When using covered call writing and put-selling strategies it is important to set goals for initial returns in order to select the most appropriate underlying security and option. My goal for initial returns is 2% – 4% per month and a bit higher in a bull market environment. Recently, several of our members have contacted me inquiring about a way to scan eligible stocks for premiums that may meet these goals. This article will address this issue using our Premium Stock Report but other resources may be used as well.One of the columns inherent in our member reports is beta. This is a measure of the volatility of a security as compared to the S&P 500. A stock with a beta of “1” has the same statistical or historical volatility as the S&P 500 and would be expected to perform similarly. Stocks with betas > 1 have higher-than-market volatility and those with betas < 1 have lower-than-market volatility Beta is therefore based on actual historical statistics.

Implied volatility, on the other hand, is a market forecast of the underlying’s volatility as implied by the current option’s pricing. Implied volatility impacts option premium more directly than does beta. However, it makes sense that those securities with higher betas will generally also have higher implied volatilities, admittedly with some exceptions. With that in mind, we will set up a screen for higher option returns by screening for eligible stocks (passed our fundamental, technical and common sense screens) that have betas > 1.50. We also want to be sure that the stocks have no earnings reports due out before contract expiration and the associated options have adequate open interest.

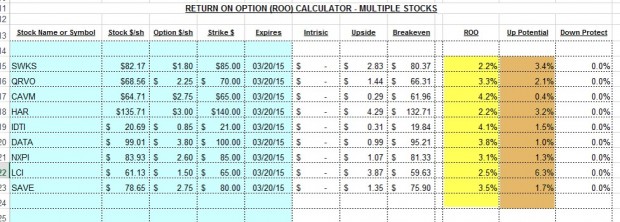

Below is a screenshot of the information gleaned from the Premium Stock report dated 2-13-15 (members wait for the new report to come out) and the option chains:

High-beta stocks

You will note that five of the nine candidates are in the “Chips” industry segment so we must be cautious not to over weigh our portfolio in one particular segment. If more candidates are needed, we can always drop our beta requirement a bit, perhaps to > 1.30. Next, we will enter the options data into the multiple tab of the Ellman Calculator (free copy by clicking the “Free Resources” link on the top black bar of this page and then scrolling down to sign in). For the purposes of this article, we will view out-of-the-money strikes only but this can be expanded to other strikes as well:

Calculations for stocks with high betas

The column highlighted in yellow, ROO, represents the actual time value initial returns which do meet our 2%c – 4% goals. The column featured in brown, upside potential, shows additional profit that may be generated if share price moves up from current market value to the strike. For example, should SWKS move up from its current price of $82.17 to the $85 strike, the total 1-month return would be 5.6% (2.2% initial profit + 3.4% from share appreciation to the strike).

Summary

One approach to screening eligible stocks for higher option returns is to look at beta statistics. The process includes setting initial goals, establishing a minimum beta required, checking options chains and then running the calculations. All this should take less than 20 minutes for those with a quality watch list.

FREE Beginners Corner tutorial for puts

Just added to our website: An 8-part video series based on my latest book. Each of the 8 videos are between 5 -10 minutes long. Click on the link shown below and enter your email address to enter the classroom:

Link to Beginners Corner for puts

Next live seminars:

February 28th and March 1st

The International Stock Trader’s Expo: New York City: Marriott Marquis Hotel

Saturday February 28th 12:50 to 1:35 PM (new time)

Sunday March 1st 1:30 – 2:30 PM

Both seminars are free to attend.

-

The minutes from the January 27 -28 FOMC meeting reflects continued discussion as to when to raise interest rates, a positive sign for the resilience of our economy

-

The Conference Board’s leading Economic Index (LEI) rose by 0.2% in January below the 0.3% expected, but still suggesting a bullish short-term outlook in 2015

-

The Producer price Index (PPI) dropped by 0.8% in January (economists projected a drop of 0.4%) mainly due to declining energy prices

-

Housing starts fell to 1,065,000 in December, a drop of 2% but year-over-year growth was up 18.7%. Severe weather conditions were a major factor

-

Building permits were down by 0.7% in December but up 8.1% year-over-year

-

Industrial production rose by 0.2% in January lower than the 0.3% projected by experts

-

Initial jobless claims for the week ending February 14th came in at 283,000, less than the 292,000 expected

Summary

IBD: Confirmed uptrend

GMI: 6/6- Buy signal since market close of January 23, 2015

BCI: Cautiously bullish using an equal number of in-the-money and out-of-the-money strikes. Global issues are still looming over our markets as possible short-term negative factors

Wishing you the best in investing,

Alan (alan@thebluecollarinvestor.com)

Hi Alan…thanks for the article that is right in my sweet spot. The idea of selecting stocks based on beta and implied volatility for the rewards of selling calls is a very unique way to look at the market. It means (to me) not to fall in love with the underlying stock but to simply focus on the return over a given period, likely around one month.

