When entering our covered call trades, we should always avoid the risk of earnings report dates. If we choose to hold the stock through that ER date, that’s okay, but don’t cap the upside with a covered call. If one of our strategy objectives is to retain the shares and prevent exercise, we need to avoid ex-dividend dates, the main reason for early exercise.

This article will analyze a real-life example with Apple Inc. (Nasdaq: AAPL) for the November 2022 monthly contracts, starting on October 17, 2022, through November 18, 2022.

ER and ex-dividend dates during the AAPL November 2022 contracts

- ER date: 10/27/2022

- Ex-dividend dates: 11/4/2022

- Avoid weeks 2 & 3 of this 5-week monthly contract

- Write a weekly covered call from 10/17/2022 – 10/21/2022

- Write a 2-week option from 11/7/2022 – 11/18/2022

Weekly option from 10/17/2022 to 10/21/2022

- AAPL opens at $144.31 on 10/17/2022

- The 10/21/2022 $146.00 strike has a bid price of $0.50

- AAPL closes on expiration Friday at $143.39

- The option expires worthless, and shares are retained with no exit strategy intervention

2-week option from 11/7/2022 to 11/18/2022

- AAPL opens at $142.09 on 11/7/2022

- The 11/18/2022 $148.00 strike has a bid price of $0.79

- AAPL closes on expiration Friday at $150.72

- We can either roll the option or allow exercise at $148.00

- We will calculate from the perspective of allowing exercise using the BCI Trade Management Calculator (TMC)

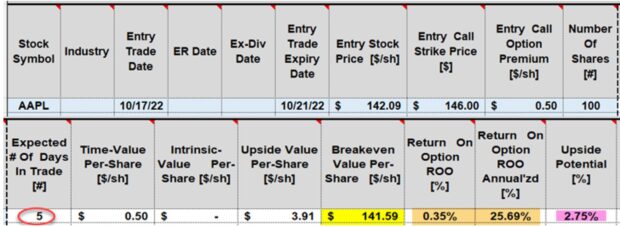

TMC calculations for the week 10/17/2022 to 10/21/2022 (The Entry Stock Price should read $144.31- see 3/31 comment below)

- Red circle: 5-day trade

- Yellow cell: Breakeven price point is $141.59

- 5-day return is 0.35%, 25.69% annualized

- Pink cell: Additional upside potential of 2.75% if AAPL moves up to or beyond the $146.00 strike price

TMC calculations for the week 11/7/2022 to 11/18/2022

- Red circle: 12-day trade

- Yellow cell: Breakeven price point is $141.30

- 12-day return is 0.56%, 16.91 annualized

- Pink cell: Additional upside potential of 4.16% if AAPL moves up to or beyond the $148.00 strike price

- The $148.00 strike was allowed to expire in-the-money and exercise occurred as shares were sold at $148.00

The calculation big picture

- Total option premium: $0.50 + $0.79 per share = $1.29 per share

- Total credit on the sale of AAPL: $148.00 – $142.09 = $5.81 per-share

- Total per-share 3-week profit: $1.29 + $5.81 = $7.10 per-share

- % return = $7.10/$142.09 = 5.00% for the November 2022 contract

Discussion

When weekly options are available, circumventing earnings and ex-dividend dates are easy to accomplish, while significant option returns are still possible.

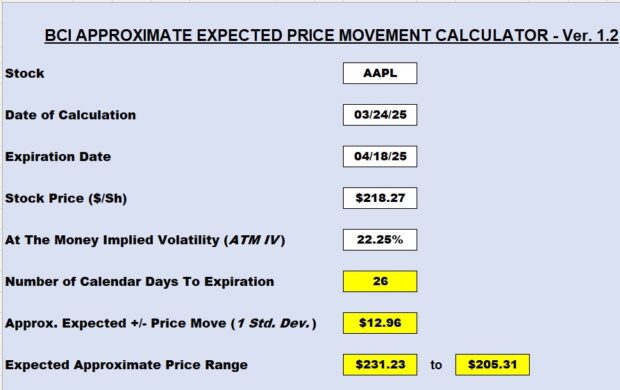

EXPECTED PRICE MOVEMENT CALCULATOR

The Expected Price Movement Calculator is designed to generate an approximate projected trading range for the underlying security, specific for selected contract expiration date. The at-the-money implied volatility (IV) of the stock or ETF (exchange-traded fund) is used to achieve this valuable information.

Inherent in the spreadsheet is a conversion formula that recalibrates the annualized IV stat into one specific for the contract being traded. Easily accessed option-chain data is entered into the white cells at the top of the spreadsheet and calculations will appear in the yellow cells below.

