When we execute multiple exit strategies in the same contract cycle using the same cash investment, the TMC will provide us with accurate individual trade calculations. But, what about total portfolio calculations? Yes, our TMC will also afford us authentic total portfolio percentiles, but we must integrate the capital adjustment section of the spreadsheet into our computations. Without this extra step, the total investment will be overestimated and, therefore, our total portfolio returns will appear lower than it should be. To examine the process, a series of trades using SOFI & ACMR and the mid-contract unwind (MCU) exit strategy, previously published on our BCI site, will be utilized. To review:

Real-life trades with SOFI & ACMR

- 6/24/2025: Buy 500 x SOFI at $15.74

- 6/24/2025: STO 5 x 7/18/2025 $16.00 calls at $0.76

- 7/9/2025: BTC 5 x 7/18/2025 $16.00 calls at $4.10

- 7/9/2025: Sell 500 x SOFI at $20.00 (this closes the initial trade)

- 7/9/2025: Buy 500 x ACMR at $29.00

- 7/9/2025: STO 5 x 7/18/2025 $30.00 calls at $0.52

- 7/18/2025: 500 shares of ACMR sold at $30.00 by “allowing” exercise of a slightly ITM call strike

Calculating all trades, start-to-finish, Using the BCI Trade Management Calculator (TMC)

After both legs of the original SOFI covered call trade were closed, the cash generated from the sale of the stock was integrated into the purchase of the ACMR shares. Let’s review the initial portfolio returns with and without using the capital adjustment section of the TMC.

Total Portfolio returns without the capital adjustment section

- At no time was $22,370.00 invested or risked

- Calculated % return = 5.68%. Should be higher

- Much of the capital used to buy ACMR came from the sale of SOFI

- We must deduct the smaller amount invested (cost of SOFI shares)

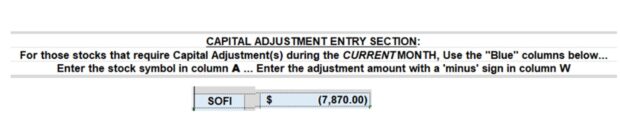

Using the capital adjustment section

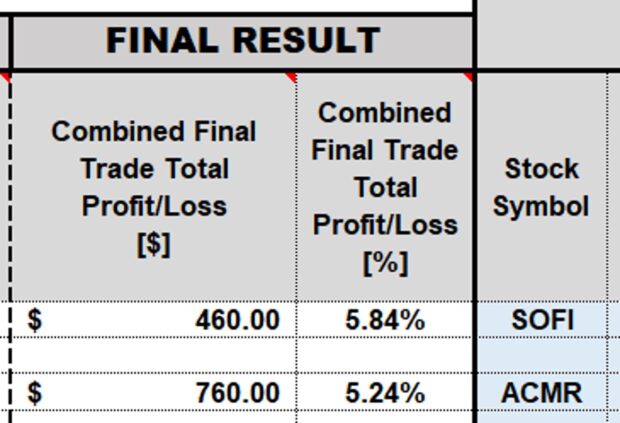

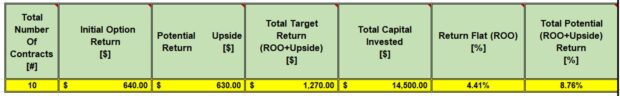

Total Portfolio returns after implementing the capital adjustment section

- Total capital invested is now an accurate $14,500.00, not $22,370.00

- The total potential return is an accurate 8.76%, not 5.68%

Discussion

When implementing multiple exit strategies in the same contract cycle, using the same cash investment, the capital adjustment section of the TMC will allow for precise total portfolio returns

The Blue Collar Investor’s Guide to:

Exit Strategies for Covered Call Writing and Selling Cash-Secured Puts

This book will detail how to enter, manage and calculate trade adjustments for all market conditions. After we select the underlying security and sell the corresponding option, we immediately move into position management mode. There are over 20 exit strategies defined, as well and when and how to implement these plans.

Free training resources

Your generous testimonials

Over the years, the BCI community has been incredibly gracious by sending our BCI team email testimonials sharing stories as to what our educational content has meant to their families. Moving forward, we have decided to publish several of these testimonials in our blog articles. We will never use a last name unless given permission:

1. BCI Educational Webinar #9

Thursday January 15, 2026

8 PM ET – 9:30 PM ET

Watch an intro video overview of the webinar.

Topic:

Using Conservative Stock Options to Create a 3rd Income Stream in Stock Portfolios

Renting your stocks on a short-term basis

You have owned shares of stock in your non-sheltered accounts for many years. Share value has been appreciated significantly over time. This has put a smile on your face. Many of these securities have also generated dividend income. This, too, has pleased you. However, there is a 3rd income stream that you can activate right now, leveraging these same stocks, using a strategy known as covered call writing.

This is a low-risk option selling strategy analogous to generating rental income with a real estate investment property. Yes, renting out your stocks for limited periods. We have 2 goals: generate a 3rd income stream + retain the underlying shares to avoid negative capital gains issues.

