Sep 5, 2015 | Covered Call Exit Strategies, Exchange-Traded Funds, Option Trading Basics, Options Calculations, Put-selling, Stock Option Strategies

Selling out-of-the-money puts and using top-performing SelectSector SPDRs can be combined to design an extremely defensive option-selling strategy in a volatile market environment like we are currently experiencing. Using Inverse Exchange-traded Funds is another...

Apr 25, 2015 | Uncategorized

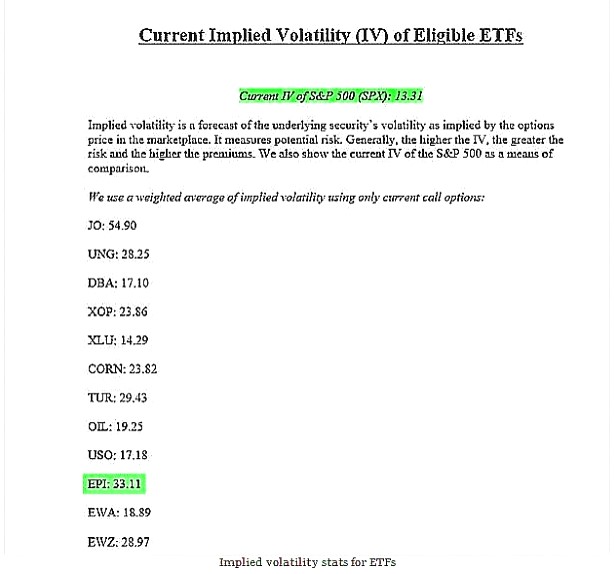

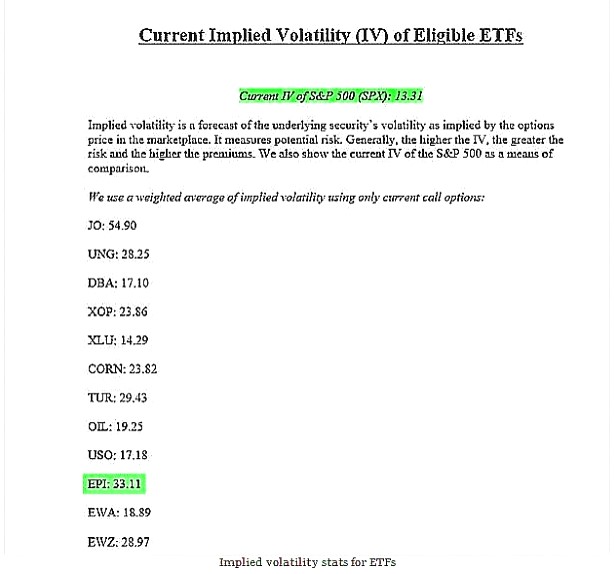

Covered call writers or cash-secured put sellers who use ETFs (as opposed to individual stocks) tend to be novice put writers, more conservative investors, or have limited funds or time. If you fall into any of these categories, knowing your risk level is critical to...

Jan 17, 2015 | Exchange-Traded Funds, Investment Basics, Option Trading Basics, Stock Option Strategies

For the strategies of covered call writing and selling cash-secured puts, we are selling the right, but not the obligation, to buy or sell 100 shares of the underlying security. That security can be a stock or and exchange-traded fund (ETF). In this article, I will...

Sep 20, 2014 | Exchange-Traded Funds, Stock Option Strategies

With the popularity of covered call writing and selling cash-secured puts growing in popularity, we have witnessed the creation of new exchange-traded funds based on these strategies. Over the last few years I have not been a proponent of these securities mainly...

Jul 26, 2014 | Exchange-Traded Funds, Investment Basics, Option Trading Basics, Stock Option Strategies

Most options traders including covered call writers are familiar with exchange-traded funds (ETFs) and many trade options on these securities. Many have also heard of, but are not as familiar with, index options. The purpose of this article is to detail the...