Most of the calls you selected in your example have very little “upside” in stock price, less than 5%. The normal impulse is to get an option that gives 10% or more upside. But that will provide very little return from the call option. The BCI approach seems to be “premium first”. It requires a re-calibration for the typical investor, including me.

Investors also should mentally prepare for the price volatility of this approach since high beta = high price volatility. Most of these stocks have violent daily price swings of 1% or more. They are mostly on the IBD top 100 list and that is the list used predominantly by day traders meaning the daily action is intense. I am in AMBA right now for the high premium and it has been quite a ride. My “stop” is at 10% which is more downside than many will want to endure.

Thanks again for your fresh look at investing.

Premium Members,

The Weekly Report for 02/20/15 has been uploaded to the Premium Member website and is available for download.

Also, be sure to check out the latest BCI Training Videos and “Ask Alan” segments. You can view them at The Blue Collar YouTube Channel. For your convenience, the BCI YouTube Channel link is:

http://www.youtube.com/user/BlueCollarInvestor

Best,

Barry and The BCI Team

Would you please explain this: Selling out-of-the-money puts is another way to navigate volatile markets.

Many thanks

Tom

Tom,

When we sell an OTM put, we generate downside protection. Here’s an example:

BCI trading @ $32

Sell the $30 OTM put for $1

If unexercised, we generate a 3.4%, 1-month return ($1/$29)

If exercised and the shares are “put” to us, our cost basis is $29 (buy @ $30 less the put premium)

$29 is a discount of 9.4% from the original $32 price when the trade was entered

Therefore, selling OTM puts will give us downside protection in bear and volatile markets.

Alan

Hello Dr. Alan

Good day

Please what to do with this:

Leap C Call exp. Jan.15.2016

Opened 20 days back.

Has gone deep ITM

The trade started loosing

What happens if the stock stays at this level or higher at expiration.

Anton.

Thanks

Anton,

If you sold a LEAP against a security that you own, my assumption is that the option premium met your goal. If share value appreciated causing the LEAP price to increase, this does not mean you are in a losing trade. This is actually a positive. Early exercise will rarely occur 11 months prior to expiration. But if it does, you have maxed your potential profit and now have the cash to re-invest well in advance of expiration.

If share price is above the strike by expiration and IF you don’t close your short option position, the shares will be sold at the strike price.

If I didn’t fully understand your trade position, let me know.

Alan

Alan,

I am using TDAmeritrade’s Think or Swim platform for Option strike prices for symbol BAC. These are priced at 50 cent increments (as are many of my holdings). I am finding these incremental prices have 0 open interest while whole dollar strike prices have alot of open interest. Should this stop me from selling at this ‘in-between’ strike prices?

Joe,

This is a really interesting situation and a great question. If you look at the options chain, today is a rare time when Vol is greater than the open interest for these BAC options which, as you pointed out, is “0” in the $0.50 increments. Here’s why:

Today is the first day that the March contracts are the “front month” The strikes in $0.50 increments were just added to the choices and will not show open interest stats until tomorrow. However, the Vol shows up and you can see lots of interest in these options in many of the strikes as well as tight b-a spreads for BAC.

Bottom line: As long as Vol is high and b-a spreads are tight, there is no concern from a liquidity standpoint.

Alan

Alan, Thanks for the explanation. Makes sense now. I am sure many of us ‘new-bees’ will be selling on the 1st day of the new month and see this every month but don’t have the experience to recognize it for what it is. Looking forward to day 2 of the option month and a more complete looking option chain.

Alan

I am having great difficulty obtaining a shortlist of stocks with an acceptable ROO (2-4%), like the shortlist you have in your article. I have worked the ROO for this week’s eligible candidates that passed all screens (all of them, a tedious task I must say) for near the money strike range and I found that the average ROO is below the 1%. The few stocks that approached a 2%, or scraped just past it, offered little or no upside or protection. I did not calculate the ROO for the eligible candidates with mixed data.

