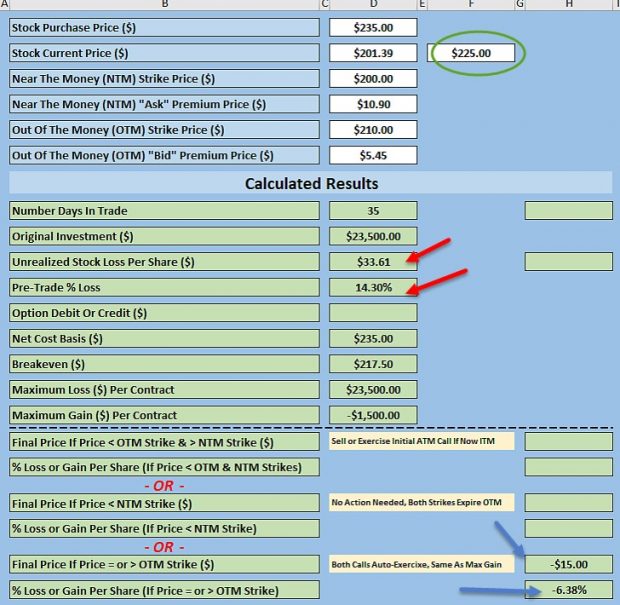

The screenshot below of the BCI Stock Repair Calculator reflects these calculations:

FDX Stock Repair Calculations: The BCI Stock Repair Calculator

The red arrows highlight the (unrealized) losses at the time the stock repair strategy was initiated and the blue arrows reflect the results if share price moves to $210.00 or higher. Since the maximum value our shares can be worth is $210.00 (our contract obligations), breakeven ($217.50) cannot be achieved but significant reduction in capital losses is possible.

Discussion

The stock repair strategy is an excellent way to reduce losses for our long stock positions. When the decline in price is significant, breakeven may not be a reasonable goal but substantial reduction in the amount of loss can be a reasonable target. In other scenarios where initial share price loss isn’t as large as this one, breakeven or even turning a profit is absolutely possible. It is also important to realize that the stock repair strategy does not protect against additional share loss if the stock price continues to decline so closing the long stock position should also be a consideration.

NEW WEBINAR

DELTA DECISIONS: IT HAPPENS AUTOMATICALLY

How Delta is Incorporated into our Option-Selling Decisions

Blue Hour Webinar #12 is now located in the premium member and video sites

Upcoming events

June 11: Plainview New York

Long Island Stock Traders Meetup

Plainview-Old Bethpage Public Library

7 PM – 9 PM

Free presentation

July 22: Chicago Traders Expo

1:30 – 2:15

Hyatt Regency McCormick Place

***********************************************************************************************************************

Market tone data is now located on page 1 of our premium member stock reports.

Hi Alan,

I totally believe that options trading is the way to go. But with so many gurus and systems, I am overwhelmed with how appealing they are.

With your experience and system, it seems you have narrowed down the trading methods that works best for your risk tolerance.

Why has option selling been your preferred trading method?

I’m not interested in losing money and looking for long term gains.

With the markets on a trend reversal towards the downside, how can options selling work when selling calls? Or should strategy resort to buying puts instead?

Thanks,

Alan

Alan,

Option-selling is where I have had my greatest success… by far. When we sell options, we are lowering our cost-basis and that is why we should “beat the market” on a consistent basis. Like you, I’m not interested in losing money in the long run and that is why I stress the importance of mastering the 3-required skills (stock selection, option selection and position management) before risking our hard-earned money.

I a short-term bear-market environment like we have now, there are several tactics we can employ. These include ITM calls, OTM puts, collars, ETFs, low implied-volatility securities and more.

(The other) Alan

Dear Dr. Alan Ellman,

I am a new member and have been trading for 10 weeks. Since I found your website my trading skills have grown exponentially. To date 58k in covered call profits (that is no typo $58,000), I credit this all to your skills in explaining a simple concept in Blue Collar every day/any man terms. Thank you!!!

The reason I am writing is to ask if you could update your Ask Alan topic list. As I understand it, you have 158 videos but your list only goes to #153. After a day of trading I find situations where I need advice and/or counsel and your videos, Blue webinars, and articles do the educational mindful job for me.

I hope to meet you in the future and thank you in person, Blue Collar investor to Blue Collar investor!

