Traditional covered call writing involves first buying a stock (or exchange-traded fund) and then selling a corresponding call option. The result of the initial trade is to generate cash flow from the option sale and lower our cost basis on the stock side. Based on member feedback, there has been a growing interest in writing covered calls on the VIX (CBOE Volatility Index). The VIX is a measure of expected price fluctuations in the S&P 500 Index options over the next 30 days. It is also often referred to as the investor fear index. Although there are VIX options, there is no VIX stock per se. This article will highlight the ways of using VIX with covered call writing and also explain why this strategy is generally not a winning idea for most investors.

What is VXXB (formerly VXX)?

This is an ETN or exchange-traded note (like a stock) that is based on a portfolio of the nearest 2 VIX futures contracts. A “stock” is created based on these futures contracts. Each day, the fund sells the near-month contract and buys the back-month contract to meet its daily goal requirement.

How to create a VIX underlying for covered call writing

- Buy 1 VIX Future contract and sell 10 VIX calls against it

- Buy 100 VXXB shares and sell 1 VXXB call option

- Synthetic covered call in VIX using 3 option positions

Since this site does not deal with futures contracts, we will focus in on the latter two.

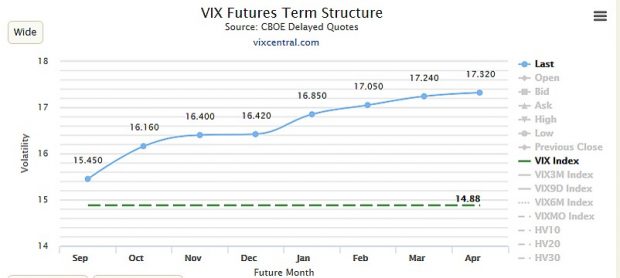

VIX covered calls using VXXB

The nature of the VXXB product is not in our best interest. There is a negative strain on the price of VXXB because the sale of the near-month futures contract in conjunction with the purchase of the back month contract usually results in a net debit…we are riding our bicycles uphill! The back month is priced higher than the front month (called being in contango) 88% of the time. Add in ETN fees along with the cost to roll the contracts daily makes this product almost impossible to become an income-generator. Here is a screenshot showing futures in a contango relationship:

VIX Futures in Contango Relationship

When there is a spike in VIX, the curve may invert resulting in a phenomenon known as backwardation. The two are compared in the screenshot below:

Contango-Backwardation Comparison Chart

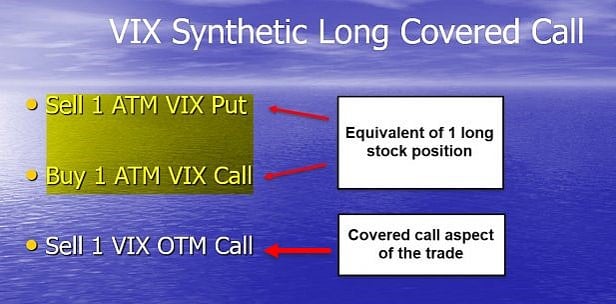

Synthetic long covered call

To create a synthetic long stock position, we can buy an at-the-money (ATM) call and sell an ATM put. Since a stock has a Delta of “1” we can create the equation from a Delta perspective:

[+.5 (long call) + (-) – .5 (short put)] = +1 (same as long stock position)

Against this synthetic long stock position, we can now sell the covered call. Here’s what it would look like graphically:

VIX Synthetic Long Covered Call

This approach has the advantage of using the actual VIX and not futures contracts as the underlying although we are now dealing with 3 legs to the trade.

Discussion

We have thousands of underlyings to select from with covered call writing. An investor must ask herself why should a futures contract, an ETN with a negative drag on price or a third leg to the trade be introduced? Volatility products are complicated and difficult to understand, even for professionals. Retail investors should be cautious before risking our hard-earned money with volatility products.

March 8th stock report

*** PLEASE NOTE: The stock report for the week ending March 8th will be published on Monday March 11th, later than usual due to vacation and travel plans. Every effort will be made to post this report as early as possible.

Upcoming events

-March 29th

Quinnipiac GAME Forum

International forum for college and graduate school finance majors

-May 8th

Alan will be hosting a free webinar for the Options Industry Council (OIC) on generating income from selling options. More information to follow.