I know I must be doing something wrong, and it is frustrating to get this part (the calculation part) wrong when I got hooked and began liking this strategy. I wish you could help.

Thanks

Anton

Anton, Can you give an example. I calculated ULTA for the $140 strike. I have a 3.8% ROO. Regards, Joe

Joe, thank you for your time to reply, I highly appreciate.

I agree with the returns for ULTA but it seems that this stock has an ER in the current contract period.

I have attached a screenshot of some calculations of the stocks that passed all screens (the first seven bold tickers in the running list). If my calculations are correct you will note that all ROO is below 2%, with the exception for the ILMN $200 strike. Even then, at a ROO of 2.3% down protect is just 0.5%.

I have the computations for all the bold tickers in the running list, which I can provide if you want, with more or less similar results. Of all 39 candidates, I can perhaps indicate just 3 stocks with an acceptable ROO (between 2% and 3% in any case) with a corresponding acceptable up potential / down protect.

I did not make calculations for stocks in the running list with mixed data (the non-bold tickers) so I cannot say what type of ROOs these might have, but as for the bold tickers, I have found the choice rather limited considering these stocks make up the pool from which to pick OTM strikes.

Hope to hear your views

Anton

I am in UVE which meets the requirements. It reports on 2/25 so should be good once that is over. I am ITM on the $22.35 March 20 contract. My 30 day yield is 3%.

There are others that are on the list that I have a position: NXPI, MNST, I am also in SIMO, NTES and AMBA which were on recently. They all work a little OTM

I looked at ILMN which is high IV but it has too few strikes, too little volume and too big a-b spreads. I looked at DATA and it had 4% return on 30 day calls (it dropped a lot yesterday, but don’t know why)

I would also offer that in strong market uptrends IV will fall and so it is hard to get very good returns with the “Buy-Write” strategy during periods of market ebullience (now?) Option returns are best when vol (risk) is highest as in during a bear market.

Anton,

All the examples in the spreadsheet from this article were taken from options chains a few days ago. There are many more examples. Make sure you are looking at monthly options, not weekly expiring options.

Alan

Alan If I buy stock for $100 and sell the option immediately and the stock goes to 110 Which Is Way in the money and I have made the difference between one and 105 for example and profit should I sell that stock early and lock in all those and immediately resell the option. Otherwise I’m waiting for the option to expire. And then I’m getting the time value of the option but no more increases because it’s beyond the strike. I suppose the answer maybe if I think the stock is going to continue upwards or not. What is your take?

Bill

Bill,

In the example you give, you have an extremely successful trade…option premium + $5 of share appreciation. You ask a very important question…when should I close if at all.

As the strike moves deeper in-the-money the time value component of the premium (premium – intrinsic value) approaches zero. If that time value cost to close is such that closing the entire position and entering a new one will generate an option credit it pays to take action.

See pages 264 – 271 of the complete Encyclopedia…for more detailed information with examples.

Alan

Hi Alan

you give an address moneycentralmsn….to access the scouter rankings I tried it but could not find the info yes I see it on the running list information. ok some interesting findings ; now that I can access the premium list I found 5 securities that met the criteria when I attempted to cover call them (still paper trading) only 2 of the 5 had above 2% monthly return! does that suggest that the others have a low implied volatility? or low beta? am I missing something?

thanks Bruce

p.s. you mentioned stocks being ranked in the upper third of their industries confusing there

you put (197) can you explain?

Bruce,

We are fortunate to be receiving Scouter data and expect it will be universally available in the near future. In the interim, the data will continue to be published in our weekly premium member stock reports.

Option premium is directly related to implied volatility but beta can assist us in finding higher IV stocks like the nine shown in this week’s blog article. There is no need to limit your selections to bold only stocks in the report. All stocks in the “white” cells are eligible.

My team divides the 197 industry segments in 20%s…the top 20% in performance ranks “A”, the next 20% ranks “B” and so on.

Alan

Hi Mr. Ellman,

I brought 3 of your books. As I was reading it. The problem with covered call is the stock drop. Will it work if I short and long a stock at the same time while selling a call?

Also, your book didn’t mention about using put options for downside protection.

Waiting to hear you back.

Thanks,

John

Hi John,

You are spot on that our main concern with selling options is share decline. I have addressed this issue extensively in my books and DVDs with an arsenal of exit strategies. Position management is one of the 3 required skills to become an elite covered call writer (stock selection and option selection being the other 2).

