Before initiating a poor man’s covered call trade (PMCC), we must first master all aspects of the strategy including understanding the pros and cons inherent in this system. Once we have made a decision that this strategy is appropriate for our portfolios, the next step is to analyze our initial trade structuring calculations. We want to ensure that, if share price accelerates substantially and we are forced to close both legs of the trade, we will close at a profit. Key to accomplishing this goal is the time-value component of the long LEAPS positions. If the time-value is too high, closing both legs may result in a loss. The first tab of the BCI PMCC Calculator will give us a “YES” or a “NO” when entering the initial trade data.

What is the PMCC strategy?

This is a covered call writing-like strategy where a LEAPS option is purchased instead of the stock or ETF itself. This allows us to enter covered call trades with a lower cash investment. There are several pros and cons associated with this strategy.

What is SPY?

The SPDR S&P 500 trust is an exchange-traded fund which trades on the NYSE. SPDR is an acronym for the Standard & Poor’s Depositary Receipts, the former name of the ETF. It is designed to track the S&P 500 stock market index. This fund is the largest ETF in the world.

Time-value of our premiums and the “moneyness” of our call strikes

At-the-money (ATM) or near-the-money (NTM) strikes have the greatest premium time-value. As the strike moves deeper in-the-money (ITM) or out-of-the-money (OTM), the time-value decreases and moves towards zero. Here is a graphic representation of this relationship:

Relationship Between Premium Time-Value and the “Moneyness” of an Option

Real-life example with SPY: Inappropriate initial trade structuring with the $400.00 LEAPS strike

PMCC SPY Trade with the $400.00 LEAPS Strike

- Red arrow: The BCI PMCC Calculator highlights that this an inappropriate trade based on the BCI methodology.

- Green arrow: Closing both legs of the trade, should share price accelerate, will result in a loss of $21.21 per-share.

This is a direct result of the time-value component of the $400.00 LEAPS being too high.

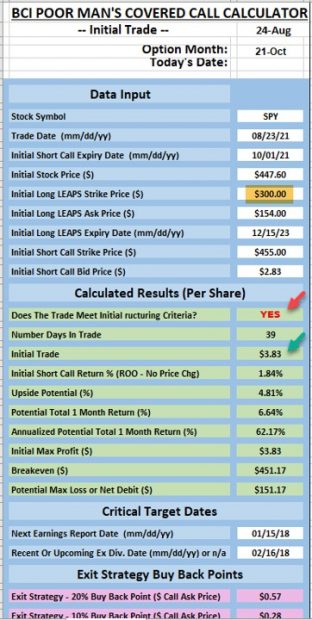

Real-life example with SPY: Appropriate initial trade structuring with the $300.00 LEAPS strike

PMCC SPY Trade with the $300.00 LEAPS Strike

- Red arrow: The BCI PMCC Calculator highlights that this an appropriate trade based on the BCI methodology.

- Green arrow: Closing both legs of the trade, should share price accelerate, will result in a gain of $3.83 per-share.

This is a direct result of the (much lower) time-value component of the $300.00 LEAPS being appropriate for our initial PMCC trade structuring.

Discussion

When setting up our PMCC trades, we must be sure that if we are forced to close our total trade positions, that we will close at a profit. This means that the time-value debit when purchasing the LEAPS option cannot be too high causing the trade to close at a loss. To decrease the time-value component of the LEAPS, we go deeper in-the-money. As we do so, the time-value will decline but the intrinsic-value component will increase meaning we will pay more to enter the trade. Lots to think about but the calculator will do all the heavy lifting when it comes to these calculations.

For more information of the PMCC

Your generous testimonials

Over the years, the BCI community has been incredibly gracious by sending our BCI team email testimonials sharing stories as to what our educational content has meant to their families. Moving forward, we have decided to share some of these testimonials in our blog articles. We will never use a last name unless given permission:

Hi Alan,

Thanks, once again, for your prompt and comprehensive reply. I think it’s great that you and your team do not rest on your laurels but continue to seek to improve your product.

As a retired physics teacher, I appreciate just how much work and dedication it takes to do the right and best thing for your students. And how easy it would be to take an easier path.

Kudos to you and your team.