-May 13th

All Stars of Options

Bally’s Hotel, Las Vegas

10 AM – 10:45 AM

How to Select the Best Options in Bull and Bear Markets

Free event

-May 14th

Las Vegas Money Show

Bally’s/ Paris Hotel

12:15 – 3:15

Master class encompassing covered call writing, put-selling and the stock repair strategy

This is a paid event hosted by The Money Show

Your generous testimonials

Over the years, the BCI community has been incredibly gracious by sending our BCI team email testimonials sharing stories as to what our educational content has meant to their families. Moving forward, we have decided to share some of these testimonials in our blog articles. We will never use a last name unless given permission:

Alan,

Just another thank you on your books. I have read all 5 of them. I was very surprised on the ease of read and how well you put them together. I have read over 500 books and I found you to be the easiest read of any Author, so I congratulate you on finding your talent of writing.

Alan A

Market tone

This week’s economic news of importance:

- Chicago Fed national activity index Jan. -0.43 (0.05 last)

- Wholesale inventories Dec. 1.1% (0.4% last)

- Housing starts Dec. 1.078 million (1.256 million expected)

- Building permits Dec. 1.326 million (1.322 million last)

- Case-Shiller home price index Dec. 4.7% (5.1% last)

- Consumer confidence index Feb. 131.4 (124.7 expected)

- Advance trade in goods Dec. -$79.5 billion (-$73.5billion expected)

- Pending home sales index Jan. 4.6% (-2.3% last)

- Factory orders Dec. 0.1% (0.5% expected)

- Weekly jobless claims 2/23 225,000 (as expected)

- GDP Q4 2.6% (1.9% expected)

- Chicago PMI Feb. 64.7 (56.7 last)

- Personal income Jan. -0.1% (0.3% expected

- Consumer spending Dec. -0.5% (-0.4% expected)

- Core inflation Dec. 0.2% (as expected)

- Markit manufacturing PMI Feb. 53.0 (53.7 last)

- ISM manufacturing index Feb. 54.2 (55.5 expected)

- Consumer sentiment index Feb. 93.8 (95.6 expected)

THE WEEK AHEAD

Mon March 4th

- Construction spending Dec.

Tue March 5th

- Markit services PMI Feb.

- New home sales Dec.

- ISM nonmanufacturing index Feb.

- Federal budget Jan.

Wed March 6th

- ADP employment Feb.

- Trade balance Dec.

- Factory orders Jan.

- Beige book

Thu March 7th

- Weekly jobless claims 3/2

- Productivity Q4

- Trade balance Jan.

- Consumer credit Jan.

Fri March 8th

- Nonfarm payrolls Feb.

- Unemployment rate Feb.

- Average hourly earnings Feb.

- Wholesale inventories Jan.

For the week, the S&P 500 moved up 0.39% for a year-to-date return of 11.84%

Summary

IBD: Market in confirmed uptrend

GMI: 6/6- Bullish signal since market close of January 31, 2019

BCI: I am continuing to favor out-of-the-money strikes 2-to-1 compared to in-the-money strikes.

WHAT THE BROAD MARKET INDICATORS (S&P 500 AND VIX) ARE TELLING US

The 6-month charts point to a greatly improving market tone. In the past six months, the S&P 500 down 3% while the VIX (13.57) moved up by 3%.

Wishing you the best in investing,

Alan and the BCI team

Premium Members,

This week’s Weekly Stock Screen And Watch List has been uploaded to The Blue Collar Investor premium member site and is available for download in the “Reports” section. Look for the report dated 03/01/19.

Also, be sure to check out the latest BCI Training Videos and “Ask Alan” segments. You can view them at The Blue Collar YouTube Channel. For your convenience, the link to the BCI YouTube Channel is:

http://www.youtube.com/user/BlueCollarInvestor

Since we are in Earnings Season, be sure to read Alan’s article, “Constructing Your Covered Call Portfolio During Earnings Season”. You can access it at:

https://www.thebluecollarinvestor.com/constructing-your-covered-call-portfolio-during-earnings-season/

*** PLEASE NOTE: The stock report for the week ending March 8th will be published on Monday, March 11th, later than usual due to vacation and travel plans. Every effort will be made to post this report as early as possible.