The risk with being short and long the stock and selling a call option is in share appreciation. Let’s say we buy and short sell a stock @ $30 and sell a $30 call option. Now the stock price rises to $40. The call buyer will exercise the option and buy our shares for $30…no harm as we paid $30. However, we are still short the stock which, in essence, we borrowed from our broker and paying interest on that loan. Those shares need to be replaced and now it will be at a $10 per share loss.

Now buying a put or the collar strategy would be a better solution and I also addressed that topic on pages 233 – 236 of the Complete Encyclopedia for Covered Call Writing.

I congratulate you for thinking outside the box and not taking action until you are fully informed.

Alan

Premium members:

This week’s 6-page report of top-performing ETFs and analysis of ALL Select Sector Components has been uploaded to your premium site. The report also lists Top-performing ETFs with Weekly options.

For your convenience, here is the link to login to the premium site:

https://www.thebluecollarinvestor.com/member/login.php

NOT A PREMIUM MEMBER? Check out this link:

https://www.thebluecollarinvestor.com/membership.shtml

Alan and the BCI team

Alan I just went over my calculations for the upcoming March calls and have a question about calculating my premium and roo

The shares I bought were at $131.75 per share my aapl premium for the 130 strike is $4.20 I’m buying two contracts so that makes my premium a total of $840.00 The Ellman calculator tells me for an itm strike such as this one I’m receiving a 1.9% return. My calculations don’t seem correct because 1.9% of my cost basis of 26.350.00 is a total of 500.65

What am I missing on my calculations?

Johnny,

When we sell ITM strikes, only the time value component of the premium is our actual initial profit. The intrinsic value (amount the strike is in-the-money) must be deducted. In this case $1.75 must be deducted from the $4.20 premium to get an accurate assessment of your initial profit, otherwise it would be exaggerated. We do use the intrinsic value to “buy down” our cost basis from $131.75 to $130. That is our downside protection of the option profit, different from the breakeven which is $131.75 – $4.20 = $127.55.

Therefore, the calculation is as follows:

($4.20 – $1.75)/($131.75 – $1.75) = 1.9%

Alan

Alan, Does the ROO you target (one month 2-4%) include appreciation in the stock price during the period? If so, it is much easier to obtain those returns if one does a buy-write just 2% OTM (2% cap appreciation + 2% call premium)?

Thanks

Brian

Brian,

It does not include share appreciation. In normal and bull market conditions I try to sell as many OTM strikes as makes sense based on the parameters detailed in my books and DVDs. My goal is to generate at least a time value return of 2%/month and share appreciation would enhance those returns.

In bear or volatile markets I favor ITM strikes again with a goal of 2-4% for time value return. I use the intrinsic value component of the premium to protect that time value. The percentages of ITM and OTM strikes fluctuates based on market conditions.

Alan

Hi Alan,

One of the perils of covered calls is holding the stock to collect the

premium when the underlying stock may continue to plummet. Why then

wouldn’t it make sense to always sell deep in the money covered calls.

You would collect the intrinsic value of the option as premium up

front. But does it do so at the expense of the extrinsic premium?

Thanks,

Erick

Erick,

The “moneyness” of the selected option depends on several factors:

1- Overall market assessment

2- Chart technicals

3- Personal risk tolerance

These factors will determine ITM or OTM. ITM has the advantage of the downside protection as you rightly suggested. The deeper ITM you go, the lower the time (extrinsic) value. OTM will allow for additional share appreciation and in the proper market environment generate the highest returns.

Strike selection is one of three skills that must be mastered to become an elite covered call writer or put-seller.

Alan

Hi Alan,

I have a question regarding exit strategies.

I am looking to develop some personal hard and fast rules when applying exit strategies using the BCI methodology. Should technical analysis take presidence over the 20%/10% guidelines? For example, if my technical analysis indicates that a support level has been reached but the 20%/10% guidelines have not, should I wait until the 20%/10% guideline has been met before applying my exit strategy?

Thank you,

Rakesh.

Rakesh,

I have found over the past 2 decades that the 20/10% guidelines are the most reliable parameters for determining when to close the short options position. Remember, these are guidelines (not hard and fast rules) so if the price is “in the ballpark” it’s okay to close. For example, if 20% computes to $0.82 and the price is $0.85 and you are concerned, it’s okay to close the short call.

If you have concern for other reasons, like unexpected bad news, then ignore the 20/10% guidelines and close. I call that the CDMCP exit strategy in my material.

Alan