Best wishes,

Lou

Upcoming events

1.BCI-only free webinar: February 17, 2022, at 8 PM ET

Click on this Zoom login link just prior to 8 PM ET

Introducing a New Exit Strategy and Exit Strategy Term

The platform allows 500 attendees so click on this registration link a few minutes before 8 PM ET.

Click here for a preview video (make sure you’re on our mailing list to get the link … sign up on the right side of our blog page…scroll down to “Free Newsletter”).

Exit strategy implementation is a critical aspect of successful covered call writing and put-selling strategies. Over the past 15 years, the BCI team has been creating rules and guidelines regarding our trade entries and adjustments while always seeking to enhance the opportunities to elevate our returns to the highest possible levels.

This webinar will introduce a new exit strategy and exit strategy term that can be applied to both covered call writing and selling cash-secured puts. We have also integrated this new exit strategy into our upcoming BCI Trade Management System which includes our new Trade Management Calculator. This new tool is the first of its kind anywhere and will be available to our BCI community during the 1st quarter, 2022. You have been asking for a trading log that allows us to both enter, adjust and calculate final returns and now you will have it.

This presentation will include scenarios when the exit strategy can be applied, how to apply it and show calculation results using both stocks and ETFs for both calls and puts.

Let’s learn from each other and use this information to become the best and most elite of all option traders.

2.Long Island Stock Investors Meetup Group

Stock Options: How to Use Implied Volatility to Determine Strike Selection

Creating 84% probability successful trades for covered call writing and selling cash-secured puts

Wednesday April 13, 2022

7:30 PM ET – 9:30 PM ET

3. LIVE at The Money Show Las Vegas

May 9th – 11th

Details and registration link to follow.

2 presentations:

Portfolio Overwriting (free)

Increasing Profits in Our Buy-And-Hold Portfolios Using Covered Call Writing

A Comprehensive Analysis of Covered Call Writing: 2-hour Master’s Class (paid event to The Money Show)

How to master all aspects of this low-risk option-selling strategy

***********************************************************************************************************************

Market tone data is now located on page 1 of our premium member stock reports and page 1 of our mid-week ETF reports.

****************************************************************************************************************

Alan,

I admire your courage in staying fully invested in such an adverse market situation.

I am 100% in cash since early February and hope that the Ukraine situation will be resolved peacefully. Right now it looks very bleak.

Also, we have not yet recovered from COVID and its resulting global fallout.

Roni

Premium Members,

This week’s Weekly Stock Screen And Watch List has been uploaded to The Blue Collar Investor Premium Member site and is available for download in the “Reports” section. Look for the report dated 02/11/22.

Also, be sure to check out the latest BCI Training Videos and “Ask Alan” segments. You can view them on The Blue Collar YouTube Channel. For your convenience, the link to the BCI YouTube Channel is:

http://www.youtube.com/user/BlueCollarInvestor

On the front page of the Weekly Stock Report, we now display the Top Performing ETFs, the Top SPDR Sector Funds, and the 4 single Inverse Index Funds. They are sorted using the 1-month performances from the Wednesday night ETF report and the prices from the weekend close.

Best,

Barry and The Blue Collar Investor Team

barry@thebluecollarinvestor.com

Alan,

I’m watching your online video course and I’m learning so much.

In the exit strategy section, you talk about rolling down in the second part of a contract. My question is do you still set a buy to close limit order with the new strike (I’m guessing yes) and if so what is it based on? The new premium, the old premium or a combination?

Thanks for all you do.

Nancy

Nancy,

Yes, you are correct. We set a BTC GTC (good until cancelled) limit order on the new premium.

If the first option was sold for $2.00 and the second option sold was for $1.00, we set a BTC GTC limit order at $0.20 in the first half of a contract or $0.10 in the last 2 weeks of a monthly contract.

Alan

Alan,

Thank you for your help with investing! Just subscribed to BCI a couple months ago and have watched all your videos online. Your work gives me hope that market-beating returns are possible without paying 1% a year to a professional.

