Jul 11, 2020 | Investment Basics, Option Trading Basics, Stock Option Strategies, Technical Analysis

Strike price selection is the second required skill for our covered call writing and put-selling portfolios. Stock (and ETF) selection and position management (exit strategies) are the other two. This article will highlight how we can use overall market assessment and...

Jun 27, 2020 | Investment Basics, Option Trading Basics, Put-selling, Stock Option Strategies

Options trading basics teaches us that the VIX or CBOE Volatility Index reflects the market’s expectation of the upcoming 30-day volatility. It measures market risk and is also known as the investor fear gauge. With this in mind, option-sellers are faced with a...

Mar 21, 2020 | Investment Basics, Option Trading Basics, Stock Option Strategies

For covered call writers and sellers of cash-secured puts, rising volatility has two faces. It is our friend in that our premiums will be higher as they are directly related to the implied volatility of the underlying securities. It is our enemy as we will be...

Aug 17, 2019 | Investment Basics, Option Trading Basics, Stock Investing, Stock Option Strategies

Options trading basics teaches us that the VIX or CBOE Volatility Index reflects the market’s expectation of the upcoming 30-day volatility. It measures market risk and is also known as the investor fear gauge. With this in mind, covered call writers are faced with a...

Mar 2, 2019 | Exchange-Traded Funds, Investment Basics, Option Trading Basics, Put-selling, Stock Option Strategies

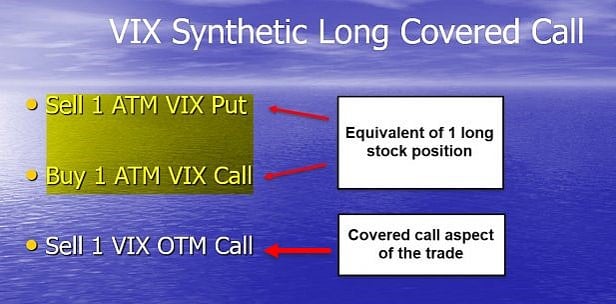

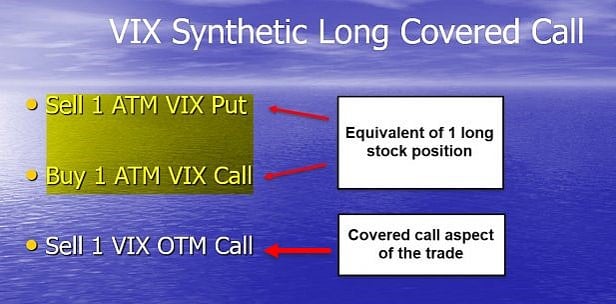

Traditional covered call writing involves first buying a stock (or exchange-traded fund) and then selling a corresponding call option. The result of the initial trade is to generate cash flow from the option sale and lower our cost basis on the stock side. Based on...