Respectfully, Nicholas

Hi Nicholas,

congratulations on the extraordinary success you acheived in such a short period of trading.

I wish you good luck with your future trades, but also would like to warn you about the dangers of taking too much risk.

Be very careful – Roni

Nicholas,

Congratulations on your recent success especially in these challenging times.

The “Ask Alan” topic list will be updated this week.

Alan

Nicholas,

Okay, just updated the file through “Ask Alan” # 159 which will be available on the member site on June 12th.

Alan

Hi All, I wanted to share my recent case and lessons I’ve learnt :

On 1/May/2019 I entered a CC position on INTC.

Bought the Stock for $51.375 and sold C(49) expiration date 17/May/2019 for $2.5.

That’s 0.26% profit and about 5% downside protection.

Reasoning :

1. INTC already depreciated about 15% since it reached the peak on mid April, Stochastic oscillator was oversold since late April.

2. Dividend due on 6/May/2019. Dividend was bigger than the time value for C(49) 17/May and although we know that it is not worthwhile exercising an option while it still has time value – most people don’t act that way and they exercise if the Div is bigger than the time value.

Now, since the Ex date 6/May was a Monday – who ever wanted to collect the Dividend had to exercise on Friday 3/May.

So – INTC simply had to stay above 49 for 2 days (May 1st to May 3rd) and my position would get exercised and I’d take the maximum profit.

I went to vacation on May 2nd and briefly checked my Broker’s statement during the weekend of 3,4/May. I saw the position was assigned ,

I was happy and kept on vacationing.

When I came back home on 13/May – I saw INTC depreciated even more on 9/May following the investor meeting – I felt happy to have escaped that and felt sorry for the one

that exercised for 49. But looking closer at my Broker’s statement – I saw that the position was only partially assigned and I was still holding part of the original position for expiration on 17/May with a stock at value around $43 – 44. I bought back the option and hoped to hit

a double , but sadly that did not happen till 17/May.

Learnings :

1. Pay better attention to the Broker’s statement – if the position was partially assigned – unwind the remaining part manually.

2. As a general practice in higher level – inspect the company’s calendar for upcoming events – such an investor meeting, because is equivalent to /has potential outcome of earnings report. and I don’t want to hold a position during such an event.

Oren

Premium Members,

This week’s Weekly Stock Screen And Watch List has been uploaded to The Blue Collar Investor premium member site and is available for download in the “Reports” section. Look for the report dated 05/31/19.

Also, be sure to check out the latest BCI Training Videos and “Ask Alan” segments. You can view them at The Blue Collar YouTube Channel. For your convenience, the link to the BCI YouTube Channel is:

http://www.youtube.com/user/BlueCollarInvestor

Since we are in Earnings Season, be sure to read Alan’s article, “Constructing Your Covered Call Portfolio During Earnings Season”. You can access it at:

https://www.thebluecollarinvestor.com/constructing-your-covered-call-portfolio-during-earnings-season/

Be sure to check out our new webinar, “Delta Decisions: It Happens Automatically”, covering how Delta is incorporated into our option-selling decisions. This webinar, Blue Hour #12, is now located in the premium member and video sites.

Best,

Barry and The Blue Collar Investor Team

Hi Alan,

In these highly unpredictable and hence volatile times, is it still a good strategy to sell Covered Calls?

OR maybe better sell Cash secured Puts and buy some good stocks (if assigned) at a discount while earning some Premiums?

Thanks

Hi Andrey,

We shall grant Alan the courtesy of at least a Sunday off :). But he will get back to you…

My two cents in answer to your questions is “yes” AND “yes”!.

Let me explain:

When the market hit highs of May then increasingly ominous trade chatter started hitting the wire I thought “Uh-Oh” and covered everything I hold longer term out to June expiry. I sold some shorter horizon things to build cash. That was lucky in hindsight.

As prices broke down since I have done selective cash secured put selling on things I think have insulation from China and do better relative to their sector like DIS, CSCO, DG and UNH on wash out days further under the market to hopefully be assigned at a deeper discount or just keep the premium..

In full disclosure I also bought LEAPS out into 2020 on two names I think will do well post China deal, BA and BABA, a few months ago. I am getting my hat handed to me on them because I was too confident of a resolution too early. It will be interesting if I can adjust those trades in the coming year and pull rabbits out of that hat :)? They might have been good PMCC stocks :)?