My question is about stop-loss orders on long term buy and hold positions. I realize CCs and CSPs are your primary focus, but I noticed on your flow chart for buy and hold portfolios that you include stop-loss orders. I have never used them, mainly because of the philosophy espoused by the Motley Fool: Don’t take days out of the market because you’ll miss out on big up days and if you buy and then hold long enough it will all work out. However, not having stop-loss orders has been costly over the last six months.

Do you recommend using stop-loss orders on all holdings? Where do you set them?

Thanks so much!

Graham

Graham,

Whether it’s in option-selling or long term buy-and-hold portfolios, we must always have mitigating strategies in place. For option-selling, we have our 20%/10%, 3% and 7% guidelines.

For long-term buy-and-hold portfolios, in my book, “Stock Investing for Students”, I have written about trailing stop-loss orders. With these broker instructions, we can set a limit on share decline from a stock’s price high but not cap the upside. A reasonable trailing stop loss order can be set at 10% (as one example) since we have defined this portfolio as long term buy-and-hold.

Alan

Hi Alan,

In your latest BCI report you stated… “On Monday, after 11 AM ET, I will make my rolling decisions.”

Assuming you have decided to make rolling decisions, the market is basically flat right now for the day and February option monthlies expire this Friday (2/18/22)… are you describing rolling to the 2/18/22 date with a low strike price for a small credit or are you stating you will be rolling to the next monthly of March 18, 2022 with the same strike price or slightly lower strike price for a credit?

Just a clarification. please.

As always… Thank you!

Tay

Las vegas, NV

P.S. All casinos and hotels are wide open now in Vegas.

Tay,

Today, I rolled-down to out-of-the-money strikes, all with 2/18 expirations.

I consider rolling-out on expiration Friday. I usually start about 1 PM ET.

BTW: I will be in Las Vegas for a Money Show event (hosting 2 presentations) between May 9th and 11th. Hope you can make it.

Alan

Thursday’s BCI-only webinar Zoom login link:

https://us06web.zoom.us/j/88320477711?pwd=RHdMVTF1ckdOUzFkWkZEVEZVb0owdz09

Premium members,

The latest Blue Chip Report of the top-performing Dow 30 stocks for the March 2022 contracts has been uploaded to your member site.

Look in the “resources/downloads” section (right side) and scroll down to “B”

Alan

Premium members:

This week’s 4-page report of top-performing ETFs and analysis of the top-performing Select Sector SPDRs has been uploaded to your premium site. One and three-month analysis are included in the report. Weekly performance has also been incorporated into the report although not part of the screening process. Weekly option availability and implied volatility stats are also incorporated.

The mid-week market tone is located on page 1 of the report.

New members check out our ongoing and never-ending training videos (“Ask Alan” and Blue Hour webinars). We add at least one new video each month. Only premium members have access to the entire library of these training tools.

For your convenience, here is the link to login to the premium site:

https://www.thebluecollarinvestor.com/member/login.php

NOT A PREMIUM MEMBER? Check out this link:

https://www.thebluecollarinvestor.com/membership.shtml

Alan and the BCI team

Tonights new Zoom login

Alan Ellman is inviting you to a scheduled Zoom meeting.

Topic: Webinar tonight BCI

Time: Feb 17, 2022 08:30 PM Eastern Time (US and Canada)

Join Zoom Meeting

https://us06web.zoom.us/j/82133942621?pwd=YmpiVHNLN24waTFsZGQxR2k3S09uQT09

Meeting ID: 821 3394 2621

Passcode: 144548

One tap mobile

+13126266799,,82133942621#,,,,*144548# US (Chicago)

+16468769923,,82133942621#,,,,*144548# US (New York)

Dial by your location

+1 312 626 6799 US (Chicago)

+1 646 876 9923 US (New York)

+1 301 715 8592 US (Washington DC)

+1 346 248 7799 US (Houston)

+1 669 900 6833 US (San Jose)

+1 253 215 8782 US (Tacoma)

Meeting ID: 821 3394 2621

Passcode: 144548

Find your local number: https://us06web.zoom.us/u/kqzbkuiaB

Webinar recording/New Exit Strategy/New Trade Management Calculator:

We had several technical issues impacting our webinar this evening. My apologies.

Here is a link to a recording I made tonight:

https://youtu.be/swtURSvcVBs