Best,

Barry and The Blue Collar Investor Team

barry@thebluecollarinvestor.com

Alan,

I read your book and listened to the dvds and started covered calls in January. Results have been very good so far. I do have a question that I don’t understand. When the stock moves higher than the strike of the option why doesn’t the option buyer buy my shares? This is the case with 3 of my covered calls.

Thanks for your help.

Lance

Lance,

This great question comes up frequently. Generally, option buyers do not want to be stock owners, but rather option sellers. They want to generate income by leveraging options on positions they are directionally correct about.

Also, option holders will make more money selling the option as opposed to exercising the option and selling the underlying security. This is because intrinsic value will be realized income while time value will be lost.

Alan

Alan,

On point!

I have bought and sold Calls for years. I have never exercised an option. I have had options exercised on me. I wasn’t interested in buying back the sold option and retaining the underlying.

Covered Call selling is by far the most conservative approach. You have a range in which the underlying can move up, down or stay flat where you can make money.

If you buy Calls, and I do, you must get two things right to make money. You must get the price direction right and you must get the time frame right. Miss either of these and you lose money.

Weeklys and monthlys let you avoid earnings reports. LEAPS do not let you avoid earnings reports. Remember my $32,000.00 loss on FB’s earnings report last July 28th. I posted that info on the blog then. It was the single worst earnings report loss that I have ever had.

Weeklys and monthlys cost less but you have less time to be right. LEAPS(cost more) give you the time but you must weather earnings reports.

There is no silver bullet.

I repeat myself. The BCI methodology is the simplest, the most conservative and, with the research provided, the most cost effective way to “beat” the market. And you will.

Thank you, Barry, your team and all the members who make this community the overwhelming value that it is.

Hoyt

Hoyt,

My team and I appreciate your support and valuable contributions to our BCI community.

Alan

Hi Alan. Good explanation. I have two comments for you.

1) You’ll want to update this write-up with VXXB. VXX reached the end of its ten-year life and was replaced with VXXB.

2) An alternative way to trade “volatility” would be a “poor man’s covered put” and take advantage of the inherent contango. The beauty of this strategy is it’s one of only a few underlyings where you “know” the direction of the move most of the time.

Thanks Steve. I updated the ticker in this article.

Alan

Steve,

How it will look like? Buying VXXB ITM put and selling OTM put against it? Do I get it right?

Also as I understand the contango doesn’t apply if we construct VIX synthetic long position?

Sunny

Hi Alan,

I came across your youtube videos while looking for some strategies to sell weekly covered calls such that the price is not hit and I get to keep my premiums and shares that I own. None of your videos talks about picking right OTM strike for weekly or monthly expiration. Would you be able to guide me? I try to sell covered calls on csco ntap hpe but end up buying back at small loss since the OTM strike is not picked right.. If you can point me to the relevant videos, it will help.

many thx and happy Sunday.

Shri

Shri,

The strategy you are alluding to is “portfolio overwriting” There is never a 100% guarantee that shares will not be sold but we can make the chances of exercise extremely remote.

Here are links to an article I published on this topic, a book that includes all aspects of portfolio overwriting and a calculator we developed to assist with this strategy:

https://www.thebluecollarinvestor.com/strike-selection-for-portfolio-overwriting-low-cost-basis-stocks/

https://thebluecollarinvestor.com/minimembership/covered-call-writing-alernative-strategies/

https://thebluecollarinvestor.com/minimembership/portfolio-overwriting-calculator/

Alan

Dear Alan

Many thx for your prompt echo.

Few clarification.. How exctly the 195 200 205 strike is chosen? You suggest to pick 6 8 10 % more than the current price and then chose monthly expiration? If I want to consider weekly or biweekly would the strategy change?

Or I have to order the book to get all these details?

-shri

Shri,

I use 6% annualized returns in my books, DVDs and articles for portfolio overwriting because it is conservative and reasonable but each investor can set his target goal based on personal risk-tolerance.

Time frames can definitely be adjusted to weekly or bi-weekly by re-setting goals. For example, if the annualized goal is 6%, then the weekly goals would be 0.12%.

The book was written and the calculator produced to allow our members to master this strategy and achieve the highest level of returns.

Alan

Alan,

I don’t sell options on volatility (that’s probably for more experienced investors) but I know it’s important to options in general. Is there a level of volatility we should avoid when selling options? I use mainly covered call writing.

Thanks you.

Marsha

Marsha,

There is no specific volatility level that is appropriate for every investor. It will vary depending on return goals and personal risk-tolerance.

