Dec 28, 2019 | Covered Call Exit Strategies, Exit Strategies, Investment Basics, Option Trading Basics, Options Calculations, Options Trade Execution, Stock Investing, Stock Option Strategies

When we write a covered call, our breakeven is stock purchase price – entire call premium. If we buy a stock for $48.00 and sell an option for $2.50, the breakeven is $45.50. In June 2019, John shared with me a series of trades he executed with Planet Fitness,...

Oct 12, 2019 | Covered Call Exit Strategies, Exit Strategies, Investment Basics, Option Trading Basics, Options Calculations, Options Trade Execution, Stock Option Strategies

Position management or exit strategies for covered call writing and selling puts is the third required skill to achieve the highest possible return levels (stock and option selection are the first two). First, we must determine if an exit strategy opportunity actually...

Jul 20, 2019 | Covered Call Exit Strategies, Exit Strategies, Investment Basics, Option Trading Basics, Options Calculations, Stock Option Strategies

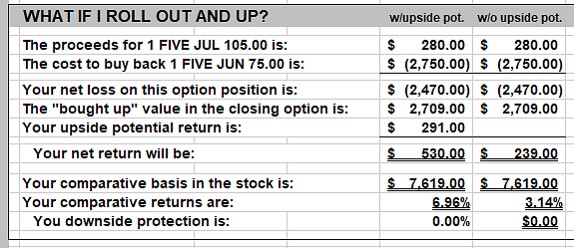

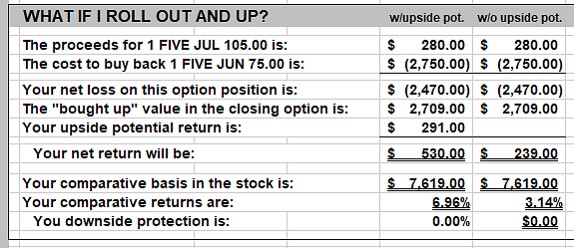

Covered call writing calculations should be as accurate as possible so that we can assess the success and feasibility of our trades. When we roll in-the-money (ITM) options out-and-up there is frequently an option debit which, on first glance, may make the trade...

Dec 8, 2018 | Covered Call Exit Strategies, Exit Strategies, Option Trading Basics, Options Calculations, Stock Option Strategies

One of our covered call writing exit strategies when the strike is in-the-money on expiration Friday is rolling out-and-up. This is when we buy back the near-month call (buy-to-close) and sell the next month’s higher strike. There are times when share...

Sep 1, 2018 | Covered Call Exit Strategies, Exit Strategies, Investment Basics, Option Trading Basics, Options Calculations, Stock Option Strategies

Rolling our covered call trades involves multiple months of trading statistics. The calculations may be deceiving initially but on deeper analysis, rolling our options can represent an invaluable trading tool which enhances our overall returns. Some of our members...