What I stopped doing a month ago was buying new long positions. That is where I may be at variance with friends here who replace called holdings or swap out holdings ever Monday or Tuesday after monthly expiry Friday.

To their credit, they are investing systematically. They are not trying to time markets except by varying the “moneyness” of their strikes each month. That is a time time tested way to invest successfully – I applaud them!

As I look at it, VIX is moving up – I am surprised it is not higher – implied volatility is therefore higher in most sectors driving options premiums up. So as a seller of premium I don’t want to sit out times like this.

In my opinion, sticking only my chin out there, if you have holdings for longer term over write them for these rainy days.June expiry could easily be as bad as May. G20 is after it.

If you have your eye on new stocks or adding to your current holdings don’t buy them here. Sell CSP’s further underneath them on the wash out days when the sky is darkest and put premiums bounce employing your cash that way! – Jay

Hello Jay,

Your choices and strategy look very good to me.

As one of your friends in the monthly expiry swapping trades strategy, I admire your guts and skills in handling the volatility period trading.

In my opinion, the Trump trade war is justifiable and should work out well for the US, who is the most powerful contender.

But his measures have unpredictable consequences, and therefore, insulation from China, and timing the market is utterly impossible.

So, I am sticking to the conventional BCI methodology, and my 2% limit loss rule.

Roni

Thanks Roni,

You are the kind of friend and investor I was complimenting in my ramble above :). My intent was never to challenge any aspect of the BCI methodology. Quite the contrary, it was simply to suggest these are the days to use the full toolbox!

I don’t want to sound like Doubting Thomas but my hunch is your stop loss discipline will keep you cash rich and prevent large loses in the weeks to come. Public Service Announcement: this five week old Bear could just as easily be wrong :).

A successful new week to all. – Jay

Andrey,

Selling deeper ITM calls and deeper OTM puts make sense until trade issues are resolved and the market returns to where it should be. The PCP strategy is an excellent approach in bear and volatile markets and I can tell you that we have many members who have moved from traditional covered call writing to the PCP strategy recently.

For new members, the PCP strategy involves entering a covered call trade at a discount while also generating put premium.

Alan

Alan,

I bought your course a few years back.

Haven’t implemented do to 3 new kids lol.

Do you still think performance can be ok in the volatility we might expect?

Love your stuff- refers to everyone I know lol.

Sudip

Sudip,

Yes, option-selling will work in almost all market conditions. The reason is that selling calls and puts lowers our cost-basis. That said, it is surely more challenging when market tone turns bearish and volatile.

Using deep ITM calls, deep OTM puts, protective puts, the PCP strategy, low implied-volatility securities like ETFs are some of the tools in our arsenal to counter these conditions. We must also be prepared to execute our exit strategy opportunities when they present.

Make sure you have completed the education process and paper-traded (practiced with a hypothetical account) before risking you hard-earned money. Then you will have years and decades to benefit from these great strategies.

Alan

Premium members,

A new file has been added to “resources/downloads” section of member site (right side);

PCP Strategy: General Considerations

This is an overview of the PCP strategy that can be reviewed before and after reading pages 231 – 237 of my book, “Selling Cash-Secured puts”

This file was created in response to a number of recent inquiries we’ve received regarding this strategy.

Alan

Alan,

Thanks for mentioning me in the article, I feel honored!

When I was looking for your advice I was trying to understand the mechanics behind this great strategy, however my option approval level back then didn’t allowed me to implement this strategy in the real life.

Unfortunately this trade was the most costly and painful mistake I made during my short career as an option trader. I bought 100 shares of FDX for $237.28 on 10/8/2018 just to see it falling to $150’s a few months later. I didn’t implemented any exit strategy hoping for rebound (and it was a BIG mistake) and just witnessed my loss turning to bigger loss and the bigger loss turning to even bigger loss… However by selling calls and puts, also collecting dividends, I was able to reduce my cost basis by $23.97 to $213.31. With stock trading near 52 weeks lows I find it undervalued and have no interest to sell at these prices. FDX reports earnings on 06/25, so I’ll wait until ER to see the numbers and the market reaction. I’ll probably keep selling far OTM calls lowering my cost basis further as I expect FDX share price appreciation to be faster than the market’s. Your article gives me an idea to rethink the possibility of applying stock repair strategy to reduce my loss.