Click here for informational video.

Your generous testimonials

Over the years, the BCI community has been incredibly gracious by sending our BCI team email testimonials sharing stories as to what our educational content has meant to their families. Moving forward, we have decided to publish several of these testimonials in our blog articles. We will never use a last name unless given permission:

Upcoming events

1. Money Masters Symposium Dallas 2025

Saturday April 5, 2025

Hilton DFW Lakes

Saturday April 5, 2025

Hilton DFW Lakes

2 events:

45-minute workshop

- Option basics

- The 3-required skills

- Practical applications

- Traditional put-selling

- PCP (Put-Call-Put or wheel) Strategy (adds covered call writing)

- Buy a stock at a discount instead of setting a limit order

All Stars of Options panel discussion

2. Investment Masters Symposium Miami 2025

Thursday May 15, 2025

Thursday, May 15, 2025, at 10:30 am – 12:30 pm EST

Using Both Covered Call Writing & Selling Cash-Secured Puts in a Multi-Tiered Option-Selling Strategy

(The Put-Call-Put (PCP or “Wheel) Strategy)

Thursday, May 15, 2025, at 3:40 pm – 4:25 pm EST

Using Cryptocurrency in Our Low-Risk Option Portfolios

Thursday, May 15, 2025, at 5:55 pm – 6:25 pm EST

All-Stars of Options Panel

3. Long Island Stock Investors Group

Private club

Thursday June 12, 2025

7:30 PM ET – 9:00 PM ET

4. BCI Educational Webinar Series

Using Cryptocurrency in Our Low-Risk Option Portfolios

June 19, 2025

Registration details to follow.

5. Orlando Money Show

Orlando Resort @ ChampionsGate

October 16 – 18, 2025

Details and registration link to follow.

Dear Mr. Ellman,

I have a couple simple questions if you don’t mind I like to ask.

The cover call options strategy, that is good during the up market, is it correct?

Because you are getting both the appreciation of the stock plus the premium that you get paid.

If the market is down, selling put strategy is the appropriate to handle your portfolio? Because you will be getting both the premium plus the price of the stock that you want to buy and own it.

Thank you so much, I was one of the attendees at the money show in Las Vegas recently.

Best regards,

Phil

Phil,

Glad you were able to attend my presentations in Las Vegas.

These are important questions. One of the many advantages of covered call writing & selling cash-secured puts is that both strategies can be crafted to be appropriate in all market conditions.

I do agree that in appreciating market conditions, selling out-of-the-money covered calls provides the potential for 2 income streams, premium + share appreciation up to the out-of-the-money call strikes.

However, in down markets, we can also use covered calls by selling in-the-money strikes, benefitting from additional downside protection offered by the intrinsic-value components of these premiums.

In declining markets, we can also use deep out-of-the-money cash-secured puts (much lower than current market value) to lower our breakeven price points.

However, in normal or bull market environments, we can also use puts (only slightly out-of-the-money) and be prepared to roll-up the option as share price accelerates. This approach may be particularly enticing for investors who do not want to own the shares.

Bottom line: We have so much flexibility with both strategies and both can be implemented in all market conditions.

Alan

Thank you Mr. Ellman for your prompt response.

One of the worst scenarios that I have encountered in the past under cover call strategy is that at the expiration date, my stock price drops, not only below the strike price but also it is below my entry point.

The premium that I received did help me a little bit to reduce my loss (paper loss), but I am still under water. Of course, the contract will not be executed because the option buyer will not be interested in owning the shares. He/she can purchase the shares at a much lower price if he/she wants them in the open market.

The question is what I should do under this kind of scenario? 1) selling the shares after the expiration date to reduce the loss if the market continues to decline or 2) rewriting another cover call contract if the market is stabilized? The stock selection is especially important and plays a key role to be successful in this strategy (Cover call Option).

Your input is greatly appreciated.

Best Regards,

Phil

Phil,

Management of our trades is critical to our success. Understanding how and when to implement exit strategies is a huge aspect of the BCI methodology.

When we trade covered calls (or cash-secured puts), we are seeking to outperform risk-free investments.

By definition, this means we are willing to incur a certain amount of low risk. Most, but not all, of our trades will be winning ones, once we master the 3 required skillsets (stock selection, option selection and position management).

To your question regarding retaining a stock where the initial trade lost money, I’ll give a brief response, with the understanding that there is so much more to be said, just not in this venue:

I would ask myself, “would I buy this stock today at the current price”? If yes, write a covered call. If no, sell the stock and select a new, better performer.