Since the volatility of the underlying security is directly related to option premium, we can establish an initial time-value return goal that will incorporate volatility considerations.

For example, I use a 2% – 4% goal for near-the-money strikes when establishing my option-selling positions in normal market environments. I will bump it up to a maximum of 6% in strong bull markets. These goals are based on a conservative approach to option-selling. Investors can set goals higher or lower depending on their personal risk-tolerance (I use 1% – 2% in my mother’s portfolio).

Alan

Hi Marsha,

I don’t sell options against volatility products either. I am much more comfortable selling CC’s and CSP’s against large cap stocks and ETF’s.

I do trade volatility buying options/spreads on the VIX itself in my IRA and sometimes the short ETF SVXY which contango helps most of the time. The short products took a heck of a melt down last year when the volatility spiked. I was glad I was not in them.

What I will say is the futures based products like SVXY, VXXB and UVXY are complicated instruments designed as trading, not investing, vehicles. If one can’t explain how they work to an investing friend I suggest staying away from them! – Jay

Thanks Alan and Jay…valuable information.

Marsha

Chicago Traders Expo:

Speaking event just added on Monday July 22nd at the Hyatt Regency McCormick Place. More information to follow.

Alan

Premium members:

This week’s 8-page report of top-performing ETFs and analysis of ALL Select Sector Components has been uploaded to your premium site. The report also lists Top-performing ETFs with Weekly options as well as the implied volatility of all eligible candidates.

New members check out the video user guide located above the recent reports.

For your convenience, here is the link to login to the premium site:

https://www.thebluecollarinvestor.com/member/login.php

NOT A PREMIUM MEMBER? Check out this link:

https://www.thebluecollarinvestor.com/membership.shtml

Alan and the BCI team

Alan,

Just a quick question.

Do I BTC all open Call contracts on the underlying before initiating the Repair strategy?

My Stock:

I purchased 100 shares of CELG at 91.25 and S-T-O the ITM Apr 18 90 Call for 5.25 (That was a 4% gain with a 1.3% downside protection on the Ellman Calculator)

Stock is now at 86.20 (90 call at $4.45 Ask)

So, I go ahead B-T-C the 90 Call and then begin strategy, is that right?

Jim

Thus, I am only working with the 100 shares of CELG on the Stock Repair Calculator

This seems proper but would feel better with a quick 10/4.

(The PDF prints says to put on 2 ATM or NTM long positions, but I think the long portion is only 1 contract and then sell 2 OTM)

Jim,

I congratulate you for recognizing the importance of and incorporating exit strategies into our option selling strategies.

Your question relates to 2 different exit strategies:

1. Covered call writing positions

2. Pure stock ownership positions

For covered call writing positions, when option value meets our 20%/10% guidelines, we buy back the short call and follow-up according to the available choices (rolling down, “hitting a double” etc.). These can be reviewed in the exit strategy chapters of my books and DVDs. The stock repair strategy does not apply to covered call writing.

When we own shares, without the option component that have moved down in value, we can lower the breakeven with the stock repair strategy. Let’s say we own 100 shares of XYZ. This represents one long position. We then purchase 1 NTM call. This is the second long position. After establishing 2 long positions, we then sell 2 OTM calls which represent 2 short positions. These OTM calls will fund the 1 long call position.

Alan

Alan,

If you are negative in your stock and positive in your short position would you roll up your stock position? In this case stock is negative $900 short call positive $700. Stock currently $83, bought this at $80. Market is negative. If I sold entire position I will be negative $200. Expiration March 15. Not sure if this is a negative situation.

Do you look at this long term position as a hedge to sell to open your short term call and in reality this is a profit only situation from my short position, otherwise I could not have a gain in my short term calls unless I had purchased the stock.

Harry

Harry,

I don’t have all the stats from your inquiry but let’s create a scenario reflected in this question.

We buy a stock for $80.00 and sell the $80.00 call. Let’s say that represented a 2.5% initial time value 1-month return. Now the stock price moves to $83.00 and the $80.00 call also moves up in value ($3.00 in intrinsic value + a time value component).

We are now in a best-case scenario. We set up the trade where the max return is 2.5%. That now is the situation and we have $3.00 of downside protection for this profit. As expiration approaches, we can decide if rolling the option (if still in-the-money) makes sense.

Alan