Sunny

Hey Sunny,

Thank you for your contributions here and please let me say this: you are not the Lone Ranger. Every one of us who are true to ourselves can tell a FDX story.

You did nothing wrong. In the options selling game the risk is never in selling the option. It is in the stock. You got the rug pulled out from under you on FDX. No amount of option selling will ever remedy that. It can band aid the wound and you are doing that but only time will heal it.

You are wise to keep your FDX shares. They benefit from the growth in e-commerce and delivery. Maybe overwrite them at about .05% a month as Alan suggests to give them recovery room, a 6% annual yield on top of dividend and let them come back to you. – Jay

Sunny,

BCI depends on members like you who generously share with me trades, ideas and questions. I’ve been writing weekly articles, producing monthly videos and writing best-selling books (thanks to one and all!) for over 10 years and I depend on this feedback to offer these services to our member. So, thank you!

Alan

Alan,

I know the stock markets closes at 4:00 PM but I would like to know a what time close for options? It is true that there are few more hours that could affect your trade?

Have a good night

Best Regard

Daniel

Daniel,

On expiration Friday, 4 PM ET is the last time we can take action regarding options we are holding or are short. However, the official time that these options cease to exist is 11:59 PM ET on expiration day. Clearing members (brokers) have until 5:30 PM ET to submit exercise notices to the OCC.

Although we act based on the pricing we see as 4 PM ET is approaching, the moneyness of an option is based on the last price traded on a national exchange and that report does not become available until an hour after closing.

The takeaway for retail investors is that if share price is close to strike price as 4 PM approaches, the moneyness of the option can flip after 4 PM.

Alan

Question that may be of interest to others. Do you have guidelines on how long to wait to hit a double. For example if sold call for .65 45 days our bought back for .1 per 20 percent rule and now .18 with 15 days to go do you sell call again or wait and see if goes up more?

Thanks as always for educating all of us.

Doug

Doug,

If the market environment and price movement is bullish on the stock I would make my latest date to re-sell the option as the 1st 2 days of the 3rd week of a 4-week contract or the 1st 2 days of the 4th week of a 5-week contract. This relates to Theta or time-value erosion which brings the time-value of our options down to zero rapidly as expiration approaches.

Alan

Hello Alan,

My question,

TGT is part of my long term stock portfolio. I don’t want to be assigned.

One day after earning report of TGT (22nd of May) I sold the 80 $ call option with July 19th expiration for 2,10 $. TGT was trading at 77,58 $.

Now (June 4th) TGT is trading at 85,85 $ and the calls ask is 7,10 $, so that there is still a time value of 1,25 $.

Should I close this position immediately or wait for less time value?

Best regards

Matthias

Matthias,

The chance of assignment at this point is extremely remote but possible. If it does occur, it will be because of a mistake made by a retail investor that landed in your account. It would make no financial sense to do so. As I said, extremely rare.

With portfolio overwriting, we set our annualized return goals and then sell options based on the specific time frame we are using. For example, if we are seeking an additional 6% annualized return in our long-term buy-and-hold portfolios and we are using Monthly options, we would seek a 1/2% monthly return which would allow us to use strikes deep out-of-the-money. The BCI Portfolio Overwriting Calculator will be quite helpful in this regard.

Alan

Premium members:

This week’s 8-page report of top-performing ETFs and analysis of ALL Select Sector Components has been uploaded to your premium site. The report also lists Top-performing ETFs with Weekly options as well as the implied volatility of all eligible candidates.

New members check out the video user guide located above the recent reports.

For your convenience, here is the link to login to the premium site:

https://www.thebluecollarinvestor.com/member/login.php

NOT A PREMIUM MEMBER? Check out this link:

https://www.thebluecollarinvestor.com/membership.shtml

Alan and the BCI team

Hoyt,

If you are still monitoring this blog for the week I want to tell you how badly I stunk up the gym so far this week after your kind words on a recent blog about my modest trading hobby.

I day trade on M/W when SPX and SPY have options expirations and there is not much time value left in them. On Fridays I use QQQ or IWM. It’s just a hobby, it keeps me market sharp and I don’t risk much.This little rally caught me asleep at the wheel and I got clobbered yesterday after being up all through May using puts.

