Covered call writers (put sellers, too) may analyze Delta stats prior to executing option trades. This article will explore the relationship between Delta and time-to-expiration. Who thinks Delta goes up over time? Who believes it goes down over time? Who thinks something else? Let’s see.

3 Definitions of Delta

- Delta is the amount an option price will change for every $1.00 change in share price

- Delta is the equivalent number of shares represented by the options position

- Delta is the percentage likelihood that, upon expiration, the option will expire in-the-money (ITM) or with intrinsic value

A majority of covered call writers are interested in the likelihood of their options being exercised and the shares sold. Delta provides insight into this concern. A Delta, for example, of 80 (.8 or 80%) suggests an approximate 80% probability of expiring in-the-money (ITM) or with intrinsic-value and, therefore, subject to exercise.

What happens to Delta stats as we go out further in time using the same strike prices?

Real-life example with Apple, Inc. (Nasdaq: AAPL)

On 9/4/2025, AAPL was trading at $238.03. We will check the option-chain data for the 1-month and 6-month $225.00 (ITM) and $250.00 (OTM) strikes, as they relate to the approximate probability of expiring ITM.

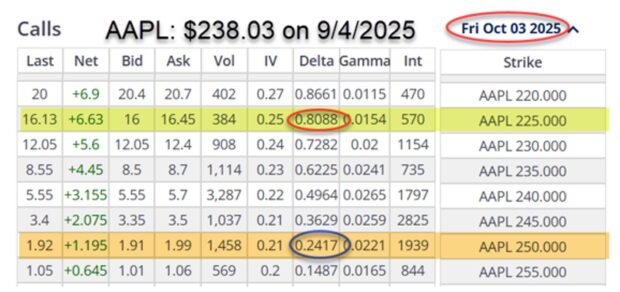

AAPL 1-month option chain

- The ITM $225.00 strike has a Delta of 80.1% (lower red oval)

- The OTM $250.00 strike shows a Delta of 24.2% (blue oval)

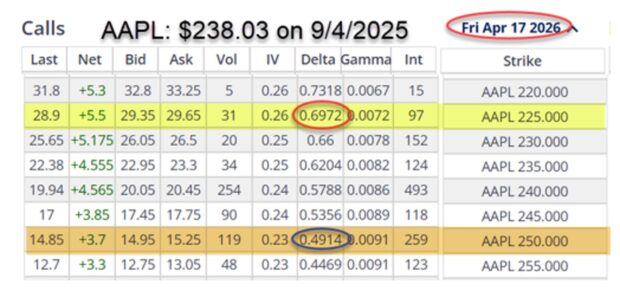

AAPL 6-month option chain

- The ITM $225.00 strike has a Delta of 69.7% (lower red oval)

- The OTM $250.00 strike shows a Delta of 49.1% (blue oval)

Comparing ITM & OTM Deltas

ITM $225.00 strike: As we went out in time, this strike went from a Delta of 80.1% to 69.7%. Why? Well, it started ITM and going out 6 months will give AAPL ample opportunity to move below the ITM strike and therefore, is slightly less likely to expire with intrinsic value.

OTM $250.00 strike: As we went out in time, this strike went from a Delta of 24.2% to 49.1%. Quite a difference. Why? Over a 6-month timeframe, AAPL can certainly move from $238.03 to above the $250.00 strike, rendering the $250.00 strike now ITM, if that occurs. The probability of expiring ITM increases over time.

Discussion

As we use longer-dated options, Delta will slightly decrease for ITM strikes and increase for OTM strikes. If you said, “Delta goes up”, partial credit. If you said, “Delta goes down”, partial credit. If you said, “something else”, partial credit- sorry, you didn’t specify.

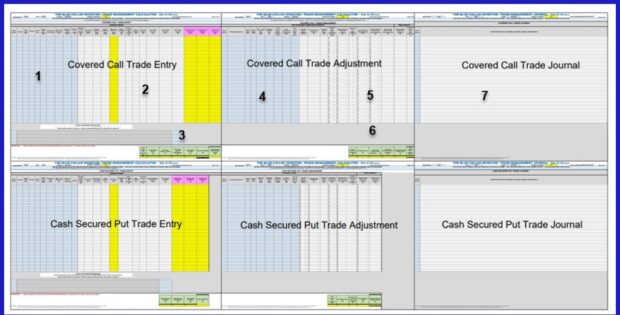

BCI Trade Management System (TMS) & Calculator (TMC)

This is a unique tool that is used to manage covered call writing and selling cash-secured put trades from start-to-finish. To our knowledge, it’s the only one of its kind anywhere.

The TMS consists of 4 tabs:

- TMC

- TMC user guide

- “What Now Worksheet” tab for covered call writing

- “Unwind Now Worksheet” tab for covered call writing

The TMC is the” meat and potatoes” of the TMS. It has 2 main sections; one for covered call writing (top of spreadsheet) and one for selling cash-secured puts (lower half of spreadsheet).

Each of these sections is divided into 4 sections that flow left to right in the same sequence as we enter and manage our trades:

Opening trade entries

- Opening trade and total portfolio initial calculations

- Exit strategy trade adjustment entries

- Exit strategy calculations & final combined trade results for both individual trades and total portfolio results.