This presentation will analyze how to implement this form of covered call writing, known as Portfolio Overwriting, always with capital preservation in mind.

Reserve a seat and register now by clicking here.

2. Long Island Stock Investors Meetup Group: Part I

Thursday February 12, 2026

7:30 PM ET – 9:00 PM ET

Credit Spreads for Bull & Bear Markets

Introducing Our Latest Products, Creating New Investment Opportunities

3. Las Vegas Money Show- 2 presentations

February 23 – 25, 2026

The Collar Strategy: Covered Call Writing with Protective Puts

Protecting covered call trades from catastrophic share loss

This is the strategy Bernie Madoff pretended to use. He called it the split strike conversion strategy, but it was simply a collar. The covered call sets a ceiling on the trade and the protective put guarantees a floor on the trade

Topics discussed

- What is the collar strategy?

- Uses for the collar

- Entering a collar trade

- Option basics for calls

- Option basics for puts

- Real-life example with NVDA

- What is an option-chain?

- Real-life example using the BCI Trade Management Calculator (TMC)

- Strategy pros & cons

- Educational products & discount coupon

- Q&A

Selling Cash-Secured Puts to Buy a Stock at a Discount or to Enter a Covered Call Trade

2 outcomes & 4 applications

Selling cash-secured puts is a low-risk option-selling strategy which generates weekly or monthly cash-flow. This presentation will detail how to craft the strategy to generate cash flow, buy a stock at a discounted price or to initiate a covered call trade. Topics included in the webinar include:

- Option basics

- The 3-required skills

- 4-practical applications

- Traditional put-selling

- PCP (Put-Call-Put or wheel) Strategy

- Buy a stock at a discount instead of setting a limit order

Real-life examples along with rules, guidelines and calculations are included in this presentation.

Time, date & registration link to follow.

4. Long Island Stock Investors Meetup Group: Part II

Thursday March12, 2026

7:30 PM ET – 9:00 PM ET

Ultra-Low-Risk Approaches to Covered Call Writing & Selling Cash-Secured Puts

Introducing Our Latest Products, Creating New Investment Opportunities

5. Hollywood Florida Money Show

April 10, 2026

11:40 AM – 12:25 PM

The Put-Call-Put (PCP) or Wheel Strategy

Using Both Covered Call Writing and Put-Selling to Generate Monthly Cash Flow

Selling stock options is a proven way to lower our cost-basis and beat the market on a consistent basis. Two such low-risk strategies are covered call writing and selling cash-secured puts. This presentation will detail how to incorporate both strategies into one multi-tiered option-selling strategy where we either generate cash-flow or buy a stock at a discount. I refer to this as the Put-Call-Put (PCP) Strategy, also referred to as the wheel strategy.

The basics and pros and cons of low-risk option-selling strategies will be discussed as well as an analysis of a real-life example and introduction into the BCI Trade Management Calculator (TMC). This seminar is appropriate for those who look to generate modest, but consistent, returns which will enable us to potentially beat the market on a consistent basis while focusing on capital preservation.

More details to follow.

6. Young Investor’s Club at The University of Central Florida

April 16, 2026

Private student investment club.

7. Orlando Money Show

October 5 – 7, 2026

Details to follow.

Premium Members,

This week’s Weekly Stock Screen and Watch List has been uploaded to The Blue Collar Investor Premium Member site and is available for download in the “Reports” section. Look for the report dated 01/02/26.

Be sure to check out the latest BCI Training Videos and “Ask Alan” segments. You can view them on The Blue Collar YouTube Channel. For your convenience, the link to the BCI YouTube Channel is:

https://www.youtube.com/user/BlueCollarInvestor

Barry and The Blue Collar Investor Team

Alan,

Have you changed your perspective on weekly options? When I first followed you you were a clear advocate of monthlies vs weeklies. What changed?

Bob

Bob,

I use both weekly and monthly expirations for both calls and puts. Both work and both can generate significant returns.

You are correct that I use a lot more weekly expirations today than I did 18 years ago when BCI started and certainly more than I did 30 years ago when I started investing with these low-risk option-selling strategies.

The reason why is simple … opportunity. With the explosion of interest in stock option, there are now a myriad of stocks and ETFs that have weekly options associated with them that simply did not exist years ago.

Keep in mind that weekly expirations can be used to circumnavigate earnings and ex-dividend dates.

Again, both work and I take advantage of both.

Alan

Premium members:

This week’s 4-page report of top-performing ETFs, along with our sample trade of the week, has been uploaded to your premium site. The Select Sector SPDR section is now crafted to align with our streamlined (CEO) approach to covered call writing. The report also lists Top-performing ETFs with Weekly options, mid-week market tone as well as the implied volatility of all eligible candidates.

We have also included a sample trade taken from one of our BCI watchlists.

Premium member video link:

https://youtu.be/EXMO-KwZuJs

For your convenience, here is the link to login to the premium site:

https://www.thebluecollarinvestor.com/member/login.php

NOT A PREMIUM MEMBER? Check out this link:

https://www.thebluecollarinvestor.com/membership.shtml

Alan and the BCI team