I have some over night ITM puts on IWM and QQQ for the morning in case the market reacts negatively to the job number. Again, tiny speculative bets just for fun. They will time decay and if I am wrong I will take another beating on those bets :)!.

Hope you are having a successful week.- Jay

Hey Jay,

WOW! Impressed you were able to make money in May. I took a real licking mainly due to my core holdings, especially AMZN. Total portfolio down 12.55% in May. Leaving me with a YTD of + 5.64%.

This week started bad Monday, down 1.36%, but as of yesterday’s close up 3.61% for the week.

As I write this (8:20ish) jobs report not out. I am afraid good news will be bad news as the market seems to want an early rate cut.

If the last three years are accurate indicators, I should close all my positions on Feb 1 and reopen them on 12/31. Each of the last three Januarys have been good years for me.

On another subject, I had my third eye surgery 5/30. It was on my right eye and seems to be going well. Will go today for follow up visit. I am foregoing additional surgery on my left eye for the near future. Looked for awhile I was going to have to give up trading but now things are looking up.:)

Hope your week ends up well.

Hoyt

Hey Jay,

Looks like, for now, bad news is bad news. Your puts should pay off. AMZN in premarket went from up 13ish to down 5ish.

Hope you do well today.

Hoyt

Thanks Hoyt,

No, the market jumped with the jobs number so my tiny put guess over night did not work this time….

I truly wish you the best with the eye treatment procedures. Speaking selfishly but hopefully for all of us here it would be a shame if you had to curtail your time at the keyboard. We would pass the hat to get you bigger keys and screen – not that you need or would accept anyone’s charity – we would simply miss you :)!

And my accounts were not up in May either. They were simply down less than the indexes since all the CC’s were closed as income and my much smaller day trading and short term spread trading did fine since I was favoring bearish tactics.

June seems to have turned on a dime and now I have lost some in trading but my accounts are looking better. I suppose it would be greedy of me to expect to have it both ways :)?

A pleasant weekend to all. – Jay

Jay,

Turns out bad news was good news. The market now expects a rate cut this month. If it doesn’t occur the end of the month could be brutal.

I am afraid the market will expect too much benefit from a rate cut and may take its eye off the upcoming recession. Record low mortgage rates are doing nothing for the housing market. Stimulus of financial markets does very little for the economy except for New York, NY. Job markets are tight but no wage pressure, thus no inflation. Demand for consumer products is in a slow growth mode and will stay that way until we open our doors to more immigrants or wages grow significantly.

I still believe an inverted rate curve portends a recession and we had one however short lived it was. It is possible for it to happen again with very little notice. While the stock market has predicted nine out of the last five recessions, the bond market has called all five. It’s not a matter of if, it’s a matter of when.

As I close positions I am adding to cash rather than opening new positions. I want to have substantial funds to invest when the market is much lower. As always pulling the trigger to really add to one’s holdings is easier said than done.

Take care and have a great weekend.

Hoyt

Hello Hoyt,

I want to add my wishes for your successful eye surgery to Jay’s and also remind you that I had many different eye related problems too.

So I know how you feel.

Take care – Roni

Thanks, Roni.

I hope all your issues got resolved to your satisfaction.

Today my surgeon said I was healing properly and I had gained three levels of sight in my right eye. He expects over time, three to six months, for it to be fully functional.

The left eye, the one with the hole in the retina, can not improve unless the hole can be repaired. Different surgeon. His prognosis of retina surgery success is 50/50. We will do more scans in about six weeks. If not worse my inclination is to stand pat.

Thanks for everyone’s thoughts.

Hoyt

Dear Roni and Hoyt.

A long time ago in a Galaxy far away I was a US Army Aviator. So my eye sight had to be OK. Today I am in my 60’s and need reader glasses for small print restaurant menus 🙂

You guys may not see this since we start a new blog in the morning but thanks for the chat this week! – Jay

Praying your eye surgery goes well.

Best,

Barry

Jay,

you do not know how fortunate you are.

everybody needs reader glasses after age 45 aprox.

This is just a muscular reality.

With age, the muscles get weaker, and are unable to deform the eyeball for close range focus.

It will probably get worse when you get older, but all you will need is more powerful lenses. No big deal.

Hoyt and myself, we have serious problems INSIDE the eyeball, which may eventually make us blind.

Big shit.

Meanwhile, let’s trade, make money, and have fun.

Roni