Click here for informational videos:

Free training resources

Your generous testimonials

Over the years, the BCI community has been incredibly gracious by sending our BCI team email testimonials sharing stories as to what our educational content has meant to their families. Moving forward, we have decided to publish several of these testimonials in our blog articles. We will never use a last name unless given permission:

1. Long Island Stock Investors Meetup Group: Part I

Thursday February 12, 2026

7:30 PM ET – 9:00 PM ET

Credit Spreads for Bull & Bear Markets

Introducing Our Latest Products, Creating New Investment Opportunities

2. Las Vegas Money Show- 2 presentations

February 23 – 25, 2026

The Collar Strategy: Covered Call Writing with Protective Puts

Protecting covered call trades from catastrophic share loss

This is the strategy Bernie Madoff pretended to use. He called it the split strike conversion strategy, but it was simply a collar. The covered call sets a ceiling on the trade and the protective put guarantees a floor on the trade

Topics discussed

- What is the collar strategy?

- Uses for the collar

- Entering a collar trade

- Option basics for calls

- Option basics for puts

- Real-life example with NVDA

- What is an option-chain?

- Real-life example using the BCI Trade Management Calculator (TMC)

- Strategy pros & cons

- Educational products & discount coupon

- Q&A

Selling Cash-Secured Puts to Buy a Stock at a Discount or to Enter a Covered Call Trade

2 outcomes & 4 applications

Selling cash-secured puts is a low-risk option-selling strategy which generates weekly or monthly cash-flow. This presentation will detail how to craft the strategy to generate cash flow, buy a stock at a discounted price or to initiate a covered call trade. Topics included in the webinar include:

- Option basics

- The 3-required skills

- 4-practical applications

- Traditional put-selling

- PCP (Put-Call-Put or wheel) Strategy

- Buy a stock at a discount instead of setting a limit order

Real-life examples along with rules, guidelines and calculations are included in this presentation.

Time, date & registration link.

3. Palm Beach Traders Club

March 10, 2026

Private Investment Club

4. Long Island Stock Investors Meetup Group: Part II

Thursday March12, 2026

7:30 PM ET – 9:00 PM ET

Ultra-Low-Risk Approaches to Covered Call Writing & Selling Cash-Secured Puts

Introducing Our Latest Products, Creating New Investment Opportunities

5. Hollywood Florida Money Show

April 10, 2026

11:40 AM – 12:25 PM

The Put-Call-Put (PCP) or Wheel Strategy

Using Both Covered Call Writing and Put-Selling to Generate Monthly Cash Flow

Selling stock options is a proven way to lower our cost-basis and beat the market on a consistent basis. Two such low-risk strategies are covered call writing and selling cash-secured puts. This presentation will detail how to incorporate both strategies into one multi-tiered option-selling strategy where we either generate cash-flow or buy a stock at a discount. I refer to this as the Put-Call-Put (PCP) Strategy, also referred to as the wheel strategy.

The basics and pros and cons of low-risk option-selling strategies will be discussed as well as an analysis of a real-life example and introduction into the BCI Trade Management Calculator (TMC). This seminar is appropriate for those who look to generate modest, but consistent, returns which will enable us to potentially beat the market on a consistent basis while focusing on capital preservation.

More details to follow.

6. Young Investor’s Club at The University of Central Florida

April 16, 2026

Private student investment club.

7. Orlando Money Show

October 5 – 7, 2026

Details to follow.

Hello Alan,

Great to hear about the portfolio overwriting methods during Thursday’s webinar. I’ve pegged about a dozen or so of my long term holdings to sell calls on. The delta 10, sounds fine on these as I’ll most likely will not, and Don’t want TO sell them.

Best to you,

Neil

Neil,

Always enjoy hearing from you and thanks for attending our webinar. Also, it’s great seeing you in person at Money Show events.

Look at deltas between 5 and 10 (.05 – 0.10) and be prepared to roll the option in the rare occasions when it is expiring ITM.

Alan

Alan,

Is there any rule of thumb that you use to determine when you want to move to more than 1 stock in a given industry instead of putting too much money in one stock? I’ve had decent luck by spreading across an industry – in some weeks I’ve had 3-4 mining stocks or 3-4 chip stocks to spread my risk. Is this a good approach or do you prefer to stock to only 1 stock per industry?

I just want to be sure I’m making good decisions and following along with the program as best I can.

BTW: I’m making far more money investing than my salary from my working days which is fantastic!

Thank you.

Andrew

Andrew,

First, I want to thank you for sharing this information. Learning of the success you are enjoying, absolutely made my day!

Let me clarify the ” 1 stock per industry” guideline. This applies if we are using only 5 stocks, not to your situation.

The breakdown you shared looks fine, noting that chips & mining stocks have been outperformers of late.

As I said in my last email, if you need more securities with weekly options, you can turn to our weekly ETF report or our monthly Blue Chip (Dow 30) Report.

Alan

Alan,

Thank you for the clarification. I did not realize that the one stock guidance was specifically related to anybody using a small number of stocks.

Appreciate all your help.

Andrew