Stock selection is based on fundamental and technical analysis, as well as common-sense principles (like avoiding earnings report, minimum trading volume etc.). These are the bases of the BCI screening process for our premium members.

You seem highly motivated to learn these strategies, a sure recipe for success.

Alan

Great video. Thanks Alan. Any thoughts on hedging with spreads?

Thanks.

Todd

Todd,

We can add protective puts to our covered call trades. This is known as a “collar trade”.

Here is a link to one of the articles I published on this topic:

https://www.thebluecollarinvestor.com/calculating-covered-call-trades-that-are-converted-to-collar-trades-2/

On another note, we are working on a BCI Credit Spread Calculator which we hope will be available in the near future.

Alan

Premium Members,

This week’s Weekly Stock Screen And Watch List has been uploaded to The Blue Collar Investor Premium Member site and is available for download in the “Reports” section. Look for the report dated 03/28/25.

Be sure to check out the latest BCI Training Videos and “Ask Alan” segments. You can view them on The Blue Collar YouTube Channel. For your convenience, the link to the BCI YouTube Channel is:

https://www.youtube.com/user/BlueCollarInvestor

Please note…Due to travel issues, the Weekly Report for April 12, 2025, will be uploaded either late on Sunday night, April 13, 2025, or on Monday, April 14, 2025.

Barry and The Blue Collar Investor Team

Alan,

I’m curious what you think of a 7% rule for ETFs. I bought SPY just about the top… but fortunately I also wrote some in the money calls on the way down, which brought my break even down to $596.

The 7% rule is $554.27 and unless I start selling way way out, just bag holding. I tend to think since it is SPY, just let it come back eventually, but I’m wondering if you still employ the 7% rule even for ETFs?

Chris

Chris,

I’ll address the 7% guideline at the end of this response

First, we must determine if the underlying, SPY in this case, is a long-term buy-and-hold, or a security we trade only in normal-to-bull markets.

If the former, I would consider writing short-term OTM covered calls to generate premium and allow for share price recovery along the way.

If the latter, I would give consideration to the Select Sector SPDRs, rather than SPY, the entire benchmark. These break up the S&P 500 into 11 distinct sector funds, several of which are usually outperforming the entire benchmark.

See the screenshot below (taken from our latest premium member ETF Report) showing the 1-month price performance of the S&P 500 and the sectors that are outperforming. We are currently experiencing an unusual aberration in market conditions.

CLICK ON IMAGE TO ENLARGE & USE THE BACK ARROW TO RETURN TO BLOG.

Now, as far as the 7% guideline, yes, I give it consideration when determining when to sell the underlying securities. I, typically, parlay this guideline with how the ETF is preforming relative to the “market”. Since SPY is the “market” that additional consideration is not available.

I can’t give specific financial advice in this venue, but if it were me, I would decide if this were a long-term holding and, if not, would give consideration to the Select Sector SPDRs.

Hope this helps.

Alan

Trade Calculations for the 10/17/2022 initial calculations:

I, incorrectly, entered $142.09 as the stock entry price when it should have been $144.31. The initial calculations are similar, but not precisely the same. The final 3-week calculations are reduced from 5% to 3.45%, assuming AAPL shares are held through the ex-date.

Click on the image below to see the actual initial calculations for this trade.

Use the back arrow to return to this blog.

With this change, here are the updated “calculation big picture” per-share, assuming that AAPL is held through the ex-dividend date:

Total option premium remains $1.29

The stock profit is $148.00 – $144.31 = $3.69

Total per-share profit – $1.29 + $3.69 = $4.98

$4.98/$144.31 = 3.45% for the 3 weeks

Thanks to Dan for pointing this out.

Alan

Premium members:

This week’s 4-page report of top-performing ETFs, along with our sample trade of the week, has been uploaded to your premium site. The Select Sector SPDR section is now crafted to align with our streamlined (CEO) approach to covered call writing. The report also lists Top-performing ETFs with Weekly options, mid-week market tone as well as the implied volatility of all eligible candidates.

ALL ETFs IN THIS REPORT HAVE ACTUALLY GONE UP IN VALUE OVER THE PAST 1-MONTH.

We have also included a sample trade taken from one of our BCI watchlists.

Premium member video link:

https://youtu.be/EXMO-KwZuJs

For your convenience, here is the link to login to the premium site:

https://www.thebluecollarinvestor.com/member/login.php

NOT A PREMIUM MEMBER? Check out this link:

https://www.thebluecollarinvestor.com/membership.shtml

Alan and the BCI team